|

Tax Policy Center

The Urban-Brookings Tax Policy Center, typically shortened to the Tax Policy Center (TPC), is a nonpartisan think tank based in Washington D.C. A joint venture of the Urban Institute and the Brookings Institution, it aims to provide independent analyses of current and longer-term tax issues, and to communicate its analyses to the public and to policymakers. TPC combines national specialists in tax, expenditure, budget policy, and microsimulation modeling to concentrate on five overarching areas of tax policy: fair, simple and efficient taxation, social policy in the tax code, business tax reform, long-term implications of tax and budget choices, and state tax issues. History In 2002, tax specialists who had served in the Ronald Reagan, George H. W. Bush, and Bill Clinton administrations established the Tax Policy Center to provide analysis of tax issues. The following year TPC developed a tax simulation model to analyze the federal income tax and proposals to change it. Tha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

WHOIS

WHOIS (pronounced as the phrase "who is") is a query and response protocol that is widely used for querying databases that store the registered users or assignees of an Internet resource, such as a domain name, an IP address block or an autonomous system, but is also used for a wider range of other information. The protocol stores and delivers database content in a human-readable format.RFC 3912, ''WHOIS Protocol Specification'', L. Daigle (September 2004) The current iteration of the WHOIS protocol was drafted by the Internet Society, and is documented in . Whois is also the name of the command-line utility on most UNIX systems used to make WHOIS protocol queries. In addition WHOIS has a sister protocol called ''Referral Whois'' ( RWhois). History Elizabeth Feinler and her team (who had created the Resource Directory for ARPANET) were responsible for creating the first WHOIS directory in the early 1970s. Feinler set up a server in Stanford's Network Information Center (NIC) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Congress

The United States Congress is the legislature of the federal government of the United States. It is bicameral, composed of a lower body, the House of Representatives, and an upper body, the Senate. It meets in the U.S. Capitol in Washington, D.C. Senators and representatives are chosen through direct election, though vacancies in the Senate may be filled by a governor's appointment. Congress has 535 voting members: 100 senators and 435 representatives. The U.S. vice president The vice president of the United States (VPOTUS) is the second-highest officer in the executive branch of the U.S. federal government, after the president of the United States, and ranks first in the presidential line of succession. The vice pr ... has a vote in the Senate only when senators are evenly divided. The House of Representatives has six non-voting members. The sitting of a Congress is for a two-year term, at present, beginning every other January. Elections are held every even-n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Reform In The United States

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but mos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Political And Economic Think Tanks In The United States

Politics (from , ) is the set of activities that are associated with making decisions in groups, or other forms of power relations among individuals, such as the distribution of resources or status. The branch of social science that studies politics and government is referred to as political science. It may be used positively in the context of a "political solution" which is compromising and nonviolent, or descriptively as "the art or science of government", but also often carries a negative connotation.. The concept has been defined in various ways, and different approaches have fundamentally differing views on whether it should be used extensively or limitedly, empirically or normatively, and on whether conflict or co-operation is more essential to it. A variety of methods are deployed in politics, which include promoting one's own political views among people, negotiation with other political subjects, making laws, and exercising internal and external force, including ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nonpartisan Organizations In The United States

Nonpartisanism is a lack of affiliation with, and a lack of bias towards, a political party. While an Oxford English Dictionary definition of ''partisan'' includes adherents of a party, cause, person, etc., in most cases, nonpartisan refers specifically to political party connections rather than being the strict antonym of "partisan". Canada In Canada, the Legislative Assembly of the Northwest Territories and the Legislative Assembly of Nunavut are the only bodies at the provincial/territorial level that are currently nonpartisan; they operate on a consensus government system. The autonomous Nunatsiavut Assembly operates similarly on a sub-provincial level. India In India, the Jaago Re! One Billion Votes campaign was a non-partisan campaign initiated by Tata Tea, and Janaagraha to encourage citizens to vote in the 2009 Indian general election. The campaign was a non-partisan campaign initiated by Anal Saha. Philippines In the Philippines, barangay elections (elections ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Foundation

The Tax Foundation is an American think tank based in Washington, D.C. It was founded in 1937 by a group of businessmen in order to "monitor the tax and spending policies of government agencies". The Tax Foundation collects data and publishes research studies on U.S. tax policies at both the federal and state levels. Its stated mission is to "improve lives through tax policy research and education that leads to greater economic growth and opportunity". The Tax Foundation is organized as a 501(c)(3) tax-exempt non-profit educational and research organization, with three primary areas of research: the Center for Federal Tax Policy, the Center for State Tax Policy, and the Center for Legal Reform. The group is known for its annual reports such as ''Facts & Figures: How Does Your State Compare'', which was first produced in 1941, and its " Tax Freedom Day" brochures, which it has produced since the early 1970s. History The Tax Foundation was organized on December 5, 1937 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institute On Taxation And Economic Policy

The Institute on Taxation and Economic Policy (ITEP) is a non-profit, non-partisan think tank that works on state and federal tax policy issues. ITEP was founded in 1980, and is a 501(c)(3) tax-exempt organization. ITEP describes its mission as striving to "keep policymakers and the public informed of the effects of current and proposed tax policies on tax fairness, government budgets and sound economic policy." Publications ITEP's flagship publication is its "Who Pays?" report. The report was originally released in 1996, and has since been updated in 2003, 2009, 2013, 2015 and 2018. The 2018 report includes tax changes enacted through September 10, 2018, at 2015 income levels. "Who Pays?" analyzes the distribution, by income level, of state and local taxes in all 50 states, as well as in the District of Columbia. Its main finding is that: "the vast majority of state and local tax systems are fundamentally unfair. An overreliance on consumption taxes and the absence of a progres ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Council On State Taxation

The Council on State Taxation (COST) is a state tax organization representing business taxpayers. It has been noted by one prominent tax policy expert as the “most influential nongovernmental organization in the state tax policy arena.” COST is a Non-profit organization, non-profit Industry trade group, trade association based in Washington, D.C. consisting of approximately 550 multistate corporations engaged in interstate and international business. COST was formed in 1969 as the "Committee on State Taxation" by a handful of companies under the sponsorship of the Council of State Chambers of Commerce, an organization with which COST remains associated. In 2000, the organization changed its name to "Council on State Taxation". COST’s objective is to preserve and promote equitable and nondiscriminatory state and local taxation of multijurisdictional business entities. Membership COST membership is exclusive, only multistate businesses that are not engaged in tax advising or c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Citizens For Tax Justice

Citizens for Tax Justice (CTJ) is a Washington, D.C.-based think tank and advocacy group founded in 1979 focusing on tax policies and their impact. CTJ's work focuses primarily on federal tax policy, but also analyzes state and local tax policies. Its stated mission is to "give ordinary people a greater voice in the development of tax laws." CTJ's goals include: "fair taxes for middle and low-income families; requiring the wealthy to pay their fair share; closing corporate tax loopholes; adequately funding important government services; nd promotingtaxation that minimizes distortion of economic markets." CTJ is generally considered a liberal organization, but its research has also been cited by Republican politicians (including President Ronald Reagan) and right-wing tax reform organizations. The organization's 2013 Form 990 Tax Return states its purpose is "to promote social welfare." CTJ is a 501(c4) organization headed by Amy Hanauer. Publications Many of the reports ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Center On Budget And Policy Priorities

The Center on Budget and Policy Priorities (CBPP) is a progressive American think tank that analyzes the impact of federal and state government budget policies. A 501(c)(3) nonprofit organization, the Center's stated mission is to "conduct research and analysis to help shape public debates over proposed budget and tax policies and to help ensure that policymakers consider the needs of low-income families and individuals in these debates." CBPP was founded in 1981 by Robert Greenstein, a former political appointee in the Jimmy Carter administration. Greenstein founded the organization, which is based in Washington, D.C., to provide an alternative perspective on the social policy initiatives of the Ronald Reagan administration. Activities Based in Washington, D.C., the Center was founded in 1981 by Robert Greenstein. In 2013, the Center reported revenue of $37.5 million, expenses of $27.3 million, and total year-end assets of $67.7 million. In 1993, the Center was involved in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

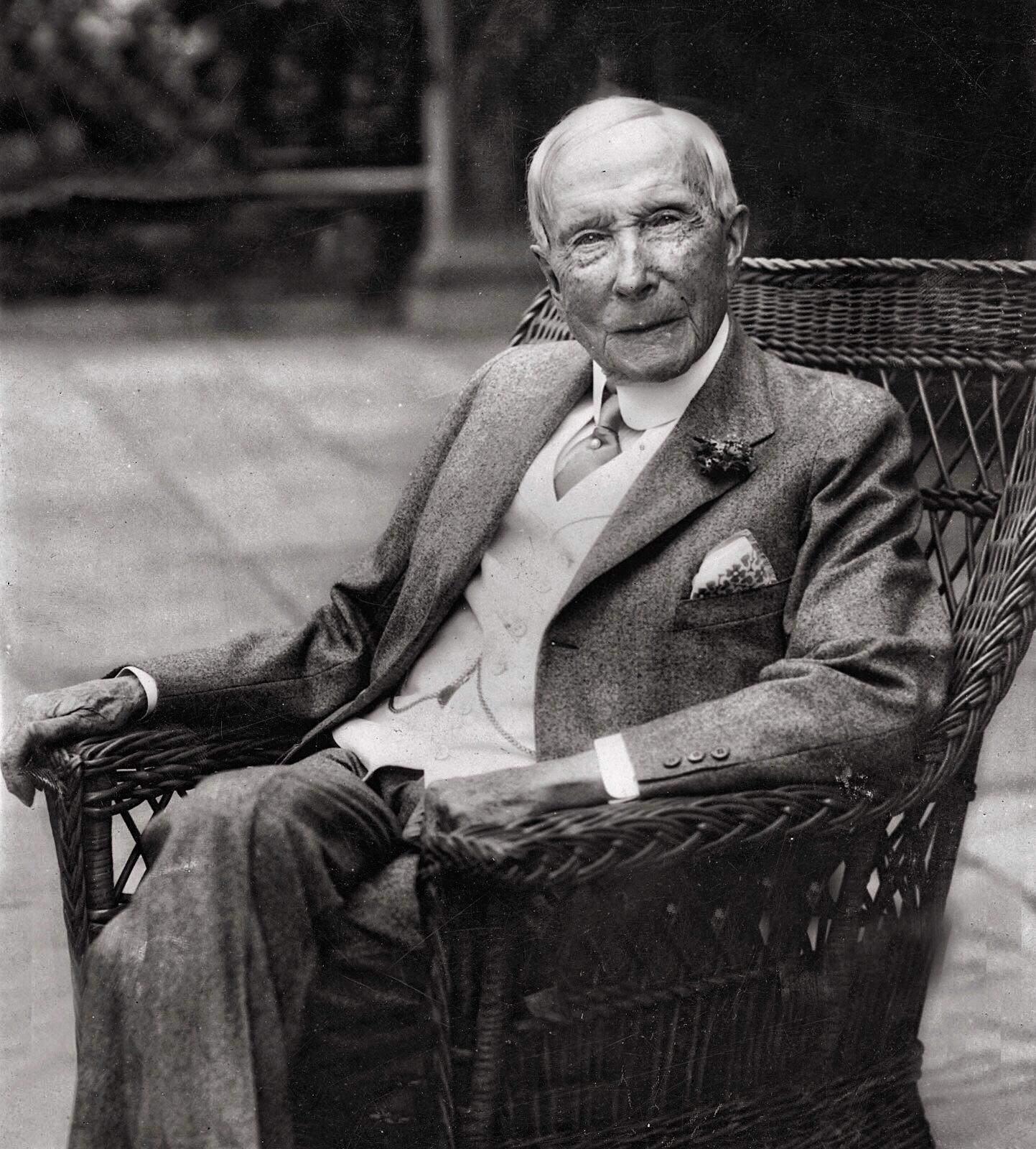

Rockefeller Foundation

The Rockefeller Foundation is an American private foundation and philanthropic medical research and arts funding organization based at 420 Fifth Avenue, New York City. The second-oldest major philanthropic institution in America, after the Carnegie Corporation, the foundation was ranked as the 39th largest U.S. foundation by total giving as of 2015. By the end of 2016, assets were tallied at $4.1 billion (unchanged from 2015), with annual grants of $173 million. According to the OECD, the foundation provided US$103.8 million for development in 2019. The foundation has given more than $14 billion in current dollars. The foundation was started by Standard Oil magnate John D. Rockefeller ("Senior") and son " Junior", and their primary business advisor, Frederick Taylor Gates, on May 14, 1913, when its charter was granted by New York. The foundation has had an international reach since the 1930s and major influence on global non-governmental organizations. The World Health ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bill And Melinda Gates Foundation

The Bill & Melinda Gates Foundation (BMGF), a merging of the William H. Gates Foundation and the Gates Learning Foundation, is an American private foundation founded by Bill Gates and Melinda French Gates. Based in Seattle, Washington, it was launched in 2000 and is reported as of 2020 to be the second largest charitable foundation in the world, holding $49.8 billion in assets. On his 43rd birthday, Bill Gates gave the foundation $1 billion. The primary stated goals of the foundation are to enhance healthcare and reduce extreme poverty across the world, and to expand educational opportunities and access to information technology in the U.S. Key individuals of the foundation include Bill Gates, Melinda French Gates, Warren Buffett, chief executive officer Mark Suzman, and Michael Larson. The BMGF had an endowment of approximately $50 billion . The scale of the foundation and the way it seeks to apply business techniques to giving makes it one of the leaders in venture philant ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |