|

Self-Invested Personal Pension

A self-invested personal pension (SIPP) is the name given to the type of UK government-registered personal pension scheme which allows individuals to make their own investment decisions from a wide range of investments by HM Revenue and Customs (HMRC). SIPPs are "tax wrappers", allowing tax rebates on contributions in exchange for limits on accessibility. SIPPs are tax-efficient investment vehicles as they allow investors to receive income tax relief on their contributions at their highest Tax_rate#Marginal, marginal tax rate. Any contributions from employers will reduce their corporate tax liability. The investments can grow tax-free, a lump sum can be taken by the investor tax-free on retirement, and SIPPs attract better inheritance tax treatment if the beneficiary dies before the age of 75. The HMRC rules allow for a greater range of investments to be held than personal pension schemes, notably equities and property. Rules for contributions, benefit withdrawal etc. are the sam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Government

His Majesty's Government, abbreviated to HM Government or otherwise UK Government, is the central government, central executive authority of the United Kingdom of Great Britain and Northern Ireland.Overview of the UK system of government : Directgov – Government, citizens and rights Archived direct.gov.uk webpage. Retrieved on 29 August 2014. The government is led by the Prime Minister of the United Kingdom, prime minister (Keir Starmer since 5 July 2024) who appoints all the other British Government frontbench, ministers. The country has had a Labour Party (UK), Labour government since 2024 United Kingdom general election, 2024. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Conduct Authority

The Financial Conduct Authority (FCA) is a financial regulatory body in the United Kingdom. It operates independently of the UK Government and is financed by charging fees to members of the financial services industry. The FCA regulates financial firms providing services to consumers, and maintains the integrity of the financial markets in the United Kingdom. It focuses on the regulation of conduct by both retail and wholesale financial services firms. Like its predecessor the FSA, the FCA is structured as a company limited by guarantee.Goldsworth, J., ''Lexicon of Trust & Foundation Practice'' ( Wendens Ambo: Mulberry House Press, 2016)p. 140 The FCA works alongside the Prudential Regulation Authority and the Financial Policy Committee to set regulatory requirements for the financial sector. The FCA is responsible for the conduct of around 58,000 businesses which employ 2.2 million people and contribute around £65.6 billion in annual tax revenue to the economy in the Unite ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1990 Introductions

Year 199 ( CXCIX) was a common year starting on Monday of the Julian calendar. At the time, it was sometimes known as year 952 ''Ab urbe condita''. The denomination 199 for this year has been used since the early medieval period, when the Anno Domini calendar era became the prevalent method in Europe for naming years. Events By place Roman Empire * Mesopotamia is partitioned into two Roman provinces divided by the Euphrates, Mesopotamia and Osroene. * Emperor Septimius Severus lays siege to the city-state Hatra in Central-Mesopotamia, but fails to capture the city despite breaching the walls. * Two new legions, I Parthica and III Parthica, are formed as a permanent garrison. China * Battle of Yijing: Chinese warlord Yuan Shao defeats Gongsun Zan. Korea * Geodeung succeeds Suro of Geumgwan Gaya, as king of the Korean kingdom of Gaya (traditional date). By topic Religion * Pope Zephyrinus succeeds Pope Victor I, as the 15th pope. Births Valerian Ro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pensions In The United Kingdom

Pensions in the United Kingdom, whereby United Kingdom tax payers have some of their wages deducted to save for retirement, can be categorised into three major divisions – state, occupational and personal pensions. The state pension is based on years worked, with a full 35-year work history yielding a pension of £203.85 per week. It is linked to the Consumer Prices Index (CPI) rate. Most employees are also enrolled by their employers in either defined contribution or defined benefit pensions which supplement this basic state-provided pension. It's also possible to have a Self-invested personal pension (SIPP). Historically, the "Old Age Pension" was introduced in 1909 in the United Kingdom (which included all of Ireland at that time). Following the passage of the ''Old Age Pensions Act 1908'' a pension of 5/— per week (£, equivalent, using the Consumer Price Index, to £ in ), or 7/6 per week (£, equivalent to £/week in ) for a married couple, was payable to persons with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broader viewpoint, an investment can be defined as "to tailor the pattern of expenditure and receipt of resources to optimise the desirable patterns of these flows". When expenditures and receipts are defined in terms of money, then the net monetary receipt in a time period is termed cash flow, while money received in a series of several time periods is termed cash flow stream. In finance, the purpose of investing is to generate a Return (finance), return on the invested asset. The return may consist of a capital gain (profit) or loss, realised if the investment is sold, unrealised capital appreciation (or depreciation) if yet unsold. It may also consist of periodic income such as dividends, interest, or rental income. The return may also inclu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Actuary's Department

The Government Actuary's Department (GAD) provides actuarial solutions including risk analysis, modelling and advice to support the UK public sector. It is a department of the Government of the United Kingdom. History In 1912 the Government appointed a chief actuary to the National Health Insurance Joint Committee, following the Old Age Pensions Act 1908 and the National Insurance Act 1911 The National Insurance Act 1911 (1 & 2 Geo. 5. c. 55) created National Insurance, originally a system of health insurance for industrial workers in Great Britain based on contributions from employers, the government, and the workers themselves. .... As the role of the Chief Actuary expanded, the post of Government Actuary was created in 1917. The Government Actuary's Department was formed 2 years later. The role of GAD within government expanded significantly in the 1940s and 1950s, coinciding with an expansion of the state's role in pensions, social security and health care. By the 19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Life Annuity

A life annuity is an annuity, or series of payments at fixed intervals, paid while the purchaser (or annuitant) is alive. The majority of life annuities are insurance products sold or issued by life insurance companies. However, substantial case law indicates that annuity products are not necessarily insurance products. Annuities can be purchased to provide an income during retirement, or originate from a ''structured settlement'' of a personal injury lawsuit. Life annuities may be sold in exchange for the immediate payment of a lump sum (single-payment annuity) or a series of regular payments (flexible payment annuity), prior to the onset of the annuity. The payment stream from the issuer to the annuitant has an unknown duration based principally upon the date of death of the annuitant. At this point the contract will terminate and the remainder of the fund accumulated is forfeited unless there are other annuitants or beneficiaries in the contract. Thus a life annuity is a for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Drawdown

Income drawdown is a method withdrawing benefits from a UK Registered Pension Scheme. In theory, it is available under any money purchase pension scheme. However, it is, in practice, rarely offered by occupational pensions and is therefore generally only available to those who own, or transfer to, a personal pension. There are a number of different types of draw-down structures: *Capped income drawdown - these permit the policy holder to withdraw an annual income between nothing and a maximum based on the initial fund value, their age at the time, and the current rates set by the UK Government Actuary's Department. The maximum is revised every three years until the 75th birthday and thereafter at annual intervals. The individual can choose to buy an annuity at any time. *Flexible income drawdown - these allowed anyone who could prove they had enough qualifying secure pension earnings, to have unlimited access to their other pension fund. For flexible drawdown declarations made b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gains Tax

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property. In South Africa, capital gains tax applies to the disposal of assets by individuals, companies, and trusts, with inclusion rates differing by entity type and with special provisions for primary residences and offshore assets. Not all countries impose a capital gains tax, and most have different rates of taxation for individuals compared to corporations. Countries that do not impose a capital gains tax include Bahrain, Barbados, Belize, the Cayman Islands, the Isle of Man, Jamaica, New Zealand, Sri Lanka, Singapore, and others. In some countries, such as New Zealand and Singapore, professional traders and those who trade frequently are taxed on such profits as a business income. In Sweden, a so-called investment savings account (ISK – ''investeringssparkonto'') wa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (United Kingdom)

In the United Kingdom, a tax return is a document that must be filed with HM Revenue & Customs declaring liability for taxation. Different bodies must file different returns with respect to various forms of taxation. The main returns currently in use are: *SA100 for individuals paying income tax *SA800 for partnerships *SA900 for trusts and estates of deceased persons *CT600 for companies paying corporation tax *VAT100 for value added tax Income tax self-assessment Most employees paying tax under the PAYE system are not required to file a tax return, because the PAYE system operates to withhold the correct amount of tax from their wages or salaries. However, some taxpayers, including employees, may have income that has not been taxed at source and needs to be declared to HMRC, usually by submitting a self assessment tax return. Legally, a tax payer is obliged to submit a tax return when HMRC request one by sending a notice to file a tax return, either because the tax payer ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

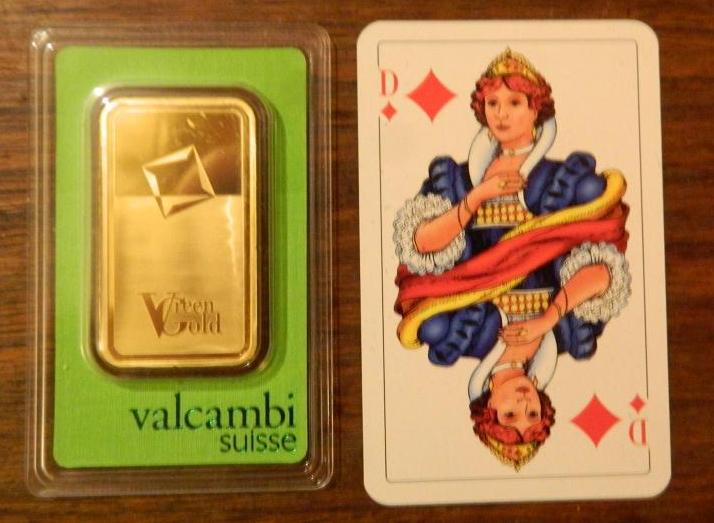

Gold As An Investment

Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the use of futures contracts and derivatives. The gold market is subject to speculation and volatility as are other markets. Compared to other precious metals used for investment, gold has been the most effective safe haven across a number of countries. Gold price Gold has been used throughout history as money and has been a relative standard for currency equivalents specific to economic regions or countries, until recent times. Many European countries implemented gold standards in the latter part of the 19th century until these were temporarily suspended in the financial crises involving World War I. After World War II, the Bretton Woods system pegged the United States dollar to gold at a rate of US$35 per troy ounce. The system existed until the 1971 Nixon shock, when the US unilaterally suspended the direct convertib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |