|

Asset–liability Mismatch

In finance, an asset–liability mismatch occurs when the financial terms of an institution's assets and liabilities do not correspond. Several types of mismatches are possible. An asset-liability mismatch presents a material risk at institutions with significant debt exposure, such as banks or sovereign governments. A significant mismatch may lead to insolvency or illiquidity, which can cause financial failure. Such risks were among the principal causes of economic crises such as the 1980s Latin American Debt Crisis, the 2007 Subprime Mortgage Crisis, the U.S. Savings and Loan Crisis, and the collapse of Silicon Valley Bank in 2023. Currency mismatch For example, a bank that borrows funds in U.S. dollars and lends in Russian rubles would have a significant currency mismatch: if the value of the ruble were to fall relative to the dollar, then the bank would incur a financial loss. In extreme cases, such changes in the value of the assets and liabilities could lead to bankru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Assets

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetaryThere are different methods of assessing the monetary value of the assets recorded on the Balance Sheet. In some cases, the ''Historical Cost'' is used; such that the value of the asset when it was bought in the past is used as the monetary value. In other instances, the present fair market value of the asset is used to determine the value shown on the balance sheet. value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business. ''Total assets'' can also be called the ''balance sheet total''. Assets can be grouped into two major classes: tangible assets and i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deposit Insurance

Deposit insurance, deposit protection or deposit guarantee is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance or deposit guarantee systems are one component of a financial system safety net that promotes financial stability. Process Banks are allowed (and usually encouraged) to lend or invest most of the money deposited with them instead of safe-keeping the full amounts (see fractional-reserve banking). If many of a bank's borrowers fail to repay their loans when due, the bank's creditors, including its depositors, risk loss. Because they rely on customer deposits that can be withdrawn on little or no notice, banks in financial trouble are prone to bank runs, where depositors seek to withdraw funds quickly ahead of a possible bank insolvency. Because banking institution failures have the potential to trigger a broad spectrum of harmful events, including ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Domestic Liability Dollarization

Domestic liability dollarization (DLD) refers to the denomination of banking system deposits and lending in a currency other than that of the country in which they are held. DLD does not refer exclusively to denomination in US dollars, as DLD encompasses accounts denominated in internationally traded "hard" currencies such as the British pound sterling, the Swiss franc, the Japanese yen, and the Euro (and some of its predecessors, particularly the Deutschmark). Measurement In developed countries, DLD is defined as Bank for International Settlements reporting banks' local asset positions in foreign currency as a share of GDP. In emerging-market economies (EMs), a proxy measure of DLD is constructed by summing dollar deposits and bank foreign borrowing as a share of GDP. This proxy is based on the assumption that banks match their assets and liabilities by currency type and transfer exchange rate risk to debtors. In other settings, DLD is defined as the share of foreign currency de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diamond–Dybvig Model

The Diamond–Dybvig model is an influential model of bank runs and related financial crises. The model shows how banks' mix of illiquid assets (such as business or mortgage loans) and liquid liabilities (deposits which may be withdrawn at any time) may give rise to self-fulfilling panics among depositors. Douglas Diamond and Philip H. Dybvig, along with Ben Bernanke, were the recipients of the 2022 Nobel Prize in Economics for their work on the Diamond-Dybvig model. Theory The model was published in the 1983 paper "Bank Runs, Deposit Insurance, and Liquidity" by Douglas W. Diamond of the University of Chicago and Philip H. Dybvig, then of Yale University. It shows how an institution with long-maturity assets and short-maturity liabilities can be unstable. A similar basic concept had formed part of the nineteenth century British Banking School theory of financial crises. Structure of the model Diamond and Dybvig's paper points out that business investment often requires expend ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt Sculpting

A project finance model is a specialized financial model, the purpose of which is to assess the economic feasibility of the project in question. The model's output can also be used in structuring, or "sculpting", the project finance deal. Context Project finance is the long-term financing of infrastructure and industrial projects based upon the projected cash flows of the project - rather than the balance sheets of its sponsors. The project is therefore only feasible when the project is capable of producing enough cash to cover all operating and debt-servicing expenses over the whole tenor of the debt. Most importantly, therefore, the model is used to determine the maximum amount of debt the project company (Special-purpose entity) can maintain - and the corresponding debt repayment profile; there are several related metrics here, the most important of which is arguably the Debt Service Coverage Ratio (DSCR) - the financial metric that measures the ability of a project to gen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Run

A bank run or run on the bank occurs when many Client (business), clients withdraw their money from a bank, because they believe Bank failure, the bank may fail in the near future. In other words, it is when, in a fractional-reserve banking system (where banks normally only keep a small proportion of their assets as cash), numerous customers withdraw cash from deposit accounts with a financial institution at the same time because they believe that the financial institution is, or might become, insolvency, insolvent. When they transfer funds to another institution, it may be characterized as a capital flight. As a bank run progresses, it may become a self-fulfilling prophecy: as more people withdraw cash, the likelihood of default increases, triggering further withdrawals. This can destabilize the bank to the point where it runs out of cash and thus faces sudden bankruptcy. To combat a bank run, a bank may acquire more cash from other banks or from the central bank, or limit the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

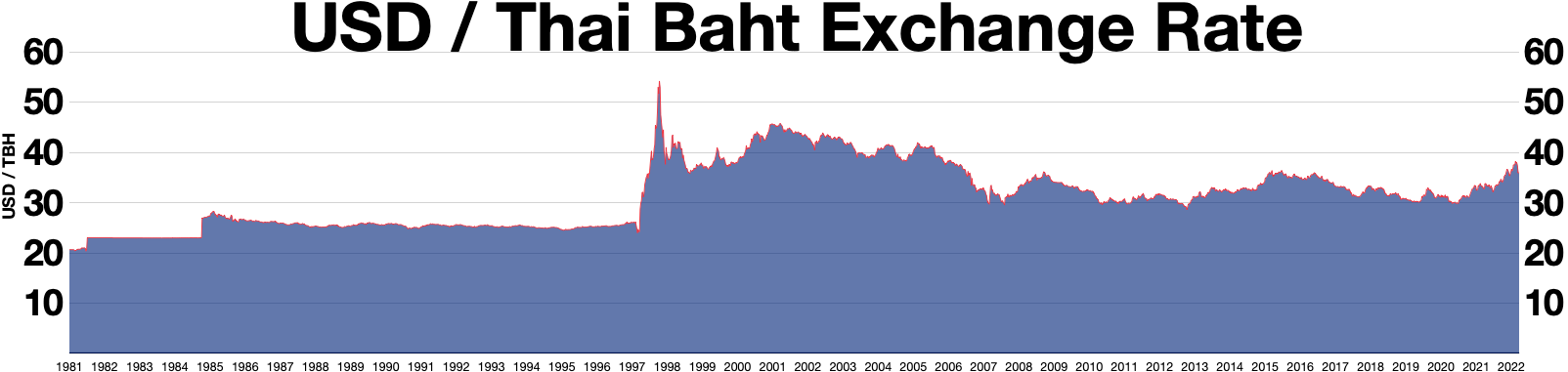

1997 Asian Financial Crisis

The 1997 Asian financial crisis gripped much of East Asia, East and Southeast Asia during the late 1990s. The crisis began in Thailand in July 1997 before spreading to several other countries with a ripple effect, raising fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid, and worries of a meltdown quickly subsided. Originating in Thailand, where it was known as the ''Tom yum, Tom Yum Kung crisis'' () on 2 July, it followed the financial collapse of the Thai baht after the Thai government was forced to floating currency, float the baht due to lack of list of circulating currencies, foreign currency to support its currency fixed exchange rate, peg to the U.S. dollar. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt. As the crisis spread, other Southeast Asian countries and later Japan and South Korea saw slumping currencies, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge (finance)

A hedge is an investment Position (finance), position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance policy, insurance, forward contracts, swap (finance), swaps, option (finance), options, gambles, many types of Over-the-counter (finance), over-the-counter and Derivative (finance), derivative products, and futures contracts. Public futures markets were established in the 19th century to allow transparent, standardized, and efficient hedging of agricultural commodity prices; they have since expanded to include futures contracts for hedging the values of Energy derivative, energy, precious metals, foreign currency, and interest rate fluctuations. Etymology Hedging is the practice of taking a position in one market to offset and balance against the risk adopted by assuming a position in a contrary or opposing market o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset Liability Management

Asset and liability management (often abbreviated ALM) is the term covering tools and techniques used by a bank or other corporate to minimise exposure to market risk and liquidity risk through holding the optimum combination of assets and liabilities. It sometimes refers more specifically to the practice of managing financial risks that arise due to mismatches - "duration gaps" - between the assets and liabilities, on the firm's balance sheet or as part of an investment strategy. ALM sits between risk management and strategic planning. It is focused on a long-term perspective rather than mitigating immediate risks; see, here, treasury management. The exact roles and perimeter around ALM can however vary significantly from one bank (or other financial institution) to another depending on the business model adopted and can encompass a broad area of risks. Traditional ALM programs focus on interest rate risk and liquidity risk because they represent the most prominent risks affec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Floating Interest Rate

A floating interest rate, also known as a variable or adjustable rate, refers to any type of debt instrument, such as a loan, Bond (finance), bond, mortgage loan, mortgage, or credit, that does not have a fixed interest, fixed rate of interest over the life of the instrument. Floating interest rates typically change based on a reference rate (a benchmark of any financial factor, such as the Consumer Price Index). One of the most common reference rates to use as the basis for applying floating interest rates is the Secure Overnight Financing Rate, or SOFR. The rate for such debt will usually be referred to as a Yield spread, spread or wikt:margin, margin over the base rate: for example, a five-year loan may be priced at the six-month SOFR + 2.50%. At the end of each six-month period, the rate for the following period will be based on the SOFR at that point (the reset date), plus the spread. The basis will be agreed between the borrower and lender, but 1, 3, 6 or 12 month money mar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income". The borrower wants, or needs, to have money sooner, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * the term to m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Duration Gap

In Finance, and accounting, and particularly in asset and liability management (ALM), the duration gap measures how well matched are the timings of Cash flow, cash inflows (from assets) and cash outflows (from liabilities), and is then one of the primary asset–liability mismatches considered in the ALM process. The term is typically used by banks, pension funds, or other financial institutions to measure, and manage, their risk due to changes in the interest rate: by duration matching, that is creating a "zero duration gap", the firm becomes immunization (finance), immunized against interest rate risk. See . Frederic S. Mishkin and Apostolos Serletis (2004)Duration Gap Analysis Staff (2020)Risk Management for Changing Interest Rates: Asset-Liability Management and Duration Techniques analystprep.com Measurement Formally, the duration gap is the difference between the Bond duration, duration - i.e. the Bond_duration#Modified_duration, average ''maturity'' - of assets and liab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |