|

Sharia Investments

Banking or banking activity that complies with Sharia (Islamic law)—known as Islamic banking and finance, or Sharia-compliant finance—has its own products, services and contracts that differ from conventional banking. Some of these include ''Mudharabah'' (profit sharing), ''Wadiah'' (safekeeping), ''Musharakah'' (joint venture), ''Murabahah'' (cost plus finance), ''Ijar'' (leasing), ''Hawala'' (an international fund transfer system), ''Takaful'' (Islamic insurance), and ''Sukuk'' (Islamic bonds). Sharia prohibits ''riba'', or usury, defined as interest paid on all loans of money (although some Muslims dispute whether there is a consensus that interest is equivalent to ''riba''). Farooq, ''Riba-Interest Equation and Islam'', 2005: pp. 3–6 Khan, ''What Is Wrong with Islamic Economics?'', 2013: pp. 216–226 Investment in businesses that provide goods or services considered contrary to Islamic principles (e.g. pork or alcohol) is also ''haraam'' ("sinful and prohibited"). By ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

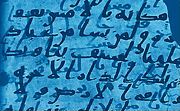

Shariah

Sharia (; ar, شريعة, sharīʿa ) is a body of religious law that forms a part of the Islamic tradition. It is derived from the religious precepts of Islam and is based on the sacred scriptures of Islam, particularly the Quran and the Hadith. In Arabic, the term ''sharīʿah'' refers to God's immutable divine law and is contrasted with ''fiqh'', which refers to its human scholarly interpretations. In the historical course, fiqh sects have emerged that reflect the preferences of certain societies and state administrations on behalf of people who are interested in the theoretical (method) and practical application (Ahkam / fatwa) studies of laws and rules, but sharia has never been a valid legal system on its own. It has been used together with " customary (Urf) law" since Omar or the Umayyads. It may also be wrong to think that the Sharia, as a religious argument or belief, is entirely within or related to Allah's commands and prohibitions. Several non-graded crimes are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Socially Responsible Investing

Socially responsible investing (SRI), social investment, sustainable socially conscious, "green" or ethical investing, is any investment strategy which seeks to consider both financial return and social/environmental good to bring about social change regarded as positive by proponents. Socially responsible investments often constitute a small percentage of total funds invested by corporations and are riddled with obstacles. Recently, it has also become known as " sustainable investing" or "responsible investing". There is also a subset of SRI known as "impact investing", devoted to the conscious creation of social impact through investment. In general, socially responsible investors encourage corporate practices that they believe promote environmental stewardship, consumer protection, human rights, and racial or gender diversity. Some SRIs avoid investing in businesses perceived to have negative social effects such as alcohol, tobacco, fast food, gambling, pornography, weapo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Saleh Abdullah Kamel

Saleh Abdullah Kamel (1941 – 18 May 2020) ( ar, صالح عبد الله كامل ''Ṣaleḥ 'Abdullāh Kamel'') was a Saudi billionaire businessman. He had a net worth estimated at US$2.3 billion, as of March 2017. He was the chairman and founder of the Dallah Al-Baraka, Dallah al Baraka Group (DBHC), one of the Middle East's largest conglomerates. He was also the chairman of the Islamic Development Bank, General Council for Islamic Banks and the Jeddah Chamber of Commerce. He was arrested by the Saudi authorities on 4 November 2017, among other businessmen such as Al-Waleed bin Talal. Early life Kamel was born in Mecca in 1941. He was educated in Mecca, Taif, and Jeddah. He earned a bachelor’s degree in commerce from the University of Riyadh in 1963. Wealth As of March 2017, ''Forbes'' estimated his net worth at US$2.3 billion. In 2018, he was removed from its list of billionaires, as it was no longer clear what assets he owned. Saleh Kamel was the founder and chairman o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gharar

''Gharar'' ( ar, غرر) literally means uncertainty, hazard, chance or risk. It is a negative element in ''mu'amalat'' ''fiqh'' (transactional Islamic jurisprudence), like ''riba'' (usury) and '' maysir'' (gambling). One Islamic dictionary (''A Concise Dictionary of Islamic Terms'') describes it as "the sale of what is not present" — such as fish not yet caught, crops not yet harvested. Similarly, author Muhammad Ayub says that "in the legal terminology of jurists", ''gharar'' is "the sale of a thing which is not present at hand, or the sale of a thing whose ''aqibah'' (consequence) is not known, or a sale involving hazard in which one does not know whether it will come to be or not". Definitions, fiqh According to Sami Al-Suwailem, "researchers in Islamic finance" do not agree on the "precise meaning" of gharar, although there is not necessarily great difference among the Islamic schools of jurisprudence (madhab) in the term's definition. The ''Hanafi'' legal school defines ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maisir

In Islam, gambling ( ar, ميسر, translit=maisîr, maysir, maisira or ''qimâr'') is absolutely forbidden ( ar, harām, script=Latn). ''Maisir'' is totally prohibited by Islamic law (''shari'a'') on the grounds that "the agreement between participants is based on immoral inducement provided by entirely wishful hopes in the participants' minds that they will gain by mere chance, with no consideration for the possibility of loss". Definitions Both ''qimar'' and ''maisir'' refer to games of chance, but ''qimar'' is a kind (or subset) of ''maisir''. Author Muhammad Ayub defines ''maisir'' as "wishing something valuable with ease and without paying an equivalent compensation for it or without working for it, or without undertaking any liability against it by way of a game of chance", Another source, Faleel Jamaldeen, defines it as "the acquisition of wealth by chance (not by effort)". Ayub defines ''qimar'' as "also mean ngreceipt of money, benefit or usufruct at the cost of othe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Murabahah

''Murabaḥah'', ''murabaḥa'', or ''murâbaḥah'' ( ar, مرابحة, derived from ''ribh'' ar, ربح, meaning profit) was originally a term of ''fiqh'' (Islamic jurisprudence) for a sales contract where the buyer and seller agree on the markup (profit) or "cost-plus" price for the item(s) being sold. In recent decades it has become a term for a very common form of Islamic (i.e., "shariah compliant") financing, where the price is marked up in exchange for allowing the buyer to pay over time—for example with monthly payments (a contract with deferred payment being known as ''bai-muajjal''). ''Murabaha'' financing is similar to a rent-to-own arrangement in the non-Muslim world, with the intermediary (e.g., the lending bank) retaining ownership of the item being sold until the loan is paid in full. There are also Islamic investment funds and ''sukuk'' (Islamic bonds) that use ''murabahah'' contracts. Jamaldeen, ''Islamic Finance For Dummies'', 2012:188-9, 220-1 The purpose o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Dietary Laws

Islamic dietary laws are dietary laws that Muslims follow. Islamic jurisprudence specifies which foods are '' '' (, "lawful") and which are '' '' (, "unlawful"). The dietary laws are found in the Quran, the holy book of Islam, as well as in collections of traditions attributed to Islamic prophet Muhammad. Herbivores or cud-chewing animals like cattle, deer, sheep, goats, and antelope are some examples of animals that are halal only if they are treated like sentient beings and slaughtered painlessly while reciting the Bismillah and Takbir. If the animal is treated poorly, or tortured while being slaughtered, the meat is haram. Forbidden food substances include alcohol, pork, carrion, the meat of carnivores and animals that died due to illness, injury, stunning, poisoning, or slaughtering not in the name of God. Regulations of food Halal (permissible, lawful) Quranic verses which have information regarding halal foods include: Q2:173, Q5:5, and Q6:118–119, 121. Permissible ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_001.jpg)