|

Virtual Bidding

Virtual bidding is a strategy implemented in various Independent System Operator electricity markets of trading Day-Ahead prices against Real-Time (or Hour-Ahead) prices. The term "bid" can be used loosely in electricity markets to refer to an offer to buy or to sell. And the term "virtual" is used to refer to the fact that, while these trades occur in a physical market, virtual trades never entail taking a physical position—because every sell (or buy) Day Ahead will be closed by a buy (or sell) in Real Time. The ISO maintains a trade execution system that ensures all virtual positions will be closed before delivery time. A virtual bidding platform gives financial entities a way to participate in these physical markets, with no physical assets or presence on the grid. They can attempt to capitalize on regular divergences between these markets of different time period for the same underlying (perhaps using time, absolute price levels, or other external variables as conditioning fac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Independent System Operator

A regional transmission organization (RTO) in the United States is an electric power transmission system operator (TSO) that coordinates, controls, and monitors a multi-state electric grid. The transfer of electricity between states is considered interstate commerce, and electric grids spanning multiple states are therefore regulated by the Federal Energy Regulatory Commission (FERC). The voluntary creation of RTOs was initiated by FERC Order No. 2000, issued on December 20, 1999. The purpose of the RTO is to promote economic efficiency, reliability, and non-discriminatory practices while reducing government oversight. An independent system operator (ISO) is similarly an organization formed at the recommendation of FERC. In the areas where an ISO is established, it coordinates, controls, and monitors the operation of the electrical power system, usually within a single US state, but sometimes encompassing multiple states. RTOs typically perform the same functions as ISOs but cov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contract

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the long position holder and the selling party is said to be the short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both parties lodging as security a margin of the value of the contract with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Markets

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management. A financial derivative is a financial instrument whose value is derived from a commodity termed an underlier. Derivatives are either exchange-traded or over-the-counter (OTC). An increasing number of derivatives are traded via clearing houses some with central counterparty clearing, which provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market. Derivatives such as futures contracts, Swaps (1970s-), Exchange-traded Commod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Delivery Point

In a postal system, a delivery point (sometimes DP) is a single mailbox or other place at which mail is delivered. It differs from a street address, in that each address may have several delivery points, such as an apartment, office department, or other room. Such buildings (primarily residential) are often called multiple-dwelling units (MDUs) by the USPS. United States Postal Service usage In the US Postal System, a delivery point is a specific set of digits between 00 and 99 assigned to every address. When combined with the ZIP + 4 code, the delivery point provides a unique identifier for every deliverable address served by the USPS. The delivery point digits are almost never printed on mail in human-readable form; instead they are encoded in the POSTNET delivery point barcode (DPBC) or as part of the newer Intelligent Mail Barcode (IMb). The DPBC makes automated mail sorting possible, including ordering the mail according to how the carrier delivers it (walk ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Load Pocket

A load pocket is an area of electric grid (typically small) that has limited ability to import electricity due to either very high concentration of demand or insufficient transmission capabilities ("intra-zonal congestion") and therefore cannot be entirely provided with power without participation of local electricity generation providers. A typical load pocket includes a major city (e.g., New York City, San Francisco, San Diego in the US). Load pocket's existence usually indicates difficulties with building of either new generation or new transmission, or both due to the area constraints or political pressure and despite the pocket being an attractive place for investment (market congestion pricing strongly incentivizes new generation inside the pocket). The load pockets represent a problem for the deregulated electricity markets, as in the absence of regulation the captive customers are forced to accept the prices set by the local providers. Effect on restructured energy markets ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Power

In economics, market power refers to the ability of a firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue.Syverson, C. (2019). Macroeconomics and Market Power. The Journal of Economic Perspectives, 33(3), 23-43. https://doi.org/10.1257/jep.33.3.23 This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. Such propensities contradict perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are consequently referred to as 'price takers', whereas market participants that exhibit market power are referred to as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

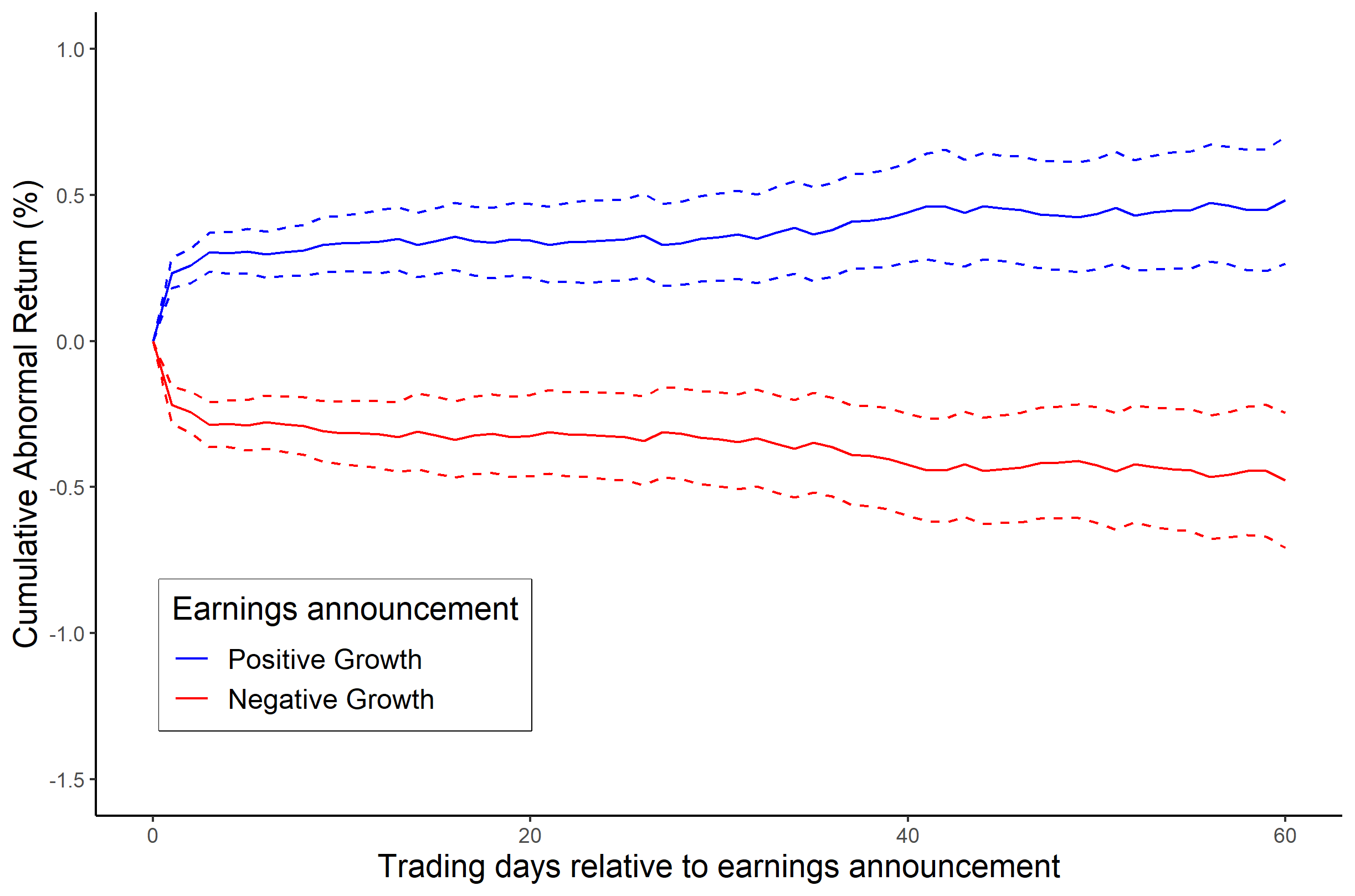

Efficient Market Hypothesis

The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information. Because the EMH is formulated in terms of risk adjustment, it only makes testable predictions when coupled with a particular model of risk. As a result, research in financial economics since at least the 1990s has focused on market anomalies, that is, deviations from specific models of risk. The idea that financial market returns are difficult to predict goes back to Bachelier, Mandelbrot, and Samuelson, but is closely associated with Eugene Fama, in part due to his influential 1970 review of the theoretical and empirical research. The EMH provides the basic logic for modern risk-based theories of asset prices, and frameworks such as consumption-based asset pricing and in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New England

New England is a region comprising six states in the Northeastern United States: Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont. It is bordered by the state of New York to the west and by the Canadian provinces of New Brunswick to the northeast and Quebec to the north. The Atlantic Ocean is to the east and southeast, and Long Island Sound is to the southwest. Boston is New England's largest city, as well as the capital of Massachusetts. Greater Boston is the largest metropolitan area, with nearly a third of New England's population; this area includes Worcester, Massachusetts (the second-largest city in New England), Manchester, New Hampshire (the largest city in New Hampshire), and Providence, Rhode Island (the capital of and largest city in Rhode Island). In 1620, the Pilgrims, Puritan Separatists from England, established Plymouth Colony, the second successful English settlement in America, following the Jamestown Settlement in Virginia foun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

White Paper

A white paper is a report or guide that informs readers concisely about a complex issue and presents the issuing body's philosophy on the matter. It is meant to help readers understand an issue, solve a problem, or make a decision. A white paper is the first document researchers should read to better understand a core concept or idea. The term originated in the 1920s to mean a type of position paper or industry report published by some department of the UK government. Since the 1990s, this type of document has proliferated in business. Today, a business-to-business (B2B) white paper is closer to a marketing presentation, a form of content meant to persuade customers and partners and promote a certain product or viewpoint. That makes B2B white papers a type of grey literature. In government The term ''white paper'' originated with the British government and many point to the Churchill White Paper of 1922 as the earliest well-known example under this name. Gertrude Bell, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Participant

The term market participant is another term for economic agent, an actor and more specifically a decision maker in a model of some aspect of the economy. For example, ''buyers'' and ''sellers'' are two common types of agents in partial equilibrium models of a single market. The term market participant is also used in United States constitutional law to describe a U.S. State which is acting as a producer or supplier of a marketable good or service. US constitutional law When a state is acting in such a role, it may permissibly discriminate against non-residents. This principle was established by the United States Supreme Court in '' Reeves, Inc. v. Stake'', 447 U.S. 429 (1980), in which the Court upheld South Dakota's right to give South Dakota residents preferential treatment in the purchase of cement produced at a cement plant owned and operated by the state. "Nothing in the purposes animating the Commerce Clause prohibits a State, in the absence of congressional action, from par ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |