|

Sectoral Balances

The sectoral balances (also called sectoral financial balances) are a sectoral analysis framework for macroeconomic analysis of national economies developed by British economist Wynne Godley. Sectoral analysis is based on the insight that when the government sector has a budget deficit, the non-government sectors (private domestic sector and foreign sector) together must have a surplus, and vice versa. In other words, if the government sector is borrowing, the other sectors taken together must be lending. The balances represent an accounting identity resulting from rearranging the components of aggregate demand, showing how the flow of funds affects the financial balances of the three sectors. This corresponds approximately to Balances Mechanics developed by Wolfgang Stützel in the 1950s. The approach is used by scholars at the Levy Economics Institute to support macroeconomic modelling and by Modern Monetary Theorists to illustrate the relationship between government budge ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sectoral Analysis

Sectoral analysis, also known as sectorial analysis, is a statistical analysis of the size, demographic, pricing, competitive, and other economic dimensions of a sector of the economy. The analysis can be done by industry or by customer designation. The method was further developed by Wynne Godley Wynne Godley (26 September 192613 May 2010) was an economist famous for his pessimism about the British economy and his criticism of the British government. In 2007, he and Marc Lavoie wrote a book about the " Stock-Flow Consistent" model, an an ... for use in macroeconomic analysis of national economies. Market research {{economics-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American economist, who is Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for ''The New York Times''. In 2008, Krugman was the winner of the Nobel Memorial Prize in Economic Sciences for his contributions to New Trade Theory and New Economic Geography. The Prize Committee cited Krugman's work explaining the patterns of international trade and the geographic distribution of economic activity, by examining the effects of economies of scale and of consumer preferences for diverse goods and services. Krugman was previously a professor of economics at MIT, and later at Princeton University. He retired from Princeton in June 2015, and holds the title of professor emeritus there. He also holds the title of Centennial Professor at the London School of Economics. Krugman was President of the Eastern Economic Association in 2010, and is among the most influential ec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balance Sheet Recession

A balance sheet recession is a type of economic recession that occurs when high levels of private sector debt cause individuals or companies to collectively focus on saving by paying down debt rather than spending or investing, causing economic growth to slow or decline. The term is attributed to economist Richard Koo and is related to the debt deflation concept described by economist Irving Fisher. Recent examples include Japan's recession that began in 1990 and the U.S. recession of 2007-2009. Definition A balance sheet recession is a particular type of recession driven by the high levels of private sector debt (i.e., the credit cycle) rather than fluctuations in the business cycle. It is characterized by a change in private sector behavior towards saving (i.e., paying down debt) rather than spending, which slows the economy through a reduction in consumption by households or investment by business. The term balance sheet derives from an accounting equation that holds that a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deleveraging

At the micro-economic level, deleveraging refers to the reduction of the leverage ratio, or the percentage of debt in the balance sheet of a single economic entity, such as a household or a firm. It is the opposite of leveraging, which is the practice of borrowing money to acquire assets and multiply gains and losses. At the macro-economic level, deleveraging of an economy refers to the simultaneous reduction of debt levels in multiple sectors, including private sectors and the government sector. It is usually measured as a decline of the total debt to GDP ratio in the national accounts. The deleveraging of an economy following a financial crisis has significant macro-economic consequences and is often associated with severe recessions. In microeconomics While leverage allows a borrower to acquire assets and multiply gains in good times, it also leads to multiple losses in bad times. During a market downturn when the value of assets and income plummets, a highly leveraged bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Richard Koo

Richard C. Koo ( ja, リチャード・クー, ; ; born 1954) is a Taiwanese-American economist living in Japan specializing in balance sheet recessions. He is Chief Economist at the Nomura Research Institute. Early life and education Koo was born in Kobe. His father, Koo Kwang-ming, was an activist in the Taiwan independence movement then living in exile in Japan, and the brother of the prominent Taiwanese businessman Koo Chen-fu. Koo lived in Tokyo for 13 years in his youth, and later attended the University of California, Berkeley where he received a BA degree in Political Science and Government in 1976. He then proceeded to Johns Hopkins University for graduate school, where he received an MA degree in 1981. Career Upon graduation from Johns Hopkins University, Koo worked at the Federal Reserve Bank of New York as an economist from 1981 to 1984. He then joined Nomura Nomura (written: 野村 "field village" or 埜村 "wilderness village") is a Japanese surname. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Austerity

Austerity is a set of political-economic policies that aim to reduce government budget deficits through spending cuts, tax increases, or a combination of both. There are three primary types of austerity measures: higher taxes to fund spending, raising taxes while cutting spending, and lower taxes and lower government spending. Austerity measures are often used by governments that find it difficult to borrow or meet their existing obligations to pay back loans. The measures are meant to reduce the budget deficit by bringing government revenues closer to expenditures. Proponents of these measures state that this reduces the amount of borrowing required and may also demonstrate a government's fiscal discipline to creditors and credit rating agencies and make borrowing easier and cheaper as a result. In most macroeconomic models, austerity policies which reduce government spending lead to increased unemployment in the short term. These reductions in employment usually occur di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Budget Deficit

The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a ''government budget surplus'', and a negative balance is a ''government budget deficit''. A government budget is a financial statement presenting the government's proposed revenues and spending for a financial year. A budget is prepared for each level of government (from national to local) and takes into account public social security obligations. The government budget balance can be broken down into the ''primary balance'' and interest payments on accumulated government debt; the two together give the budget balance. Furthermore, the budget balance can be broken down into the ''structural balance'' (also known as ''cyclically-adjusted balance'') and the cyclical component: the structural budget balance attempts to adjust for the impact of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union, and oversees their commercial banking system. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Most central banks also have supervisory and regulatory powers to ensure the stability of member institutions, to prevent bank runs, and to discourage reckless or fraudulent behavior by member banks. Central banks in most developed nations are institutionally independent from political interference. Still, limited control by the executive and legislative bodies exists. Activities of central banks Functions of a central bank usually include: * Monetary policy: by setting the official interest rate and controlling the money supply; *Financial stability: acting as a government's banker and as the bankers' bank (" lender of last resort"); * Reserve management: managing a cou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Modern Money Theory

Modern Monetary Theory or Modern Money Theory (MMT) is a heterodox * * * * * * macroeconomic theory that describes currency as a public monopoly and unemployment as evidence that a currency monopolist is overly restricting the supply of the financial assets needed to pay taxes and satisfy savings desires.Warren MoslerME/MMT: The Currency as a Public MonopolyTymoigne, Éric; Wray, L. Randall (November 2013)"Modern Money Theory 101: A Reply to Critics" Levy Economics Institute of Bard College. Working Paper No. 778. MMT is opposed to the mainstream understanding of macroeconomic theory and has been criticized heavily by many mainstream economists. MMT says that governments create new money by using fiscal policy and that the primary risk once the economy reaches full employment is inflation, which can be addressed by gathering taxes to reduce the spending capacity of the private sector. MMT is debated with active dialogues about its theoretical integrity, the implications ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomics

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole. For example, using interest rates, taxes, and government spending to regulate an economy's growth and stability. This includes regional, national, and global economies. According to a 2018 assessment by economists Emi Nakamura and Jón Steinsson, economic "evidence regarding the consequences of different macroeconomic policies is still highly imperfect and open to serious criticism." Macroeconomists study topics such as GDP (Gross Domestic Product), unemployment (including unemployment rates), national income, price indices, output, consumption, inflation, saving, investment, energy, international trade, and international finance. Macroeconomics and microeconomics are the two most general fields in economics. The United Nations Sustainable Development Goal 17 has a ta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt. In 2020, the value of government debt worldwide was $87.4 US trillion, or 99% measured as a share of gross domestic product (GDP). Government debt accounted for almost 40% of all debt (which includes corporate and household debt), the highest share since the 1960s. The rise in government debt since 2007 is largely attributable to the global financial crisis of 2007–2008, and the COVID-19 pandemic. The ability of government to issue debt has been central to state formation and to state building. Public deb ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

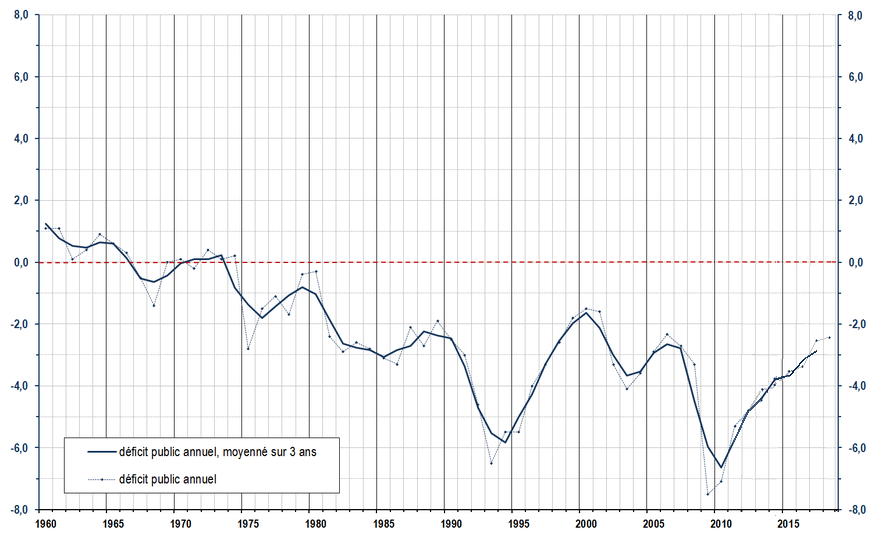

Public Deficit

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. Government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression. It is a central point of controversy in economics, as discussed below. Controversy Government deficit spending is a central point of controversy in economics, with prominent economists holding differing views. The mainstream economics position is that deficit spending is desirable and necessary as part of countercyclical fiscal policy, but that there should not be a structural deficit (i.e., permanent deficit): The government should run deficits during recessions to compensate for the shortfall in aggregate demand, but should run surpluses in boom t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |