|

Wage Subsidy

A wage subsidy is a payment to workers by the state, made either directly or through their employers. Its purposes are to redistribute income and to obviate the welfare trap attributed to other forms of relief, thereby reducing unemployment. It is most naturally implemented as a modification to the income tax system. The wage subsidy was proposed by A. C. Pigou in his 1933 book ''The Theory of Unemployment''.A. C. Pigou, "The Theory of Unemployment" (1933); see 'subsidies' in the index for mentions in the text. It was subsequently advocated by American economists Edmund Phelps and Scott Sumner, by American policy advisor Oren Cass, and by British economist Tony Atkinson under the name of participation income.Anthony B. Atkinson, "Inequality" (2015). The wage subsidy differs from universal basic income (UBI) in being limited in its scope to workers in paid employment, and does not generally seek to take the place of other benefits. Properties Income tax is payment made by the wor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare Trap

The welfare trap (or unemployment trap or poverty trap in British English) theory asserts that taxation and welfare systems can jointly contribute to keep people on social insurance because the withdrawal of means-tested benefits that comes with entering low-paid work causes there to be no significant increase in total income. According to this theory, an individual sees that the opportunity cost of getting a better paying job is too great for too little a financial return, and this can create a perverse incentive to not pursue a better paying job. Different definitions The term used for this concept varies depending on country. In the United States, where government benefit payments are colloquially referred to as "welfare", the welfare trap often indicates that a person is completely dependent on benefits, with little or no hope of self-sufficiency. The welfare trap is also known as the ''unemployment trap'' or the ''poverty trap'', with both terms frequently being used interc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Guaranteed Minimum Income

Guaranteed minimum income (GMI), also called minimum income (or mincome for short), is a social-welfare system that guarantees all citizens or families an income sufficient to live on, provided that certain eligibility conditions are met, typically: citizenship; a means test; and either availability to participate in the labor market, or willingness to perform community services. The primary goal of a guaranteed minimum income is reduction of poverty. In circumstances when citizenship is the sole qualification, the program becomes a universal basic income system. Elements A system of guaranteed minimum income can consist of several elements, most notably: * Calculation of the social minimum, usually below the minimum wage * Social safety net that helps those without sufficient financial means survive at the social minimum through payments or a loan, generally conditional on availability for work, performance of community services, some kind of social contract, or commitme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomas Piketty

Thomas Piketty (; born 7 May 1971) is a French economist who is Professor of Economics at the School for Advanced Studies in the Social Sciences, Associate Chair at the Paris School of Economics and Centennial Professor of Economics in the International Inequalities Institute at the London School of Economics. Piketty's work focuses on public economics, in particular income and wealth inequality. He is the author of the best-selling book ''Capital in the Twenty-First Century'' (2013), which emphasises the themes of his work on wealth concentrations and distribution over the past 250 years. The book argues that the rate of capital return in developed countries is persistently greater than the rate of economic growth, and that this will cause wealth inequality to increase in the future. Piketty proposes improving the education systems and considers diffusion of knowledge, diffusion of skills, diffusion of idea of productivity as the main mechanism that will lead to lower in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prime Pour L'emploi

The Prime pour l'emploi (PPE) was a French tax credit aimed at reducing the impact of falling Revenu de solidarité active (welfare benefits) for people returning to work. Implemented in 2001 by the government of Lionel Jospin, it was replaced by the prime d'activité in 2015. In 2008, 8.7 million working people received the tax credit. The average amount was €36 per month. Amount The amount depends on whether a person is single or in a couple and whether the income per person is between €3,473 and €17,451. The amount increases between the lower limit and €12,475 and then decreases until revenue reaches the upper limit. See also * Guaranteed minimum income *Poverty in France *Revenu minimum d'insertion *Working tax credit Working Tax Credit (WTC) is a state benefit in the United Kingdom made to people who work and have a low income. It was introduced in April 2003 and is a means-tested benefit. Despite their name, tax credits are not to be confused with tax cred ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lionel Jospin

Lionel Robert Jospin (; born 12 July 1937) is a French politician who served as Prime Minister of France from 1997 to 2002. Jospin was First Secretary of the Socialist Party from 1995 to 1997 and the party's candidate for President of France in the 1995 and 2002 elections. In 1995, he was narrowly defeated in the second round by Jacques Chirac. In 2002, he was eliminated in the first round after finishing behind both Chirac and far-right candidate Jean-Marie Le Pen, prompting him to announce his retirement from politics. In 2015, he was appointed to the Constitutional Council by National Assembly President Claude Bartolone. Biography Early life Lionel Robert Jospin was born to a Protestant family in Meudon, Seine (nowadays Hauts-de-Seine), a suburb of Paris, and is the son of Mireille Dandieu Aliette and Robert Jospin. He attended the Lycée Janson-de-Sailly before studying at Sciences Po and the École nationale d'administration (ÉNA). He was active in the UNEF stud ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Working Tax Credit

Working Tax Credit (WTC) is a state benefit in the United Kingdom made to people who work and have a low income. It was introduced in April 2003 and is a means-tested benefit. Despite their name, tax credits are not to be confused with tax credits linked to a person's tax bill, because they are used to top-up wages. Unlike most other benefits, it is paid by HM Revenue and Customs (HMRC). WTC can be claimed by working individuals, childless couples and working families with dependent children. In addition, people may also be entitled to Child Tax Credit (CTC) if they are responsible for any children. WTC and CTC are assessed jointly and families remain eligible for CTC even if where no adult is working or they have too much income to receive WTC. In 2010 the coalition government announced that the Working Tax Credit would, by 2017, be integrated into and replaced by the new Universal Credit. However implementation of this has been repeatedly delayed and will not be finished unt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tony Blair

Sir Anthony Charles Lynton Blair (born 6 May 1953) is a British former politician who served as Prime Minister of the United Kingdom from 1997 to 2007 and Leader of the Labour Party from 1994 to 2007. He previously served as Leader of the Opposition from 1994 to 1997, and had served in various shadow cabinet posts from 1987 to 1994. Blair was the Member of Parliament (MP) for Sedgefield from 1983 to 2007. He is the second longest serving prime minister in modern history after Margaret Thatcher, and is the longest serving Labour politician to have held the office. Blair attended the independent school Fettes College, and studied law at St John's College, Oxford, where he became a barrister. He became involved in Labour politics and was elected to the House of Commons in 1983 for the Sedgefield constituency in County Durham. As a backbencher, Blair supported moving the party to the political centre of British politics. He was appointed to Neil Kinnock's shadow cabin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Major

Sir John Major (born 29 March 1943) is a British former politician who served as Prime Minister of the United Kingdom and Leader of the Conservative Party from 1990 to 1997, and as Member of Parliament (MP) for Huntingdon, formerly Huntingdonshire, from 1979 to 2001. Prior to becoming prime minister, he served as Foreign Secretary and Chancellor of the Exchequer in the third Thatcher government. Having left school a day before turning sixteen, Major was elected to Lambeth London Borough Council in 1968, and a decade later to parliament, where he held several junior government positions, including Parliamentary Private Secretary and assistant whip. Following Margaret Thatcher's resignation in 1990, Major stood in the 1990 Conservative Party leadership election to replace her and emerged victorious, becoming prime minister. Two years into his premiership, Major went on to lead the Conservative Party to a fourth consecutive electoral victory, winning more than 14 mil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earned Income Tax Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children. Low income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.Tax Year 2020 1040 and 1040-SR Instructions, including the instructions for Schedules 1 through 3 Rules for EIC begin on page 40 for 2020 Tax Year. EITC phases in slowly, has a medium-length plateau, and phases out more slowly than it was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minimum Wage

A minimum wage is the lowest remuneration that employers can legally pay their employees—the price floor below which employees may not sell their labor. Most countries had introduced minimum wage legislation by the end of the 20th century. Because minimum wages increase the cost of labor, companies often try to avoid minimum wage laws by using gig workers, by moving labor to locations with lower or nonexistent minimum wages, or by automating job functions. The movement for minimum wages was first motivated as a way to stop the exploitation of workers in sweatshops, by employers who were thought to have unfair bargaining power over them. Over time, minimum wages came to be seen as a way to help lower-income families. Modern national laws enforcing compulsory union membership which prescribed minimum wages for their members were first passed in New Zealand in 1894. Although minimum wage laws are now in effect in many jurisdictions, differences of opinion exist about the be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Negative Income Tax

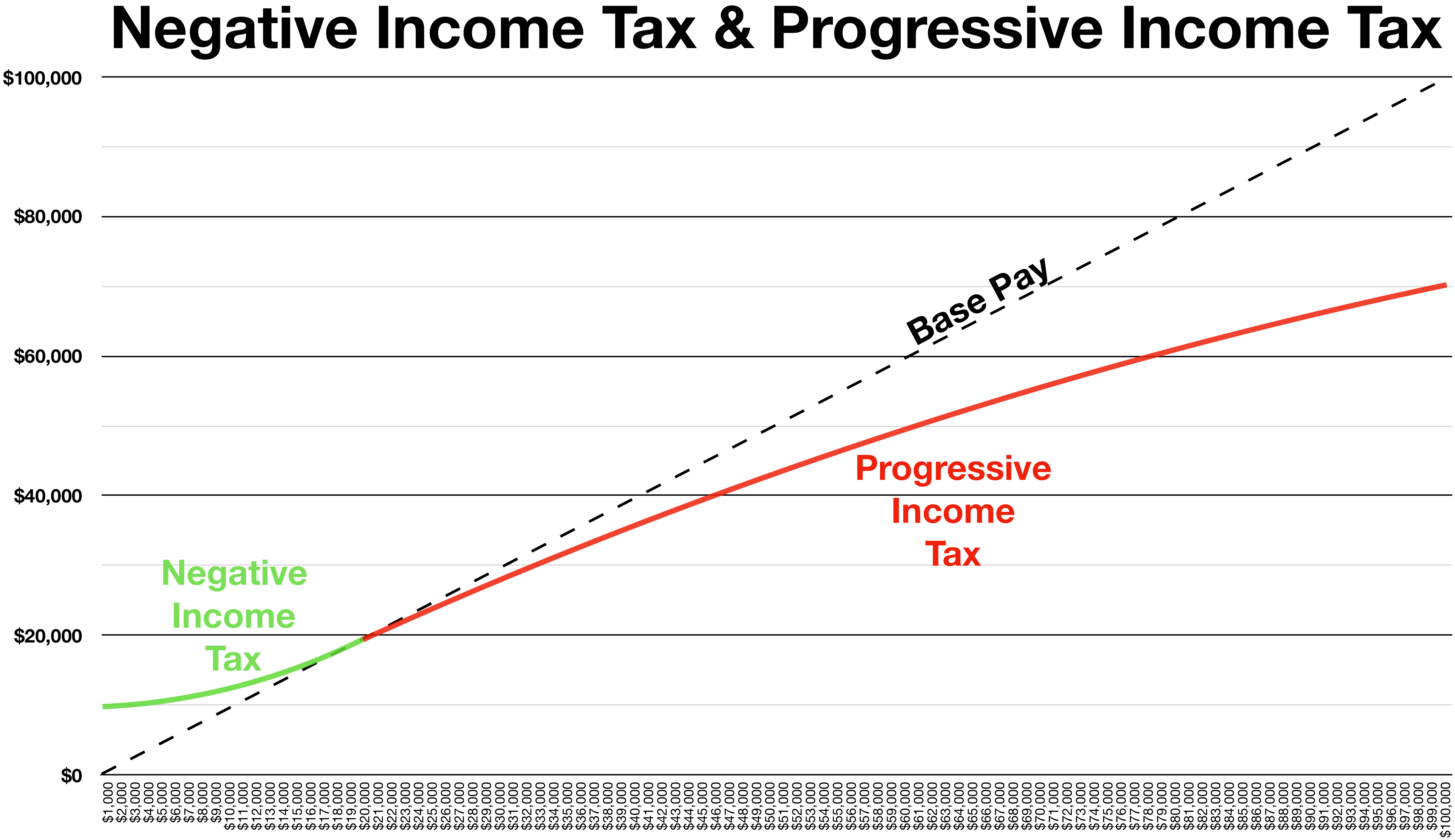

In economics, a negative income tax (NIT) is a system which reverses the direction in which tax is paid for incomes below a certain level; in other words, earners above that level pay money to the state while earners below it receive money, as shown by the blue arrows in the diagram. NIT was proposed by Juliet Rhys-Williams while working on the Beveridge Report in the early 1940s and popularized by Milton Friedman in the 1960s as a system in which the state makes payments to the poor when their income falls below a threshold, while taxing them on income above that threshold. Together with Friedman, supporters of NIT also included James Tobin, Joseph A. Pechman, and Peter M. Mieszkowski, and even then-President Richard Nixon, who suggested implementation of modified NIT in his Family Assistance Plan. After the increase in popularity of NIT, an experiment sponsored by the US government was conducted between 1968 and 1982 on effects of NIT on labour supply, income, and substitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |