Deutsche Bank AG (), sometimes referred to simply as Deutsche, or internally as DB, is a German multinational

investment bank and

financial services

Financial services are the Service (economics), economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, acco ...

company headquartered in

Frankfurt, Germany, and dual-listed on the

Frankfurt Stock Exchange and the

New York Stock Exchange.

Deutsche Bank was founded in 1870 in

Berlin. From 1929 to 1937, following its merger with

Disconto-Gesellschaft, it was known as ''Deutsche Bank und Disconto-Gesellschaft'' or DeDi-Bank.

Other transformative acquisitions have included those of

Mendelssohn & Co. in 1938,

Morgan Grenfell in 1990,

Bankers Trust in 1998, and

Deutsche Postbank in 2010.

As of 2018, the bank's network spanned 58 countries with a large presence in Europe, the Americas, and Asia. It is a component of the

DAX stock market index and is often referred to as the

largest German banking institution, with Deutsche Bank holding the majority stake in

DWS Group for combined assets of 2.2 trillion euros, rivaling even

Sparkassen-Finanzgruppe in terms of combined assets.

Deutsche Bank has been designated a global

systemically important bank by the

Financial Stability Board since 2011.

It has been designated as a Significant Institution since the entry into force of

European Banking Supervision in late 2014, and as a consequence is directly supervised by the

European Central Bank.

According to a 2020 article in the ''New Yorker'', Deutsche Bank had long had an "abject" reputation among major banks, as it has been involved in major scandals across various issue areas.

History

1870–1933

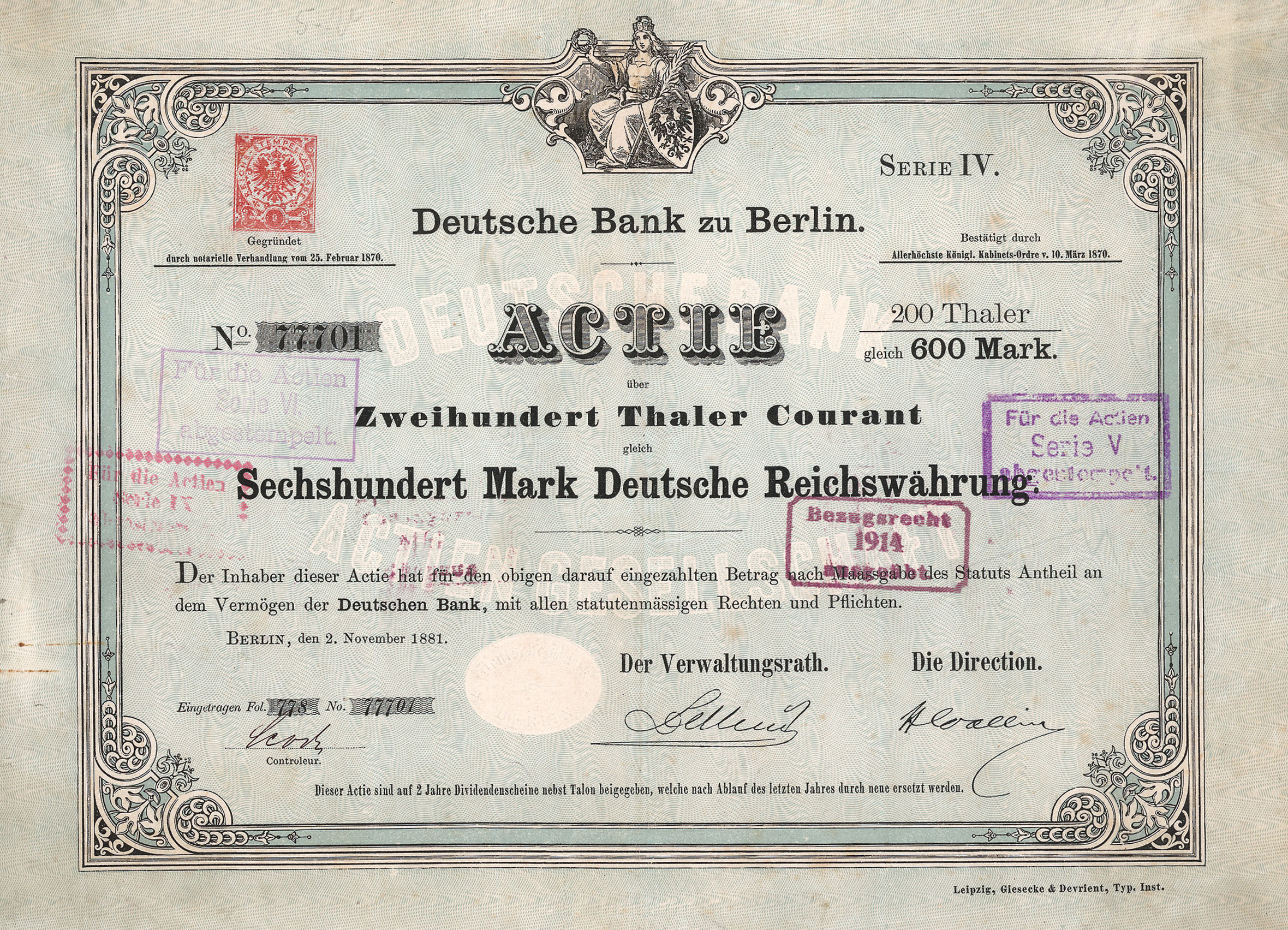

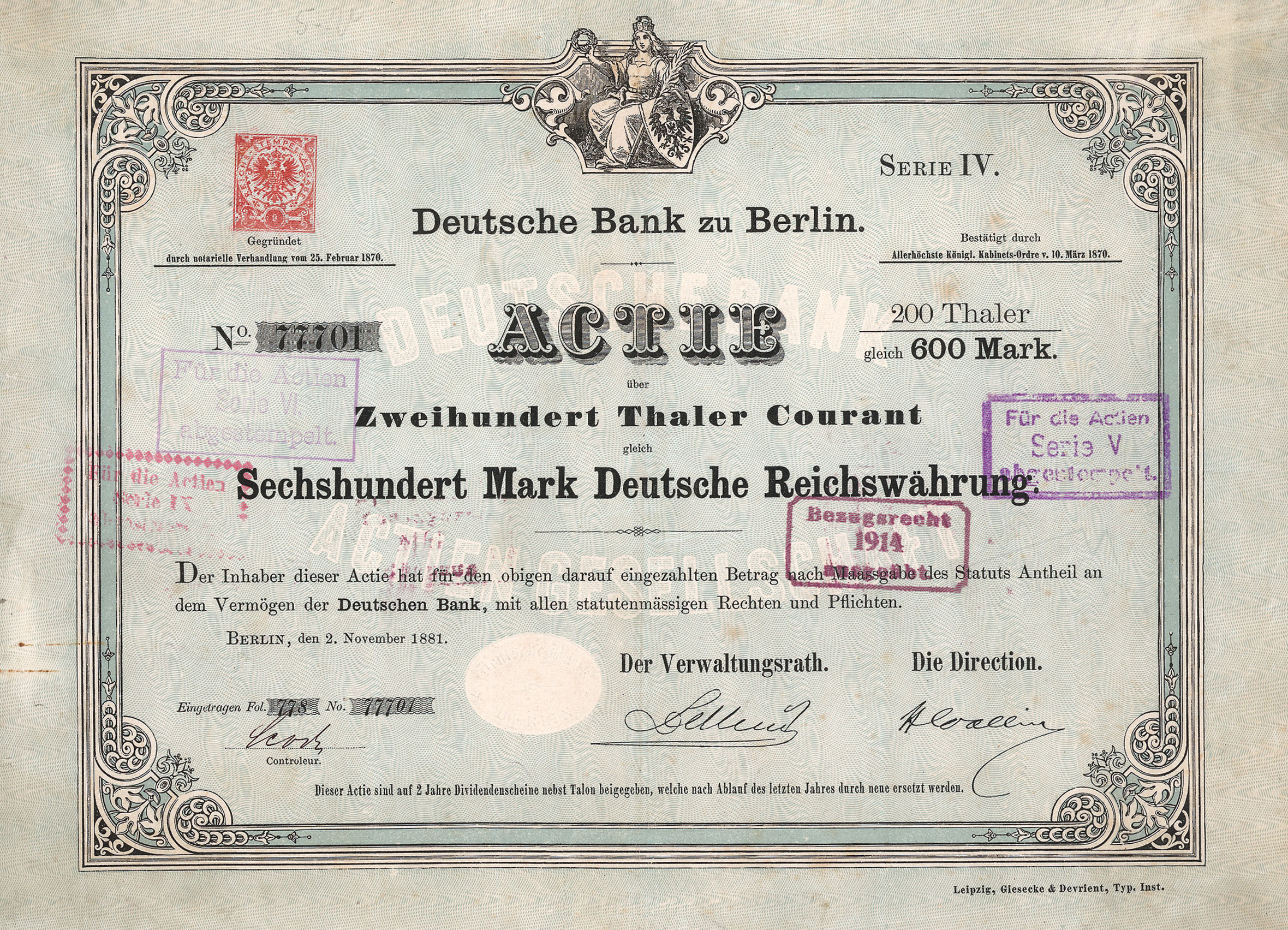

Deutsche Bank was founded in 1870 in

Berlin as a specialist bank for financing foreign trade and promoting German exports.

It subsequently played a large part in developing Germany's financial services industry, as its business model focused on providing finance to industrial customers.

The bank's statute was adopted on 22 January 1870, and on 10 March 1870 the

Prussian government granted it a banking license. The statute laid great stress on foreign business: Prior to the founding of Deutsche Bank, German importers and exporters were dependent upon British and French banking institutions in the world markets—a serious handicap in that German

bills were almost unknown in international commerce, generally disliked and subject to a higher rate of a discount than English or French bills.

The founding members were: Hermann Zwicker (Bankhaus Gebr. Schickler, Berlin); Anton Adelssen (Bankhaus Adelssen & Co., Berlin);

Adelbert Delbrück

Gottlieb Adelbert Delbrück (; January 16, 1822 in Magdeburg – May 26, 1890 in Kreuzlingen) was a German banker and businessman.

Early life

His father Gottlied Delbrück (1777–1842) worked in Magdeburg. The ''Delbrück'' family was a pr ...

(Bankhaus Delbrück, Leo & Co.); Heinrich von Hardt (Hardt & Co., Berlin, New York);

Ludwig Bamberger (politician, former chairman of Bischoffsheim, Goldschmidt & Co); Victor Freiherr von Magnus (Bankhaus F. Mart Magnus); (Bankhaus Deichmann & Co., Cologne); Gustav Kutter (Bankhaus Gebrüder Sulzbach, Frankfurt); and Gustav Müller (Württembergische Vereinsbank, Stuttgart). The First directors were Wilhelm Platenius,

Georg Siemens, and

Hermann Wallich

Hermann Wallich (December 28, 1833 – April 30, 1928) was a German Jewish banker.

Together with Georg von Siemens, he co-founded Deutsche Bank.

Hermann Wallich was born in Bonn. He married Anna Jacoby in 1875. The couple had a son, Paul Wallich ...

. Georg Siemens was a son of a cousin of

Werner von Siemens.

The bank initially operated from the first floor of a building at 21 Französische Strasse, then in 1871 moved to premises near the

Berlin Stock Exchange, and in 1876 started building its massive head office complex on Mauerstrasse.

The bank's first domestic branches, inaugurated in 1871 and 1872, were opened in

Bremen

Bremen (Low German also: ''Breem'' or ''Bräm''), officially the City Municipality of Bremen (german: Stadtgemeinde Bremen, ), is the capital of the German state Free Hanseatic City of Bremen (''Freie Hansestadt Bremen''), a two-city-state consis ...

and

Hamburg. Its first overseas offices opened in

Shanghai and

Yokohama in 1872, and London in 1873, followed by South American offices between 1874 and 1886.

The branch opening in London, after one failure and another partially successful attempt, was a prime necessity for the establishment of credit for the German trade in what was then the world's money center.

[ Deutsche Bank also took advantage of the Panic of 1873 by taking over a number of banks in liquidation, including the Berlin-based which had itself consolidated a number of failed banks in the early 1870s.]Krupp

The Krupp family (see pronunciation), a prominent 400-year-old German dynasty from Essen, is notable for its production of steel, artillery, ammunition and other armaments. The family business, known as Friedrich Krupp AG (Friedrich Krup ...

(1879) and introduced the chemical company Bayer

Bayer AG (, commonly pronounced ; ) is a German multinational corporation, multinational pharmaceutical and biotechnology company and one of the largest pharmaceutical companies in the world. Headquartered in Leverkusen, Bayer's areas of busi ...

to the Berlin stock market.

The second half of the 1890s saw the beginning of a new period of expansion at Deutsche Bank. The bank formed alliances with large regional banks, giving itself an entry into Germany's main industrial regions. It thus formed community-of-interests partnerships with in Elberfeld and in Breslau, linked to the fast-growing industrial economies of the Rhineland and Silesia respectively; it eventually acquired the two banks in 1914 and 1917 respectively. Joint ventures were symptomatic of the concentration then under way in the German banking industry. For Deutsche Bank, domestic branches of its own were still something of a rarity at the time; the Frankfurt branch dated from 1886 and the Munich branch from 1892, while further branches were established in Dresden and Leipzig in 1901.

In 1889, Deutsche Bank participated in the creation of the Deutsch-Asiatische Bank in Shanghai, in 1894, of the Banca Commerciale Italiana in Milan, and in 1898, of the Banque Internationale de Bruxelles.

In addition, the bank rapidly perceived the value of specialist institutions for the promotion of foreign business. Gentle pressure from the Foreign Ministry played a part in the establishment of Deutsche Ueberseeische Bank in 1886 and the stake taken in the newly established Deutsch-Asiatische Bank three years later, but the success of those companies showed that their existence made sound commercial sense. By end-1908, Deutsche was by far the largest German joint-stock bank by total deposits, with a total of 489 million Marks ahead of Dresdner Bank

Dresdner Bank AG was a German bank and was based in Frankfurt. It was one of Germany's largest banking corporations and was acquired by competitor Commerzbank in May 2009.

History

19th century

The Dresdner Bank was established on 12 Novemb ...

(225 million), Disconto-Gesellschaft (219 million), Darmstädter Bank (109 million) and A. Schaaffhausen'scher Bankverein

The ''A. Schaaffhausen'scher Bankverein'' (, sometimes simply referred to as Schaaffhausen) was a bank in Cologne, initially founded in 1791. In 1848 it was reorganized as a joint stock company; purchased in 1914 by the Berlin-based Disconto-Gese ...

(72 million). During World War I and in its immediate aftermath, the operations of Deutsche Bank in Brussels, London, Tokyo and Yokohama were expropriated; conversely, its activity in the Ottoman Empire expanded considerably, and it greatly expanded its footprint in Germany. In 1919, the bank purchased the state's share of Universum Film Aktiengesellschaft ( UFA).

During World War I and in its immediate aftermath, the operations of Deutsche Bank in Brussels, London, Tokyo and Yokohama were expropriated; conversely, its activity in the Ottoman Empire expanded considerably, and it greatly expanded its footprint in Germany. In 1919, the bank purchased the state's share of Universum Film Aktiengesellschaft ( UFA).Berliner Handels-Gesellschaft

Berliner is most often used to designate a citizen of Berlin, Germany

Berliner may also refer to:

People

* Berliner (surname)

Places

* Berliner Lake, a lake in Minnesota, United States

* Berliner Philharmonie, concert hall in Berlin, Germany

* ...

(412 million).

In the crisis summer of 1931 the Deutsche Golddiskontbank

The Deutsche Golddiskontbank (also Golddiskontbank, and abbreviated Dego) was a state-owned special bank founded in 1924 to promote German export industry by financing raw material imports. It was liquidated in 1945.

The purpose of the Deutsche Go ...

, a subsidiary of the Reichsbank, acquired 35 percent of DeDi-Bank's equity as part of a sector-wide rescue, bringing total government ownership of the bank to 38.5 percent. This did not, however, result in significant government interference in the management of the company, unlike at Dresdner Bank whose capital was near-completely nationalized.

1933–1945

After Adolf Hitler became leader of Germany, Deutsche Bank increasingly became integrated into the Nazi power structures, and fully implemented the Nazi policy of aryanization. In 1934 it dismissed its three Jewish management board members, Oscar Wassermann

Oscar Wassermann (born April 4 1869 in Bamberg; died September 8 1934 in Garmisch) was a German -Jewish banker.

Life

Oscar Angelo Wassermann's grandfather Samuel Wassermann (1810-1884) came to Bamberg from Regensburg and opened a bank, A. E ...

, Theodor Frank, and Georg Solmssen; in 1938 it dismissed its last Jewish supervisory board member. By the end of 1938, it had been involved as an intermediary and lender in at least 363 cases of expropriation of Jewish-owned businesses. In 1938, it acquired Jewish-controlled German bank Mendelssohn & Co. under duress. Meanwhile, the Nazi government fully re-privatized Deutsche Bank in 1935-1937, largely out of budgetary considerations. Its name changed back to Deutsche Bank in 1937.

While the Nazi policies of financial repression were largely unhelpful to the domestic business of Deutsche and other German commercial banks, its expansionary behavior created opportunities that Deutsche Bank pursued. In 1938 following Hitler's Anschluss of Austria, Deutsche Bank gradually took control of Creditanstalt-Bankverein, the former country's leading bank. On the latter was coerced to enter a "friendship agreement" with Deutsche Bank, by which the latter secured a presence in its board of directors.[ Creditanstalt executive Louis de Rothschild was immediately arrested and imprisoned, deprived of his position and property, then released upon payment of $21,000,000, believed to have been the largest bail bond in history for any individual, and migrated to the U.S. in 1939 after more than one year in custody. Later in 1938, Creditanstalt was jointly taken over, without compensation, by German government holding , Deutsche Bank, and the Reichsbank, which held respectively 51 percent, 25 percent, and 12 percent of its capital.][ In April 1942, Deutsche Bank raised its ownership to 51 percent by acquiring a block of shares from VIAG.]Sudetenland

The Sudetenland ( , ; Czech and sk, Sudety) is the historical German name for the northern, southern, and western areas of former Czechoslovakia which were inhabited primarily by Sudeten Germans. These German speakers had predominated in the ...

. In March 1939, it forcibly took over control of the BUB itself, in which it built a majority stake complemented with prior shareholding of Creditanstalt. It also took over management control of the National Bank of Greece during the Axis occupation of Greece, without however acquiring ownership out of consideration for Italian sensitivities. Through the Creditanstalt-Bankverein, Deutsche Bank also became a major shareholder of the (AJB), which had been formed in 1928 from the two former branches of the Wiener Bankverein in Belgrade and Zagreb, and of the Landesbank für Bosnien und Herzegowina

The Landesbank für Bosnien und Herzegowina ( sh, Privilegovana zemaljska banka za Bosnu i Hercegovinu, ) was a bank established in Sarajevo in 1895 to help finance the development of Bosnia and Herzegovina under Austro-Hungarian rule. It kept op ...

in Sarajevo, together with the Société Générale de Belgique and its affiliate Banque Belge pour l'Étranger

The ''Banque Belge pour l'Étranger'' (BBE, "Belgian Bank for Lands Abroad") was a Belgian bank that operated mainly in Asia. It was originally established in 1902 in Brussels as the ''Banque Sino-Belge'' ("Chinese-Belgian Bank"), by the Sociét� ...

. In 1940, following the German invasion of Belgium German invasion of Belgium may refer to:

* German invasion of Belgium (1914) during World War I

*German invasion of Belgium (1940)

The invasion of Belgium or Belgian campaign (10–28 May 1940), often referred to within Belgium as the 18 Days' ...

, Deutsche Bank bought out the Belgian stake under duress and became the AJB's dominant shareholder, with 88 percent held either directly or through Creditanstalt. Deutsche Bank simultaneously took control of the Landesbank in Sarajevo. Following the German invasion of Yugoslavia

The invasion of Yugoslavia, also known as the April War or Operation 25, or ''Projekt 25'' was a German-led attack on the Kingdom of Yugoslavia by the Axis powers which began on 6 April 1941 during World War II. The order for the invasion was p ...

, the AJB was divided into two separate institutions, respectively the in occupied Serbia,Katowice

Katowice ( , , ; szl, Katowicy; german: Kattowitz, yi, קאַטעוויץ, Kattevitz) is the capital city of the Silesian Voivodeship in southern Poland and the central city of the Upper Silesian metropolitan area. It is the 11th most popul ...

, loaned the funds used to build the Auschwitz

Auschwitz concentration camp ( (); also or ) was a complex of over 40 concentration and extermination camps operated by Nazi Germany in occupied Poland (in a portion annexed into Germany in 1939) during World War II and the Holocaust. It con ...

camp and the nearby IG Farben

Interessengemeinschaft Farbenindustrie AG (), commonly known as IG Farben (German for 'IG Dyestuffs'), was a German chemical and pharmaceutical conglomerate (company), conglomerate. Formed in 1925 from a merger of six chemical companies—BASF, ...

facilities. Deutsche Bank publicly acknowledged its involvement at Auschwitz in 1999. It also was a principal participant in the Nazi regime's gold transactions. Between 1942 and 1944, Deutsche Bank purchased 4,446 kg of gold from the Reichsbank, of which 744 kg came from Holocaust victims.

In an effort to come to terms with its past during the Nazi era, Deutsche Bank in 1995 published a history volume that detailed its entanglement with the dictatorship. In December 1999, along with other major German companies, Deutsche Bank contributed to a US$5.2 billion compensation fund following lawsuits brought by Holocaust survivors; U.S. officials had reportedly threatened to block Deutsche Bank's $10 billion purchase of Bankers Trust if it did not contribute to the fund.

1945–2000

Following Germany's defeat in World War II, the Allied authorities, in 1948, ordered Deutsche Bank's break-up into regional banks.

Following Germany's defeat in World War II, the Allied authorities, in 1948, ordered Deutsche Bank's break-up into regional banks.Alfred Herrhausen

Alfred Herrhausen (30 January 1930 in Essen – 30 November 1989 in Bad Homburg vor der Höhe) was a German banker and the Chairman of Deutsche Bank, who was assassinated in 1989. He was a member of the Steering Committee of the Bilderberg Group a ...

, chairman of Deutsche Bank, was killed when a car that he was in exploded while he was traveling in the Frankfurt suburb of Bad Homburg

Bad Homburg vor der Höhe () is the district town of the Hochtaunuskreis, Hesse, on the southern slope of the Taunus mountains. Bad Homburg is part of the Frankfurt Rhein-Main Regional Authority, Frankfurt Rhein-Main urban area. The town's offic ...

. The Red Army Faction claimed responsibility for the blast.

In 1989, the first steps towards creating a significant investment-banking presence were taken with the acquisition of Morgan, Grenfell & Co., a UK-based investment bank which was renamed Deutsche Morgan Grenfell in 1994. In 1995 to greatly expand into international investments and money management, Deutsche Bank hired Edson Mitchell, a risk specialist from Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment bank ...

, who hired two other former Merrill Lynch risk specialists Anshu Jain and William S. Broeksmit.1998 Russian financial crisis

The Russian financial crisis (also called the ruble crisis or the Russian flu) began in Russia on 17 August 1998. It resulted in the Russian government and the Russian Central Bank devaluing the ruble and defaulting on its debt. The crisis had s ...

since it had a large position in Russian government bonds,UBS

UBS Group AG is a multinational Investment banking, investment bank and financial services company founded and based in Switzerland. Co-headquartered in the cities of Zürich and Basel, it maintains a presence in all major financial centres ...

, Fidelity Investments, and the Japanese post office's life insurance fund.[ At the time, Deutsche Bank owned a 12% stake in DaimlerChrysler but United States banking laws prohibit banks from owning industrial companies, so Deutsche Bank received an exception to this prohibition through 1978 legislation from Congress.][

Deutsche continued to build up its presence in Italy with the acquisition in 1993 of Banca Popolare di Lecco from Banca Popolare di Novara for about $476 million. In 1999, it acquired a minority interest in Cassa di Risparmio di Asti.

]

21st century

In the 11 September 2001 terrorist attacks

The September 11 attacks, commonly known as 9/11, were four coordinated suicide terrorist attacks carried out by al-Qaeda against the United States on Tuesday, September 11, 2001. That morning, nineteen terrorists hijacked four commerc ...

the Deutsche Bank Building in Lower Manhattan

Lower Manhattan (also known as Downtown Manhattan or Downtown New York) is the southernmost part of Manhattan, the central borough for business, culture, and government in New York City, which is the most populated city in the United States with ...

, formerly Bankers Trust Plaza, was heavily damaged by the collapse of the South Tower of the World Trade Center. Demolition work on the 39-story building continued for nearly a decade, and was completed in early 2011.

In October 2001, Deutsche Bank was listed on the New York Stock Exchange. This was the first NYSE listing after interruption due to 11 September attacks

The September 11 attacks, commonly known as 9/11, were four coordinated Suicide attack, suicide List of terrorist incidents, terrorist attacks carried out by al-Qaeda against the United States on Tuesday, September 11, 2001. That morning, ...

. The following year, Josef Ackermann became CEO of Deutsche Bank and served as CEO until 2012 when he became involved with the Bank of Cyprus.Anshu Jain

Anshuman Jain (7 January 1963 – 12 August 2022) was an Indian-born British business executive. From 2017 to 2022, he was the president of the American financial services firm Cantor Fitzgerald.

He previously served as the Global co-CEO and ...

's aggressive expansion to gain strong relationships with state partners in Russia.Yaroslavl region

Yaroslavl Oblast (russian: Яросла́вская о́бласть, ''Yaroslavskaya oblast'') is a federal subject of Russia (an oblast), which is located in the Central Federal District, surrounded by Tver, Moscow, Ivanovo, Vladimir, Kostroma, ...

of Russia.[ He was not wearing a helmet.]Dresdner Bank

Dresdner Bank AG was a German bank and was based in Frankfurt. It was one of Germany's largest banking corporations and was acquired by competitor Commerzbank in May 2009.

History

19th century

The Dresdner Bank was established on 12 Novemb ...

entered into a payment transaction agreement with Postbank to have Postbank process payments as the clearing center for the three banks.

Since the mid-1990s Deutsche Bank commercial real estate division offered Donald Trump financial backing, even though in the early 1990s Citibank

Citibank, N. A. (N. A. stands for " National Association") is the primary U.S. banking subsidiary of financial services multinational Citigroup. Citibank was founded in 1812 as the City Bank of New York, and later became First National City ...

, Manufacturers Hanover, Chemical, Bankers Trust, and 68 other entities refused to financially support him.Citigroup

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking ...

, Bank of America, and Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment bank ...

, becoming Trump's new personal banker at Deutsche Bank.Deutsche Bank Twin Towers

The Deutsche Bank Twin Towers, also known as Deutsche Bank Headquarters (German: ''Zwillingstürme der Deutschen Bank'' or ''Hauptverwaltung Deutsche Bank AG''), is a twin tower skyscraper complex in the Westend-Süd district of Frankfurt, G ...

building, was extensively renovated for three years, certified LEED

Leadership in Energy and Environmental Design (LEED) is a

green building certification program used worldwide. Developed by the non-profit U.S. Green Building Council (USGBC), it includes a set of rating systems for the design, construction ...

Platinum and DGNB Gold.

In 2010, the bank developed and owned the Cosmopolitan of Las Vegas, after the casino's original developer defaulted on its borrowings. Deutsche Bank ran it at a loss until its sale in May 2014. The bank's exposure at the time of sale was more than $4 billion, and sold the property to Blackstone Group for $1.73 billion.

Housing credit bubble and CDO market

On 3 January 2014, it was reported that Deutsche Bank would settle a lawsuit brought by US shareholders, who had accused the bank of bundling and selling bad real estate loans before the 2008 downturn. This settlement came subsequent and in addition to Deutsche's $1.93 billion settlement with the US Housing Finance Agency over similar litigation related to the sale of mortgage-backed securities to Fannie Mae and Freddie Mac.

Leveraged super-senior trades

Former employees including Eric Ben-Artzi and Matthew Simpson have claimed that, during the crisis, Deutsche failed to recognize up to $12 billion of paper losses on its $130 billion portfolio of leveraged super senior trades, although the bank rejects the claims.[ One of them claims that "If Lehman Brothers didn't have to mark its books for six months it might still be in business, and if Deutsche had marked its books it might have been in the same position as Lehman."][

Deutsche had become the biggest operator in this market, which were a form of credit derivative designed to behave like the most senior tranche of a CDO.][ Deutsche bought insurance against default by blue-chip companies from investors, mostly Canadian pension funds, who received a stream of insurance premiums as income in return for posting a small amount of collateral.][ The bank then sold protection to US investors via the CDX credit index, the spread between the two was tiny but was worth $270m over the 7 years of the trade.][ It was considered very unlikely that many blue chips would have problems at the same time, so Deutsche required collateral of just 10% of the contract value.

The risk of Deutsche taking large losses if the collateral was wiped out in a crisis was called the gap option.][ Ben-Artzi claims that after modeling came up with "economically unfeasible" results, Deutsche accounted for the gap option first with a simple 15% "haircut" on the trades (described as inadequate by another employee in 2006) and then in 2008 by a $1–2bn reserve for the credit correlation desk designed to cover all risks, not just the gap option.][ In October 2008, it stopped modeling the gap option and just bought S&P put options to guard against further market disruption, but one of the whistleblowers has described this as an inappropriate hedge.][ A model from Ben-Artzi's previous job at Goldman Sachs suggested that the gap option was worth about 8% of the value of the trades, worth $10.4bn. Simpson claims that traders were not simply understating the gap option but actively mismarking the value of their trades.][

]

European debt crisis, 2009–today

In 2008, Deutsche Bank reported its first annual loss in five decades, despite receiving billions of dollars from its insurance arrangements with AIG, including US$11.8 billion from funds provided by US taxpayers to bail out AIG.

Based on a preliminary estimation from the European Banking Authority (EBA), in late 2011, Deutsche Bank AG needed to raise capital of about €3.2 billion as part of a required 9% core Tier 1 ratio after sovereign debt write-down starting in mid-2012.

As of 2012, Deutsche Bank had negligible exposure to Greece, but Spain and Italy accounted for a tenth of its European private and corporate banking business with credit risks of about €18 billion in Italy and €12 billion in Spain.

In 2017, Deutsche Bank needed to get its common equity tier-1 capital ratio up to 12.5% in 2018 to be marginally above the 12.25% required by regulators.

Since 2012

In January 2014, Deutsche Bank reported a €1.2 billion ($1.6 billion) pre-tax loss for the fourth quarter of 2013. This came after analysts had predicted a profit of nearly €600 million, according to FactSet estimates. Revenues slipped by 16% versus the prior year.

Deutsche Bank's Capital Ratio Tier-1 (CET1) was reported in 2015 to be only 11.4%, lower than the 12% median CET1 ratio of Europe's 24 biggest publicly traded banks, so there would be no dividend for 2015 and 2016. Furthermore, 15,000 jobs were to be cut.

In June 2015, the then co-CEOs, Jürgen Fitschen and Anshu Jain, both offered their resignations to the bank's supervisory board, which were accepted. Jain's resignation took effect in June 2015, but he provided consultancy to the bank until January 2016. Fitschen continued as joint CEO until May 2016. The appointment of John Cryan

John is a common English name and surname:

* John (given name)

* John (surname)

John may also refer to:

New Testament

Works

* Gospel of John, a title often shortened to John

* First Epistle of John, often shortened to 1 John

* Seco ...

as joint CEO was announced, effective July 2015; he became sole CEO at the end of Fitschen's term.

In January 2016, Deutsche Bank pre-announced a 2015 loss before income taxes of approximately €6.1 billion and a net loss of approximately €6.7 billion. Following this announcement, a bank analyst at Citi declared: "We believe a capital increase now looks inevitable and see an equity shortfall of up to €7 billion, on the basis that Deutsche may be forced to book another €3 billion to €4 billion of litigation charges in 2016."conglomerate

Conglomerate or conglomeration may refer to:

* Conglomerate (company)

* Conglomerate (geology)

* Conglomerate (mathematics)

In popular culture:

* The Conglomerate (American group), a production crew and musical group founded by Busta Rhymes

** Co ...

HNA Group

HNA Group Co., Ltd., is a Chinese conglomerate headquartered in Haikou, Hainan, China. Founded in 2000, it was involved in numerous industries including aviation, real estate, financial services, tourism, logistics, and more. It is a part owner ...

became its biggest shareholder, owning 9.90% of its shares.

However, HNA Group's stake reduced to 8.8% as of 16 February 2018.

In November 2018, the bank's Frankfurt offices were raided by police in connection with investigations around the Panama papers

The Panama Papers ( es, Papeles de Panamá) are 11.5 million leaked documents (or 2.6 terabytes of data) that were published beginning on April 3, 2016. The papers detail financial and attorney–client information for more than 214,488 ...

and money laundering

Money laundering is the process of concealing the origin of money, obtained from illicit activities such as drug trafficking, corruption, embezzlement or gambling, by converting it into a legitimate source. It is a crime in many jurisdictions ...

. Deutsche Bank released a statement confirming it would "cooperate closely with prosecutors".Christian Sewing

Christian Sewing (; born 24 April 1970 in Bünde) is a German banker who currently serves as the CEO of Deutsche Bank. He has been a member of the management board since 1 January 2015. On 8 April 2018 he was appointed chief executive officer (CEO ...

said he was expecting a "deluge of criticism" about the bank's performance and announced that he was ready to make "tough cutbacks" after the failure of merger negotiations with Commerzbank AG

Commerzbank AG () is a major German bank operating as a universal bank, headquartered in Frankfurt am Main. In the 2019 financial year, the bank was the second largest in Germany by the total value of its balance sheet. Founded in 1870 in Hambur ...

and weak profitability. According to '' The New York Times'', "its finances and strategy rein disarray and 95 percent of its market value as beenerased". News headlines in late June 2019 claimed that the bank would cut 20,000 jobs, over 20% of its staff, in a restructuring plan. On 8 July 2019, the bank began to cut 18,000 jobs, including entire teams of equity traders in Europe, the US, and Asia. On the previous day, Sewing had laid blame on unnamed predecessors who created a "culture of poor capital allocation" and chasing revenue for the sake of revenue, according to a '' Financial Times'' report, and promised that going forward, the bank "will only operate where we are competitive".

In January 2020, Deutsche Bank had decided to cut the bonus pool at its investment branch by 30% following restructuring efforts.

In February 2021, it was reported that Deutsche Bank made a profit of €113 million ($135.6 million) for 2020, the first annual net profit it had posted since 2014.

In March 2021, Deutsche Bank sold about $4 billion of holdings seized in the implosion of Archegos Capital Management

Archegos Capital Management was a limited partnership family office that managed the personal assets of Bill Hwang, at one time managing over $36 billion in assests. On April 27, 2022 Hwang was indicted and arrested on federal charges of fraud a ...

in a private deal.

21st-century acquisitions

* Scudder Investments, 2001

* RREEF, 2002

* Berkshire Mortgage Finance, 22 October 2004

* Chapel Funding (now DB Home Lending), 12 September 2006

* Norisbank, 2 November 2006

* MortgageIT, 3 January 2007

* Hollandsche Bank-Unie Hollandsche Bank-Unie (HBU) was a second-tier domestic bank in the Netherlands that Deutsche Bank absorbed in 2010. It had a notable international history.

History Establishment

On 28 March 1914, the Rotterdamsche Bank, together with the Nederland ...

, 2 July 2008

* Sal. Oppenheim

Sal. Oppenheim was a German private bank founded in 1789 and headquartered in Cologne, Germany. It provided asset management solutions for wealthy individual clients and institutional investors. In 2009, the bank became a subsidiary of Deutsche Ba ...

, 2010

* Deutsche Postbank, 2010

* Park Plaza Mall

Park Plaza Mall is an enclosed shopping mall located in the Midtown neighborhood of Little Rock, Arkansas. Originally opened in 1960 as Park Plaza Shopping Center, an open-air shopping center, the mall is home to two Dillard's flagship stores and ...

(enclosed shopping center in Little Rock, Arkansas), 2021

* Numis, 2023

File:Antigua Bolsa, Múnich, Alemania1.JPG, Former branch in Munich

File:Leipzig - Martin-Luther-Ring + Deutsche Bank 01 ies.jpg, Branch in Leipzig, former

File:DeutscheBank-Domshof.jpg, Branch in Bremen

Bremen (Low German also: ''Breem'' or ''Bräm''), officially the City Municipality of Bremen (german: Stadtgemeinde Bremen, ), is the capital of the German state Free Hanseatic City of Bremen (''Freie Hansestadt Bremen''), a two-city-state consis ...

File:Hannoversche Bank Haus III Georgstrasse Georgsplatz Mitte Hannover Germany 02.jpg, Branch in Hanover, former (taken over by Deutsche in 1920), alt=Branch in Hanover, former Hannoversche Bank e(taken over by Deutsche in 1920): 228

File:HL Kohlmarkt – Commerz-Bank.jpg, Branch in Lübeck, former Commerz-Bank

File:Düsseldorf, Deutsche Bank an der Kö.jpg, Branch in Düsseldorf

File:Goslar asv2022-06 img19 Deutsche Bank building.jpg, Branch in Goslar

File:Kaiserstraße 90 - Karlsruhe - Bankgebäude - 20220820 151844.jpg, Branch in Karlsruhe

File:Deutsche Bank Köln, Komödienstraße-9453.jpg, Branch in Cologne, former head office of Sal. Oppenheim

Sal. Oppenheim was a German private bank founded in 1789 and headquartered in Cologne, Germany. It provided asset management solutions for wealthy individual clients and institutional investors. In 2009, the bank became a subsidiary of Deutsche Ba ...

File:Bochum - Viktoriastraße+Husemannplatz 03 ies.jpg, Branch in Bochum

Bochum ( , also , ; wep, Baukem) is a city in North Rhine-Westphalia. With a population of 364,920 (2016), is the sixth largest city (after Cologne, Düsseldorf, Dortmund, Essen and Duisburg) of the most populous Germany, German federal state o ...

Shareholders

Deutsche Bank is one of the leading listed companies in German post-war history. Its shares are traded on the Frankfurt Stock Exchange and, since 2001, also on the New York Stock Exchange and are included in various indices, including the DAX and the Euro Stoxx 50. As the share had lost value since mid-2015 and market capitalization had shrunk to around €18 billion, it temporarily withdrew from the Euro Stoxx 50 on 8 August 2016. With a 0.73% stake, it is currently the company with the lowest index weighting.

In 2001, Deutsche Bank merged its mortgage banking business with that of Dresdner Bank

Dresdner Bank AG was a German bank and was based in Frankfurt. It was one of Germany's largest banking corporations and was acquired by competitor Commerzbank in May 2009.

History

19th century

The Dresdner Bank was established on 12 Novemb ...

and Commerzbank

Commerzbank AG () is a major German bank operating as a universal bank, headquartered in Frankfurt am Main. In the 2019 financial year, the bank was the second largest in Germany by the total value of its balance sheet. Founded in 1870 in Hambur ...

to form Eurohypo AG. In 2005, Deutsche Bank sold its stake in the joint company to Commerzbank.

Logotype

In 1972, the bank created the world-known blue logo "Slash in a Square" – designed by Anton Stankowski and intended to represent growth within a risk-controlled framework.

Business divisions

The bank's business model rests on three pillars – the Corporate & Investment Bank (CIB), the Private & Commercial Bank and Asset Management (DWS).

The bank's business model rests on three pillars – the Corporate & Investment Bank (CIB), the Private & Commercial Bank and Asset Management (DWS).

Corporate and Investment Bank (CIB)

The Corporate & Investment Bank (CIB) is Deutsche Bank's capital markets business. The CIB comprises the below six units.

* Corporate Finance is responsible for advisory and mergers & acquisitions (M&A).

* Equities / Fixed Income & Currencies. These two units are responsible for sales and trading of securities.

* Global Capital Markets (GCM) is focused on financing and risk management solutions. It includes debt and equity issuances.

* Global Transaction Banking (GTB) caters to corporates and financial institutions by providing commercial banking products including cross-border payments, cash management, Securities Services, and international trade finance.

* Deutsche Bank Research provides analysis of products, markets, and trading strategies.

The Corporate & Investment Bank (CIB) is Deutsche Bank's capital markets business. The CIB comprises the below six units.

* Corporate Finance is responsible for advisory and mergers & acquisitions (M&A).

* Equities / Fixed Income & Currencies. These two units are responsible for sales and trading of securities.

* Global Capital Markets (GCM) is focused on financing and risk management solutions. It includes debt and equity issuances.

* Global Transaction Banking (GTB) caters to corporates and financial institutions by providing commercial banking products including cross-border payments, cash management, Securities Services, and international trade finance.

* Deutsche Bank Research provides analysis of products, markets, and trading strategies.

Private and Commercial Bank

* Private & Commercial Clients Germany / International is the retail bank of Deutsche Bank. In Germany, it operates under two brands – Deutsche Bank and Postbank. Additionally, it has operations in Belgium, Italy, Spain and India. The businesses in Poland and Portugal are in the process of being sold.

* Wealth Management functions as the bank's private banking arm, serving high-net-worth individual

High-net-worth individual (HNWI) is a term used by some segments of the financial services industry to designate persons whose investible wealth (assets such as stocks and bonds) exceeds a given amount. Typically, these individuals are defined ...

s and families worldwide. The division has a presence in the world's private banking hotspots, including Switzerland, Luxembourg, the Channel Islands, the Cayman Islands and Dubai.

Deutsche Asset Management (DWS)

Deutsche Bank holds a majority stake in the listed asset manager DWS Group (formerly Deutsche Asset Management), which was separated from the bank in March 2018.

Controversies

Deutsche Bank in general as well as specific employees have frequently figured in controversies and allegations of deceitful behavior or illegal transactions. As of 2016, the bank was involved in some 7,800 legal disputes and calculated €5.4 billion as litigation reserves, with a further €2.2 billion held against other contingent liabilities.

Role in financial crisis of 2007–2008

In January 2017, Deutsche Bank agreed to a $7.2 billion settlement with the United States Department of Justice over its sale and pooling of toxic mortgage securities in the years leading up to the Financial crisis of 2007–2008. As part of the agreement, Deutsche Bank was required to pay a civil monetary penalty of $3.1 billion and provide $4.1 billion in consumer relief, such as loan forgiveness. At the time of the agreement, Deutsche Bank was still facing investigations into the alleged manipulation of foreign exchange rates, suspicious equities trades in Russia, as well as alleged violations of United States sanctions against Iran and other countries. Since 2012, Deutsche Bank had paid more than €12 billion for litigation, including a deal with U.S. mortgage-finance giants Fannie Mae and Freddie Mac.

Espionage scandal, 2009

In 2009, the bank admitted it engaged in covert espionage on its critics from 2001 to 2007 directed by its corporate security department, although it characterized the incidents as "isolated".Michael Bohndorf

Michael may refer to:

People

* Michael (given name), a given name

* Michael (surname), including a list of people with the surname Michael

Given name "Michael"

* Michael (archangel), ''first'' of God's archangels in the Jewish, Christian and ...

(an activist investor in the bank), Leo Kirch (a former media executive in litigation with the bank), and the Munich law firm of Bub Gauweiler & Partner, which represented Kirch.[ This was confirmed by the Public Prosecutor's Office in Frankfurt in October 2009. BaFin found deficiencies in operations within Deutsche Bank's security unit in Germany but no systemic misconduct. The bank said it took steps to strengthen controls for the mandating of external service providers by its Corporate Security Department.][

]

Deutsche Bank document release, 2014

On 26 January 2014, William S. Broeksmit, a risk specialist at Deutsche Bank who was very close to Anshu Jain and hired by Edson Mitchell to spearhead Deutsche Bank's foray into international investments and money management in the 1990s, released numerous Deutsche Bank documents from the New York branch of the Deutsche Bank Trust Company Americas (DBTCA), which Broeksmit's adopted son Val Broeksmit, who is a close friend of Moby

Richard Melville Hall (born September 11, 1965), known professionally as Moby, is an American musician, songwriter, singer, producer, and animal rights activist. He has sold 20 million records worldwide. AllMusic considers him to be "among the ...

, later gave, along with numerous emails, to both Welt am Sonntag and ZDF, which revealed numerous irregularities including both a $10 billion money laundering scheme spearheaded by the Russia branch of Deutsche Bank at Moscow, which the New York State Department of Financial Services fined Deutsche Bank $425 million, and derivatives improprieties.[Me and My Whistle-Blower](_blank)

/ref>

Libor scandal, 2015

On 23 April 2015, Deutsche Bank agreed to a combined US$2.5 billion in fines – a US$2.175 billion fine by American regulators, and a €227 million penalty by British authorities – for its involvement in the Libor scandal uncovered in June 2012. It was one of several banks colluding to fix interest rates used to price hundreds of trillions of dollars of loans and contracts worldwide, including mortgages and student loans.Financial Conduct Authority

The Financial Conduct Authority (FCA) is a financial regulation, financial regulatory body in the United Kingdom, but operates independently of the UK Government, and is financed by charging fees to members of the financial services industry. The ...

director Georgina Philippou said "This case stands out for the seriousness and duration of the breaches ... One division at Deutsche Bank had a culture of generating profits without proper regard to the integrity of the market. This wasn't limited to a few individuals but, on certain desks, it appeared deeply ingrained."

U.S. sanctions violations, 2015

On 5 November 2015, Deutsche Bank was ordered to pay US$258 million (€237.2 million) in penalties imposed by the New York State Department of Financial Services (NYDFS) and the United States Federal Reserve Bank

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

after the bank was caught doing business with Burma, Libya, Sudan, Iran, and Syria, which were under US sanctions at the time. According to the US federal authorities, Deutsche Bank handled 27,200 US dollar clearing transactions valued at more than US$10.86 billion (€9.98 billion) to help evade US sanctions between early 1999 until 2006 which were done on behalf of Iranian, Libyan, Syrian, Burmese, and Sudanese financial institutions and other entities subject to US sanctions, including entities on the Specially Designated Nationals by the Office of Foreign Assets Control

The Office of Foreign Assets Control (OFAC) is a financial intelligence and enforcement agency of the U.S. Treasury Department. It administers and enforces economic and trade sanctions in support of U.S. national security and foreign policy ob ...

.

In response to the penalties, the bank will pay US$200 million (€184 million) to the NYDFS while the rest (US$58 million; €53.3 million) will go to the Federal Reserve. In addition to the payment, the bank will install an independent monitor, fire six employees who were involved in the incident, and ban three other employees from any work involving the bank's US-based operations.

Tax evasion, 2016

In June 2016 six former employees in Germany were accused of being involved in a major tax fraud deal with CO2 emission certificates, and most of them were subsequently convicted. It was estimated that the sum of money in the tax evasion scandal might have been as high as €850 million. Deutsche Bank itself was not convicted due to an absence of corporate liability laws in Germany.

Russian money-laundering operations

In January 2017, the bank was fined $425 million by the New York State Department of Financial Services (DFS) and £163 million by the UK Financial Conduct Authority

The Financial Conduct Authority (FCA) is a financial regulation, financial regulatory body in the United Kingdom, but operates independently of the UK Government, and is financed by charging fees to members of the financial services industry. The ...

regarding accusations of laundering $10 billion out of Russia.

In the decade preceding the Russian mirror-trading scheme, Deutsche Bank was informed of substantial and widespread compliance concerns. The offsetting trades in this instance lacked economic purpose and could have been used to facilitate money laundering or other illegal activity. On 30 January 2017, the NYSDFS (New York State Department of Financial Services) fined Deutsche Bank $425 million for violating New York's anti-money laundering laws. There was a "mirror trading" scheme involved. Deutsche Bank's Moscow, London, and New York branches laundered $10 billion out of Russia.Russia's 2022 invasion of Ukraine

On 24 February 2022, in a major escalation of the Russo-Ukrainian War, which began in 2014. The invasion has resulted in tens of thousands of deaths on both sides. It has caused Europe's largest refugee crisis since World War II. An ...

, Deutsche Bank refused to close down its Russia business. At the same time, other banks and major businesses were exiting Russia.

In June 2023, the bank notified customers that it could no longer guarantee them access to the shares they hold on the basis of depositary receipts issued prior to February 2022. He explained this by the shortage of shares in the Russian depository. The bank also warned that it would be able to return the funds for the share significantly below the market price.

Relationship with Donald Trump, 1995–2021

Deutsche Bank is widely recognized as being the largest creditor to real-estate mogul and politician Donald Trump, 45th President of the United States, lending him and his company more than $2 billion over twenty years ending 2020. The bank held more than $360 million in outstanding loans to him prior to his 2016 election. Although his 2019 final report never mentioned Deutsche Bank, as of December 2017, Special Counsel Robert Mueller investigated Deutsche Bank's role in Trump and Russian parties allegedly cooperating to elect him.House

A house is a single-unit residential building. It may range in complexity from a rudimentary hut to a complex structure of wood, masonry, concrete or other material, outfitted with plumbing, electrical, and heating, ventilation, and air condi ...

Democrats subpoenaed the Bank for Trump's personal and financial records. On 29 April 2019, U.S. President Donald Trump, his business, and his children Donald Trump Jr., Eric Trump, and Ivanka Trump sued Deutsche Bank and Capital One bank to block them from turning over financial records to congressional committees. On 22 May 2019, judge Edgardo Ramos of the federal District Court in Manhattan rejected the Trump suit against Deutsche Bank, ruling the bank must comply with congressional subpoenas. Six days later, Ramos granted Trump's attorneys their request for a stay so they could pursue an expedited appeal through the courts. In October 2019, a federal appeals court said the bank asserted it did not have Trump's tax returns. In December 2019, the Second Circuit Court of Appeals ruled that Deutsche Bank must release Trump's financial records, with some exceptions, to congressional committees; Trump was given seven days to seek another stay pending a possible appeal to the Supreme Court.

In May 2019, '' The New York Times'' reported that anti-money laundering specialists in the bank detected what appeared to be suspicious transactions involving entities controlled by Trump and his son-in-law Jared Kushner, for which they recommended filing suspicious activity report

In financial regulation, a Suspicious Activity Report (SAR) or Suspicious Transaction Report (STR) is a report made by a financial institution about suspicious or potentially suspicious activity. The criteria to decide when a report must be ma ...

s with the Financial Crimes Enforcement Network of the Treasury Department, but bank executives rejected the recommendations. One specialist noted money moving from Kushner Companies to Russian individuals and flagged it in part because of the bank's previous involvement in a Russian money-laundering scheme.

On 19 November 2019, Thomas Bowers, a former Deutsche Bank executive and head of the American wealth management division, was reported to have committed suicide in his Malibu home. Bowers had been in charge of overseeing and personally signing over $360 million in high-risk loans for Trump's National Doral Miami resort. The loans had been subject to a criminal investigation by special counsel Robert Mueller in his investigation of the president's 2016 campaign involvement in Russian election meddling. Documents on those loans have also been subpoenaed from Deutsche Bank by the House Democrats together with the financial documents of the president. A relationship between Bowers's responsibilities and apparent suicide has not been established; the Los Angeles County Medical Examiner – Coroner closed the case, giving no indication to wrongdoing by third parties.

In early 2021, Deutsche Bank elected to discontinue its relationship with Donald Trump following the January 6 United States Capitol attack.

Fine for business with Jeffrey Epstein, 2020

Deutsche Bank lent money and traded currencies for the well-known sex offender Jeffrey Epstein up to May 2019, long after Epstein's 2008 guilty plea in Florida to soliciting prostitution from underage girls, according to news reports.

Involvement in Danske Bank money-laundering scandal, 2018

On 19 November 2018, a whistleblower of the Danske Bank money laundering scandal stated that a large European bank was involved in helping Danske process $150 billion in suspect funds.

Improper handling of ADRs, 2018

On 20 July 2018, Deutsche Bank agreed to pay nearly $75 million to settle charges of improper handling of "pre-released" American depositary receipt (ADRs) under investigation of the U.S. Securities and Exchange Commission (SEC). Deutsche Bank didn't admit or deny the investigation findings but agreed to pay disgorgement of more than $44.4 million in ill-gotten gains plus $6.6 million in prejudgment interest and a penalty of $22.2 million.

Malaysian 1MDB fund

In July 2019, U.S. prosecutors investigated Deutsche Bank's role in a multibillion-dollar fraud scandal involving the 1Malaysia Development Berhad

1Malaysia Development Berhad (1MDB; ) is an insolvent Malaysian strategic development company, wholly owned by the Minister of Finance (Incorporated).

1MDB was established to drive strategic initiatives for long-term economic development ...

, or 1MDB.

Commodities trading, bribery fine, 2021

In January 2021, Deutsche Bank agreed to pay a U.S. fine of more than $130 million for a scheme to conceal bribes to foreign officials in countries such as Saudi Arabia and China

China, officially the People's Republic of China (PRC), is a country in East Asia. It is the world's most populous country, with a population exceeding 1.4 billion, slightly ahead of India. China spans the equivalent of five time zones and ...

, and the city of Abu Dhabi

Abu Dhabi (, ; ar, أَبُو ظَبْيٍ ' ) is the capital and second-most populous city (after Dubai) of the United Arab Emirates. It is also the capital of the Emirate of Abu Dhabi and the centre of the Abu Dhabi Metropolitan Area.

...

, between 2008 and 2017 and a commodities case where it spoofed precious metals futures.

Greenwashing, 2022

On the 31st of May, 2022, police in Germany raided the offices of Deutsche Bank in Frankfurt over allegations of greenwashing. In late July 2023, the Financial Times reported that DWS (80% owned by Deustche Bank) which was also involved in the case was nearing a settlement having earmarked €21mn for the settlement and incurred €39mn in legal costs. DWS had made misleading statements about the size of their ESG assets and the employee who raised concerns was fired unfairly. Reuters composed a more extensive timeline highlighting how the issue developed over the course of several years including when the stock price fell sharply on news of a US SEC investigation and the resignation of the CEO.

Leadership

After Deutsche Bank was first organized in 1870, the Management Board was represented by a Speaker (german: Vorstandssprecher). Beginning in February 2012, the bank has been led by two co-CEOs; in July 2015 it announced it would be led by one CEO beginning in 2016.

* Hermann Josef Abs

Hermann Josef Abs (born 15 October 1901 in Bonn – died 5 February 1994 in Bad Soden) was a leading German banker and advisor to Chancellor Adenauer. He was a member of the board of directors of Deutsche Bank from 1938 to 1945, as well as of ...

, Speaker of the Board 1957-1967

* Karl Klasen

Karl Klasen (23 April 1909 – 22 April 1991) was a German jurist and served as president of the Bundesbank from 1970 to 1977. He was co-head of Deutsche Bank

Deutsche Bank AG (), sometimes referred to simply as Deutsche, is a German multinat ...

, co-Speaker of the Board 1967-1969

* Franz Heinrich Ulrich, co-Speaker of the Board 1967-1976

* Wilfried Guth, co-Speaker of the Board 1976-1985

* Friedrich Wilhelm Christians, co-Speaker of the Board 1976-1988

* Alfred Herrhausen

Alfred Herrhausen (30 January 1930 in Essen – 30 November 1989 in Bad Homburg vor der Höhe) was a German banker and the Chairman of Deutsche Bank, who was assassinated in 1989. He was a member of the Steering Committee of the Bilderberg Group a ...

, Speaker of the Board 1985-1989

* Hilmar Kopper

Hilmar Kopper (13 March 1935 – 11 November 2021) was a German banker and former chairman of the Board of Deutsche Bank (1989–1997).

Life and career

Kopper was born in Osłonino (Poland), the second of four children of a Mennonite family ...

, Speaker of the Board 1989-1997

* Rolf-Ernst Breuer, Speaker of the Board 1997-2002

* Josef Ackermann, Speaker of the Board (2002-2006), CEO 2006-2012

* Anshu Jain

Anshuman Jain (7 January 1963 – 12 August 2022) was an Indian-born British business executive. From 2017 to 2022, he was the president of the American financial services firm Cantor Fitzgerald.

He previously served as the Global co-CEO and ...

, co-CEO 2012-2015

* Jürgen Fitschen, co-CEO 2012-2016John Cryan

John is a common English name and surname:

* John (given name)

* John (surname)

John may also refer to:

New Testament

Works

* Gospel of John, a title often shortened to John

* First Epistle of John, often shortened to 1 John

* Seco ...

, co-CEO 2015-2016, CEO 2016-2018Christian Sewing

Christian Sewing (; born 24 April 1970 in Bünde) is a German banker who currently serves as the CEO of Deutsche Bank. He has been a member of the management board since 1 January 2015. On 8 April 2018 he was appointed chief executive officer (CEO ...

, CEO since 2018

Other notable employees and officers have included:

* Paul Achleitner, long-time chairman of the supervisory board

* Michael Cohrs, former head of Global Banking (2002–2010)

* Sir John Craven

Sir John Anthony Craven (23 October 1940 – 30 March 2022) was a British financier who was chairman of Deutsche Morgan Grenfell Group plc, and a director of Deutsche Bank and Reuters.

Early life

Craven was born in Leominster on 23 October ...

– financier in London

* David Folkerts-Landau, head of Research

* Katherine Garrett-Cox, supervisory board member

* Henry Jackson – founder of OpCapita

* Sajid Javid, former managing-director (2007–2009)

* Josh Frydenberg, former director of global banking (2005)

* Otto Hermann Kahn – philanthropist

* Karl Kimmich

Karl Kimmich (September 14, 1880 in Ulm – September 10, 1945 in Berlin) was a German banker. From 1933 to 1942, he was member of the executive board of Deutsche Bank and from 1942 to 1945 chairman of the same firm.

Early life

He was the son ...

, former chair (1942–1945)

* Philip May, spouse of a former prime minister of the United Kingdom

* Steven Reich

Steven F. Reich is an American attorney who currently serves as 3M Company’s Executive Vice President & Chief Counsel, Enterprise Risk Management. Reich joined 3M in 2022 after nearly seven years at Deutsche Bank AG. At Deutsche Bank, Reich se ...

– CEO of Deutsche Bank Trust Company Americas, associate deputy attorney general (2011–2013)

* Georg von Siemens, co-founder and director (1870–1900)

* Georg Solmssen, former chair (short time 1933)

* Johannes Teyssen, (chair of the management board of E.ON)

* Ted Virtue

TED may refer to:

Economics and finance

* TED spread between U.S. Treasuries and Eurodollar

Education

* ''Türk Eğitim Derneği'', the Turkish Education Association

** TED Ankara College Foundation Schools, Turkey

** Transvaal Education Depart ...

– executive board member

* Hermann Wallich

Hermann Wallich (December 28, 1833 – April 30, 1928) was a German Jewish banker.

Together with Georg von Siemens, he co-founded Deutsche Bank.

Hermann Wallich was born in Bonn. He married Anna Jacoby in 1875. The couple had a son, Paul Wallich ...

, co-founder and director (1870–1893)

* Boaz Weinstein – derivatives trader

* Chandra Wilson – actress

See also

* Cash Group

* List of largest banks

*List of corporate collapses and scandals

A corporate collapse typically involves the insolvency or bankruptcy of a major business enterprise. A corporate scandal involves alleged or actual unethical behavior by people acting within or on behalf of a corporation. Many recent corporate col ...

Sources

* David Enrich, ''Dark Towers: Deutsche Bank, Donald Trump, and an Epic Trail of Destruction'', Custom House (2020) - The story of Deutsche Bank.

Notes

References

External links

*

*

*

*

Historical Association of Deutsche Bank

Deutsche Bank

in the Federal Financial Supervisory Authority (BaFin) database

Literature by and about Deutsche Bank

in the German National Library

{{Authority control

1870 establishments in Germany

Banks established in 1870

Banks under direct supervision of the European Central Bank

Companies listed on the Frankfurt Stock Exchange

Companies listed on the New York Stock Exchange

Companies in the DAX index

Exchange-traded funds

Financial services companies established in 1870

German brands

Companies involved in the Holocaust

German companies established in 1870

Investment banks

Investment management companies of Germany

Multinational companies headquartered in Germany

Primary dealers

Systemically important financial institutions

During World War I and in its immediate aftermath, the operations of Deutsche Bank in Brussels, London, Tokyo and Yokohama were expropriated; conversely, its activity in the Ottoman Empire expanded considerably, and it greatly expanded its footprint in Germany. In 1919, the bank purchased the state's share of Universum Film Aktiengesellschaft ( UFA). In 1926, the bank assisted in the merger of Daimler and Benz.

The bank merged with Disconto-Gesellschaft in 1929 and rebranded itself Deutsche Bank und Disconto-Gesellschaft, sometimes referred to as DeDi-Bank. By 1930, Deutsche Bank & Disconto-Gesellschaft maintained a similar dominant position as before World War I, with 4.8 billion Reichsmarks in total deposits ahead of Danat-Bank (2.4 billion), Dresdner Bank (2.3 billion), Commerz- und Privatbank (1.5 billion), Reichs-Kredit-Gesellschaft (619 million), and

During World War I and in its immediate aftermath, the operations of Deutsche Bank in Brussels, London, Tokyo and Yokohama were expropriated; conversely, its activity in the Ottoman Empire expanded considerably, and it greatly expanded its footprint in Germany. In 1919, the bank purchased the state's share of Universum Film Aktiengesellschaft ( UFA). In 1926, the bank assisted in the merger of Daimler and Benz.

The bank merged with Disconto-Gesellschaft in 1929 and rebranded itself Deutsche Bank und Disconto-Gesellschaft, sometimes referred to as DeDi-Bank. By 1930, Deutsche Bank & Disconto-Gesellschaft maintained a similar dominant position as before World War I, with 4.8 billion Reichsmarks in total deposits ahead of Danat-Bank (2.4 billion), Dresdner Bank (2.3 billion), Commerz- und Privatbank (1.5 billion), Reichs-Kredit-Gesellschaft (619 million), and  Following Germany's defeat in World War II, the Allied authorities, in 1948, ordered Deutsche Bank's break-up into regional banks. These regional banks were later consolidated into three major banks in 1952: Norddeutsche Bank AG; Süddeutsche Bank AG; and Rheinisch-Westfälische Bank AG. In 1957, these three banks merged to form Deutsche Bank AG with its headquarters in Frankfurt.

In 1959, the bank entered retail banking by introducing small personal loans. In the 1970s, the bank pushed ahead with international expansion, opening new offices in new locations, such as Milan (1977), Moscow, London, Paris, and Tokyo. In the 1980s, this continued when the bank paid U$603 million in 1986 to acquire Banca d'America e d'Italia.

In 1972, the bank established its ''Fiduciary Services Division'' which provides support to its private wealth division.

At 8:30 am on 30 November 1989,

Following Germany's defeat in World War II, the Allied authorities, in 1948, ordered Deutsche Bank's break-up into regional banks. These regional banks were later consolidated into three major banks in 1952: Norddeutsche Bank AG; Süddeutsche Bank AG; and Rheinisch-Westfälische Bank AG. In 1957, these three banks merged to form Deutsche Bank AG with its headquarters in Frankfurt.

In 1959, the bank entered retail banking by introducing small personal loans. In the 1970s, the bank pushed ahead with international expansion, opening new offices in new locations, such as Milan (1977), Moscow, London, Paris, and Tokyo. In the 1980s, this continued when the bank paid U$603 million in 1986 to acquire Banca d'America e d'Italia.

In 1972, the bank established its ''Fiduciary Services Division'' which provides support to its private wealth division.

At 8:30 am on 30 November 1989,  The bank's business model rests on three pillars – the Corporate & Investment Bank (CIB), the Private & Commercial Bank and Asset Management (DWS).

The bank's business model rests on three pillars – the Corporate & Investment Bank (CIB), the Private & Commercial Bank and Asset Management (DWS).

The Corporate & Investment Bank (CIB) is Deutsche Bank's capital markets business. The CIB comprises the below six units.

* Corporate Finance is responsible for advisory and mergers & acquisitions (M&A).

* Equities / Fixed Income & Currencies. These two units are responsible for sales and trading of securities.

* Global Capital Markets (GCM) is focused on financing and risk management solutions. It includes debt and equity issuances.

* Global Transaction Banking (GTB) caters to corporates and financial institutions by providing commercial banking products including cross-border payments, cash management, Securities Services, and international trade finance.

* Deutsche Bank Research provides analysis of products, markets, and trading strategies.

The Corporate & Investment Bank (CIB) is Deutsche Bank's capital markets business. The CIB comprises the below six units.

* Corporate Finance is responsible for advisory and mergers & acquisitions (M&A).

* Equities / Fixed Income & Currencies. These two units are responsible for sales and trading of securities.

* Global Capital Markets (GCM) is focused on financing and risk management solutions. It includes debt and equity issuances.

* Global Transaction Banking (GTB) caters to corporates and financial institutions by providing commercial banking products including cross-border payments, cash management, Securities Services, and international trade finance.

* Deutsche Bank Research provides analysis of products, markets, and trading strategies.