Greece faced a

sovereign debt crisis in the aftermath of the

financial crisis of 2007–2008. Widely known in the country as The Crisis (

Greek: Η Κρίση), it reached the populace as a series of sudden reforms and

austerity

Austerity is a set of political-economic policies that aim to reduce government budget deficits through spending cuts, tax increases, or a combination of both. There are three primary types of austerity measures: higher taxes to fund spend ...

measures that led to

impoverishment and loss of income and property, as well as a small-scale

humanitarian crisis. In all, the Greek economy suffered the longest recession of any advanced mixed economy to date. As a result, the Greek political system has been upended,

social exclusion increased, and hundreds of thousands of well-educated Greeks have left the country.

The Greek crisis started in late 2009, triggered by the turmoil of the world-wide

Great Recession, structural weaknesses in the

Greek economy

The economy of Greece is the 53rd largest in the world, with a nominal gross domestic product (GDP) of $222.008 billion per annum. In terms of purchasing power parity, Greece is the world's 54th largest economy, at $387.801 billion per annum ...

, and

lack of monetary policy flexibility as a member of the

Eurozone.

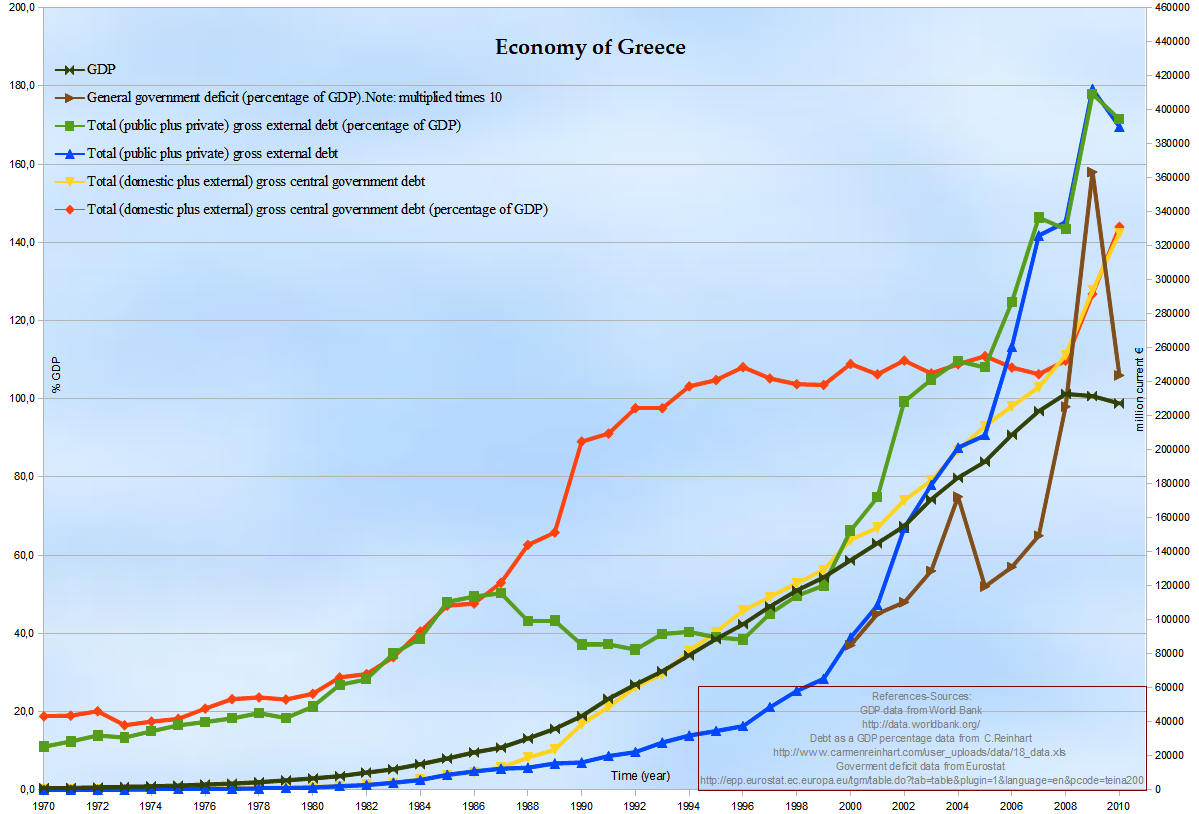

The crisis included revelations that previous data on

government debt levels and deficits had been underreported by the Greek government: the official forecast for the 2009 budget deficit was less than half the final value as calculated in 2010, while after revisions according to

Eurostat

Eurostat ('European Statistical Office'; DG ESTAT) is a Directorate-General of the European Commission located in the Kirchberg, Luxembourg, Kirchberg quarter of Luxembourg City, Luxembourg. Eurostat's main responsibilities are to provide statis ...

methodology, the 2009 government debt was finally

raised from $269.3bn to $299.7bn, i.e. about 11% higher than previously reported.

The crisis led to a loss of confidence in the Greek economy, indicated by a widening of

bond yield spread

Yield may refer to:

Measures of output/function

Computer science

* Yield (multithreading) is an action that occurs in a computer program during multithreading

* See generator (computer programming)

Physics/chemistry

* Yield (chemistry), the am ...

s and rising cost of risk insurance on

credit default swaps compared to the other

Eurozone countries, particularly Germany. The government enacted 12 rounds of tax increases, spending cuts, and reforms from 2010 to 2016, which at times triggered local riots and nationwide protests. Despite these efforts, the country required bailout loans in 2010, 2012, and 2015 from the

International Monetary Fund,

Eurogroup, and the

European Central Bank, and negotiated a 50% "

haircut" on debt owed to private banks in 2011, which amounted to a €100bn debt relief (a value effectively reduced due to bank recapitalisation and other resulting needs).

After a popular referendum which rejected further austerity measures required for the third bailout, and after closure of banks across the country (which lasted for several weeks), on 30 June 2015, Greece became the first

developed country

A developed country (or industrialized country, high-income country, more economically developed country (MEDC), advanced country) is a sovereign state that has a high quality of life, developed economy and advanced technological infrastruct ...

to fail to make an IMF loan repayment on time (the payment was made with a 20-day delay).

At that time, debt levels stood at €323bn or some €30,000 per capita, little changed since the beginning of the crisis and at a per capita value below the OECD average,

but high as a percentage of the respective GDP.

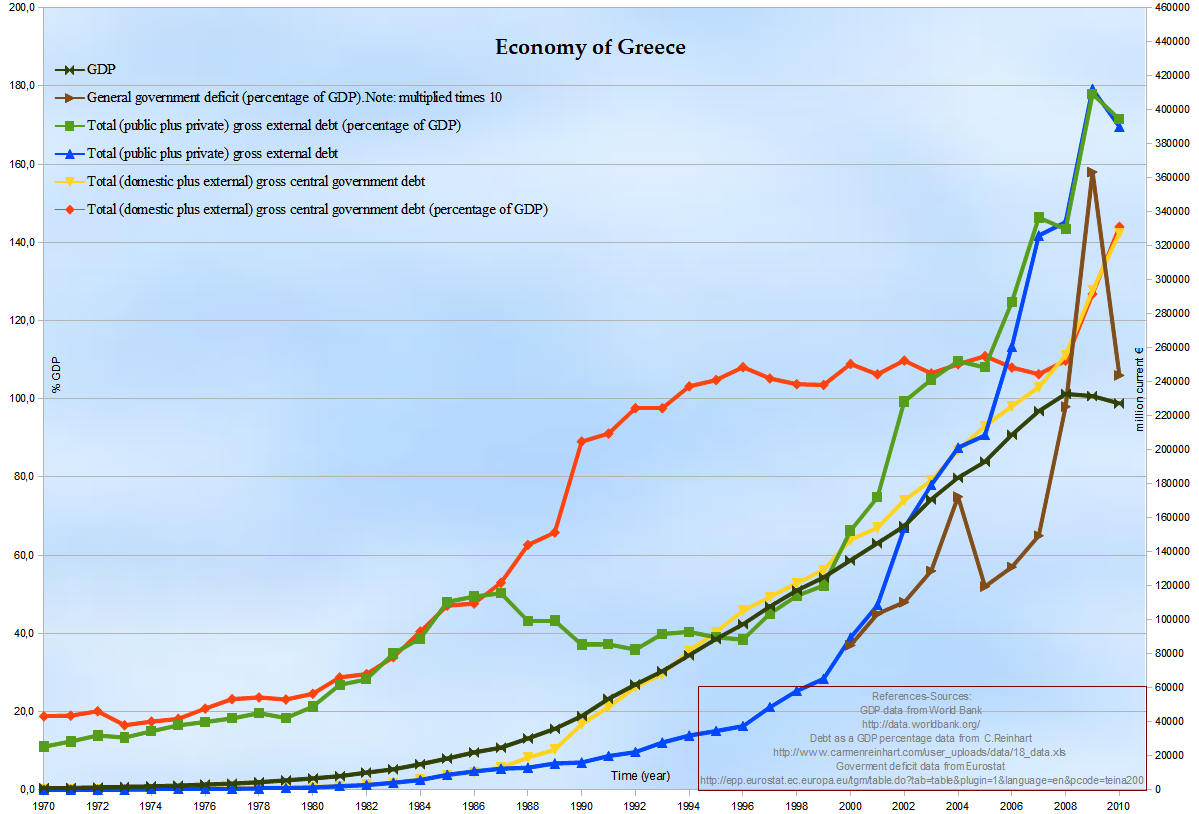

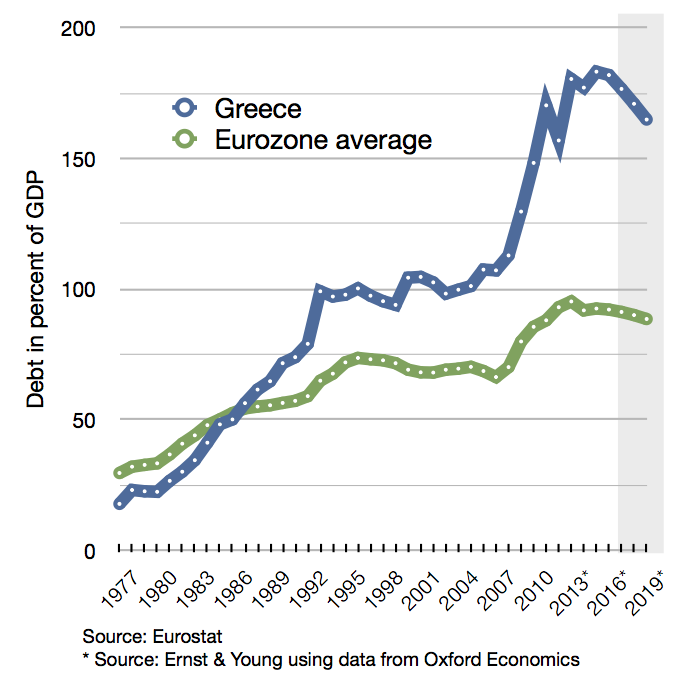

Between 2009 and 2017, the Greek government debt rose from €300bn to €318bn.

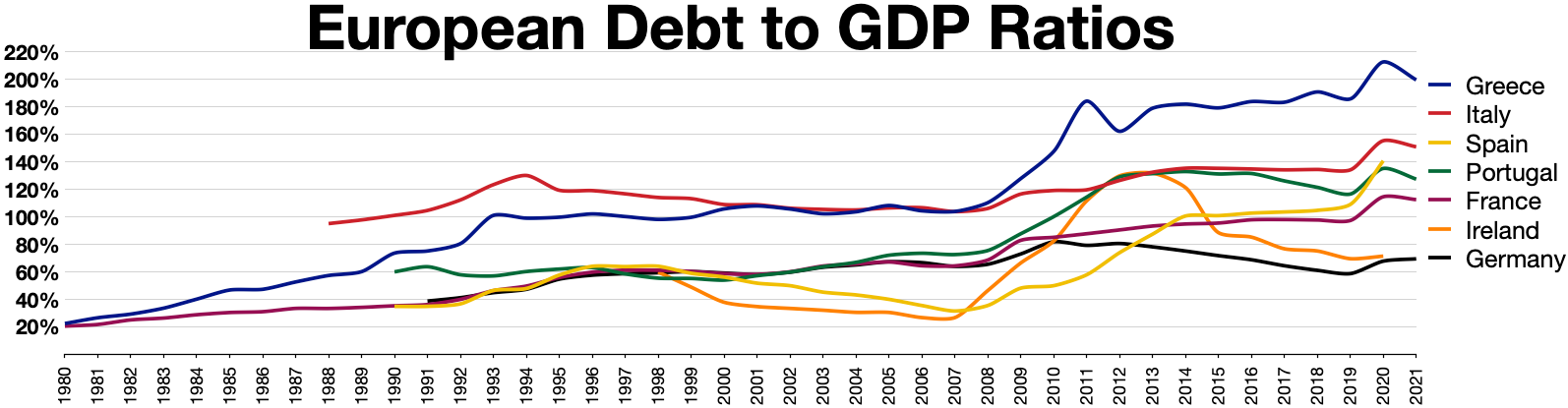

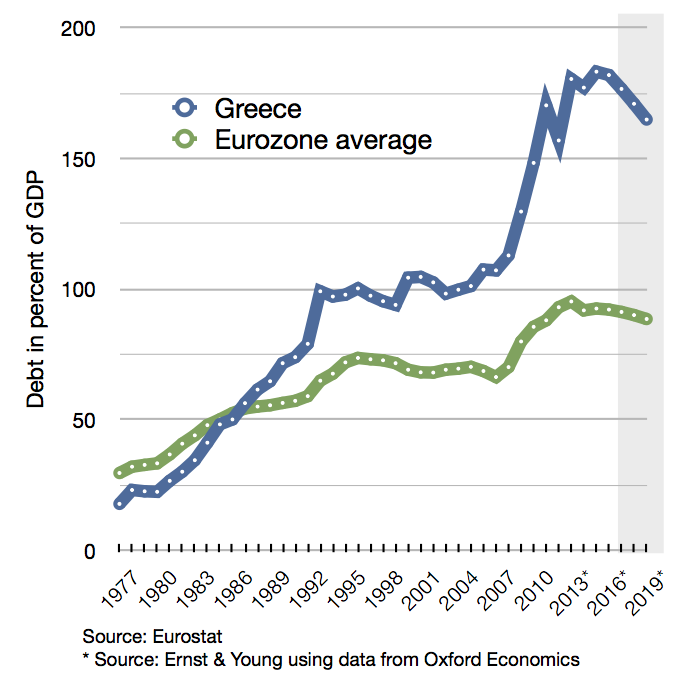

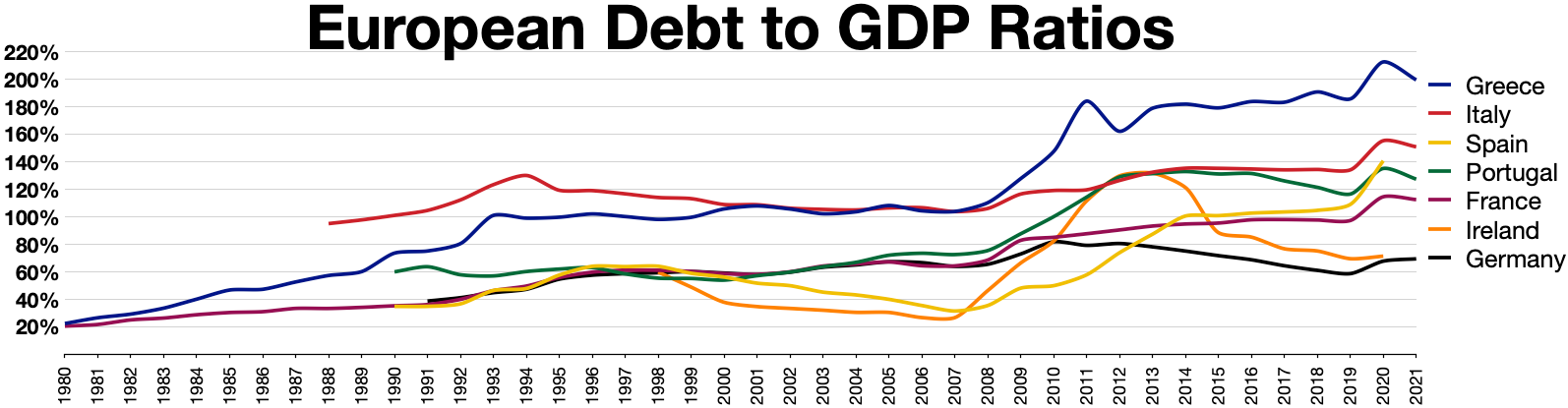

However, during the same period the Greek debt-to-GDP ratio rose up from 127% to 179%

due to the severe GDP drop

during the handling of the crisis.

Overview

Historical debt

Greece, like other European nations, had faced

debt crises in the 19th century, as well as a similar crisis in 1932 during the

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

. While economists

Carmen Reinhart and

Kenneth Rogoff wrote that "from 1800 until well after World War II, Greece found itself virtually in continual default", (referring to a period which included Greece's war of independence, two wars with the Ottoman Empire, two Balkan wars, two World Wars, and a Civil War) Greece recorded

fewer cases of default than Spain or Portugal in the aforementioned period (in reality starting from 1830, as this was the year of Greece's independence).

Actually, during the 20th century, Greece enjoyed one of the highest GDP growth rates in the world

[ Angus Maddison]

"Monitoring the World Economy 1820–1992"

OECD (1995) and average Greek government debt-to-GDP from 1909 to 2008 (a century until the eve of the debt crisis) was lower than that of the UK, Canada or France.

During the 30-year period immediately prior to its entrance into the

European Economic Community

The European Economic Community (EEC) was a regional organization created by the Treaty of Rome of 1957,Today the largely rewritten treaty continues in force as the ''Treaty on the functioning of the European Union'', as renamed by the Lisb ...

in 1981,

the Greek government's debt-to-GDP ratio averaged only 19.8%.

Indeed, accession to the EEC (and later the

European Union) was predicated on keeping the debt-to-GDP well below the 60% level, and certain members watched this figure closely.

Between 1981 and 1993, Greece's debt-to-GDP ratio steadily rose, surpassing the average of what is today the Eurozone in the mid-1980s. For the next 15 years, from 1993 to 2007, Greece's government debt-to-GDP ratio remained roughly unchanged (not affected by the

2004 Athens Olympics

The 2004 Summer Olympics ( el, Θερινοί Ολυμπιακοί Αγώνες 2004, ), officially the Games of the XXVIII Olympiad ( el, Αγώνες της 28ης Ολυμπιάδας, ) and also known as Athens 2004 ( el, Αθήνα 2004), ...

), averaging 102%;

this figure was lower than that of Italy (107%) and Belgium (110%) during the same 15-year period,

and comparable to that for the U.S. or the OECD average in 2017.

During the latter period, the country's annual budget deficit usually exceeded 3% of GDP, but its effect on the debt-to GDP ratio was counterbalanced by high GDP growth rates.

The debt-to GDP values for 2006 and 2007 (about 105%) were established after

audits resulted in corrections of up to 10 percentage points for the particular years. These corrections, although altering the debt level by

a maximum of about 10%, resulted in a popular notion that "Greece was previously hiding its debt".

Evolutions after birth of euro currency

The 2001 introduction of the euro reduced trade costs between Eurozone countries, increasing overall trade volume. Labour costs increased more (from a lower base) in peripheral countries such as Greece relative to core countries such as Germany without compensating rise in productivity, eroding Greece's competitive edge. As a result, Greece's

current account (trade) deficit rose significantly.

A trade deficit means that a country is consuming more than it produces, which requires borrowing/direct investment from other countries.

Both the Greek

trade deficit and

budget deficit rose from below 5% of

GDP in 1999 to peak around 15% of GDP in the 2008–2009 periods.

One driver of the investment inflow was Greece's membership in the EU and the Eurozone. Greece was perceived as a higher

credit risk alone than it was as a member of the Eurozone, which implied that investors felt the EU would bring discipline to its finances and support Greece in the event of problems.

As the

Great Recession spread to Europe, the amount of funds lent from the European

core countries (e.g. Germany) to the peripheral countries such as Greece began to decline. Reports in 2009 of Greek fiscal mismanagement and deception increased

borrowing costs; the combination meant Greece could no longer borrow to finance its

trade and

budget deficits at an affordable cost.

A country facing a '

sudden stop

''Sudden Stop'' is the second studio album by Canadian blues musician Colin James released in 1990 on Virgin Records. The album was recorded in Vancouver and Memphis, Tennessee.

The album features guest appearances by Bonnie Raitt, The Memphi ...

' in private investment and a high (local currency)

debt load typically allows its currency to

depreciate to encourage investment and to pay back the debt in devalued currency. This was not possible while Greece remained in the euro.

"However, the sudden stop has not prompted the European periphery countries to move toward devaluation by abandoning the euro, in part because capital transfers from euro-area partners have allowed them to finance current account deficits".

In addition, to become more competitive, Greek wages fell nearly 20% from mid-2010 to 2014, a form of

deflation. This significantly reduced income and GDP, resulting in a severe

recession, decline in tax receipts and a significant rise in the

debt-to-GDP ratio

In economics, the debt-to-GDP ratio is the ratio between a country's government debt (measured in units of currency) and its gross domestic product (GDP) (measured in units of currency per year). While it is a "ratio", it is technically measured i ...

. Unemployment reached nearly 25%, from below 10% in 2003. Significant government spending cuts helped the Greek government return to a primary

budget surplus

A balanced budget (particularly that of a government) is a budget in which revenues are equal to expenditures. Thus, neither a budget deficit nor a budget surplus exists (the accounts "balance"). More generally, it is a budget that has no budget ...

by 2014 (collecting more

revenue than it paid out, excluding

interest).

Causes

External factors

The Greek crisis was triggered by the turmoil of the

Great Recession, which led the budget deficits of several Western nations to reach or exceed 10% of GDP.

In the case of Greece, the high budget deficit (which, after several corrections, was revealed that it had been allowed to reach 10.2% and 15.1% of GDP in 2008 and 2009, respectively

) was coupled with a high public debt to GDP ratio (which, until then, was relatively stable for several years, at just above 100% of GDP- as calculated after all corrections).

Thus, the country appeared to lose control of its public debt to GDP ratio, which already reached 127% of GDP in 2009.

In contrast, Italy was able (despite the crisis) to keep its 2009 budget deficit at 5.1% of GDP,

which was crucial, given that it had a public debt to GDP ratio comparable to Greece's.

In addition, being a member of the Eurozone, Greece had essentially no autonomous

monetary policy flexibility.

Finally, there was an effect of controversies about Greek statistics (due the aforementioned drastic budget deficit revisions which led to an increase in the calculated value of the Greek public debt by

about 10%, i.e., public debt to GDP ratio of about 100% until 2007), while there have been arguments about a possible effect of

media reports. Consequently, Greece was "punished" by the markets which increased borrowing rates, making it impossible for the country to finance its debt since early 2010.

Internal factors

In January 2010, the

Greek Ministry of Finance

The Ministry of Finance ( el, Υπουργείο Οικονομικών) is the government department responsible for Greece's public finances. The incumbent minister is Christos Staikouras of New Democracy.

Minister's role

According to Arti ...

published ''Stability and Growth Program 2010''.

The report listed five main causes, poor GDP growth, government debt and deficits, budget compliance and data credibility. Causes found by others included excess government spending, current account deficits,

tax avoidance and

tax evasion.

GDP growth

After 2008, GDP growth was lower than the

Greek national statistical agency had anticipated. The Greek Ministry of Finance reported the need to improve competitiveness by reducing salaries and bureaucracy

and to redirect governmental spending from non-growth sectors such as the military into growth-stimulating sectors.

The global financial crisis had a particularly large negative impact on GDP growth rates in Greece. Two of the country's largest earners, tourism and shipping were badly affected by the downturn, with revenues falling 15% in 2009.

Government deficit

Fiscal imbalances developed from 2004 to 2009: "output increased in nominal terms by 40%, while central government primary expenditures increased by 87% against an increase of only 31% in tax revenues." The Ministry intended to implement real expenditure cuts that would allow expenditures to grow 3.8% from 2009 to 2013, well below expected inflation at 6.9%. Overall revenues were expected to grow 31.5% from 2009 to 2013, secured by new, higher taxes and by a major reform of the ineffective tax collection system. The deficit needed to decline to a level compatible with a declining debt-to-GDP ratio.

Government debt

The debt increased in 2009 due to the higher-than-expected government deficit and higher debt-service costs. The Greek government assessed that structural economic reforms would be insufficient, as the debt would still increase to an unsustainable level before the positive results of reforms could be achieved. In addition to structural reforms, permanent and temporary

austerity measures (with a size relative to GDP of 4.0% in 2010, 3.1% in 2011, 2.8% in 2012 and 0.8% in 2013) were needed. Reforms and austerity measures, in combination with an expected return of positive economic growth in 2011, would reduce the baseline deficit from €30.6 billion in 2009 to €5.7 billion in 2013, while the debt/GDP ratio would stabilize at 120% in 2010–2011 and decline in 2012 and 2013.

After 1993, the debt-to-GDP ratio remained above 94%.

The

crisis caused the debt level to exceed the maximum sustainable level, defined by

IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster globa ...

economists to be 120%.

According to the report "The Economic Adjustment Programme for Greece" published by the EU Commission in October 2011, the debt level was expected to reach 198% in 2012, if the proposed debt restructure agreement was not implemented.

Budget compliance

Budget compliance was acknowledged to need improvement. For 2009 it was found to be "a lot worse than normal, due to economic control being more lax in a year with political elections". The government wanted to strengthen the monitoring system in 2010, making it possible to track revenues and expenses, at both national and local levels.

Data credibility

Problems with unreliable data had existed since Greece applied for Euro membership in 1999.

In the five years from 2005 to 2009,

Eurostat

Eurostat ('European Statistical Office'; DG ESTAT) is a Directorate-General of the European Commission located in the Kirchberg, Luxembourg, Kirchberg quarter of Luxembourg City, Luxembourg. Eurostat's main responsibilities are to provide statis ...

noted reservations about Greek fiscal data in five semiannual assessments of the quality of EU member states' public finance statistics. In its January 2010 report on Greek Government Deficit and Debt Statistics, the European Commission/Eurostat wrote (page 28): "On five occasions since 2004 reservations have been expressed by Eurostat on the Greek data in the biannual press release on deficit and debt data. When the Greek EDP data have been published without reservations, this has been the result of Eurostat interventions before or during the notification period in order to correct mistakes or inappropriate recording, with the result of increasing the notified deficit." Previously reported figures were consistently revised down.

The misreported data made it impossible to predict GDP growth, deficit and debt. By the end of each year, all were below estimates. Data problems had been evident over time in several other countries, but in the case of Greece, the problems were so persistent and so severe that the European Commission/Eurostat wrote in its January 2010 Report on Greek Government Deficit and Debt Statistics (page 3): "Revisions of this magnitude in the estimated past government deficit ratios have been extremely rare in the other EU Member States, but have taken place for Greece on several occasions. These most recent revisions are an illustration of the lack of quality of the Greek fiscal statistics (and of macroeconomic statistics in general) and show that the progress in the compilation of fiscal statistics in Greece, and the intense scrutiny of the Greek fiscal data by Eurostat since 2004 (including 10 EDP visits and 5 reservations on the notified data), have not sufficed to bring the quality of Greek fiscal data to the level reached by other EU Member States." And the same report further noted (page 7): "The partners in the ESS

uropean Statistical Systemare supposed to cooperate in good faith. Deliberate misreporting or fraud is not foreseen in the regulation."

In April 2010, in the context of the semiannual notification of deficit and debt statistics under the EU's Excessive Deficit Procedure, the Greek government deficit for years 2006–2008 was revised upward by about 1.5–2 percentage points for each year and the deficit for 2009 was estimated for the first time at 13.6%, the second highest in the EU relative to GDP behind Ireland at 14.3% and the

United Kingdom third at 11.5%. Greek government debt for 2009 was estimated at 115.1% of GDP, which was the second highest in the EU after Italy's 115.8%. Yet, these deficit and debt statistics reported by Greece were again published with reservation by Eurostat, "due to uncertainties on the surplus of social security funds for 2009, on the classification of some public entities and on the recording of off-market swaps."

The revised statistics revealed that Greece from 2000 to 2010 had exceeded the

Eurozone stability criteria, with yearly deficits exceeding the recommended maximum limit at 3.0% of GDP, and with the debt level significantly above the limit of 60% of GDP. It is widely accepted that the persistent misreporting and lack of credibility of Greece's official statistics over many years was an important enabling condition for the buildup of Greece's fiscal problems and eventually its debt crisis. The February 2014 Report of the European Parliament on the enquiry on the role and operations of the Troika (ECB, Commission and IMF) with regard to the euro area programme countries (paragraph 5) states: "

he European Parliament

He or HE may refer to:

Language

* He (pronoun), an English pronoun

* He (kana), the romanization of the Japanese kana へ

* He (letter), the fifth letter of many Semitic alphabets

* He (Cyrillic), a letter of the Cyrillic script called ''He'' in ...

is of the opinion that the problematic situation of Greece was also due to statistical fraud in the years preceding the setting-up of the programme".

Government spending

The Greek economy was one of the Eurozone's fastest growing from 2000 to 2007, averaging 4.2% annually, as foreign capital flooded in. This capital inflow coincided with a higher budget deficit.

Greece had budget surpluses from 1960 to 1973, but thereafter it had budget deficits.

From 1974 to 1980 the government had budget deficits below 3% of GDP, while 1981–2013 deficits were above 3%.

[ ]

An editorial published by ''

Kathimerini

''Kathimerini'' (Greek: Η Καθημερινή, pronounced kaθimeriˈni meaning ''The Daily'') is a daily, political and financial morning newspaper published in Athens. Its first edition was printed on September 15, 1919. and it is considered ...

'' claimed that after the removal of the

right-wing military junta in 1974, Greek governments wanted to bring left-leaning Greeks into the economic mainstream and so ran large deficits to finance military expenditures, public sector jobs, pensions and other social benefits.

In 2008, Greece was the largest importer of conventional weapons in Europe and its military spending was the highest in the European Union relative to the country's GDP, reaching twice the European average.

Even in 2013, Greece had the second-biggest defense spending in

NATO as a percentage of GDP, after the US.

Pre-Euro, currency

devaluation helped to finance Greek government borrowing. Thereafter this tool disappeared. Greece was able to continue borrowing because of the lower interest rates for Euro bonds, in combination with strong GDP growth.

Current account balance

Economist

Paul Krugman wrote, "What we’re basically looking at ... is a balance of payments problem, in which capital flooded south after the creation of the euro, leading to overvaluation in southern Europe" and "In truth, this has never been a fiscal crisis at its root; it has always been a balance of payments crisis that manifests itself in part in budget problems, which have then been pushed onto the center of the stage by ideology."

The translation of trade deficits to budget deficits works through

sectoral balances

The sectoral balances (also called sectoral financial balances) are a sectoral analysis framework for macroeconomic analysis of national economies developed by British economist Wynne Godley. Sectoral analysis is based on the insight that when the ...

. Greece ran current account (trade) deficits averaging 9.1% GDP from 2000 to 2011.

By definition, a trade deficit requires capital inflow (mainly borrowing) to fund; this is referred to as a capital surplus or foreign financial surplus.

Greece's large budget deficit was funded by running a large foreign financial surplus. As the inflow of money stopped during the crisis, reducing the foreign financial surplus, Greece was forced to reduce its budget deficit substantially. Countries facing such a sudden reversal in capital flows typically devalue their currencies to resume the inflow of capital; however, Greece was unable to do this, and so has instead suffered significant income (GDP) reduction, an internal form of devaluation.

Tax evasion and corruption

Before the crisis, Greece was one of EU's worst performers according to

Transparency International's

Corruption Perception Index

The Corruption Perceptions Index (CPI) is an index which ranks countries "by their perceived levels of public sector corruption, as determined by expert assessments and opinion surveys." The CPI generally defines corruption as an "abuse of entr ...

(see table). At some time during the culmination of the crisis, it temporarily became the worst performer.

One bailout condition was to implement an anti-corruption strategy;

by 2017 the situation had improved, but the respective score remained one of the worst in the EU.

The ability to pay its debts depends greatly on the amount of tax the government is able to collect. In Greece, tax receipts were consistently below the expected level. Data for 2012 indicated that the Greek "shadow economy" or "underground economy", from which little or no tax was collected, was a full 24.3% of GDP – compared with 28.6% for Estonia, 26.5% for Latvia, 21.6% for Italy, 17.1% for Belgium, 14.7% for Sweden, 13.7% for Finland, and 13.5% for Germany.

(The situation had improved for Greece, along with most EU countries, by 2017).

Given that tax evasion is correlated with the percentage of working population that is self-employed,

the result was predictable in Greece, where in 2013 the percentage of self-employed workers was more than double the EU average.

Also in 2012, Swiss estimates suggested that Greeks had some 20 billion euros in Switzerland of which only one percent had been declared as taxable in Greece. In 2015, estimates indicated that the amount of evaded taxes stored in Swiss banks was around 80 billion euros.

A mid-2017 report indicated Greeks were being "taxed to the hilt" and many believed that the risk of penalties for tax evasion were less serious than the risk of bankruptcy. One method of evasion that was continuing was the so-called "black market" or "grey economy" or "underground economy": work is done for cash payment which is not declared as income; as well,

VAT

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the en ...

is not collected and remitted.

A January 2017 report

by the DiaNEOsis think-tank indicated that unpaid taxes in Greece at the time totaled approximately 95 billion euros, up from 76 billion euros in 2015, much of it was expected to be uncollectable. The same study estimated that the loss to the government as a result of tax evasion was between 6% and 9% of the country's GDP, or roughly between 11 billion and 16 billion euros per annum.

The shortfall in the collection of VAT (roughly, sales tax) was also significant. In 2014, the government collected 28% less than was owed to it; this shortfall was about double the average for the EU. The uncollected amount that year was about 4.9 billion euros.

The 2017 DiaNEOsis study estimated that 3.5% of GDP was lost due to VAT fraud, while losses due to smuggling of alcohol, tobacco and petrol amounted to approximately another 0.5% of the country's GDP.

=Actions to reduce tax evasion

=

Following similar actions by the

United Kingdom and

Germany, the Greek government was in talks with

Switzerland

). Swiss law does not designate a ''capital'' as such, but the federal parliament and government are installed in Bern, while other federal institutions, such as the federal courts, are in other cities (Bellinzona, Lausanne, Luzern, Neuchâtel ...

in 2011, to try to force Swiss banks to reveal information on the bank accounts of Greek citizens.

The

Ministry of Finance stated that Greeks with Swiss bank accounts would be required either to pay a tax or to reveal information such as the identity of the bank account holder to the Greek internal revenue services.

The Greek and Swiss governments hoped to reach a deal on the matter by the end of 2011.

The solution demanded by Greece had still not been effected as of 2015; when there was an estimated €80 billion of taxes evaded on Swiss bank accounts. But by then the Greek and Swiss governments were seriously negotiating a tax treaty to address this issue.

On 1 March 2016 Switzerland ratified an agreement creating a new tax transparency law to fight tax evasion more effectively. Starting in 2018, banks in both Greece and Switzerland were to exchange information about the bank accounts of citizens of the other country, to minimize the possibility of hiding untaxed income.

In 2016 and 2017, the government was encouraging the use of

credit cards and

debit card

A debit card, also known as a check card or bank card is a payment card that can be used in place of cash to make purchases. The term '' plastic card'' includes the above and as an identity document. These are similar to a credit card, but u ...

s to pay for goods and services in order to reduce cash only payments. By January 2017, taxpayers were only granted tax allowances or deductions when payments were made electronically, with a "paper trail" of the transactions that the government could easily audit. This was expected to reduce the problem of businesses taking payments but not issuing an invoice. This tactic had been used by various companies to avoid payment of VAT as well as income tax.

By 28 July 2017, numerous businesses were required by law to install a

point of sale

The point of sale (POS) or point of purchase (POP) is the time and place at which a retail transaction is completed. At the point of sale, the merchant calculates the amount owed by the customer, indicates that amount, may prepare an invoice f ...

(POS) device to enable them to accept payment by credit or debit card. Failure to comply can lead to fines of up to €1,500. The requirement applied to around 400,000 firms or individuals in 85 professions. The greater use of cards had helped to achieve significant increases in VAT receipts in 2016.

Chronology

2010 revelations and IMF bailout

Despite the crisis, the Greek government's bond auction in January 2010 of €8bn 5-year bonds was 4x over-subscribed. The next auction (March) sold €5bn in 10-year bonds reached 3x. However, yields (interest rates) increased, which worsened the deficit. In April 2010, it was estimated that up to 70% of Greek government bonds were held by foreign investors, primarily banks.

In April, after publication of GDP data which showed an intermittent period of recession starting in 2007,

then downgraded Greek bonds to

junk status in late April 2010. This froze private capital markets, and put Greece in danger of

sovereign default without a bailout.

On 2 May, the

European Commission,

European Central Bank (ECB) and

International Monetary Fund (IMF) (the

Troika) launched a bailout loan to rescue Greece from

sovereign default and cover its financial needs through June 2013, conditional on implementation of

austerity measures, structural reforms and privatization of government assets. The bailout loans were mainly used to pay for the maturing bonds, but also to finance the continued yearly budget deficits.

Fraudulent statistics, revisions and controversies

To keep within the

monetary union guidelines, the government of Greece for many years simply misreported economic statistics. The areas in which Greece's deficit and debt statistics did not follow common European Union rules spanned about a dozen different areas outlined and explained in two European Commission/Eurostat reports, from January 2010 (including its very detailed and candid annex) and from November 2010.

For example, at the beginning of 2010, it was discovered that Goldman Sachs and other banks had arranged financial transactions involving the use of derivatives to reduce the Greek government's nominal foreign currency debt, in a manner that the banks claim was consistent with EU debt reporting rules, but which others have argued were contrary at the very least to the spirit of the reporting rules of such instruments.

Christoforos Sardelis, former head of Greece's

Public Debt Management Agency, said that the country did not understand what it was buying. He also said he learned that "other EU countries such as Italy" had made similar deals (while similar cases were reported for other countries, including Belgium, Portugal, and even Germany).

Most notable was a

cross currency swap

A cross is a geometrical figure consisting of two intersecting lines or bars, usually perpendicular to each other. The lines usually run vertically and horizontally. A cross of oblique lines, in the shape of the Latin letter X, is termed a sa ...

, where billions worth of Greek debts and loans were converted into yen and dollars at a fictitious exchange rate, thus hiding the true extent of Greek loans. Such off market swaps were not originally registered as debt because

Eurostat

Eurostat ('European Statistical Office'; DG ESTAT) is a Directorate-General of the European Commission located in the Kirchberg, Luxembourg, Kirchberg quarter of Luxembourg City, Luxembourg. Eurostat's main responsibilities are to provide statis ...

statistics did not include such financial derivatives until March 2008, when Eurostat issued a Guidance note that instructed countries to record as debt such instruments. A German derivatives dealer commented, "The

Maastricht rules can be circumvented quite legally through swaps", and "In previous years, Italy used a similar trick to mask its true debt with the help of a different US bank."

These conditions enabled Greece and other governments to spend beyond their means, while ostensibly meeting EU deficit targets.

However, while in 2008 other EU countries with such off-market swaps declared them to Eurostat and went back to correct their debt data (with reservations and disputes remaining

), the Greek government told Eurostat it had no such off market swaps and did not adjust its debt measure as required by the rules. The European Commission/Eurostat November 2010 report explains the situation in detail and inter alia notes (page 17): "In 2008 the Greek authorities wrote to Eurostat that: "The State does not engage in options, forwards, futures or FOREX swaps, nor in off market swaps (swaps with non-zero market value at inception)."

In reality, however, according to the same report, at end-2008 Greece had off-market swaps with a market value of 5.4 billion Euro, thus understating the value of general government debt by the same amount (2.3 percent of GDP).The European statistics agency, Eurostat, had at regular intervals from 2004 to 2010, sent 10 delegations to Athens with a view to improving the reliability of Greek statistical figures. In January it issued a report that contained accusations of falsified data and political interference. The Finance Ministry accepted the need to restore trust among investors and correct methodological flaws, "by making the National Statistics Service an independent legal entity and phasing in, during the first quarter of 2010, all the necessary checks and balances".

The new government of

George Papandreou revised the 2009 deficit forecast from a previous 6%–8% to 12.7% of GDP. The final value, after revisions concluded in the following year using Eurostat's standardized method, was 15.4% of GDP.

The figure for Greek government debt at the end of 2009 increased from its first November estimate at (113% of GDP)

to a revised (127% of GDP

). This was the highest for any EU country.

The methodology of revisions, has led to a certain controversy. Specifically, questions have been raised about the way the cost of aforementioned previous actions such as cross currency swaps was estimated, and why it was retroactively added to the 2006, 2007, 2008 and 2009 budget deficits, rather than to those of earlier years, more relevant to the transactions. However, Eurostat and ELSTAT have explained in detail in public reports from November 2010 that the proper recording of off-market swaps that was carried out in November 2010 increased the stock of debt for each year for which the swaps were outstanding (including the years 2006–2009) by about 2.3 percent of GDP but at the same time decreased -not increased- the deficit for each of these years by about 0.02 percent of GDP.

Regarding the latter, the Eurostat report explains: " at the same time

s the upward correction of the debt stock there must be a correction throughout the whole period for the deficit of Greece, as the flows of interest under the swap contract are reduced by an amount equal to the part of any settlement flows relating to the amortisation of the loan (this is a financial transaction with no impact on the deficit), whereas interest on the loan are still imputed as expenditure." Further questions involve the way deficits of several legal entities from the non-financial corporations in the General Government sector were estimated and retroactively added to the same years' (2006 to 2009) budget deficits. Nevertheless, both Eurostat and ELSTAT have explained in public reports how the previous misclassification of certain (17 in number) government enterprises and other government entities outside the General Government sector was corrected as they did not meet the criteria for being classified outside the General Government. As the Eurostat report noted, "Eurostat discovered that the ESA 95 rules for classification of state owned units were not being applied."

In the context of this controversy, the former head of Greece's statistical agency, Andreas Georgiou, has been accused of inflating Greece's budget deficit for the aforementioned years.

He was cleared of charges of inflating Greece's deficit in February 2019. It has been argued by many international as well as Greek observers that "despite overwhelming evidence that Mr. Georgiou correctly applied EU rules in revising Greece’s fiscal deficit and debt figures, and despite strong international support for his case, some Greek courts continued the witch hunt."

The combined corrections lead to an increase of the Greek public debt by

about 10%. After the

financial audit of the fiscal years 2006–2009 Eurostat announced in November 2010 that the revised figures for 2006–2009 finally were considered to be reliable.

2011

A year later, a worsened recession along with the poor performance of the Greek government in achieving the conditions of the agreed bailout, forced a second bailout. In July 2011, private creditors agreed to a voluntary haircut of 21 percent on their Greek debt, but Eurozone officials considered this write-down to be insufficient. Especially

Wolfgang Schäuble, the German finance minister, and

Angela Merkel, the German chancellor, "pushed private creditors to accept a 50 percent loss on their Greek bonds",

while

Jean-Claude Trichet of the European Central Bank had long opposed a haircut for private investors, "fearing that it could undermine the vulnerable European banking system".

When private investors agreed to accept bigger losses, the Troika launched the second bailout worth . This included a bank recapitalization package worth €48bn. Private bondholders were required to accept extended maturities, lower interest rates and a 53.5% reduction in the bonds' face value.

On 17 October 2011,

Minister of Finance Evangelos Venizelos announced that the government would establish a new fund, aimed at helping those who were hit the hardest from the government's austerity measures.

The money for this agency would come from a crackdown on

tax evasion.

The government agreed to creditor proposals that Greece raise up to €50 billion through the sale or development of state-owned assets, but receipts were much lower than expected, while the policy was strongly opposed by the left-wing political party,

Syriza

The Coalition of the Radical Left – Progressive Alliance ( el, Συνασπισμός Ριζοσπαστικής Αριστεράς – Προοδευτική Συμμαχία, Synaspismós Rizospastikís Aristerás – Proodeftikí Simachía), ...

. In 2014, only €530m was raised. Some key assets were sold to insiders.

2012

The second bailout programme was ratified in February 2012. A total of was to be transferred in regular tranches through December 2014. The recession worsened and the government continued to dither over bailout program implementation. In December 2012 the Troika provided Greece with more debt relief, while the IMF extended an extra €8.2bn of loans to be transferred from January 2015 to March 2016.

2014

The fourth review of the bailout programme revealed unexpected financing gaps.

[

] In 2014 the outlook for the Greek economy was optimistic. The government predicted a

structural surplus

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget ...

in 2014,

opening access to the private lending market to the extent that its entire financing gap for 2014 was covered via private

bond sales.

Instead a fourth recession started in Q4-2014.

The parliament called

snap parliamentary elections in December, leading to a

Syriza

The Coalition of the Radical Left – Progressive Alliance ( el, Συνασπισμός Ριζοσπαστικής Αριστεράς – Προοδευτική Συμμαχία, Synaspismós Rizospastikís Aristerás – Proodeftikí Simachía), ...

-led government that rejected the existing bailout terms.

Like the previous Greek governments, the Syriza-led government was met with the same response from Troika, "

Pacta sunt servanda

''Pacta sunt servanda'', Latin for "agreements must be kept", is a brocard and a fundamental principle of law. According to Hans Wehberg, a professor of international law, "few rules for the ordering of Society have such a deep moral and religi ...

" (agreements must be kept). The Troika suspended all scheduled remaining aid to Greece, until the Greek government retreated or convinced the Troika to accept a revised programme.

This rift caused a liquidity crisis (both for the Greek government and Greek financial system), plummeting stock prices at the

Athens Stock Exchange

The Athens Stock Exchange (ASE or ATHEX; el, Χρηματιστήριο Αθηνών (Χ.Α.), ''Chrimatistírio Athinón'') is the stock exchange of Greece, based in the capital city of Athens. It was founded in 1876. There are currently five ...

and a renewed loss of access to private financing.

2015

After

Greece's January snap election, the Troika granted a further four-month technical extension of its bailout programme; expecting that the payment terms would be renegotiated before the end of April,

allowing for the review and the last financial transfer to be completed before the end of June.

Facing sovereign default, the government made new proposals in the first

and second half of June.

Both were rejected, raising the prospect of recessionary

capital controls to avoid a

collapse of the banking sector – and

Greek exit from the Eurozone.

The government unilaterally broke off negotiations on 26 June.

announced that a

referendum would be held on 5 July to approve or reject the Troika's 25 June proposal.

The

Greek stock market closed on 27 June.

The government campaigned for rejection of the proposal, while four opposition parties (

PASOK,

To Potami

The River ( el, Το Ποτάμι, To Potami, ) was a centrist and social-liberal political party in Greece. The party was founded in February 2014 by Stavros Theodorakis. The party did not run in the 2019 elections and had no seats in the Hel ...

,

KIDISO

The Movement of Democratic Socialists ( el, Κίνημα Δημοκρατών Σοσιαλιστών, ''Kinima Dimokraton Sosialiston'') is a political party in Greece established on 3 January 2015 by George Papandreou after splitting from the ...

and

New Democracy) objected that the proposed referendum was unconstitutional. They petitioned for the

parliament or

president to reject the referendum proposal.

Meanwhile, the Eurogroup announced that the existing second bailout agreement would technically expire on 30 June, 5 days before the referendum.

The Eurogroup clarified on 27 June that only if an agreement was reached prior to 30 June could the bailout be extended until the referendum on 5 July. The Eurogroup wanted the government to take some responsibility for the subsequent program, presuming that the referendum resulted in approval.

The Eurogroup had signaled willingness to uphold their "November 2012 debt relief promise", presuming a final agreement.

This promise was that if Greece completed the program, but its debt-to-GDP ratio subsequently was forecast to be over 124% in 2020 or 110% in 2022 for any reason, then the Eurozone would provide debt-relief sufficient to ensure that these two targets would still be met.

On 28 June the referendum was approved by the Greek parliament with no interim bailout agreement. The

ECB decided to stop its Emergency Liquidity Assistance to Greek banks. Many Greeks continued to withdraw cash from their accounts fearing that capital controls would soon be invoked.

On 5 July a 61% majority

voted to reject the bailout terms. This caused stock indexes worldwide to tumble, fearing Greece's potential exit from the Eurozone ("

Grexit

A Greek withdrawal from the eurozone was a hypothetical scenario, debated mostly in the early to mid 2010s, under which Greece would withdraw from the Eurozone to deal with the Greek government-debt crisis of the time. This conjecture was give ...

"). Following the vote, Greece's finance minister

Yanis Varoufakis stepped down on 6 July, because of the Prime Minister's denial to follow the public vote and was replaced by

Euclid Tsakalotos

Euclid Stefanou Tsakalotos ( el, Ευκλείδης Στεφάνου Τσακαλώτος, ; born 1960) is a Greek economist and politician who was Minister of Finance of Greece from 2015 to 2019. He is also a member of the Central Committee of ...

.

On 13 July, after 17 hours of negotiations, Eurozone leaders reached a provisional agreement on a third bailout programme, substantially the same as their June proposal. Many financial analysts, including the largest private holder of Greek debt, private equity firm manager,

Paul Kazarian

Paul B. Kazarian ( ; born October 15, 1955) is an Armenian-American investor, philanthropist, and former Investment banking, investment banker. He is the founder, managing director and chief executive officer (CEO) of Japonica Partners, a Hedge fun ...

, found issue with its findings, citing it as a distortion of net debt position.

2017

On 20 February 2017, the Greek finance ministry reported that the government's debt load had reached €226.36 billion after increasing by €2.65 billion in the previous quarter. By the middle of 2017, the yield on Greek government bonds began approaching pre-2010 levels, signalling a potential return to economic normalcy for the country.

According to the International Monetary Fund (IMF), Greece's GDP was estimated to grow by 2.8% in 2017.

The

Medium-term Fiscal Strategy Framework 2018–2021 voted on 19 May 2017 introduced amendments of the provisions of the 2016

thirteenth austerity package.

In June 2017, news reports indicated that the "crushing debt burden" had not been alleviated and that Greece was at the risk of defaulting on some payments. The

International Monetary Fund stated that the country should be able to borrow again "in due course". At the time, the Eurozone gave Greece another credit of $9.5-billion, $8.5 billion of loans and brief details of a possible debt relief with the assistance of the IMF. On 13 July, the Greek government sent a letter of intent to the IMF with 21 commitments it promised to meet by June 2018. They included changes in labour laws, a plan to cap public sector work contracts, to transform temporary contracts into permanent agreements and to recalculate pension payments to reduce spending on social security.

2018

On 21 June 2018, Greece's creditors agreed on a 10-year extension of maturities on 96.6 billion euros of loans (i.e. almost a third of Greece's total debt), as well as a 10-year grace period in interest and amortization payments on the same loans.

Greece successfully exited (as declared) the bailouts on 20 August 2018.

2019

In March 2019, Greece sold 10-year bonds for the first time since before the bailout.

2021

In March 2021, Greece sold its first 30-year bond since the financial crisis in 2008.

The bond issue raised 2.5 billion euros.

Bailout programmes

First Economic Adjustment Programme

On 1 May 2010, the Greek government announced a series of austerity measures.

On 3 May, the Eurozone countries and the IMF agreed to a three-year loan, paying 5.5% interest, conditional on the implementation of austerity measures. Credit rating agencies immediately downgraded Greek governmental bonds to an even lower junk status.

The

programme was met with anger by the Greek public, leading to

protests, riots and social unrest. On 5 May 2010, a national strike was held in opposition.

Nevertheless, the austerity package was approved on 29 June 2011, with 155 out of 300 members of parliament voting in favour.

Second Economic Adjustment Programme

At a 21 July 2011 summit in Brussels, Eurozone leaders agreed to extend Greek (as well as Irish and Portuguese) loan repayment periods from 7 years to a minimum of 15 years and to cut interest rates to 3.5%. They also approved an additional support package, with exact content to be finalized at a later summit.

On 27 October 2011, Eurozone leaders and the IMF settled an agreement with banks whereby they accepted a 50% write-off of (part of) Greek debt.

Greece brought down its primary deficit from €25bn (11% of GDP) in 2009 to €5bn (2.4% of GDP) in 2011.

However, the Greek recession worsened. Overall 2011 Greek GDP experienced a 7.1% decline. The unemployment rate grew from 7.5% in September 2008 to an unprecedented 19.9% in November 2011.

Third Economic Adjustment Programme

The third and last Economic Adjustment Programme for Greece was signed on 12 July 2015 by the Greek Government under prime minister Alexis Tsipras and it expired on 20 August 2018.

Effects on the GDP compared to other Eurozone countries

There were key differences in the effects of the Greek programme compared to those for other Eurozone bailed-out countries. According to the applied programme, Greece had to accomplish by far the largest fiscal adjustment (by more than 9 points of GDP between 2010 and 2012

[ ]), "a record fiscal consolidation by OECD standards ".

Between 2009 and 2014 the change (improvement) in structural primary balance was 16.1 points of GDP for Greece, compared to 8.5 for Portugal, 7.3 for Spain, 7.2 for Ireland, and 5.6 for Cyprus.

The negative effects of such a rapid fiscal adjustment on the Greek GDP, and thus the scale of resulting increase of the Debt to GDP ratio, had been underestimated by the IMF, apparently due to a calculation error.

Indeed, the result was a magnification of the debt problem.

Even were the amount of debt to remain the same, Greece's Debt to GDP ratio of 127% in 2009 would still jump to about 170% – considered unsustainable – solely due to the drop in GDP (which fell by more than 25% between 2009 and 2014).

The much larger scale of the above effects does not easily support a meaningful comparison with the performance of programmes in other bailed-out countries.

Bank recapitalization

The Hellenic Financial Stability Fund (HFSF) completed a €48.2bn bank recapitalization in June 2013, of which the first €24.4bn were injected into the four biggest Greek banks. Initially, this recapitalization was accounted for as a debt increase that elevated the debt-to-GDP ratio by 24.8 points by the end of 2012. In return for this, the government received shares in those banks, which it could later sell (per March 2012 was expected to generate €16bn of extra "privatization income" for the Greek government, to be realized during 2013–2020).ecb

HFSF offered three out of the four big Greek banks (

NBG,

Alpha

Alpha (uppercase , lowercase ; grc, ἄλφα, ''álpha'', or ell, άλφα, álfa) is the first letter of the Greek alphabet. In the system of Greek numerals, it has a value of one. Alpha is derived from the Phoenician letter aleph , whic ...

and

Piraeus)

warrants

Warrant may refer to:

* Warrant (law), a form of specific authorization

** Arrest warrant, authorizing the arrest and detention of an individual

** Search warrant, a court order issued that authorizes law enforcement to conduct a search for eviden ...

to buy back all HFSF bank shares in semi-annual exercise periods up to December 2017, at some predefined strike prices.

These banks acquired additional private investor capital contribution at minimum 10% of the conducted recapitalization. However

Eurobank Ergasias failed to attract private investor participation and thus became almost entirely financed/owned by HFSF. During the first warrant period, the shareholders in Alpha bank bought back the first 2.4% of HFSF shares. Shareholders in Piraeus Bank bought back the first 0.07% of HFSF shares. National Bank (NBG) shareholders bought back the first 0.01% of the HFSF shares, because the market share price was cheaper than the strike price. Shares not sold by the end of December 2017 may be sold to alternative investors.

In May 2014, a second round of bank recapitalization worth €8.3bn was concluded, financed by private investors. All six commercial banks (Alpha, Eurobank, NBG, Piraeus,

Attica and Panellinia) participated.

HFSF did not tap into their current €11.5bn reserve capital fund. Eurobank in the second round was able to attract private investors. This required HFSF to dilute their ownership from 95.2% to 34.7%.

According to HFSF's third quarter 2014 financial report, the fund expected to recover €27.3bn out of the initial €48.2bn. This amount included "A€0.6bn positive cash balance stemming from its previous selling of warrants (selling of recapitalization shares) and liquidation of assets, €2.8bn estimated to be recovered from liquidation of assets held by its 'bad asset bank', €10.9bn of EFSF bonds still held as capital reserve, and €13bn from its future sale of recapitalization shares in the four systemic banks." The last figure is affected by the highest amount of uncertainty, as it directly reflects the current market price of the remaining shares held in the four systemic banks (66.4% in Alpha, 35.4% in Eurobank, 57.2% in NBG, 66.9% in Piraeus), which for HFSF had a combined market value of €22.6bn by the end of 2013 – declining to €13bn on 10 December 2014.

Once HFSF liquidates its assets, the total amount of recovered capital will be returned to the Greek government to help to reduce its debt. In early December 2014, the

Bank of Greece

The Bank of Greece ( el, Τράπεζα της Ελλάδος , ΤτΕ) is the central bank of Greece. Its headquarters is located in Athens on Panepistimiou Street, but it also has several branches across the country. It was founded in 192 ...

allowed HFSF to repay the first €9.3bn out of its €11.3bn reserve to the Greek government. A few months later, the remaining HFSF reserves were likewise approved for repayment to ECB, resulting in redeeming €11.4bn in notes during the first quarter of 2015.

Creditors

Initially, European banks had the largest holdings of Greek debt. However, this shifted as the "troika" (ECB, IMF and a European government-sponsored fund) gradually replaced private investors as Greece's main creditor, by setting up the EFSF. As of early 2015, the largest individual contributors to the EFSF fund were Germany, France and Italy with roughly €130bn total of the €323bn debt. The IMF was owed €32bn. As of 2015, various European countries still had a substantial amount of loans extended to Greece.

Separately, the European Central Bank acquired around 45 billion euros of Greek bonds through the "securities market programme" (SMP).

European banks

Excluding Greek banks, European banks had €45.8bn exposure to Greece in June 2011.

However, by early 2015 their holdings had declined to roughly €2.4bn,

in part due to the 50% debt write-down.

European Investment Bank

In November 2015, the

European Investment Bank

The European Investment Bank (EIB) is the European Union's investment bank and is owned by the EU Member States. It is one of the largest supranational lenders in the world. The EIB finances and invests both through equity and debt solutions ...

(EIB) lent Greece about 285 million euros. This extended the 2014 deal that EIB would lend 670 million euros. It was thought that the Greek government would invest the money on Greece's energy industries so as to ensure energy security and manage environmentally friendly projects.

Werner Hoyer

Werner Hoyer (born 17 November 1951 in Wuppertal) is a German economist and politician of the Free Democratic Party (FDP) who is currently serving as the President of the European Investment Bank.

Education and early career

Hoyer graduated as a ...

, the president of EIB, expected the investment to boost employment and have a positive impact on Greece's economy and environment.

Diverging views within the troika

In hindsight, while the troika shared the aim to avoid a Greek sovereign default, the approach of each member began to diverge, with the IMF on one side advocating for more debt relief while, on the other side, the EU maintained a hardline on debt repayment and strict monitoring.

[

]

Greek public opinion

According to a poll in February 2012 by Public Issue and SKAI Channel, PASOK—which won the national elections of 2009 with 43.92% of the vote—had seen its approval rating decline to 8%, placing it fifth after centre-right New Democracy (31%), left-wing Democratic Left (18%), far-left

According to a poll in February 2012 by Public Issue and SKAI Channel, PASOK—which won the national elections of 2009 with 43.92% of the vote—had seen its approval rating decline to 8%, placing it fifth after centre-right New Democracy (31%), left-wing Democratic Left (18%), far-left Communist Party of Greece

The Communist Party of Greece ( el, Κομμουνιστικό Κόμμα Ελλάδας, ''Kommounistikó Kómma Elládas'', KKE) is a political party in Greece.

Founded in 1918 as the Socialist Labour Party of Greece and adopted its curren ...

(KKE) (12.5%) and radical left Syriza

The Coalition of the Radical Left – Progressive Alliance ( el, Συνασπισμός Ριζοσπαστικής Αριστεράς – Προοδευτική Συμμαχία, Synaspismós Rizospastikís Aristerás – Proodeftikí Simachía), ...

(12%). The same poll suggested that Papandreou was the least popular political leader with a 9% approval rating, while 71% of Greeks did not trust him.Giorgos Papakonstantinou

Giórgos Papakonstantínou ( el, Γιώργος Παπακωνσταντίνου; born 30 October 1961) in Athens, Greece, is a Greek economist and politician and former Minister for the Environment, Energy and Climate Change of Greece and former ...

, to handle the crisis.

Economic, social and political effects

Economic effects

Greek GDP's worst decline, −6.9%, came in 2011,Eurostat

Eurostat ('European Statistical Office'; DG ESTAT) is a Directorate-General of the European Commission located in the Kirchberg, Luxembourg, Kirchberg quarter of Luxembourg City, Luxembourg. Eurostat's main responsibilities are to provide statis ...

:

* Greek GDP fell from €242 billion in 2008 to €179 billion in 2014, a 26% decline. Greece was in recession for over five years, emerging in 2014 by some measures. This fall in GDP dramatically increased the Debt to GDP ratio, severely worsening Greece's debt crisis.

* GDP per capita fell from a peak of €22,500 in 2007 to €17,000 in 2014, a 24% decline.

* The public debt to GDP ratio in 2014 was 177% of GDP or €317 billion. This ratio was the world's third highest after Japan and Zimbabwe. Public debt peaked at €356 billion in 2011; it was reduced by a bailout program to €305 billion in 2012 and then rose slightly.

* The annual budget deficit (expenses over revenues) was 3.4% GDP in 2014, much improved versus the 15% of 2009.

* Tax revenues for 2014 were €86 billion (about 48% GDP), while expenditures were €89.5 billion (about 50% GDP).

* The unemployment rate rose from below 10% (2005–2009) to around 25% (2014–2015).

* An estimated 36% of Greeks lived below the poverty line in 2014.

Greece defaulted on a $1.7 billion IMF payment on 29 June 2015 (the payment was made with a 20-day delayIMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster globa ...

reported on 2 July 2015 that the "debt dynamics" of Greece were "unsustainable" due to its already high debt level and "...significant changes in policies since 014 014 may refer to:

* Argus As 014

* BIND-014

* 014 Construction Unit

* Divi Divi Air Flight 014

* Pirna 014

* Tyrrell 014

The Tyrrell 014 was a Formula One car, designed for Tyrrell Racing by Maurice Philippe for use in the season. The cars wer ...

��not least, lower primary surpluses and a weak reform effort that will weigh on growth and privatization— hichare leading to substantial new financing needs." The report stated that debt reduction (haircuts, in which creditors sustain losses through debt principal reduction) would be required if the package of reforms under consideration were weakened further.

Taxation

In response to the crisis, the Greek governments resolved to raise the tax rates dramatically. A study showed that indirect taxes were almost doubled between the beginning of the Crisis and 2017. This crisis-induced system of high taxation has been described as "unfair", "complicated", "unstable" and, as a result, "encouraging tax evasion".

Tax evasion and avoidance

A mid-2017 report indicated Greeks have been "taxed to the hilt" and many believed that the risk of penalties for tax evasion were less serious than the risk of bankruptcy.

Social effects

The social effects of the austerity measures on the Greek population were severe.

The social effects of the austerity measures on the Greek population were severe.homeless shelter

Homeless shelters are a type of homeless service agency which provide temporary residence for homeless individuals and families. Shelters exist to provide residents with safety and protection from exposure to the weather while simultaneously r ...

s. These homeless had extensive work histories and were largely free of mental health and substance abuse concerns.street newspaper

Street newspapers (or street papers) are newspapers or magazines sold by homeless or poor individuals and produced mainly to support these populations. Most such newspapers primarily provide coverage about homelessness and poverty-related is ...

''Schedia'' ( el, Σχεδία, "Raft"),Eurostat

Eurostat ('European Statistical Office'; DG ESTAT) is a Directorate-General of the European Commission located in the Kirchberg, Luxembourg, Kirchberg quarter of Luxembourg City, Luxembourg. Eurostat's main responsibilities are to provide statis ...

, it was found that 1 in 3 Greek citizens lived under poverty conditions in 2016.

Political effects

The economic and social crisis had profound political effects. In 2011 it gave rise to the anti-austerity Movement of the Indignant in Syntagma Square. The two-party system which dominated Greek politics from 1977 to 2009 crumbled in the double elections of 6 May

Events Pre-1600

*1527 – Spanish and German troops sack Rome; many scholars consider this the end of the Renaissance.

*1536 – The Siege of Cuzco commences, in which Incan forces attempt to retake the city of Cuzco from the Spanish ...

and 17 June 2012. The main features of this transformation were:

a) The crisis of the two main parties, the center-right New Democracy (ND) and center-left PASOK. ND saw its share of the vote drop from an historical average of >40% to a record low of 19–33% in 2009–19. PASOK collapsed from 44% in 2009 to 13% in June 2012 and stabilized around 8% in the 2019 elections. Meanwhile, Syriza

The Coalition of the Radical Left – Progressive Alliance ( el, Συνασπισμός Ριζοσπαστικής Αριστεράς – Προοδευτική Συμμαχία, Synaspismós Rizospastikís Aristerás – Proodeftikí Simachía), ...

emerged as the main rival of ND, with a share of the vote that rose from 4% to 27% between 2009 and June 2012. This peaked in the elections of 25 January 2015 when Syriza received 36% of the vote and fell to 31.5% in the 7 July 2019 elections.

b) The sharp rise of the Neo-Nazi Golden Dawn

Golden Dawn or The Golden Dawn may refer to:

Organizations

* Hermetic Order of the Golden Dawn, a nineteenth century magical order based in Britain

** The Hermetic Order of the Golden Dawn, Inc., a modern revival founded in 1977

** Open Source ...

, whose share of the vote increased from 0.29% in 2009 to 7% in May and June 2012. In 2012–19, Golden Dawn was the third largest party in the Greek Parliament.

c) A general fragmentation of the popular vote. The average number of parties represented in the Greek Parliament in 1977–2012 was between 4 and 5. In 2012–19 this increased to 7 or 8 parties.

d) From 1974 to 2011 Greece was ruled by single-party governments, except for a brief period in 1989–90. In 2011–19, the country was ruled by two- or three-party coalitions.

The victory of ND in the 7 July 2019 elections with 40% of the vote and the formation of the first one-party government in Greece since 2011 could be the beginning of a new functioning two-party system. However, the significantly weaker performance of Syriza and PASOK's endurance as a competing centre-left party could signal continued party system fluidity.

Other effects

Horse racing

Horse racing is an equestrian performance sport, typically involving two or more horses ridden by jockeys (or sometimes driven without riders) over a set distance for competition. It is one of the most ancient of all sports, as its basic p ...

has ceased operation due to the liquidation of the conducting organization.

Paid soccer

Association football, more commonly known as football or soccer, is a team sport played between two teams of 11 players who primarily use their feet to propel the ball around a rectangular field called a pitch. The objective of the game is ...

players will receive their salary with new tax rates.

Responses

Electronic payments to reduce tax evasion

In 2016 and 2017, the government was encouraging the use of credit card or debit cards

A debit card, also known as a check card or bank card is a payment card that can be used in place of cash to make purchases. The term ''plastic card'' includes the above and as an identity document. These are similar to a credit card, but unl ...

to pay for goods and services in order to reduce cash only payments. By January 2017, taxpayers were only granted tax-allowances or deductions when payments were made electronically, with a "paper trail" of the transactions. This was expected to reduce the opportunity by vendors to avoid the payment of VAT (sales) tax and income tax.

Grexit

Krugman suggested that the Greek economy could recover from the recession by exiting the Eurozone ("Grexit") and returning to its national currency, the drachma. That would restore Greece's control over its monetary policy, allowing it to navigate the trade-offs between inflation and growth on a national basis, rather than the entire Eurozone. Iceland made a dramatic recovery following the default of its commercial banking system in 2008, in part due to the devaluing of the krona (ISK). In 2013, it enjoyed an economic growth rate of some 3.3 percent.[OECD, National Accounts of OECD Countries detailed tables 2006–2013, Volume 2014/2] Canada was able to improve its budget position in the 1990s by devaluing its currency.

However, the consequences of "Grexit" could be global and severe, including:

Bailout

Greece could accept additional bailout funds and debt relief (i.e. bondholder haircuts or principal reductions) in exchange for greater austerity. However, austerity has damaged the economy, deflating wages, destroying jobs and reducing tax receipts, thus making it even harder to pay its debts. If further austerity were accompanied by enough reduction in the debt balance owed, the cost might be justifiable.

European debt conference

Economist Thomas Piketty said in July 2015: "We need a conference on all of Europe’s debts, just like after World War II. A restructuring of all debt, not just in Greece but in several European countries, is inevitable." This reflected the difficulties that Spain, Portugal, Italy and Ireland had faced (along with Greece) before ECB-head Mario Draghi signaled a pivot to looser monetary policy. Piketty noted that Germany received significant debt relief after World War II. He warned that: "If we start kicking states out, then....Financial markets will immediately turn on the next country."

Germany's role in Greece

Germany has played a major role in discussion concerning Greece's debt crisis.

Charges of hypocrisy

Hypocrisy has been alleged on multiple bases. "Germany is coming across like a know-it-all in the debate over aid for Greece", commented ''Der Spiegel'',

pdf

corruption

Corruption is a form of dishonesty or a criminal offense which is undertaken by a person or an organization which is entrusted in a position of authority, in order to acquire illicit benefits or abuse power for one's personal gain. Corruption m ...

, yet the arms sales meant that the trade with Greece became synonymous with high-level bribery and corruption; former defence minister Akis Tsochadzopoulos was jailed in April 2012 ahead of his trial on charges of accepting an €8m bribe from Germany company Ferrostaal.

Pursuit of national self-interest

"The counterpart to Germany living within its means is that others are living beyond their means", according to Philip Whyte, senior research fellow at the Centre for European Reform The Centre for European Reform (CER) is a London-based think tank that focuses on matters of European integration. It is a prominent source of ideas and commentary in debates about a wide range of EU-related issues, both in the United Kingdom and in ...

. "So if Germany is worried about the fact that other countries are sinking further into debt, it should be worried about the size of its trade surpluses, but it isn't."Carnegie Endowment for International Peace

The Carnegie Endowment for International Peace (CEIP) is a nonpartisan international affairs think tank headquartered in Washington D.C. with operations in Europe, South and East Asia, and the Middle East as well as the United States. Founded in ...

in 2010 noted that "Germany, now poised to derive the greatest gains from the euro's crisis-triggered decline, should boost its domestic demand" to help the periphery recover. In March 2012, Bernhard Speyer of Deutsche Bank reiterated: "If the eurozone is to adjust, southern countries must be able to run trade surpluses, and that means somebody else must run deficits. One way to do that is to allow higher inflation in Germany but I don't see any willingness in the German government to tolerate that, or to accept a current account Current account or Current Account may refer to:

* Current account (balance of payments), a country's balance of trade, net of factor income and cash transfers

* Current account (banking)

A transaction account, also called a checking account, ch ...

deficit."Credit Suisse

Credit Suisse Group AG is a global investment bank and financial services firm founded and based in Switzerland. Headquartered in Zürich, it maintains offices in all major financial centers around the world and is one of the nine global " ...

, "Solving the periphery economic imbalances does not only rest on the periphery countries' shoulders even if these countries have been asked to bear most of the burden. Part of the effort to re-balance Europe also has to been borne [sic] by Germany via its current account."[ "The senior US Treasury official said: 'It is more important than ever for surplus economies to strengthen private demand and there was some discussion of that'."]

Even with such policies, Greece and other countries would face years of hard times, but at least there would be some hope of recovery.Association of Greek Tourism Enterprises

The Association of Greek Tourism Enterprises ( el, Σύνδεσμος Ελληνικών Τουριστικών Επιχειρήσεων), commonly abbreviated to SETE (ΣΕΤΕ), is a non-governmental, non-profit organization founded in 1991. It ...

estimates that German visits for 2012 will decrease by about 25%.[ ]

Effect of applied programmes on the debt crisis

Greece's GDP dropped by 25%, connected with the bailout programmes.

Criticism of the role of news media and stereotyping

A large number of negative articles about the Greek economy and society have been published in international media before and during the crisis, leading to accusations about negative stereotyping and possible effects on the evolution of the crisis itself.

Economic statistics

See also

* Currency crisis

* European debt crisis

* The role of the Institute of International Finance in the Greek debt crisis

* Japonica Partner's Greek bond trade

* List of acronyms: European sovereign-debt crisis

* List of countries by external debt

This is a list of countries by external debt, it is the total public and private debt owed to nonresidents repayable in internationally accepted currencies, goods or services, where the public debt is the money or credit owed by any level of gov ...

*

* Puerto Rican government-debt crisis

The Puerto Rican government-debt crisis was a financial crisis affecting the government of Puerto Rico. The crisis began in 2014 when three major credit agencies downgraded several bond issues by Puerto Rico to "junk status" after the governmen ...

* Vulture fund

Analogous events

* 1997 Asian financial crisis

The Asian financial crisis was a period of financial crisis that gripped much of East Asia and Southeast Asia beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1 ...

* 1998 Russian financial crisis

The Russian financial crisis (also called the ruble crisis or the Russian flu) began in Russia on 17 August 1998. It resulted in the Russian government and the Russian Central Bank devaluing the ruble and defaulting on its debt. The crisis had s ...

* 1998–2002 Argentine great depression

The Argentine Great Depression was an economic depression in Argentina, which began in the third quarter of 1998 and lasted until the second quarter of 2002. It followed the fifteen years stagnation and a brief period of free-market reforms. ...

* Latin American debt crisis

The Latin American debt crisis ( es, Crisis de la deuda latinoamericana; pt, Crise da dívida latino-americana) was a financial crisis that originated in the early 1980s (and for some countries starting in the 1970s), often known as ''La Décad ...

* South American economic crisis of 2002

Film about the debt

* ''Debtocracy

''Debtocracy'' ( el, Χρεοκρατία ''Chreokratía'') is a 2011 left-wing documentary film by Katerina Kitidi and Aris Chatzistefanou. The documentary examines the causes of the Greek debt crisis in 2010 and advocates for the default of ...

''

Notes and references

Bibliography

*

* .

* .

* .

*

*

*

*

* .

* .

*

* .

* .

* Albanese Ginammi Alessandro, Conte Giampaolo, Greek Bailouts in Historical Perspective: Comparative Case Studies, 1893 and 2010, The Journal of European Economic History, 2 2016

{{Europe topic, Poverty in

2009 in Greece

2010s in Greece

2009 in economics

2010s economic history

Athens Exchange

Economic history of Greece

Eurozone crisis

Financial crises

Government debt by country

Government finances in Greece

History of Greece since 1974

Poverty in Europe

Sovereign default

The Greek economy was one of the Eurozone's fastest growing from 2000 to 2007, averaging 4.2% annually, as foreign capital flooded in. This capital inflow coincided with a higher budget deficit.

Greece had budget surpluses from 1960 to 1973, but thereafter it had budget deficits. From 1974 to 1980 the government had budget deficits below 3% of GDP, while 1981–2013 deficits were above 3%.

An editorial published by ''

The Greek economy was one of the Eurozone's fastest growing from 2000 to 2007, averaging 4.2% annually, as foreign capital flooded in. This capital inflow coincided with a higher budget deficit.

Greece had budget surpluses from 1960 to 1973, but thereafter it had budget deficits. From 1974 to 1980 the government had budget deficits below 3% of GDP, while 1981–2013 deficits were above 3%.

An editorial published by ''

According to a poll in February 2012 by Public Issue and SKAI Channel, PASOK—which won the national elections of 2009 with 43.92% of the vote—had seen its approval rating decline to 8%, placing it fifth after centre-right New Democracy (31%), left-wing Democratic Left (18%), far-left

According to a poll in February 2012 by Public Issue and SKAI Channel, PASOK—which won the national elections of 2009 with 43.92% of the vote—had seen its approval rating decline to 8%, placing it fifth after centre-right New Democracy (31%), left-wing Democratic Left (18%), far-left

The social effects of the austerity measures on the Greek population were severe. In February 2012, it was reported that 20,000 Greeks had been made homeless during the preceding year, and that 20 per cent of shops in the historic city centre of Athens were empty.