|

Welfare Trap

The welfare trap (or unemployment trap or poverty trap in British English) theory asserts that taxation and welfare systems can jointly contribute to keep people on social insurance because the withdrawal of means-tested benefits that comes with entering low-paid work causes there to be no significant increase in total income. According to this theory, an individual sees that the opportunity cost of getting a better paying job is too great for too little a financial return, and this can create a perverse incentive to not pursue a better paying job. Different definitions The term used for this concept varies depending on country. In the United States, where government benefit payments are colloquially referred to as "welfare", the welfare trap often indicates that a person is completely dependent on benefits, with little or no hope of self-sufficiency. The welfare trap is also known as the ''unemployment trap'' or the ''poverty trap'', with both terms frequently being used interch ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal person, legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner (Tax noncompliance, non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat tax, flat percentag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minimum Wage

A minimum wage is the lowest remuneration that employers can legally pay their employees—the price floor below which employees may not sell their labor. Most countries had introduced minimum wage legislation by the end of the 20th century. Because minimum wages increase the cost of labor, companies often try to avoid minimum wage laws by using gig workers, by moving labor to locations with lower or nonexistent minimum wages, or by automating job functions. The movement for minimum wages was first motivated as a way to stop the exploitation of workers in sweatshops, by employers who were thought to have unfair bargaining power over them. Over time, minimum wages came to be seen as a way to help lower-income families. Modern national laws enforcing compulsory union membership which prescribed minimum wages for their members were first passed in New Zealand in 1894. Although minimum wage laws are now in effect in many jurisdictions, differences of opinion exist about the benefit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Poverty Trap

In economics, a cycle of poverty or poverty trap is caused by self-reinforcing mechanisms that cause poverty, once it exists, to persist unless there is outside intervention. It can persist across generations, and when applied to developing countries, is also known as a development trap. Families trapped in the cycle of poverty have few to no resources. There are many self-reinforcing disadvantages that make it virtually impossible for individuals to break the cycle. This occurs when poor people do not have the resources necessary to escape poverty, such as financial capital, education, or connections. Impoverished individuals do not have access to economic and social resources as a result of their poverty. This lack may increase their poverty. This could mean that the poor remain poor throughout their lives.Hutchinson Encycloped ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Negative Income Tax

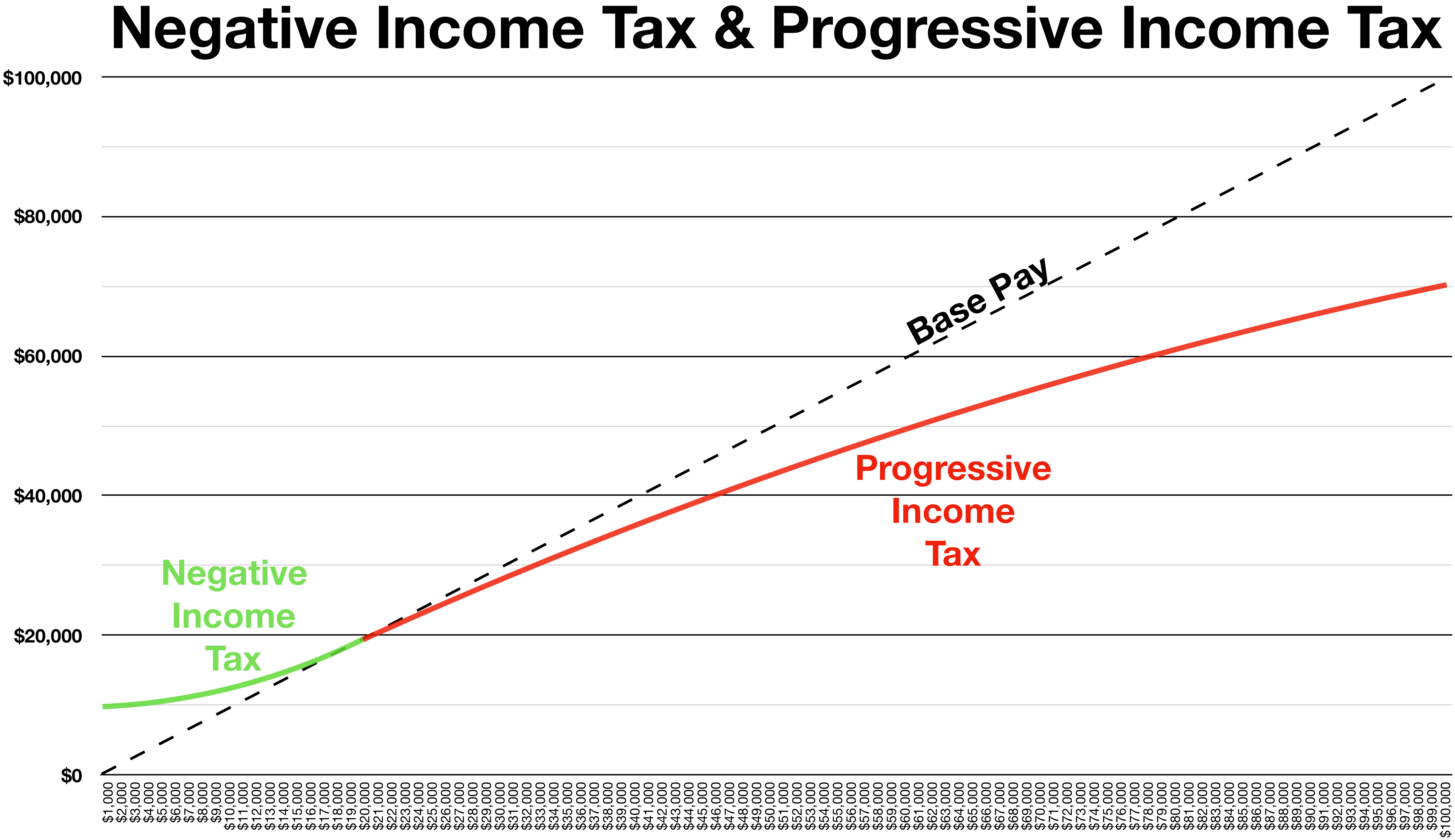

In economics, a negative income tax (NIT) is a system which reverses the direction in which tax is paid for incomes below a certain level; in other words, earners above that level pay money to the state while earners below it receive money, as shown by the blue arrows in the diagram. NIT was proposed by Juliet Rhys-Williams while working on the Beveridge Report in the early 1940s and popularized by Milton Friedman in the 1960s as a system in which the state makes payments to the poor when their income falls below a threshold, while taxing them on income above that threshold. Together with Friedman, supporters of NIT also included James Tobin, Joseph A. Pechman, and Peter M. Mieszkowski, and even then-President Richard Nixon, who suggested implementation of modified NIT in his Family Assistance Plan. After the increase in popularity of NIT, an experiment sponsored by the US government was conducted between 1968 and 1982 on effects of NIT on labour supply, income, and substitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Generational Poverty

In economics, a cycle of poverty or poverty trap is caused by self-reinforcing mechanisms that cause poverty, once it exists, to persist unless there is outside intervention. It can persist across generations, and when applied to developing countries, is also known as a development trap. Families trapped in the cycle of poverty have few to no resources. There are many self-reinforcing disadvantages that make it virtually impossible for individuals to break the cycle. This occurs when poor people do not have the resources necessary to escape poverty, such as financial capital, education, or connections. Impoverished individuals do not have access to economic and social resources as a result of their poverty. This lack may increase their poverty. This could mean that the poor remain poor throughout their lives.Hutchinson Encycloped ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Criticisms Of Welfare

The modern welfare state has been criticized on economic and moral grounds from all ends of the political spectrum. Many have argued that the provision of Taxation, tax-funded Service (economics), services or transfer payments reduces the incentive for workers to seek employment, thereby reducing the need to work, reducing the rewards of work and exacerbating poverty. On the other hand, Socialism, socialists typically criticize the welfare state as championed by Social democracy, social democrats as an attempt to legitimize and strengthen the Capitalist mode of production (Marxist theory), capitalist economic system which conflicts with the socialist goal of replacing capitalism with a Socialist mode of production, socialist economic system. Conservative criticism In his 1912 book ''The Servile State'', Anglo-French poet and social critic Hilaire Belloc, a devout Roman Catholic, argued that capitalism was inherently unstable, but that attempts to amend its defects through ever ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Catch-22 (logic)

A catch-22 is a paradoxical situation from which an individual cannot escape because of contradictory rules or limitations. The term was coined by Joseph Heller, who used it in his 1961 novel ''Catch-22''. An example is Brantley Foster in '' The Secret of My Success'': "How can I get any experience until I get a job that me experience?" Catch-22s often result from rules, regulations, or procedures that an individual is subject to, but has no control over, because to fight the rule is to accept it. Another example is a situation in which someone is in need of something that can only be had by not being in need of it (e.g. the only way to qualify for a loan is to prove to the bank that you do not need a loan). One connotation of the term is that the creators of the "catch-22" situation have created arbitrary rules in order to justify and conceal their own abuse of power. Origin and meaning Joseph Heller coined the term in his 1961 novel ''Catch-22'', which describes absurd bureau ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basic Income

Universal basic income (UBI) is a social welfare proposal in which all citizens of a given population regularly receive an unconditional transfer payment, that is, without a means test or need to work. It would be received independently of any other income. If the level is sufficient to meet a person's basic needs (i.e., at or above the poverty line), it is sometimes called a full basic income; if it is less than that amount, it may be called a partial basic income. No country has yet introduced either, although there have been numerous pilot projects and the idea is discussed in many countries. Some have labelled UBI as utopian due to its historical origin. There are several welfare arrangements which can be considered similar to basic income, although they are not unconditional. Many countries have a system of child benefit, which is essentially a basic income for guardians of children. Pension may be a basic income for retired persons. There are also quasi-basic income p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unconditional Basic Income

Universal basic income (UBI) is a social welfare proposal in which all citizens of a given population regularly receive an unconditional transfer payment, that is, without a means test or need to work. It would be received independently of any other income. If the level is sufficient to meet a person's basic needs (i.e., at or above the poverty line), it is sometimes called a full basic income; if it is less than that amount, it may be called a partial basic income. No country has yet introduced either, although there have been numerous pilot projects and the idea is discussed in many countries. Some have labelled UBI as utopian due to its historical origin. There are several welfare arrangements which can be considered similar to basic income, although they are not unconditional. Many countries have a system of child benefit, which is essentially a basic income for guardians of children. Pension may be a basic income for retired persons. There are also quasi-basic income pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employment Support Allowance

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Employees work in return for wages, which can be paid on the basis of an hourly rate, by piecework or an annual salary, depending on the type of work an employee does, the prevailing conditions of the sector and the bargaining power between the parties. Employees in some sectors may receive gratuities, bonus payments or stock options. In some types of employment, employees may receive benefits in addition to payment. Benefits may include health insurance, housing, disability insurance. Employment is typically governed by employment laws, organisation or legal contracts. Employees and employers An employee contributes labour and expertise to an endeavor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Incapacity Benefit

Incapacity Benefit was a British social security benefit that was paid to people facing extra barriers to work because of their long-term illness or their disability. It replaced Invalidity Benefit in 1995. The government began to phase out Incapacity Benefit in 2008 by making it unavailable to new claimants, and later moved almost all the remaining long-term recipients onto Employment and Support Allowance. History 1995 In 1995, the Conservative Secretary of State for Social Security, Peter Lilley, abolished Invalidity Benefit for fresh claims and replaced it with Incapacity Benefit after the Prime Minister of the day, John Major, had complained about the burgeoning caseload, saying: "Frankly, it beggars belief that so many more people have suddenly become invalids, especially at a time when the health of the population has improved". A new feature of Incapacity Benefit was that officials could ask for claimants' disabilities to be confirmed using a bespoke testing procedure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brian Lee Crowley

Brian Lee Crowley (born 1955) is a Canadian political economist, author, and public policy commentator. Since 2010 he has been managing director of the Macdonald-Laurier Institute, a think tank in Ottawa, Ontario, Canada. From 1995 until about 2009 he was president of the Atlantic Institute for Market Studies in Halifax, Nova Scotia. Books * ''The Self, the Individual and the Community''. Oxford University Press, 1987 * ''The Road to Equity: Impolitic Essays''. Stoddart, 1994 * ''Taking Ownership: Property Rights and Fishery Management on the Atlantic Coast'', editor. Atlantic Institute for Market Studies, 1996. * ''Fearful Symmetry: The Fall and Rise of Canada's Founding Values''. Key Porter Books, 2009. * ''The Canadian Century: Moving Out of America's Shadow'', with Jason Clemens and Neils Veldhuis. Key Porter Books Key Porter Books was a book publishing company based in Toronto, Ontario, Canada. Founded in 1979 by Anna Porter, later well known as a writer, the company ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |