|

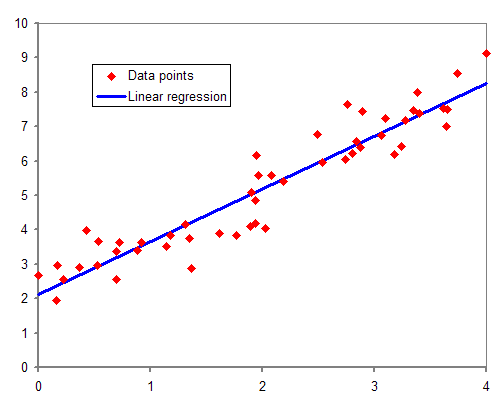

Security Characteristic Line

Security characteristic line (SCL) is a regression line, plotting performance of a particular security or portfolio against that of the market portfolio at every point in time. The SCL is plotted on a graph where the Y-axis is the excess return on a security over the risk-free return and the X-axis is the excess return of the market in general. The slope of the SCL is the security's beta, and the intercept is its alpha. Formula :\mathrm : R_ - R_ = \alpha_i + \beta_i\, ( R_ - R_ ) + \epsilon_ where: :''α''''i'' is called the asset's alpha (abnormal return) :''βi''(''R''''M'',''t'' – ''Rf'') is a nondiversifiable or systematic risk :''ε''''i'',''t'' is the non-systematic or diversifiable, non-market or idiosyncratic risk :''R''''M'',''t'' is the return to market portfolio :''Rf'' is a risk-free rate See also * Security market line * Capital allocation line * Capital market line * Modern portfolio theory Modern portfolio theory (MPT), or mean-variance analysis, is a mat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regression Analysis

In statistical modeling, regression analysis is a set of statistical processes for estimating the relationships between a dependent variable (often called the 'outcome' or 'response' variable, or a 'label' in machine learning parlance) and one or more independent variables (often called 'predictors', 'covariates', 'explanatory variables' or 'features'). The most common form of regression analysis is linear regression, in which one finds the line (or a more complex linear combination) that most closely fits the data according to a specific mathematical criterion. For example, the method of ordinary least squares computes the unique line (or hyperplane) that minimizes the sum of squared differences between the true data and that line (or hyperplane). For specific mathematical reasons (see linear regression), this allows the researcher to estimate the conditional expectation (or population average value) of the dependent variable when the independent variables take on a given ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Portfolio

Market portfolio is a portfolio consisting of a weighted sum of every asset in the market, with weights in the proportions that they exist in the market, with the necessary assumption that these assets are infinitely divisible. Richard Roll's critique states that this is only a theoretical concept, as to create a market portfolio for investment purposes in practice would necessarily include every single possible available asset, including real estate, precious metals, stamp collections, jewelry, and anything with any worth, as the theoretical market being referred to would be the world market. There is some question of whether what is used for the market portfolio really matters. Some authors say that it does not make a big difference; you can use any representative index and get similar results. Roll gave an example where different indexes produce much different results, and that by choosing the index you can get any ranking you want. Brown and Brown (1987) examine this, using ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk-free Interest Rate

The risk-free rate of return, usually shortened to the risk-free rate, is the rate of return of a hypothetical investment with scheduled payments over a fixed period of time that is assumed to meet all payment obligations. Since the risk-free rate can be obtained with no risk, any other investment having some risk will have to have a higher rate of return in order to induce any investors to hold it. In practice, to infer the risk-free interest rate in a particular currency, market participants often choose the yield to maturity on a risk-free bond issued by a government of the same currency whose risks of default are so low as to be negligible. For example, the rate of return on T-bills is sometimes seen as the risk-free rate of return in US dollars. Theoretical measurement As stated by Malcolm Kemp in chapter five of his book ''Market Consistency: Model Calibration in Imperfect Markets'', the risk-free rate means different things to different people and there is no consensus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beta (finance)

In finance, the beta (β or market beta or beta coefficient) is a measure of how an individual asset moves (on average) when the overall stock market increases or decreases. Thus, beta is a useful measure of the contribution of an individual asset to the risk of the market portfolio when it is added in small quantity. Thus, beta is referred to as an asset's non-diversifiable risk, its systematic risk, market risk, or hedge ratio. Beta is ''not'' a measure of idiosyncratic risk. Interpretation of values By definition, the value-weighted average of all market-betas of all investable assets with respect to the value-weighted market index is 1. If an asset has a beta above (below) 1, it indicates that its return moves more (less) than 1-to-1 with the return of the market-portfolio, on average. In practice, few stocks have negative betas (tending to go up when the market goes down). Most stocks have betas between 0 and 3. Treasury bills (like most fixed income instrumen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alpha (finance)

Alpha is a measure of the active return on an investment, the performance of that investment compared with a suitable market index. An alpha of 1% means the investment's return on investment over a selected period of time was 1% better than the market during that same period; a negative alpha means the investment underperformed the market. Alpha, along with beta, is one of two key coefficients in the capital asset pricing model used in modern portfolio theory and is closely related to other important quantities such as standard deviation, R-squared and the Sharpe ratio. In modern financial markets, where index funds are widely available for purchase, alpha is commonly used to judge the performance of mutual funds and similar investments. As these funds include various fees normally expressed in percent terms, the fund has to maintain an alpha greater than its fees in order to provide positive gains compared with an index fund. Historically, the vast majority of traditional fu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security Market Line

Security market line (SML) is the representation of the capital asset pricing model. It displays the expected rate of return of an individual security as a function of systematic, non-diversifiable risk. The risk of an individual risky security reflects the volatility of the return from security rather than the return of the market portfolio. The risk in these individual risky securities reflects the systematic risk. Formula The Y-intercept of the SML is equal to the risk-free interest rate. The slope of the SML is equal to the market risk premium and reflects the risk return tradeoff at a given time: :\mathrm : E(R_i) = R_f + \beta_ (R_M) - R_f, where: : is an expected return on security : is an expected return on market portfolio :''β'' is a nondiversifiable or systematic risk : is a market rate of return : is a risk-free rate When used in portfolio management, the SML represents the investment's opportunity cost (investing in a combination of the market portfolio and the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

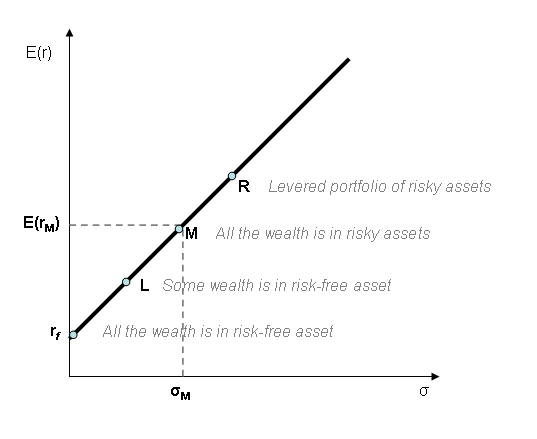

Capital Allocation Line

Capital allocation line (CAL) is a graph created by investors to measure the risk of risky and risk-free assets. The graph displays the return to be made by taking on a certain level of risk. Its slope is known as the "reward-to-variability ratio". Formula The capital allocation line is a straight line that has the following equation: :\mathrm : E(r_) = r_F + \sigma_C \frac In this formula ''P'' is the risky portfolio, ''F'' is riskless portfolio, and ''C'' is a combination of portfolios ''P'' and ''F''. The slope of the capital allocation line is equal to the incremental return of the portfolio to the incremental increase of risk. Hence, the slope of the capital allocation line is called the reward-to-variability ratio because the expected return increases continually with the increase of risk as measured by the standard deviation. Derivation If investors can purchase a risk free asset with some return ''rF'', then all correctly priced risky assets or portfolios will have e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Market Line

Capital market line (CML) is the tangent line drawn from the point of the risk-free asset to the feasible region for risky assets. The tangency point M represents the market portfolio, so named since all rational investors (minimum variance criterion) should hold their risky assets in the same proportions as their weights in the market portfolio. Formula :\mathrm : \sigma_p \mapsto R_f +\sigma_p \cdot\frac The CML results from the combination of the market portfolio and the risk-free asset (the point L). All points along the CML have superior risk-return profiles to any portfolio on the efficient frontier, with the exception of the Market Portfolio, the point on the efficient frontier to which the CML is the tangent. From a CML perspective, the portfolio M is composed entirely of the risky asset, the market, and has no holding of the risk free asset, i.e., money is neither invested in, nor borrowed from the money market account. Points to the left of and above the CML are infeasib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Modern Portfolio Theory

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of diversification in investing, the idea that owning different kinds of financial assets is less risky than owning only one type. Its key insight is that an asset's risk and return should not be assessed by itself, but by how it contributes to a portfolio's overall risk and return. It uses the variance of asset prices as a proxy for risk. Economist Harry Markowitz introduced MPT in a 1952 essay, for which he was later awarded a Nobel Memorial Prize in Economic Sciences; see Markowitz model. Mathematical model Risk and expected return MPT assumes that investors are risk averse, meaning that given two portfolios that offer the same expected return, investors will prefer the less risky one. Thus, an investor will take on increased risk only if compen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |