|

Tax Expenditure

Tax expenditures are government revenue losses from tax exclusions, exemptions, deductions, credits, deferrals, and preferential tax rates. They are a counterpart to direct expenditures, in that they both are forms of government spending. Tax expenditures function as subsidies for certain activities and alter the horizontal and vertical equity of the basic tax system by giving preferential treatment to those activities. For instance, two people who have the same income can have different effective tax rates if one of the tax payers qualifies for certain tax expenditures by owning a home, having children, or receiving employer-provided health care and pension insurance. Definition The Congressional Budget and Impoundment Control Act of 1974 (CBA) defines tax expenditures as "those revenue losses attributable to provisions of the Federal tax laws which allow a special credit, a preferential rate of tax, or a deferral of tax liability". The term was coined in 1967 by S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Exemption

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios. Tax exemption generally refers to a statutory exception to a general rule rather than the mere absence of taxation in particular circumstances, otherwise known as an exclusion. Tax exemption also refers to removal from taxation of a particular item rather than a deduction. International duty free shopping may be termed "tax-free shopping". In tax-free shopping, the goods are permanently taken outside the jurisdiction, thus paying taxes is not necessary. Tax-free shopping is also found in ships, airplanes and other vessels traveling ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Domestic Product

Gross domestic product (GDP) is a money, monetary Measurement in economics, measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is often revised before being considered a reliable indicator. List of countries by GDP (nominal) per capita, GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation, inflation rates of the countries; therefore, using a basis of List of countries by GDP (PPP) per capita, GDP per capita at purchasing power parity (PPP) may be more useful when comparing standard of living, living standards between nations, while nominal GDP is more useful comparing national economies on the international market. Total GDP can also be broken down into the contribution of each industry or sector of the economy. The ratio of GDP to the total population of the region is the GDP per capita, p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Policy Center

The Urban-Brookings Tax Policy Center, typically shortened to the Tax Policy Center (TPC), is a nonpartisan think tank based in Washington D.C. A joint venture of the Urban Institute and the Brookings Institution, it aims to provide independent analyses of current and longer-term tax issues, and to communicate its analyses to the public and to policymakers. TPC combines national specialists in tax, expenditure, budget policy, and microsimulation modeling to concentrate on five overarching areas of tax policy: fair, simple and efficient taxation, social policy in the tax code, business tax reform, long-term implications of tax and budget choices, and state tax issues. History In 2002, tax specialists who had served in the Ronald Reagan, George H. W. Bush, and Bill Clinton administrations established the Tax Policy Center to provide analysis of tax issues. The following year TPC developed a tax simulation model to analyze the federal income tax and proposals to change it. That mod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deep South

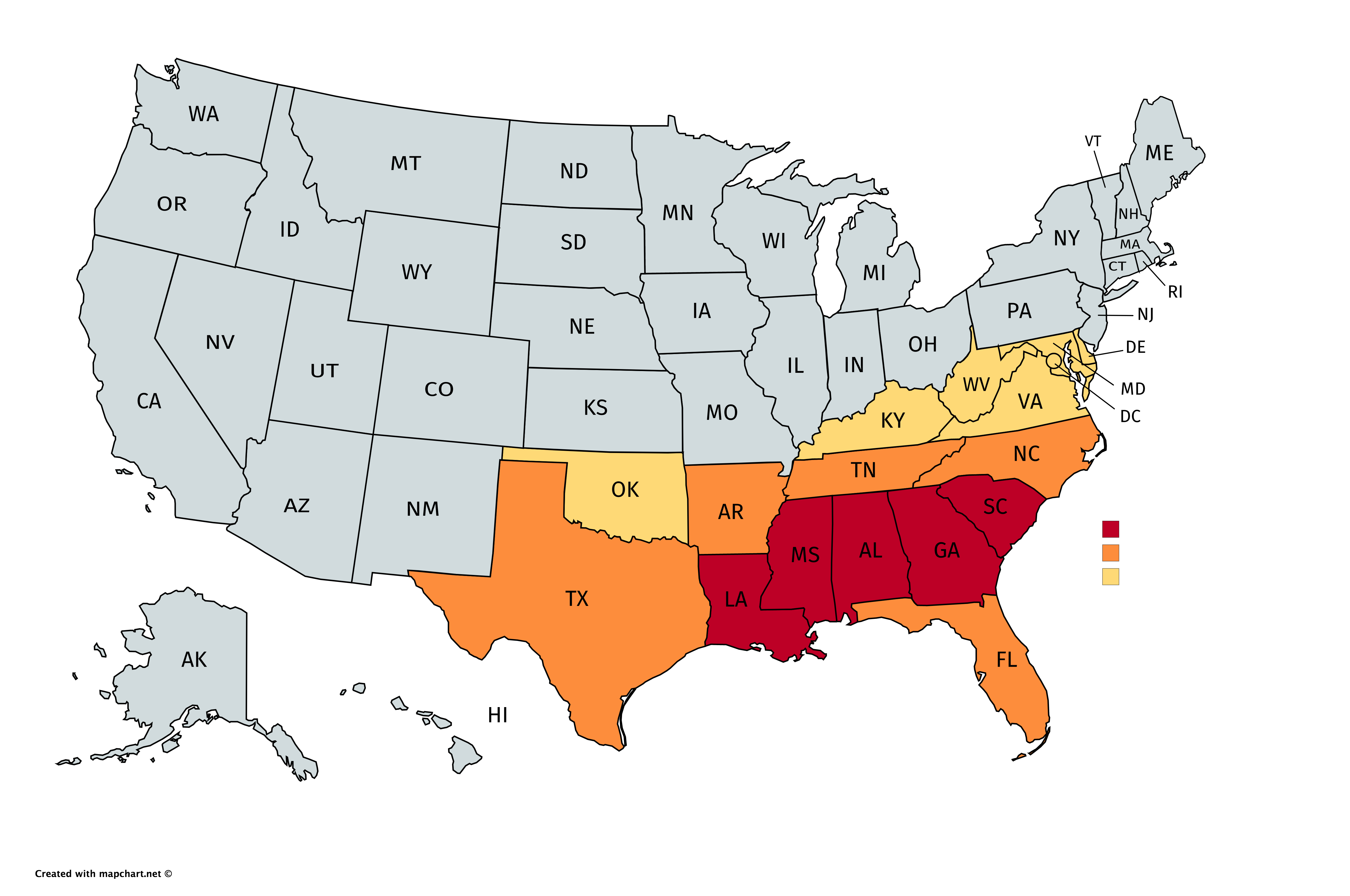

The Deep South or the Lower South is a cultural and geographic subregion in the Southern United States. The term was first used to describe the states most dependent on plantations and slavery prior to the American Civil War. Following the war, the region suffered economic hardship and was a major site of racial tension during and after the Reconstruction era. Before 1945, the Deep South was often referred to as the "Cotton States" since cotton was the primary cash crop for economic production. The civil rights movement in the 1950s and 1960s helped usher in a new era, sometimes referred to as the New South. Usage The term "Deep South" is defined in a variety of ways: *Most definitions include the following states: Louisiana, Mississippi, Alabama, Georgia, and South Carolina. *Texas, and Florida are sometimes included,Neal R. Pierce, ''The Deep South States of America: People, Politics, and Power in the Seven States of the Deep South'' (1974), pp 123–61 due to being peri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Socio-economic Mobility In The United States

Socioeconomics (also known as social economics) is the social science that studies how economic activity affects and is shaped by social processes. In general it analyzes how modern societies progress, stagnate, or regress because of their local or regional economy, or the global economy. Overview “Socioeconomics” is sometimes used as an umbrella term for various areas of inquiry. The term “social economics” may refer broadly to the "use of economics in the study of society". More narrowly, contemporary practice considers behavioral interactions of individuals and groups through social capital and social "markets" (not excluding, for example, sorting by marriage) and the formation of social norms. In the relation of economics to social values. A distinct supplemental usage describes social economics as "a discipline studying the reciprocal relationship between economic science on the one hand and social philosophy, ethics, and human dignity on the other" toward social ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the certificate (or its ID number) to a seller at the point of purchase, al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Progressive Tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases.Sommerfeld, Ray M., Silvia A. Madeo, Kenneth E. Anderson, Betty R. Jackson (1992), ''Concepts of Taxation'', Dryden Press: Fort Worth, TX The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate.Hyman, David M. (1990) ''Public Finance: A Contemporary Application of Theory to Policy'', 3rd, Dryden Press: Chicago, ILJames, Simon (1998) ''A Dictionary of Taxation'', Edgar Elgar Publishing Limited: Northampton, MA The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cambridge University Press

Cambridge University Press is the university press of the University of Cambridge. Granted letters patent by Henry VIII of England, King Henry VIII in 1534, it is the oldest university press A university press is an academic publishing house specializing in monographs and scholarly journals. Most are nonprofit organizations and an integral component of a large research university. They publish work that has been reviewed by schola ... in the world. It is also the King's Printer. Cambridge University Press is a department of the University of Cambridge and is both an academic and educational publisher. It became part of Cambridge University Press & Assessment, following a merger with Cambridge Assessment in 2021. With a global sales presence, publishing hubs, and offices in more than 40 Country, countries, it publishes over 50,000 titles by authors from over 100 countries. Its publishing includes more than 380 academic journals, monographs, reference works, school and uni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Entitlement

An entitlement is a provision made in accordance with a legal framework of a society. Typically, entitlements are based on concepts of principle ("rights") which are themselves based in concepts of social equality or enfranchisement. In psychology, entitlement mentality is defined as a sense of deservingness or being owed a favor when little or nothing has been done to deserve special treatment. Psychology An inflated sense of what is sometimes called ''psychological entitlement'' – unrealistic, exaggerated, or rigidly held – is especially prominent among narcissists. According to the DSM-5, individuals with narcissistic personality disorder (NPD) are likely to have a "sense of entitlement to special treatment and to obedience from others," typically without commensurate qualities or accomplishments: Similarly, according to Sam Vaknin, the narcissistic personality attempts to protect the vulnerable self by building layers of grandiosity and a huge sense of entitlement. Sim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Princeton University Press

Princeton University Press is an independent publisher with close connections to Princeton University. Its mission is to disseminate scholarship within academia and society at large. The press was founded by Whitney Darrow, with the financial support of Charles Scribner, as a printing press to serve the Princeton community in 1905. Its distinctive building was constructed in 1911 on William Street in Princeton. Its first book was a new 1912 edition of John Witherspoon's ''Lectures on Moral Philosophy.'' History Princeton University Press was founded in 1905 by a recent Princeton graduate, Whitney Darrow, with financial support from another Princetonian, Charles Scribner II. Darrow and Scribner purchased the equipment and assumed the operations of two already existing local publishers, that of the ''Princeton Alumni Weekly'' and the Princeton Press. The new press printed both local newspapers, university documents, ''The Daily Princetonian'', and later added book publishing to it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Insurance Contributions Act Tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court rule ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Center On Budget And Policy Priorities

The Center on Budget and Policy Priorities (CBPP) is a progressive American think tank that analyzes the impact of federal and state government budget policies. A 501(c)(3) nonprofit organization, the Center's stated mission is to "conduct research and analysis to help shape public debates over proposed budget and tax policies and to help ensure that policymakers consider the needs of low-income families and individuals in these debates." CBPP was founded in 1981 by Robert Greenstein, a former political appointee in the Jimmy Carter administration. Greenstein founded the organization, which is based in Washington, D.C., to provide an alternative perspective on the social policy initiatives of the Ronald Reagan administration. Activities Based in Washington, D.C., the Center was founded in 1981 by Robert Greenstein. In 2013, the Center reported revenue of $37.5 million, expenses of $27.3 million, and total year-end assets of $67.7 million. In 1993, the Center was involved in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |