Bank runs on:

[Wikipedia]

[Google]

[Amazon]

A bank run or run on the bank occurs when many clients withdraw their money from a

A bank run or run on the bank occurs when many clients withdraw their money from a

Under

Under  If only a few depositors withdraw at any given time, this arrangement works well. Barring some major emergency on a scale matching or exceeding the bank's geographical area of operation, depositors' unpredictable needs for cash are unlikely to occur at the same time; that is, by the

If only a few depositors withdraw at any given time, this arrangement works well. Barring some major emergency on a scale matching or exceeding the bank's geographical area of operation, depositors' unpredictable needs for cash are unlikely to occur at the same time; that is, by the

A bank run is the sudden withdrawal of deposits of just one bank. A ''banking panic'' or ''bank panic'' is a

A bank run is the sudden withdrawal of deposits of just one bank. A ''banking panic'' or ''bank panic'' is a

Several techniques have been used to help prevent or mitigate bank runs.

Several techniques have been used to help prevent or mitigate bank runs.

A bank run or run on the bank occurs when many clients withdraw their money from a

A bank run or run on the bank occurs when many clients withdraw their money from a bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

Because ...

, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking

Fractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve, ...

system (where banks normally only keep a small proportion of their assets as cash), numerous customers withdraw cash from deposit account

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below.

...

s with a financial institution at the same time because they believe that the financial institution is, or might become, insolvent

In accounting, insolvency is the state of being unable to pay the debts, by a person or company (debtor), at maturity; those in a state of insolvency are said to be ''insolvent''. There are two forms: cash-flow insolvency and balance-sheet inso ...

; they keep the cash or transfer it into other assets, such as government bonds, precious metal

Precious metals are rare, naturally occurring metallic chemical elements of high economic value.

Chemically, the precious metals tend to be less reactive than most elements (see noble metal). They are usually ductile and have a high lustre. ...

s or gemstone

A gemstone (also called a fine gem, jewel, precious stone, or semiprecious stone) is a piece of mineral crystal which, in cut and polished form, is used to make jewelry or other adornments. However, certain rocks (such as lapis lazuli, opal, ...

s. When they transfer funds to another institution, it may be characterized as a capital flight

Capital flight, in economics, occurs when assets or money rapidly flow out of a country, due to an event of economic consequence or as the result of a political event such as regime change or economic globalization. Such events could be an increas ...

. As a bank run progresses, it may become a self-fulfilling prophecy

A self-fulfilling prophecy is a prediction that comes true at least in part as a result of a person's or group of persons' belief or expectation that said prediction would come true. This suggests that people's beliefs influence their actions. ...

: as more people withdraw cash, the likelihood of default increases, triggering further withdrawals. This can destabilize the bank to the point where it runs out of cash and thus faces sudden bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor ...

. To combat a bank run, a bank may limit how much cash each customer may withdraw, suspend withdrawals altogether, or promptly acquire more cash from other banks or from the central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central ba ...

, besides other measures.

A banking panic or bank panic is a financial crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and man ...

that occurs when many banks suffer runs at the same time, as people suddenly try to convert their threatened deposits into cash or try to get out of their domestic banking system altogether. A systemic banking crisis is one where all or almost all of the banking capital in a country is wiped out. The resulting chain of bankruptcies can cause a long economic recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

as domestic businesses and consumers are starved of capital as the domestic banking system shuts down. According to former U.S. Federal Reserve chairman Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Fed, he was appointed a distinguished fellow at the Brookings Institution. Durin ...

, the Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

was caused by the Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

, and much of the economic damage was caused directly by bank runs. The cost of cleaning up a systemic banking crisis can be huge, with fiscal costs averaging 13% of GDP

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is ofte ...

and economic output losses averaging 20% of GDP for important crises from 1970 to 2007.

Several techniques have been used to try to prevent bank runs or mitigate their effects. They have included a higher reserve requirement

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the centra ...

(requiring banks to keep more of their reserves as cash), government bailout

A bailout is the provision of financial help to a corporation or country which otherwise would be on the brink of bankruptcy.

A bailout differs from the term ''bail-in'' (coined in 2010) under which the bondholders or depositors of global sys ...

s of banks, supervision and regulation of commercial banks, the organization of central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central ba ...

s that act as a lender of last resort

A lender of last resort (LOLR) is the institution in a financial system that acts as the provider of liquidity to a financial institution which finds itself unable to obtain sufficient liquidity in the interbank lending market when other facil ...

, the protection of deposit insurance

Deposit insurance or deposit protection is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance systems are one component of ...

systems such as the U.S. Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures cred ...

, and after a run has started, a temporary suspension of withdrawals. These techniques do not always work: for example, even with deposit insurance, depositors may still be motivated by beliefs they may lack immediate access to deposits during a bank reorganization.

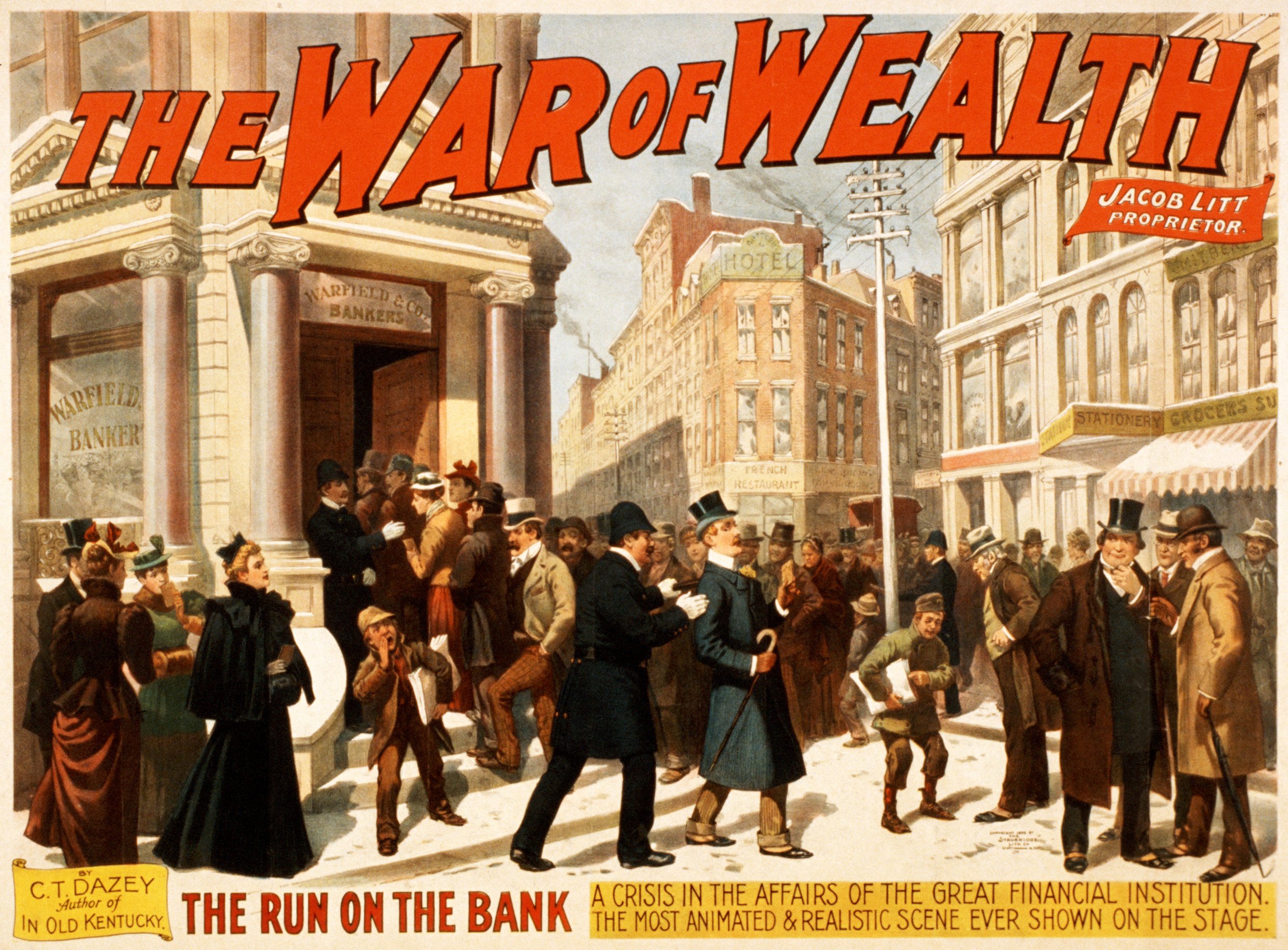

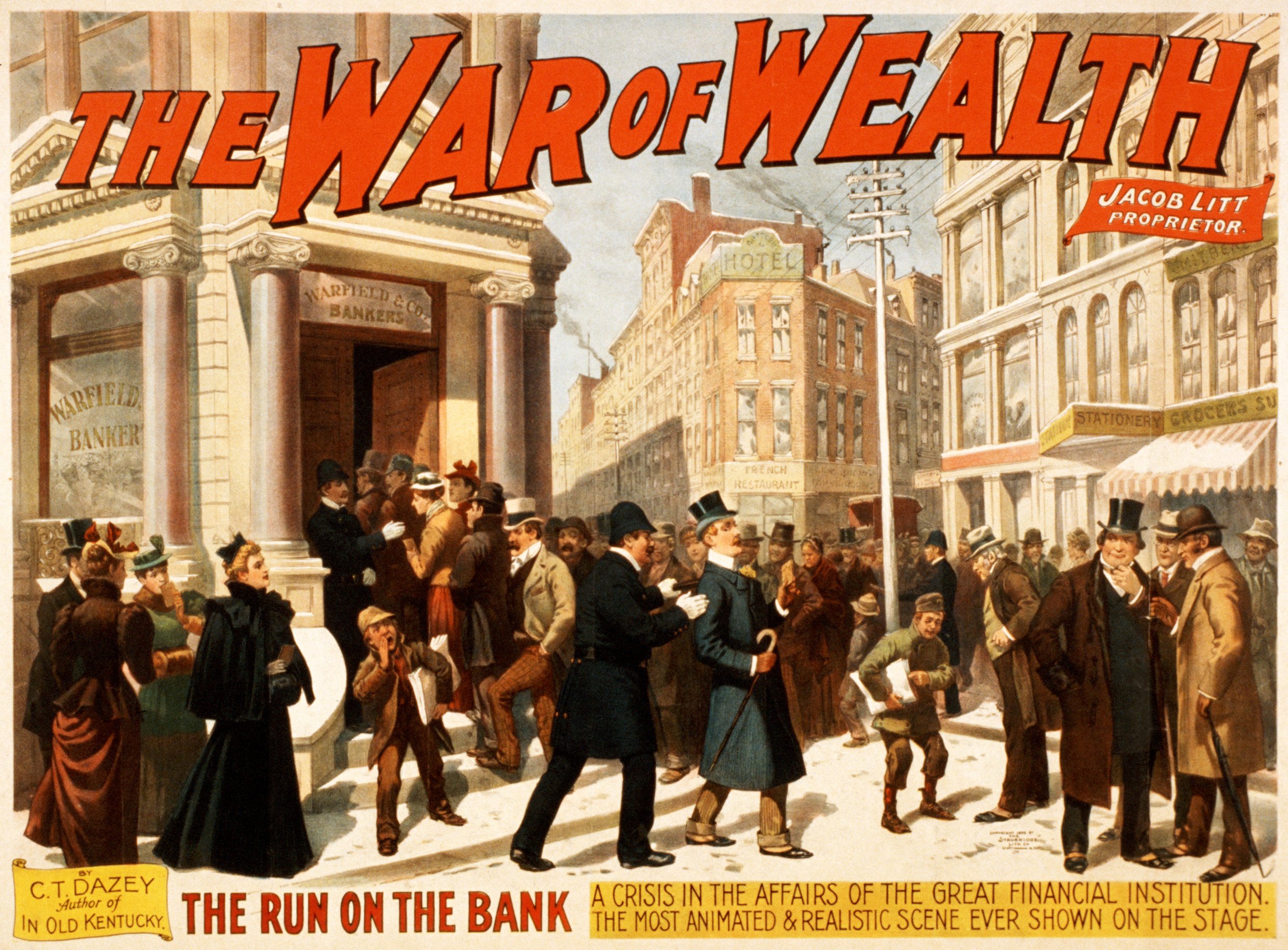

History

Bank runs first appeared as part of cycles of credit expansion and its subsequent contraction. In the 16th century onwards, English goldsmiths issuing promissory notes suffered severe failures due to bad harvests, plummeting parts of the country into famine and unrest. Other examples are the Dutchtulip mania

Tulip mania ( nl, tulpenmanie) was a period during the Dutch Golden Age when contract prices for some bulbs of the recently introduced and fashionable tulip reached extraordinarily high levels. The major acceleration started in 1634 and then ...

s (1634–1637), the British South Sea Bubble

South is one of the cardinal directions or compass points. The direction is the opposite of north and is perpendicular to both east and west.

Etymology

The word ''south'' comes from Old English ''sūþ'', from earlier Proto-Germanic ''*sunþaz ...

(1717–1719), the French Mississippi Company

The Mississippi Company (french: Compagnie du Mississippi; founded 1684, named the Company of the West from 1717, and the Company of the Indies from 1719) was a corporation holding a business monopoly in French colonies in North America and th ...

(1717–1720), the post-Napoleonic depression (1815–1830), and the Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

(1929–1939).

Bank runs have also been used to blackmail individuals or governments. In 1832, for example, the British government under the Duke of Wellington

Arthur Wellesley, 1st Duke of Wellington, (1 May 1769 – 14 September 1852) was an Anglo-Irish people, Anglo-Irish soldier and Tories (British political party), Tory statesman who was one of the leading military and political figures of Uni ...

overturned a majority government on the orders of the king, William IV

William IV (William Henry; 21 August 1765 – 20 June 1837) was King of the United Kingdom of Great Britain and Ireland and King of Hanover from 26 June 1830 until his death in 1837. The third son of George III, William succeeded h ...

, to prevent reform (the later 1832 Reform Act

The Representation of the People Act 1832 (also known as the 1832 Reform Act, Great Reform Act or First Reform Act) was an Act of Parliament of the United Kingdom (indexed as 2 & 3 Will. IV c. 45) that introduced major changes to the electo ...

). Wellington's actions angered reformers, and they threatened a run on the banks under the rallying cry "Stop the Duke, go for gold!".

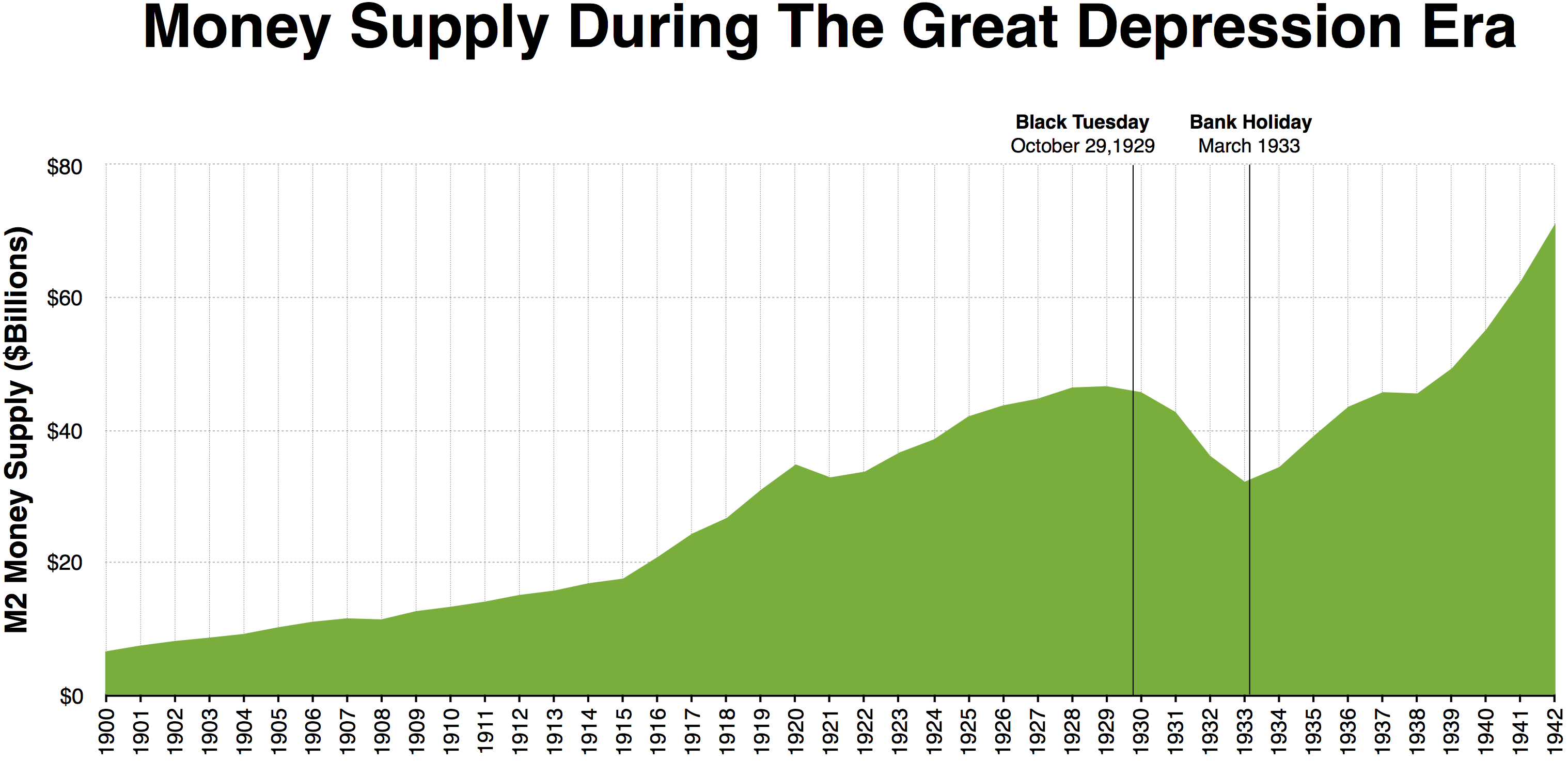

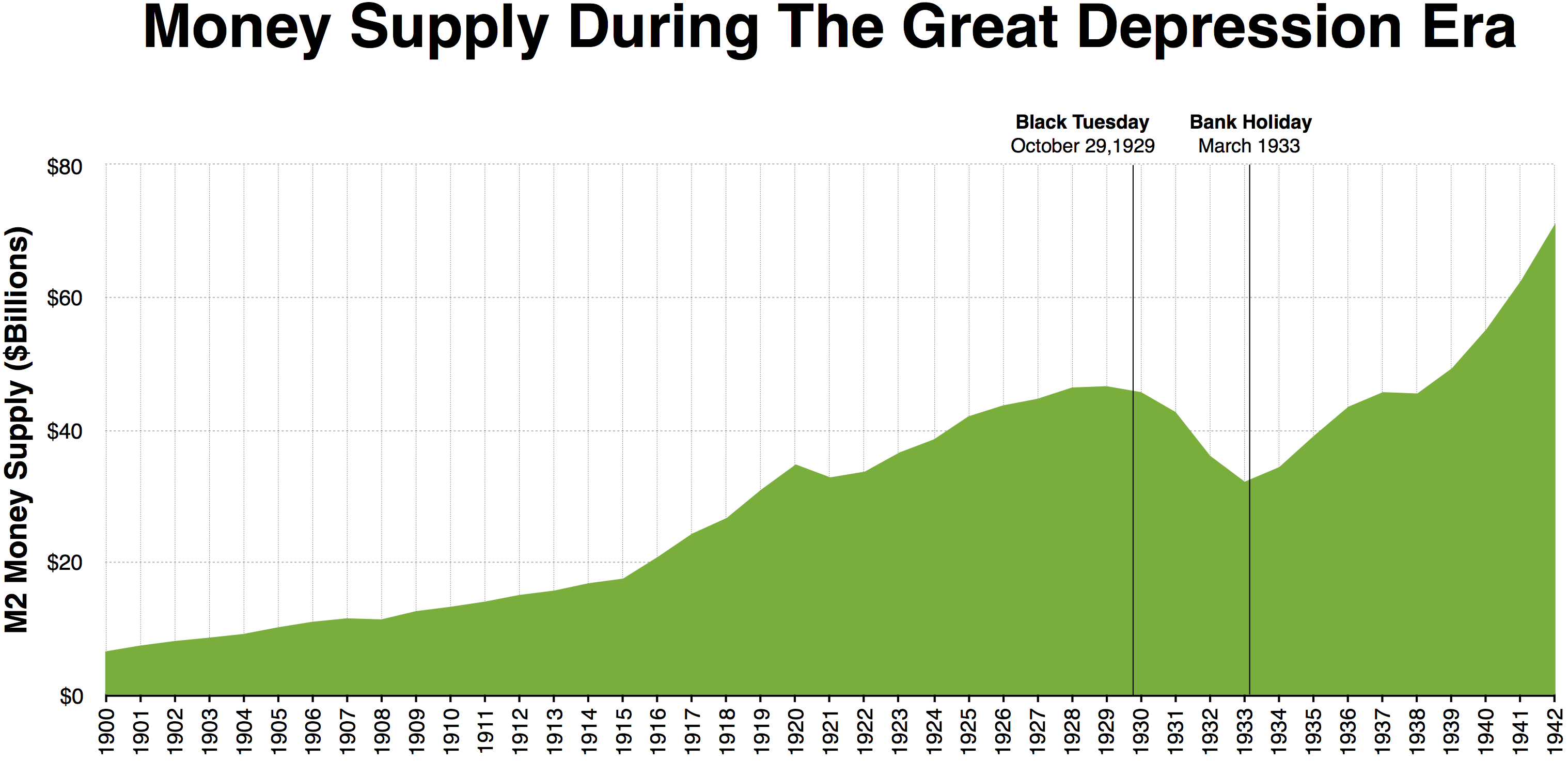

Many of the recessions in the United States were caused by banking panics. The Great Depression contained several banking crises consisting of runs on multiple banks from 1929 to 1933; some of these were specific to regions of the U.S. Bank runs were most common in states whose laws allowed banks to operate only a single branch, dramatically increasing risk compared to banks with multiple branches particularly when single-branch banks were located in areas economically dependent on a single industry.

Banking panics began in the Southern United States in November 1930, one year after the stock market crash, triggered by the collapse of a string of banks in Tennessee and Kentucky, which brought down their correspondent networks. In December, New York City experienced massive bank runs that were contained to the many branches of a single bank. Philadelphia was hit a week later by bank runs that affected several banks, but were successfully contained by quick action by the leading city banks and the Federal Reserve Bank. Withdrawals became worse after financial conglomerates in New York and Los Angeles failed in prominently-covered scandals. Much of the US Depression's economic damage was caused directly by bank runs, though Canada had no bank runs during this same era due to different banking regulations.

Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

and Anna Schwartz argued that steady withdrawals from banks by nervous depositors ("hoarding") were inspired by news of the fall 1930 bank runs and forced banks to liquidate loans, which directly caused a decrease in the money supply, shrinking the economy. Bank runs continued to plague the United States for the next several years. Citywide runs hit Boston (December 1931), Chicago (June 1931 and June 1932), Toledo (June 1931), and St. Louis (January 1933), among others. Institutions put into place during the Depression have prevented runs on U.S. commercial banks since the 1930s, even under conditions such as the U.S. savings and loan crisis of the 1980s and 1990s.

The global financial crisis that began in 2007 was centered around market-liquidity failures that were comparable to a bank run. The crisis contained a wave of bank nationalizations, including those associated with Northern Rock

Northern Rock, formerly the Northern Rock Building Society, was a British bank. Based at Regent Centre in Newcastle upon Tyne, United Kingdom, Northern Rock was originally a building society. It demutualised and became Northern Rock bank in ...

of the UK and IndyMac

IndyMac, a contraction of Independent National Mortgage Corporation, was an American bank based in California that failed in 2008 and was seized by the United States Federal Deposit Insurance Corporation (FDIC).

Before its failure, IndyMac Ban ...

of the U.S. This crisis was caused by low real interest rates stimulating an asset price bubble fuelled by new financial products that were not stress tested and that failed in the downturn.

Theory

Under

Under fractional-reserve banking

Fractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve, ...

, the type of banking currently used in most developed countries

A developed country (or industrialized country, high-income country, more economically developed country (MEDC), advanced country) is a sovereign state that has a high quality of life, developed economy and advanced technological infrastruct ...

, banks retain only a fraction of their demand deposit

Demand deposits or checkbook money are funds held in demand accounts in commercial banks. These account balances are usually considered money and form the greater part of the narrowly defined money supply of a country. Simply put, these are depo ...

s as cash. The remainder is invested in securities and loan

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that d ...

s, whose terms are typically longer than the demand deposits, resulting in an asset–liability mismatch

In finance, an asset–liability mismatch occurs when the financial terms of an institution's assets and liabilities do not correspond. Several types of mismatches are possible.

For example, a bank that chose to borrow entirely in US dollars and ...

. No bank has enough reserves on hand to cope with all deposits being taken out at once.

Diamond and Dybvig developed an influential model to explain why bank runs occur and why banks issue deposits that are more liquid

A liquid is a nearly incompressible fluid that conforms to the shape of its container but retains a (nearly) constant volume independent of pressure. As such, it is one of the four fundamental states of matter (the others being solid, gas, a ...

than their assets. According to the model, the bank acts as an intermediary between borrowers who prefer long-maturity loans and depositors who prefer liquid accounts. Reprinted (2000) in ''Federal Reserve Bank of Minneapolis Quarterly Review'' 24 (1), 14–23. The Diamond–Dybvig model provides an example of an economic game

A game is a structured form of play (activity), play, usually undertaken for enjoyment, entertainment or fun, and sometimes used as an educational tool. Many games are also considered to be work (such as professional players of spectator s ...

with more than one Nash equilibrium

In game theory, the Nash equilibrium, named after the mathematician John Nash, is the most common way to define the solution of a non-cooperative game involving two or more players. In a Nash equilibrium, each player is assumed to know the equili ...

, where it is logical for individual depositors to engage in a bank run once they suspect one might start, even though that run will cause the bank to collapse.

In the model, business investment requires expenditures in the present to obtain returns that take time in coming, for example, spending on machines and buildings now for production in future years. A business or entrepreneur that needs to borrow to finance investment will want to give their investments a long time to generate returns before full repayment, and will prefer long maturity loans, which offer little liquidity to the lender. The same principle applies to individuals and households seeking financing to purchase large-ticket items such as housing

Housing, or more generally, living spaces, refers to the construction and assigned usage of houses or buildings individually or collectively, for the purpose of shelter. Housing ensures that members of society have a place to live, whether it ...

or automobile

A car or automobile is a motor vehicle with Wheel, wheels. Most definitions of ''cars'' say that they run primarily on roads, Car seat, seat one to eight people, have four wheels, and mainly transport private transport#Personal transport, pe ...

s. The households and firms who have the money to lend to these businesses may have sudden, unpredictable needs for cash, so they are often willing to lend only on the condition of being guaranteed immediate access to their money in the form of liquid demand deposit accounts, that is, accounts with shortest possible maturity. Since borrowers need money and depositors fear to make these loans individually, banks provide a valuable service by aggregating funds from many individual deposits, portioning them into loans for borrowers, and spreading the risks both of default and sudden demands for cash. Banks can charge much higher interest on their long-term loans than they pay out on demand deposits, allowing them to earn a profit.

If only a few depositors withdraw at any given time, this arrangement works well. Barring some major emergency on a scale matching or exceeding the bank's geographical area of operation, depositors' unpredictable needs for cash are unlikely to occur at the same time; that is, by the

If only a few depositors withdraw at any given time, this arrangement works well. Barring some major emergency on a scale matching or exceeding the bank's geographical area of operation, depositors' unpredictable needs for cash are unlikely to occur at the same time; that is, by the law of large numbers

In probability theory, the law of large numbers (LLN) is a theorem that describes the result of performing the same experiment a large number of times. According to the law, the average of the results obtained from a large number of trials shou ...

, banks can expect only a small percentage of accounts withdrawn on any one day because individual expenditure needs are largely uncorrelated

In probability theory and statistics, two real-valued random variables, X, Y, are said to be uncorrelated if their covariance, \operatorname ,Y= \operatorname Y- \operatorname \operatorname /math>, is zero. If two variables are uncorrelated, there ...

. A bank can make loans over a long horizon, while keeping only relatively small amounts of cash on hand to pay any depositors who may demand withdrawals.

However, if many depositors withdraw all at once, the bank itself (as opposed to individual investors) may run short of liquidity, and depositors will rush to withdraw their money, forcing the bank to liquidate many of its assets at a loss, and eventually to fail. If such a bank were to attempt to call in its loans early, businesses might be forced to disrupt their production while individuals might need to sell their homes and/or vehicles, causing further losses to the larger economy. Even so, many if not most debtors would be unable to pay the bank in full on demand and would be forced to declare bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor ...

, possibly affecting other creditors in the process.

A bank run can occur even when started by a false story. Even depositors who know the story is false will have an incentive to withdraw, if they suspect other depositors will believe the story. The story becomes a self-fulfilling prophecy

A self-fulfilling prophecy is a prediction that comes true at least in part as a result of a person's or group of persons' belief or expectation that said prediction would come true. This suggests that people's beliefs influence their actions. ...

. Indeed, Robert K. Merton

Robert King Merton (born Meyer Robert Schkolnick; July 4, 1910 – February 23, 2003) was an American sociologist who is considered a founding father of modern sociology, and a major contributor to the subfield of criminology. He served as th ...

, who coined the term ''self-fulfilling prophecy'', mentioned bank runs as a prime example of the concept in his book ''Social Theory and Social Structure

''Social Theory and Social Structure'' (''STSS'') was a landmark publication in sociology by Robert K. Merton. It has been translated into close to 20 languages and is one of the most frequently cited texts in social sciences. It was first publish ...

''. Mervyn King, governor of the Bank of England, once noted that it may not be rational to start a bank run, but it is rational to participate in one once it had started.

Systemic banking crisis

A bank run is the sudden withdrawal of deposits of just one bank. A ''banking panic'' or ''bank panic'' is a

A bank run is the sudden withdrawal of deposits of just one bank. A ''banking panic'' or ''bank panic'' is a financial crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and man ...

that occurs when many banks suffer runs at the same time, as a cascading failure

A cascading failure is a failure in a system of interconnected parts in which the failure of one or few parts leads to the failure of other parts, growing progressively as a result of positive feedback. This can occur when a single part fails, i ...

. In a ''systemic banking crisis'', all or almost all of the banking capital in a country is wiped out; this can result when regulators ignore systemic risk

In finance, systemic risk is the risk of collapse of an entire financial system or entire market, as opposed to the risk associated with any one individual entity, group or component of a system, that can be contained therein without harming the ...

s and spillover effect

In economics a spillover is an economic event in one context that occurs because of something else in a seemingly unrelated context. For example, externalities of economic activity are non-monetary spillover effects upon non-participants. Odors f ...

s.

Systemic banking crises are associated with substantial fiscal costs and large output losses. Frequently, emergency liquidity support and blanket guarantees have been used to contain these crises, not always successfully. Although fiscal tightening may help contain market pressures if a crisis is triggered by unsustainable fiscal policies, expansionary fiscal policies are typically used. In crises of liquidity and solvency, central banks can provide liquidity to support illiquid banks. Depositor protection can help restore confidence, although it tends to be costly and does not necessarily speed up economic recovery. Intervention is often delayed in the hope that recovery will occur, and this delay increases the stress on the economy.

Some measures are more effective than others in containing economic fallout and restoring the banking system after a systemic crisis. These include establishing the scale of the problem, targeted debt relief programs to distressed borrowers, corporate restructuring programs, recognizing bank losses, and adequately capitalizing banks. Speed of intervention appears to be crucial; intervention is often delayed in the hope that insolvent banks will recover if given liquidity support and relaxation of regulations, and in the end this delay increases stress on the economy. Programs that are targeted, that specify clear quantifiable rules that limit access to preferred assistance, and that contain meaningful standards for capital regulation, appear to be more successful. According to IMF, government-owned asset management companies (bad bank

A bad bank is a corporate structure which isolates illiquid and high risk assets (typically non-performing loans) held by a bank or a financial organisation, or perhaps a group of banks or financial organisations. A bank may accumulate a large por ...

s) are largely ineffective due to political constraints.

A ''silent run'' occurs when the implicit fiscal deficit from a government's unbooked loss exposure to zombie bank

A zombie bank is a financial institution that has an economic net worth less than zero but continues to operate because its ability to repay its debts is shored up by implicit or explicit government credit support. The term was first used by Ed ...

s is large enough to deter depositors of those banks. As more depositors and investors begin to doubt whether a government can support a country's banking system, the silent run on the system can gather steam, causing the zombie banks' funding costs to increase. If a zombie bank sells some assets at market value, its remaining assets contain a larger fraction of unbooked losses; if it rolls over its liabilities at increased interest rates, it squeezes its profits along with the profits of healthier competitors. The longer the silent run goes on, the more benefits are transferred from healthy banks and taxpayers to the zombie banks. The term is also used when many depositors in countries with deposit insurance draw down their balances below the limit for deposit insurance.

The cost of cleaning up after a crisis can be huge. In systemically important banking crises in the world from 1970 to 2007, the average net recapitalization cost to the government was 6% of GDP

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is ofte ...

, fiscal costs associated with crisis management averaged 13% of GDP (16% of GDP if expense recoveries are ignored), and economic output losses averaged about 20% of GDP during the first four years of the crisis.

Prevention and mitigation

Several techniques have been used to help prevent or mitigate bank runs.

Several techniques have been used to help prevent or mitigate bank runs.

Individual banks

Some prevention techniques apply to individual banks, independently of the rest of the economy. * Banks often project an appearance of stability, with solid architecture and conservative dress. * A bank may try to hide information that might spark a run. For example, in the days before deposit insurance, it made sense for a bank to have a large lobby and fast service, to prevent the formation of a line of depositors extending out into the street which might cause passers-by to infer a bank run. * A bank may try to slow down the bank run by artificially slowing the process. One technique is to get a large number of friends and relatives of bank employees to stand in line and make many small, slow transactions. * Scheduling prominent deliveries of cash can convince participants in a bank run that there is no need to withdraw deposits hastily. * Banks can encourage customers to make term deposits that cannot be withdrawn on demand. If term deposits form a high enough percentage of a bank's liabilities its vulnerability to bank runs will be reduced considerably. The drawback is that banks have to pay a higher interest rate on term deposits. * A bank can temporarily suspend withdrawals to stop a run; this is called ''suspension of convertibility''. In many cases the threat of suspension prevents the run, which means the threat need not be carried out. * Emergency acquisition of a vulnerable bank by another institution with stronger capital reserves. This technique is commonly used by the U.S.Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures cred ...

to dispose of insolvent banks, rather than paying depositors directly from its own funds.

* If there is no immediate prospective buyer for a failing institution, a regulator or deposit insurer may set up a bridge bank

A bridge bank is an institution created by a national regulator or central bank to operate a failed bank until a buyer can be found.

While national laws vary, the bridge bank is usually established by a publicly backed deposit insurance organi ...

which operates temporarily until the business can be liquidated or sold.

* To clean up after a bank failure, the government may set up a "bad bank

A bad bank is a corporate structure which isolates illiquid and high risk assets (typically non-performing loans) held by a bank or a financial organisation, or perhaps a group of banks or financial organisations. A bank may accumulate a large por ...

", which is a new government-run asset management corporation that buys individual nonperforming assets from one or more private banks, reducing the proportion of junk bonds in their asset pools, and then acts as the creditor in the insolvency cases that follow. This, however, creates a moral hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs of that risk. For example, when a corporation is insured, it may take on higher risk ...

problem, essentially subsidizing bankruptcy: temporarily underperforming debtors can be forced to file for bankruptcy in order to make them eligible to be sold to the bad bank.

Systemic techniques

Some prevention techniques apply across the whole economy, though they may still allow individual institutions to fail. *Deposit insurance

Deposit insurance or deposit protection is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance systems are one component of ...

systems insure each depositor up to a certain amount, so that depositors' savings are protected even if the bank fails. This removes the incentive to withdraw one's deposits simply because others are withdrawing theirs. However, depositors may still be motivated by fears they may lack immediate access to deposits during a bank reorganization. To avoid such fears triggering a run, the U.S. FDIC keeps its takeover operations secret, and re-opens branches under new ownership on the next business day. Government deposit insurance programs can be ineffective if the government itself is perceived to be running short of cash.

* Bank capital requirement

A capital requirement (also known as regulatory capital, capital adequacy or capital base) is the amount of capital a bank or other financial institution has to have as required by its financial regulator. This is usually expressed as a capital ad ...

s reduces the possibility that a bank becomes insolvent. The Basel III

Basel III is the third Basel Accord, a framework that sets international standards for bank capital adequacy, stress testing, and liquidity requirements. Augmenting and superseding parts of the Basel II standards, it was developed in response to ...

agreement strengthens bank capital requirements and introduces new regulatory requirements on bank liquidity and bank leverage.

** Full-reserve banking

Full-reserve banking (also known as 100% reserve banking, narrow banking, or sovereign money system) is a system of banking where banks do not lend demand deposits and instead, only lend from time deposits. It differs from fractional-reserve bank ...

is the hypothetical case where the reserve ratio is set to 100%, and funds deposited are not lent out by the bank as long as the depositor retains the legal right to withdraw the funds on demand. Under this approach, banks would be forced to match maturities of loans and deposits, thus greatly reducing the risk of bank runs.

** A less severe alternative to full-reserve banking is a reserve ratio

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the centra ...

requirement, which limits the proportion of deposits which a bank can lend out, making it less likely for a bank run to start, as more reserves will be available to satisfy the demands of depositors. This practice sets a limit on the fraction in fractional-reserve banking

Fractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve, ...

.

* Transparency may help prevent crises spreading through the banking system. In the context of the recent crisis, the extreme complexity of certain types of assets made it difficult for market participants to assess which financial institutions would survive, which amplified the crisis by making most institutions very reluctant to lend to one another.

* Central banks

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central ba ...

act as a lender of last resort

A lender of last resort (LOLR) is the institution in a financial system that acts as the provider of liquidity to a financial institution which finds itself unable to obtain sufficient liquidity in the interbank lending market when other facil ...

. To prevent a bank run, the central bank guarantees that it will make short-term loans to banks, to ensure that, if they remain economically viable, they will always have enough liquidity to honor their deposits. Walter Bagehot

Walter Bagehot ( ; 3 February 1826 – 24 March 1877) was an English journalist, businessman, and essayist, who wrote extensively about government, economics, literature and race. He is known for co-founding the ''National Review'' in 1855 ...

's book Lombard Street provides influential early analysis of the role of the lender of last resort

A lender of last resort (LOLR) is the institution in a financial system that acts as the provider of liquidity to a financial institution which finds itself unable to obtain sufficient liquidity in the interbank lending market when other facil ...

.

The role of the lender of last resort, and the existence of deposit insurance, both create moral hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs of that risk. For example, when a corporation is insured, it may take on higher risk ...

, since they reduce banks' incentive to avoid making risky loans. They are nonetheless standard practice, as the benefits of collective prevention are commonly believed to outweigh the costs of excessive risk-taking.

Techniques to deal with a banking panic when prevention have failed:

* Declaring an emergency bank holiday

A bank holiday is a national public holiday in the United Kingdom, Republic of Ireland and the Crown Dependencies. The term refers to all public holidays in the United Kingdom, be they set out in statute, declared by royal proclamation or held ...

* Government or central bank announcements of increased lines of credit, loans, or bailouts for vulnerable banks

Depictions in fiction

The bank panic of 1933 is the setting of Archibald MacLeish's 1935 play, ''Panic

Panic is a sudden sensation of fear, which is so strong as to dominate or prevent reason and logical thinking, replacing it with overwhelming feelings of anxiety and frantic agitation consistent with an animalistic fight-or-flight reactio ...

''. Other fictional depictions of bank runs include those in ''American Madness

''American Madness'' is a 1932 American pre-Code film directed by Frank Capra and starring Walter Huston as a New York banker embroiled in scandal.

Plot

At the Union National Bank, the directors are concerned because they think that bank presi ...

'' (1932), ''It's a Wonderful Life

''It's a Wonderful Life'' is a 1946 American Christmas by medium#Films, Christmas Fantasy film, fantasy drama film produced and directed by Frank Capra, based on the short story and booklet ''The Greatest Gift'', which Philip Van Doren Stern se ...

'' (1946, set in 1932 U.S.), '' Silver River'' (1948), ''Mary Poppins It may refer to:

* ''Mary Poppins'' (book series), the original 1934–1988 children's fantasy novels that introduced the character.

* Mary Poppins (character), the nanny with magical powers.

* ''Mary Poppins'' (film), a 1964 Disney film sta ...

'' (1964, set in 1910 London), '' Rollover'' (1981), '' Noble House'' (1988) and ''The Pope Must Die

''The Pope Must Die'' (alternative known title as ''The Pope Must Diet!'' in the United States and Canada) is a 1991 British Catholic Church comedy film directed by Peter Richardson, who also wrote the screenplay with Pete Richens derived from ...

'' (1991).

Arthur Hailey

Arthur Frederick Hailey, AE (5 April 1920 – 24 November 2004) was a British-Canadian novelist whose plot-driven storylines were set against the backdrops of various industries. His books, which include such best sellers as ''Hotel'' (1965), ...

's novel ''The Moneychangers

''The Moneychangers'' is a 1975 novel written by Arthur Hailey. The plot revolves around the politics inside a major bank.

Plot summary

As the novel begins, the position of CEO of one of America's largest banks, ''First Mercantile American'', ...

'' includes a potentially fatal run on a fictitious US bank.

A run on a bank is one of the many causes of the characters' suffering in Upton Sinclair's ''The Jungle

''The Jungle'' is a 1906 novel by the American journalist and novelist Upton Sinclair. Sinclair's primary purpose in describing the meat industry and its working conditions was to advance socialism in the United States. However, most readers wer ...

''.

See also

*List of bank runs

This is a list of bank runs. A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank might fail. As more people withdraw their deposits, the likelihood of default increases, and this encour ...

*Market run

A market run or run on the market occurs when consumers increase purchasing of a particular product because they fear a shortage. As a market run progresses, it generates its own momentum: as more people demand the item, the supply line becomes un ...

*Altman Z-score

Example of an Excel spreadsheet that uses Altman Z-score to predict the probability that a firm will go into bankruptcy within two years ">bankruptcy.html" ;"title="probability that a firm will go into bankruptcy">probability that a firm will ...

*Financial crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and man ...

References

External links

* {{Financial crises Banking Systemic risk Financial crises Business cycle