|

Trial Balance

A trial balance is a list of all the general ledger accounts (both revenue and capital) contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance. The debit balance values will be listed in the debit column of the trial balance and the credit value balance will be listed in the credit column. The trading profit and loss statement and balance sheet and other financial reports can then be produced using the ledger accounts listed on the same balance. History The first published description of the process is found in Luca Pacioli's 1494 work ''Summa de arithmetica'', in the section titled ''Particularis de Computis et Scripturis''. Although he did not use the term, he essentially prescribed a technique similar to a post-closing trial balance. Usage The purpose of a trial balance is to prove that the value of a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debits And Credits

Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value ''to'' that account, and a credit entry represents a transfer ''from'' the account. Each transaction transfers value from credited accounts to debited accounts. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account. Similarly, the landlord would enter a credit in the rent income account associated with the tenant and a debit for the bank account where the cheque is deposited. Debits and credits are traditionally distinguished by writing the transfer amounts in separate columns of an account book. Alternately, they can be listed in one column, indicating debits with the suffix "Dr" or writing them plain, and indicating credits with the suffix "Cr" or a minus si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balance Sheet

In financial accounting, a balance sheet (also known as statement of financial position or statement of financial condition) is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business partnership, a corporation, private limited company or other organization such as government or not-for-profit entity. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a "snapshot of a company's financial condition". Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business's calendar year. A standard company balance sheet has two sides: assets on the left, and financing on the right–which itself has two parts; liabilities and ownership equity. The main categories of assets are usually listed first, and typically in order of liquidity. Assets are followed by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Luca Pacioli

Fra Luca Bartolomeo de Pacioli (sometimes ''Paccioli'' or ''Paciolo''; 1447 – 19 June 1517) was an Italian mathematician, Franciscan friar, collaborator with Leonardo da Vinci, and an early contributor to the field now known as accounting. He is referred to as the father of accounting and bookkeeping and he was the first person to publish a work on the double-entry system of book-keeping on the continent. He was also called Luca di Borgo after his birthplace, Borgo Sansepolcro, Tuscany. Several of his works were plagiarised from Piero della Francesca, in what has been called "probably the first full-blown case of plagiarism in the history of mathematics". Life Luca Pacioli was born between 1446 and 1448 in the Tuscan town of Sansepolcro where he received an abbaco education. This was education in the vernacular (''i.e.'', the local tongue) rather than Latin and focused on the knowledge required of merchants. His father was Bartolomeo Pacioli; however, Luca Pacioli was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Summa De Arithmetica

' (''Summary of arithmetic, geometry, proportions and proportionality'') is a book on mathematics written by Luca Pacioli and first published in 1494. It contains a comprehensive summary of Renaissance mathematics, including practical arithmetic, basic algebra, basic geometry and accounting, written for use as a textbook and reference work. Written in vernacular Italian, the ''Summa'' is the first printed work on algebra, and it contains the first published description of the double-entry bookkeeping system. It set a new standard for writing and argumentation about algebra, and its impact upon the subsequent development and standardization of professional accounting methods was so great that Pacioli is sometimes referred to as the "father of accounting". Contents The ''Summa de arithmetica'' as originally printed consists of ten chapters on a series of mathematical topics, collectively covering essentially all of Renaissance mathematics. The first seven chapters form a summary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

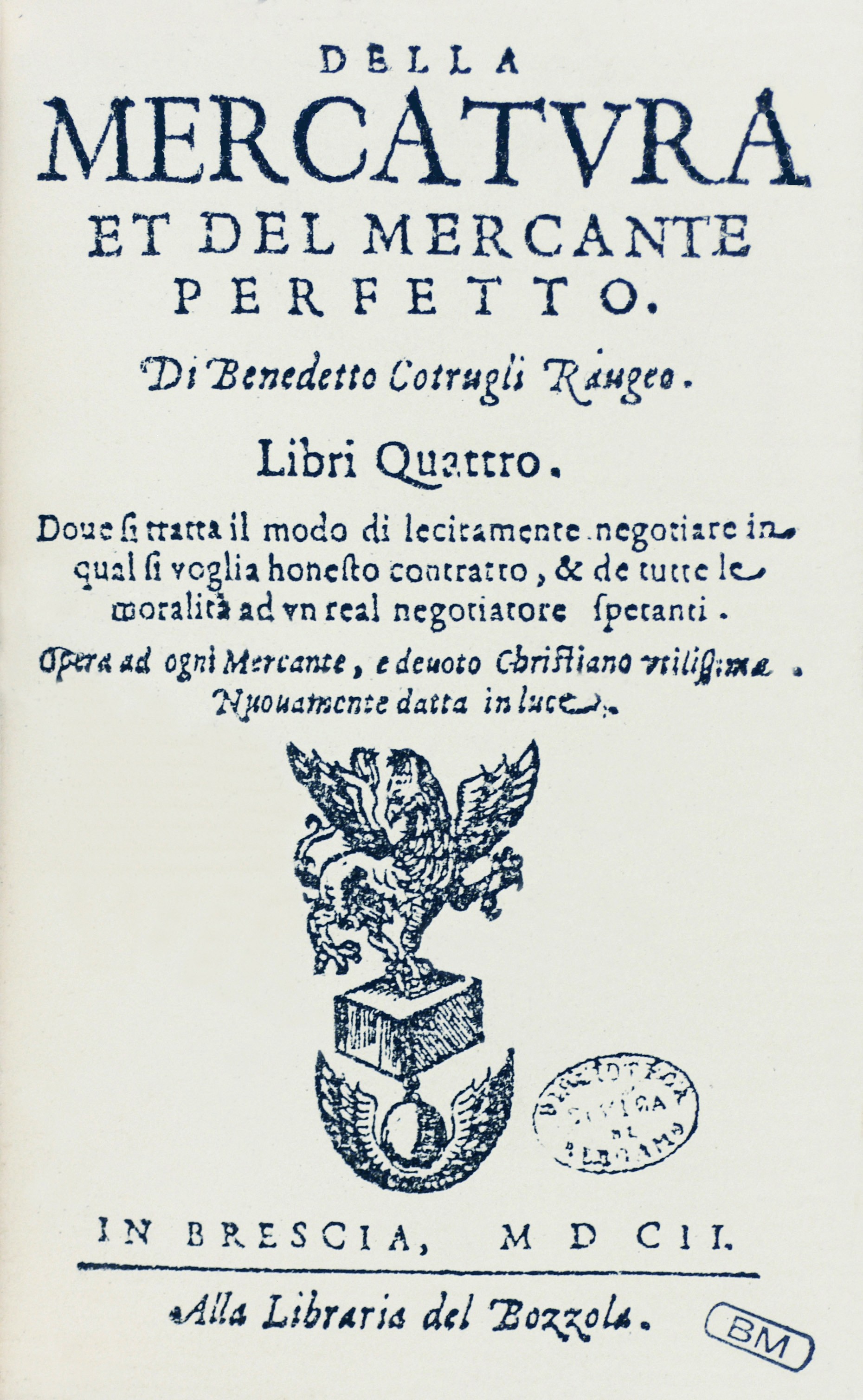

Double-entry Bookkeeping System

Double-entry bookkeeping, also known as double-entry accounting, is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information. Every entry to an account requires a corresponding and opposite entry to a different account. The double-entry system has two equal and corresponding sides known as debit and credit. A transaction in double-entry bookkeeping always affects at least two accounts, always includes at least one debit and one credit, and always has total debits and total credits that are equal. The purpose of double-entry bookkeeping is to allow the detection of financial errors and fraud. For example, if a business takes out a bank loan for $10,000, recording the transaction would require a debit of $10,000 to an asset account called "Cash", as well as a credit of $10,000 to a liability account called "Notes Payable". The basic entry to record this transaction in a general ledger will look like this: Double-entry bookkeeping is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double-entry Bookkeeping

Double-entry bookkeeping, also known as double-entry accounting, is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information. Every entry to an account requires a corresponding and opposite entry to a different account. The double-entry system has two equal and corresponding sides known as debit and credit. A transaction in double-entry bookkeeping always affects at least two accounts, always includes at least one debit and one credit, and always has total debits and total credits that are equal. The purpose of double-entry bookkeeping is to allow the detection of financial errors and fraud. For example, if a business takes out a bank loan for $10,000, recording the transaction would require a debit of $10,000 to an asset account called "Cash", as well as a credit of $10,000 to a liability account called "Notes Payable". The basic entry to record this transaction in a general ledger will look like this: Double-entry bookkeeping is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Statements

Financial statements (or financial reports) are formal records of the financial activities and position of a business, person, or other entity. Relevant financial information is presented in a structured manner and in a form which is easy to understand. They typically include four basic financial statements accompanied by a management discussion and analysis: # A balance sheet or statement of financial position, reports on a company's assets, liabilities, and owners equity at a given point in time. # An income statement—or profit and loss report (P&L report), or statement of comprehensive income, or statement of revenue & expense—reports on a company's income, expenses, and profits over a stated period. A profit and loss statement provides information on the operation of the enterprise. These include sales and the various expenses incurred during the stated period. # A statement of changes in equity or statement of equity, or statement of retained earnings, reports on t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting Terminology

Accounting, also known as accountancy, is the measurement, processing, and communication of financial and non financial information about economic entities such as businesses and corporations. Accounting, which has been called the "language of business", measures the results of an organization's economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms "accounting" and "financial reporting" are often used as synonyms. Accounting can be divided into several fields including financial accounting, management accounting, tax accounting and cost accounting. Financial accounting focuses on the reporting of an organization's financial information, including the preparation of financial statements, to the external users of the information, such as investors, regulators and suppliers; and management accounting focuses on the measurement, ana ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |