bank number on:

[Wikipedia]

[Google]

[Amazon]

In the

Routing Number Policy

allows for up to five ABA RTNs to be assigned to a financial institution. Many institutions have more than five ABA RTNs as a result of mergers. ABA RTNs are only for use in payment transactions within the United States. They are used on paper check, wire transfers, and ACH transactions. On a paper check, the ABA RTN is usually the middle set of nine numbers printed at the bottom of the check. Domestic transfers that use the ABA RTN will usually be returned to the paying bank. Incoming international wire transfers also use a BIC code, also known as a SWIFT code, as they are administered by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) and defined by

The ABA RTN appears in two forms on a standard check – the fraction form and the

The ABA RTN appears in two forms on a standard check – the fraction form and the

The symbol that delimits a routing transit number is the

The symbol that delimits a routing transit number is the

Official ABA Routing Number Policy

revised June 27, 2016 (

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territorie ...

, an ABA routing transit number (ABA RTN) is a nine-digit code

In communications and information processing, code is a system of rules to convert information—such as a letter, word, sound, image, or gesture—into another form, sometimes shortened or secret, for communication through a communication ...

printed on the bottom of checks

Check or cheque, may refer to:

Places

* Check, Virginia

Arts, entertainment, and media

* ''Check'' (film), a 2021 Indian Telugu-language film

* ''The Checks'' (episode), a 1996 TV episode of ''Seinfeld''

Games and sports

* Check (chess), a thr ...

to identify the financial institution

Financial institutions, sometimes called banking institutions, are business entities that provide services as intermediaries for different types of financial monetary transactions. Broadly speaking, there are three major types of financial insti ...

on which it was drawn. The American Bankers Association

The American Bankers Association (ABA) is a Washington, D.C.-based trade association for the U.S. banking industry, founded in 1875. They lobby for banks of all sizes and charters, including community banks, regional and money center banks, sav ...

(ABA) developed the system in 1910 to facilitate the sorting, bundling, and delivering of paper checks to the drawer's (check writer's) bank for debit to the drawer's account.

Newer electronic payment methods continue to rely on ABA RTNs to identify the paying bank or other financial institution. The Federal Reserve Bank

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve A ...

uses ABA RTNs in processing Fedwire

Fedwire (formerly known as the Federal Reserve Wire Network) is a real-time gross settlement funds transfer system operated by the United States Federal Reserve Banks that allows financial institutions to electronically transfer funds between its ...

funds transfers. The ACH Network

In the United States, the ACH Network is the national automated clearing house (ACH) for electronic funds transfers established in the 1960s and 1970s. It processes financial transactions for consumers, businesses, and federal, state, and loca ...

also uses ABA RTNs in processing direct deposit

A direct deposit (or direct credit), in banking, is a deposit of money by a payer directly into a payee's bank account. Direct deposits are most commonly made by businesses in the payment of salaries and wages and for the payment of suppliers' acco ...

s, bill payments, and other automated money transfers.

Management

Since 1911, the American Bankers Association has partnered with a series of registrars, currentlyAccuity

RELX plc (pronounced "Rel-ex") is a British multinational information and analytics company headquartered in London, England. Its businesses provide scientific, technical and medical information and analytics; legal information and analytics; ...

, to manage the ABA routing number system. Accuity is the Official Routing Number Registrar and is responsible for assigning ABA RTNs and managing the ABA RTN system. Accuity publishes the ''American Bankers Association Key to Routing Numbers'' semi-annually. The "Key Book" contains the listing of all ABA RTNs that have been assigned.

There are approximately 26,895 active ABA RTNs currently in use. Every financial institution in the United States has at least one. ThRouting Number Policy

allows for up to five ABA RTNs to be assigned to a financial institution. Many institutions have more than five ABA RTNs as a result of mergers. ABA RTNs are only for use in payment transactions within the United States. They are used on paper check, wire transfers, and ACH transactions. On a paper check, the ABA RTN is usually the middle set of nine numbers printed at the bottom of the check. Domestic transfers that use the ABA RTN will usually be returned to the paying bank. Incoming international wire transfers also use a BIC code, also known as a SWIFT code, as they are administered by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) and defined by

ISO 9362

ISO 9362 is an international standard for Business Identifier Codes (BIC), a unique identifier for business institutions, approved by the International Organization for Standardization (ISO). BIC is also known as SWIFT-BIC, SWIFT ID, or SWIFT code, ...

. In addition, many international financial institutions use an IBAN

IBAN or Iban or Ibán may refer to:

Banking

* International Bank Account Number

Ethnology

* Iban culture

* Iban language

* Iban people

Given name

Cycling

* Iban Iriondo (born 1984)

* Iban Mayo (born 1977)

* Iban Mayoz (born 1981)

Football

* ...

code.

The IBAN

IBAN or Iban or Ibán may refer to:

Banking

* International Bank Account Number

Ethnology

* Iban culture

* Iban language

* Iban people

Given name

Cycling

* Iban Iriondo (born 1984)

* Iban Mayo (born 1977)

* Iban Mayoz (born 1981)

Football

* ...

was originally developed to facilitate payments within the European Union but the format is flexible enough to be applied globally. It consists of an ISO 3166-1 alpha-2 country code, followed by two check digits that are calculated using a mod-97 technique, and Basic Bank Account Number (BBAN

The International Bank Account Number (IBAN) is an internationally agreed system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcriptio ...

) with up to thirty alphanumeric characters. The BBAN includes the domestic bank account number and potentially routing information. The national banking communities decide individually on a fixed length for all BBAN in their country.

History

The bank numbers in theUnited States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territorie ...

were originated by the American Bankers Association

The American Bankers Association (ABA) is a Washington, D.C.-based trade association for the U.S. banking industry, founded in 1875. They lobby for banks of all sizes and charters, including community banks, regional and money center banks, sav ...

(ABA) in 1911. Banks had been disagreeing on identification. The ABA arranged a meeting of clearing house managers in Chicago

(''City in a Garden''); I Will

, image_map =

, map_caption = Interactive Map of Chicago

, coordinates =

, coordinates_footnotes =

, subdivision_type = Country

, subdivision_name ...

in December 1910. The gathering chose a committee to assign each bank in the country convenient numbers to use. In May 1911, the American Bankers Association released the codes. The numerical committee was W. G. Schroeder, C. R. McKay, and J. A. Walker. The publisher of the new directory was Rand-McNally and Company. The ABA clearing house codes are like the sub-headings in a decimal outline. The prefixes mean locations and the suffixes banking firms within those locations. Half of the prefixes represent major cities the other half represent regions of the United States. Lower prefixes are used for higher populations, first based on the 1910 U. S. Census. Likewise, within each prefix area banks are numbered in order of city population and bank seniority, although single-bank towns are numbered in alphabetical order. When a new bank is being organized, the current publisher of the directory of banks assigns it a transit code. The American Bankers Association asked banks to use the directory exclusively so banks would agree on how to sort checks. The book was abbreviated ''Key to Numerical System of The American Bankers Association,'' and as the ''Key''. It was published by Rand McNally & Co. In 1952 Rand McNally moved its corporate headquarters to Skokie, Illinois, and became more interested in publishing maps. Also in Skokie is a company called Accuity, which from its history has been the official registrar of ABA bank numbers since 1911. By 2014 it was the publisher of the semi-annual ''ABA Key to Routing Numbers'' and was owned by Reed Business Information, British publisher of reference works for professionals, which in turn is owned by Reed-Elsevier, English-Dutch publisher of online format reference works for professionals. Over the years the ABA's identification numbers for banks accommodated the Federal Reserve Act

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Panic ...

, the Expedited Funds Act and the Check 21 Act. By 2014 the ''Key'' included the U. S. Federal Reserve's nine-digit magnetic-ink routing numbers. ABA, p. Key to Routing Numbers—Accuity

Formats

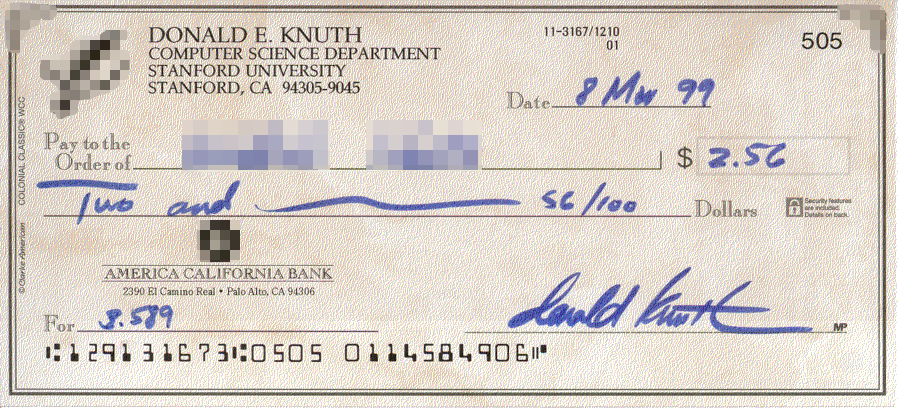

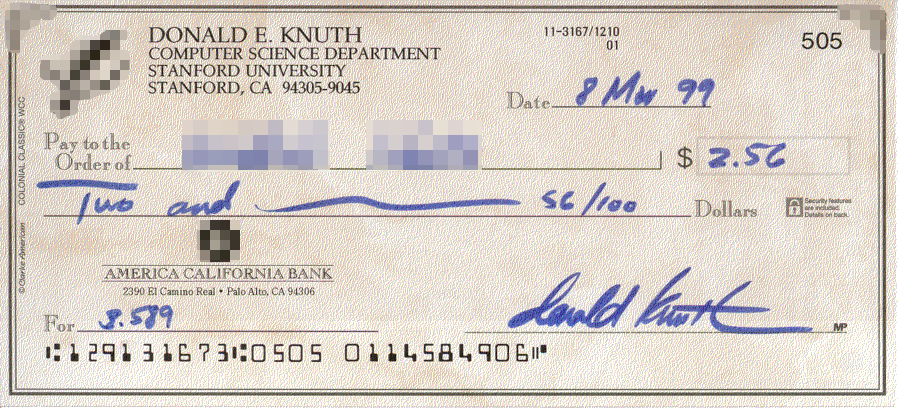

The ABA RTN appears in two forms on a standard check – the fraction form and the

The ABA RTN appears in two forms on a standard check – the fraction form and the MICR

Magnetic ink character recognition code, known in short as MICR code, is a character recognition technology used mainly by the banking industry to streamline the processing and clearance of cheques and other documents. MICR encoding, called the '' ...

(magnetic ink character recognition) form. Both forms give essentially the same information, though there are slight differences.

The MICR forms are the main form – it is printed in magnetic ink, and is machine-readable; it appears at the bottom left of a check, and consists of nine digits.

The fraction form was used for manual processing before the invention of the MICR line, and still serves as a backup in check processing should the MICR line become illegible or torn; it generally appears in the upper right part of a check near the date.

The MICR number is of the form

: XXXXYYYYC

where XXXX is Federal Reserve Routing Symbol, YYYY is ABA Institution Identifier,

and C is the Check Digit, while the fraction is of the form:

: PP-YYYY/XXXX

where PP is a 1 or 2 digit Prefix, no longer used in processing, but still printed, representing the bank's check processing center location, with 1 through 49 for processing centers located in a major city, and 50 through 99 representing processing is done at a non-major city in a particular state. Sometimes a branch number or the account number are printed below the fraction form; branch number is not used in processing, while the account number is listed in MICR form at the bottom. Further, the Federal Reserve Routing Symbol and ABA Institution Identifier may have fewer than 4 digits in the fraction form. The essential data, shared by both forms, is the Federal Reserve Routing Symbol (XXXX), and the ABA Institution Identifier (YYYY), and these are usually the same in both the fraction form and the MICR, with only the order and format switched (and left-padded with 0s to ensure that they are 4 digits long).

The prefix and the Federal Reserve Routing Symbol (XXXX) are determined by the bank's geographical location and treatment by the Federal Reserve type, while the remaining data (YYYY, and Branch number, if present) depends on the specific bank, and are unique within a Federal Reserve district.

In the check depicted above right, the fraction form is ''11-3167/1210'' (with ''01'' below it) and MICR form is ''129131673'' which are analyzed as follows:

* the ''prefix'' 11 corresponds to San Francisco,

* 3167 (common to both) is the ABA Institution Identifier,

* 1210 and 1291 are the Federal Reserve Routing Symbols (generally equal, here different probably due to obfuscation, see image file history for more information), with the initial "12" corresponding to the Federal Reserve Bank of San Francisco, the third digits ("1" and "9") corresponding to check processing centers, and the fourth digits ("0" and "1") corresponding to where the bank is located – "0" indicates "in the Federal Reserve city of San Francisco", while "1" indicates "in the state of California".

* the final "3" in the MICR is the check digit, and

* the "01" below the fraction form is the branch number.

In the case of a MICR line that is illegible or torn, the check can still be processed without the check digit. Typically, a repair strip or sleeve is attached to the check, then a new MICR line is imprinted. Either 021200025 or 0212-0002 (with a hyphen, but no check digit) may be printed, and both are 9 digits. The former (with check digit) is preferred to ensure better accuracy, but requires computing the check digit, while the latter is easily determined by inspection of the fraction, with minimal clerical handling.

MICR routing number format

The MICR routing number consists of 9 digits: : XXXXYYYYC where XXXX is Federal Reserve Routing Symbol, YYYY is ABA Institution Identifier, and C is the check digit.Federal Reserve

The Federal Reserve uses the ABA RTN system for processing its customers' payments. The ABA RTNs were originally assigned in the systematic way outlined below, reflecting a financial institution's geographical location and internal handling by the Federal Reserve. Following consolidation of the Federal Reserve's check processing facilities, and the consolidation in the banking industry, the RTN a financial institution uses may not reflect the "Fed District" where the financial institution's place of business is located. Check processing is now centralized at the Federal Reserve Bank of Atlanta. The first two digits of the nine digit RTN must be in the ranges 00 through 12, 21 through 32, 61 through 72, or 80. The digits are assigned as follows: * 00 is used by theUnited States Government

The federal government of the United States (U.S. federal government or U.S. government) is the national government of the United States, a federal republic located primarily in North America, composed of 50 states, a city within a fede ...

* 01 through 12 are the "normal" routing numbers, and correspond to the 12 Federal Reserve Bank

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve A ...

s. For example, 0260-0959-3 is the routing number for Bank of America incoming wires in New York, with the initial "02" indicating the Federal Reserve Bank of New York

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is responsible for the Second District of the Federal Reserve System, which encompasses the State of New York, the 12 northern counties of New ...

.

* 21 through 32 were assigned only to thrift institutions

A savings and loan association (S&L), or thrift institution, is a financial institution that specializes in accepting savings deposits and making mortgage and other loans. The terms "S&L" or "thrift" are mainly used in the United States; simi ...

(e.g. credit union

A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit organization, nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including depo ...

s and savings banks) through 1985, but are no longer assigned (thrifts are assigned normal 01–12 numbers). Currently they are still used by the thrift institutions, or their successors, and correspond to the normal routing number, plus 20. (For example, 2260-7352-3 is the routing number for Grand Adirondack Federal Credit Union in New York, with the initial "22" corresponding to "02" (New York Fed) plus "20" (thrift).)

* 61 through 72 are special purpose routing numbers designated for use by non-bank payment processors and clearinghouses and are termed Electronic Transaction Identifiers (ETIs), and correspond to the normal routing number, plus 60.

* 80 is used for traveler's check

A traveller's cheque is a medium of exchange that can be used in place of hard currency. They can be denominated in one of a number of major world currencies and are preprinted, fixed-amount cheques designed to allow the person signing it to ma ...

s

The first two digits correspond to the 12 Federal Reserve Bank

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve A ...

s as follows:

The third digit corresponds to the Federal Reserve check processing center originally assigned to the bank.

The fourth digit is "0" if the bank is located in the Federal Reserve city proper, and otherwise is 1–9, according to which state in the Federal Reserve district it is.

ABA Institution Identifier

The fifth through eighth digits constitute the bank's unique ABA identity within the given Federal Reserve district.Check digit

The ninth,check digit

A check digit is a form of redundancy check used for error detection on identification numbers, such as bank account numbers, which are used in an application where they will at least sometimes be input manually. It is analogous to a binary parity ...

provides a checksum

A checksum is a small-sized block of data derived from another block of digital data for the purpose of detecting errors that may have been introduced during its transmission or storage. By themselves, checksums are often used to verify data ...

test using a position-weighted sum of each of the digits. High-speed check-sorting equipment will typically verify the checksum and if it fails, route the item to a reject pocket for manual examination, repair, and re-sorting. Mis-routings to an incorrect bank are thus greatly reduced.

The following condition must hold:

:

: (Mod

Mod, MOD or mods may refer to:

Places

* Modesto City–County Airport, Stanislaus County, California, US

Arts, entertainment, and media Music

* Mods (band), a Norwegian rock band

* M.O.D. (Method of Destruction), a band from New York City, US ...

or modulo is the remainder of a division operation.)

In terms of weights, this is 371 371 371. This allows one to catch any single-digit error (incorrectly inputting one digit), together with most transposition errors. 1, 3, and 7 are used because they (together with 9) are coprime

In mathematics, two integers and are coprime, relatively prime or mutually prime if the only positive integer that is a divisor of both of them is 1. Consequently, any prime number that divides does not divide , and vice versa. This is equivale ...

to 10; using a coefficient that is divisible by 2 or 5 would lose information (because ), and thus would not catch some substitution errors. These do not catch transpositions of two digits that differ by 5 (0 and 5, 1 and 6, 2 and 7, 3 and 8, 4 and 9), but captures other transposition errors.

As an example, consider 111000025 (which is a valid routing number of Bank of America

The Bank of America Corporation (often abbreviated BofA or BoA) is an American multinational investment bank and financial services holding company headquartered at the Bank of America Corporate Center in Charlotte, North Carolina. The bank w ...

in Virginia

Virginia, officially the Commonwealth of Virginia, is a state in the Mid-Atlantic and Southeastern regions of the United States, between the Atlantic Coast and the Appalachian Mountains. The geography and climate of the Commonwealth ar ...

). Applying the formula, we get:

: .

Routing symbol

MICR

Magnetic ink character recognition code, known in short as MICR code, is a character recognition technology used mainly by the banking industry to streamline the processing and clearance of cheques and other documents. MICR encoding, called the '' ...

E-13B

Magnetic ink character recognition code, known in short as MICR code, is a character recognition technology used mainly by the banking industry to streamline the processing and clearance of cheques and other documents. MICR encoding, called the ' ...

transit character ⑆ This character, with Unicode value U+2446, appears at right.

Fraction format

The fraction form looks like afraction

A fraction (from la, fractus, "broken") represents a part of a whole or, more generally, any number of equal parts. When spoken in everyday English, a fraction describes how many parts of a certain size there are, for example, one-half, eight ...

, with a numerator

A fraction (from la, fractus, "broken") represents a part of a whole or, more generally, any number of equal parts. When spoken in everyday English, a fraction describes how many parts of a certain size there are, for example, one-half, eight ...

and a denominator

A fraction (from la, fractus, "broken") represents a part of a whole or, more generally, any number of equal parts. When spoken in everyday English, a fraction describes how many parts of a certain size there are, for example, one-half, eight ...

.

The numerator consists of two parts separated by a dash. The prefix (no longer used in check processing, yet still printed on most checks) is a 1 or 2 digit code (P or PP) indicating the region where the bank is located. The numbers 1 to 49 are cities, assigned by size of the cities in 1910. The numbers 50 to 99 are states, assigned in a rough spatial geographic order, and are used for banks located outside one of the 49 numbered cities.

The second part of the numerator (after the dash) is the bank's ABA Institution Identifier, which also forms digits 5 to 8 of the nine digit routing number (YYYY).

The denominator is also part of the routing number; by adding leading zeroes to make up four digits where necessary (e.g. 212 is written as 0212, 31 is written as 0031, etc.), it forms the first four digits of the routing number (XXXX).

There might also be a fourth element printed to the right of the fraction: this is the bank's branch number. It is not included in the MICR line. It would only be used internally by the bank, e.g. to show where the signature card is located, where to contact the responsible officer in case of an overdraft, etc.

For example, a check from Wachovia Bank in Yardley, PA, has a fraction of 55-2/212 and a routing number of 021200025. The prefix (55) no longer has any relevance, but from the remainder of the fraction, the first 8 digits of the routing number (02120002) can be determined, and the check digit (the last digit, 5 in this example) can be calculated by using the check digit formula (thus giving 021200025).

ABA prefix table

This table is up to date as of 2020. One weakness of the current routing table arrangement is that various territories like American Samoa, Guam, Puerto Rico and the US Virgin Islands share the same routing code.See also

General category *Bank card number

A payment card number, primary account number (PAN), or simply a card number, is the card identifier found on payment cards, such as credit cards and debit cards, as well as stored-value cards, gift cards and other similar cards. In some situati ...

– Used as Bank Identification Number

* Bank code

A bank code is a code assigned by a central bank, a bank supervisory body or a Bankers Association in a country to all its licensed member banks or financial institutions. The rules vary to a great extent between the countries. Also the name of ban ...

discusses formats used by other countries and regions.

* Bank State Branch

A Bank State Branch (often referred to as "BSB") is the name used in Australia for a bank code, which is a branch identifier. The BSB is normally used in association with the account number system used by each financial institution. The structure ...

, or BSB code used for Australian banks

* International Bank Account Number

The International Bank Account Number (IBAN) is an internationally agreed system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription ...

* ISO 9362

ISO 9362 is an international standard for Business Identifier Codes (BIC), a unique identifier for business institutions, approved by the International Organization for Standardization (ISO). BIC is also known as SWIFT-BIC, SWIFT ID, or SWIFT code, ...

, the SWIFT/BIC code standard

* Magnetic ink character recognition

Magnetic ink character recognition code, known in short as MICR code, is a character recognition technology used mainly by the banking industry to streamline the processing and clearance of cheques and other documents. MICR encoding, called the '' ...

– How RTN's are printed

* Sort code

Sort codes are the domestic bank codes used to route money transfers between financial institutions in the United Kingdom, and in the Republic of Ireland. They are six-digit hierarchical numerical addresses that specify clearing banks, clearing s ...

, used by British banks

Canada has similar but different transaction routing structures

* Interac

Interac is a Canadian interbank network that links financial institutions and other enterprises for the purpose of exchanging electronic financial transactions. Interac serves as the Canadian debit card system and the predominant funds tra ...

* Large Value Transfer System The Large Value Transfer System, or LVTS, was the primary system in Canada for electronic wire transfers of large sums of money, and was operated by Payments Canada. It permitted the participating institutions and their clients to send large sums of ...

(Canada)

* Routing number (Canada)

A routing number is the term for bank codes in Canada. Routing numbers consist of eight numerical digits with a dash between the fifth and sixth digit for paper financial documents encoded with magnetic ink character recognition and nine numerical ...

References

* *External links

Official ABA Routing Number Policy

revised June 27, 2016 (

PDF File

Portable Document Format (PDF), standardized as ISO 32000, is a file format developed by Adobe Systems, Adobe in 1992 to present documents, including text formatting and images, in a manner independent of application software, Computer hardware, ...

)

{{Bank codes and identification

American Bankers Association

Bank codes

Banking in the United States

Banking terms

Financial metadata

Interbank networks