|

Self-invested Personal Pension

A self-invested personal pension (SIPP) is the name given to the type of UK government-approved personal pension scheme which allows individuals to make their own investment decisions from the full range of investments approved by HM Revenue and Customs (HMRC). SIPPs are " tax wrappers", allowing tax rebates on contributions in exchange for limits on accessibility. The HMRC rules allow for a greater range of investments to be held than personal pension schemes, notably equities and property. Rules for contributions, benefit withdrawal etc. are the same as for other personal pension schemes. Another subset of this type of pension is the stakeholder pension scheme. History The rules and conditions for a broader range of investments were originally set out in ''Joint Office Memorandum 101'' issued by the UK's Inland Revenue in 1989. However, the first true SIPP was taken out in March 1990. James Hay Partnership, the parent company of then Personal Pension Management, offered the fir ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Government

ga, Rialtas a Shoilse gd, Riaghaltas a Mhòrachd , image = HM Government logo.svg , image_size = 220px , image2 = Royal Coat of Arms of the United Kingdom (HM Government).svg , image_size2 = 180px , caption = Royal Arms , date_established = , state = United Kingdom , address = 10 Downing Street, London , leader_title = Prime Minister (Rishi Sunak) , appointed = Monarch of the United Kingdom (Charles III) , budget = 882 billion , main_organ = Cabinet of the United Kingdom , ministries = 23 ministerial departments, 20 non-ministerial departments , responsible = Parliament of the United Kingdom , url = The Government of the United Kingdom (commonly referred to as British Government or UK Government), officially His Majesty's Government (abbreviated to HM Government), is the central executive authority of the United Kingdom of Great Britain and Northern Ireland. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been described as a '' sui generis'' political entity (without precedent or comparison) combining the characteristics of both a federation and a confederation. Containing 5.8per cent of the world population in 2020, the EU generated a nominal gross domestic product (GDP) of around trillion in 2021, constituting approximately 18per cent of global nominal GDP. Additionally, all EU states but Bulgaria have a very high Human Development Index according to the United Nations Development Programme. Its cornerstone, the Customs Union, paved the way to establishing an internal single market based on standardised legal framework and legislation that applies in all member states in those matters, and only those matters, where the states have agreed to act ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1990 Introductions

Year 199 ( CXCIX) was a common year starting on Monday (link will display the full calendar) of the Julian calendar. At the time, it was sometimes known as year 952 '' Ab urbe condita''. The denomination 199 for this year has been used since the early medieval period, when the Anno Domini calendar era became the prevalent method in Europe for naming years. Events By place Roman Empire * Mesopotamia is partitioned into two Roman provinces divided by the Euphrates, Mesopotamia and Osroene. * Emperor Septimius Severus lays siege to the city-state Hatra in Central-Mesopotamia, but fails to capture the city despite breaching the walls. * Two new legions, I Parthica and III Parthica, are formed as a permanent garrison. China * Battle of Yijing: Chinese warlord Yuan Shao defeats Gongsun Zan. Korea * Geodeung succeeds Suro of Geumgwan Gaya, as king of the Korean kingdom of Gaya (traditional date). By topic Religion * Pope Zephyrinus succeeds Pope Victor I, as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pensions In The United Kingdom

Pensions in the United Kingdom, whereby United Kingdom tax payers have some of their wages deducted to save for retirement, can be categorised into three major divisions - state, occupational and personal pensions. The state pension is based on years worked, with a 35-year work history yielding a pension of £185.15 per week. It is linked to wage and price increases. Most employees and the self-employed are also enrolled in employer-subsidised and tax-efficient occupational and personal pensions which supplement this basic state-provided pension. Historically, the "Old Age Pension" was introduced in 1909 in the United Kingdom (which included all of Ireland at that time). Following the passage of the Old-Age Pensions Act 1908 a pension of 5 shillings per week (25p, equivalent, using the Consumer Price Index, to £ in present-day terms), or 7s.6d per week (equivalent to £/week today) for a married couple, was payable to persons with an income below £21 per annum (equivalent to � ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical effec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Individual Savings Account

An individual savings account (ISA; ) is a class of retail investment arrangement available to residents of the United Kingdom. First introduced in 1999, the accounts have favourable tax status. Payments into the account are made from after-tax income, then the account is exempt from income tax and capital gains tax on the investment returns, and no tax is payable on money withdrawn from the scheme. Cash and a broad range of investments can be held within the arrangement, and there is no restriction on when or how much money can be withdrawn. Since 2017, there have been four types of account: cash ISA, stocks & shares ISA, innovative finance ISA (IFISA) and lifetime ISA (LISA). Each taxpayer has an annual investment limit (£20,000 since ) which can be split among the four types as desired. Additionally, children under 18 may hold a junior ISA, with a different annual limit. Until the lifetime ISA was introduced in 2017, ISAs were not a specific retirement investment, but any type ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

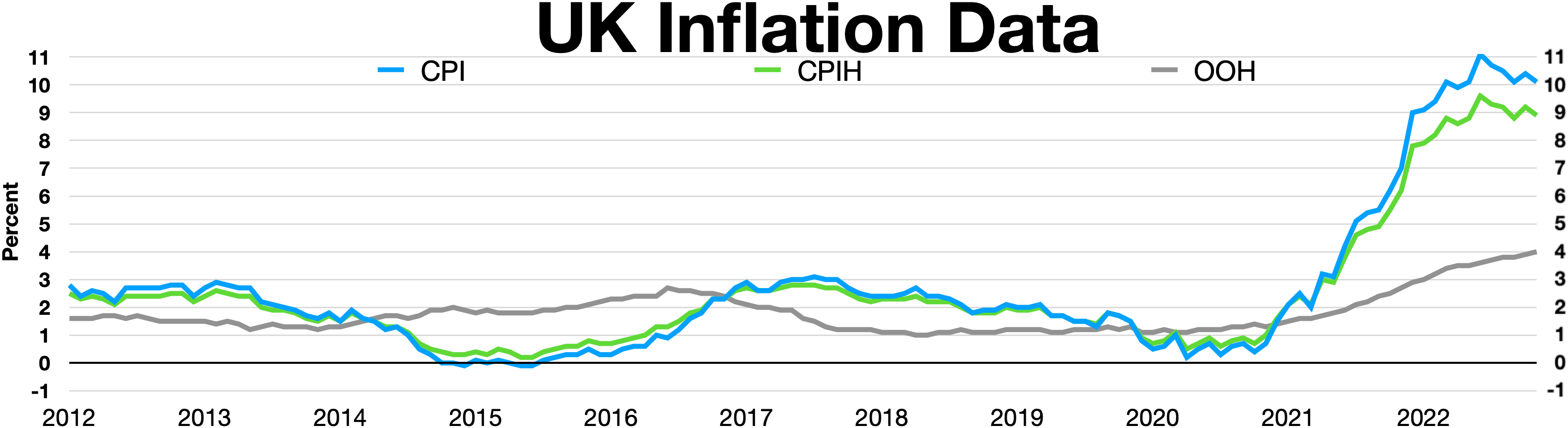

Consumer Price Index (United Kingdom)

The Consumer Price Index (CPI) is the official measure of inflation of consumer prices of the United Kingdom. It is also called the Harmonised Index of Consumer Prices (HICP). History The traditional measure of inflation in the UK for many years was the Retail Prices Index (RPI), which was first calculated in the early 20th century to evaluate the extent to which workers were affected by price changes during the First World War. The main index was described as the Interim Index of Retail Prices from 1947 to 1955. In January 1956, it was rebased and renamed the Index of Retail Prices. In January 1962 this was replaced by the General Index of Retail Prices, which was again rebased at that time. A further rebasing occurred in January 1987, subsequent to the issue of the first index-linked gilts. RPIX An explicit inflation target was first set in October 1992 by Chancellor of the Exchequer Norman Lamont, following the UK's departure from the Exchange Rate Mechanism. Initially, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Actuary's Department

, type = Non-ministerial government department , logo = Actuary.svg , logo_width = 150px , logo_caption = , picture = , picture_width = , picture_caption = , formed = , dissolved = , superseding = , jurisdiction = United Kingdom , headquarters = Finlaison House, 15-17 Furnival Street, London, EC4A 1AB , region_code = GB , coordinates = , employees = c. 220 , budget = £0 (2020-2021) , minister1_name = , minister1_pfo = , chief1_name = Martin Clarke , chief1_position = Government Actuary , chief2_name = , chief2_position = , chief3_name = , chief3_position = , chief4_name = , chief4_position = , chief5_name = , chief5_position = , agency_type = , chief6_name = , chief6_position = , chief7_name = , chief7_position = , chief8_name = , chief8_position = , chief9_name = , chief9_position = , p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Life Annuity

A life annuity is an annuity, or series of payments at fixed intervals, paid while the purchaser (or annuitant) is alive. The majority of life annuities are insurance products sold or issued by life insurance companies however substantial case law indicates that annuity products are not necessarily insurance products. Annuities can be purchased to provide an income during retirement, or originate from a ''structured settlement'' of a personal injury lawsuit. Life annuities may be sold in exchange for the immediate payment of a lump sum (single-payment annuity) or a series of regular payments (flexible payment annuity), prior to the onset of the annuity. The payment stream from the issuer to the annuitant has an unknown duration based principally upon the date of death of the annuitant. At this point the contract will terminate and the remainder of the fund accumulated is forfeited unless there are other annuitants or beneficiaries in the contract. Thus a life annuity is a form o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Drawdown

Income drawdown is a method withdrawing benefits from a UK Registered Pension Scheme. In theory, it is available under any money purchase pension scheme. However, it is, in practice, rarely offered by occupational pensions and is therefore generally only available to those who own, or transfer to, a personal pension. There are a number of different types of draw-down structures: *Capped income drawdown - these permit the policy holder to withdraw an annual income between nothing and a maximum based on the initial fund value, their age at the time, and the current rates set by the UK Government Actuary's Department. The maximum is revised every three years until the 75th birthday and thereafter at annual intervals. The individual can choose to buy an annuity at any time. *Flexible income drawdown - these allowed anyone who could prove they had enough qualifying secure pension earnings, to have unlimited access to their other pension fund. For flexible drawdown declarations made b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gains Tax

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, Bond (finance), bonds, precious metals, real estate, and property. Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. Countries that do not impose a capital gains tax include Bahrain, Barbados, Belize, Cayman Islands, Isle of Man, Jamaica, New Zealand, Sri Lanka, Singapore, and others. In some countries, such as New Zealand and Singapore, professional traders and those who trade frequently are taxed on such profits as a business income. In Sweden, the Investment Savings Account (ISK – ''Investeringssparkonto'') was introduced in 2012 in response to a decision by Parliament to stimulate saving in funds and equities. There is no tax on capital gains in ISKs; instead, the saver pays an annual standard low rate of tax. Fund savers nowadays mainly ch ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (United Kingdom)

In the United Kingdom, a tax return is a document that must be filed with HM Revenue & Customs declaring liability for taxation. Different bodies must file different returns with respect to various forms of taxation. The main returns currently in use are: *SA100 for individuals paying income tax *SA800 for partnerships *SA900 for trusts and estates of deceased persons *CT600 for companies paying corporation tax *VAT100 for value added tax Income tax self-assessment Most employees paying tax under the PAYE system are not required to file a tax return, because the PAYE system operates to withhold the correct amount of tax from their wages or salaries. However, some tax payers, including employees, may have income that has not been taxed at source and needs to be declared to HMRC, usually by submitting a self assessment tax return. Legally, a tax payer is obliged to submit a tax return when HMRC request one by sending a notice to file a tax return, either because the tax payer has ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |