|

Protected Trust Deed

A protected trust deed, overseen by the Accountant in Bankruptcy, is a voluntary but formal arrangement that is used by Scottish residents where a debtor (who can be a natural person or partnership) grants a ''trust deed'' in favour of the trustee which transfers their estate to the trustee for the benefit of creditors. Any person wanting to make an application for a protected trust deed must have been a resident of Scotland for at least six months prior to making the application. This can be a way for people to deal with debt problems by protecting the debtor from the legal enforcement of debts which are included in the trust deed, but only once it has become protected. It will not reverse any action that has been taken prior to the trust deed, such as earning or bank arrestments, although the trustee may negotiate the lifting of any arrestment. Many people who enter trust deeds are able to keep their homes, but where there is equity, that equity will normally have to be reali ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accountant In Bankruptcy

The Accountant in Bankruptcy (AiB) is the Scottish government agency responsible for administering the process of personal bankruptcy and corporate insolvency, administering the Debt Arrangement Scheme (DAS), and implementing, monitoring and reviewing government policy in these and related areas, for example protected trust deeds and diligence. It reports to the Scottish Government's Minister for Business, Fair Work and Skills, who is Jamie Hepburn . The agency is based in Pennyburn Road, Kilwinning, Ayrshire. See also * Court of Session * Diligence (Scots law) * Reconstruction (law) * Sequestration (law) * Scheme of arrangement * Institute of Chartered Accountants of Scotland * Insolvency Practitioners Association * Debtors (Scotland) Act 1838 The Debtors (Scotland) Act 1838 (1 & 2 Vict. c. 114), sometimes the Personal Diligence Act, was an Act of Parliament in the United Kingdom, signed into law on 16 August 1838. It amended the law of Scotland in matters relating to pe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scotland

Scotland (, ) is a country that is part of the United Kingdom. Covering the northern third of the island of Great Britain, mainland Scotland has a border with England to the southeast and is otherwise surrounded by the Atlantic Ocean to the north and west, the North Sea to the northeast and east, and the Irish Sea to the south. It also contains more than 790 islands, principally in the archipelagos of the Hebrides and the Northern Isles. Most of the population, including the capital Edinburgh, is concentrated in the Central Belt—the plain between the Scottish Highlands and the Southern Uplands—in the Scottish Lowlands. Scotland is divided into 32 administrative subdivisions or local authorities, known as council areas. Glasgow City is the largest council area in terms of population, with Highland being the largest in terms of area. Limited self-governing power, covering matters such as education, social services and roads and transportation, is devolved from the Scott ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity. The term can also be used metaphorically to cover moral obligations and other interactions not based on a monetary value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person. Etymology The English term "debt" was first used in the late 13th century. The term "debt" comes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

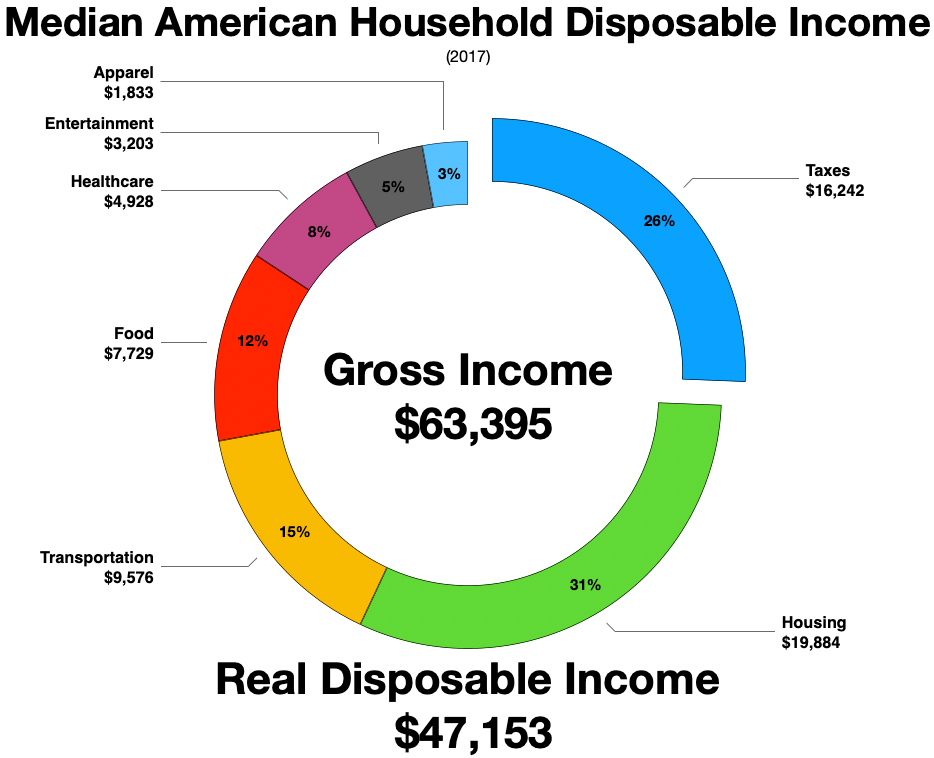

Disposable Income

Disposable income is total personal income minus current income taxes. In national accounts definitions, personal income minus personal current taxes equals disposable personal income. Subtracting personal outlays (which includes the major category of personal r privateconsumption expenditure) yields personal (or, private) savings, hence the income left after paying away all the taxes is referred to as disposable income. Restated, consumption expenditure plus savings equals disposable income after accounting for transfers such as payments to children in school or elderly parents’ living and care arrangements. The marginal propensity to consume (MPC) is the fraction of a change in disposable income that is consumed. For example, if disposable income rises by $100, and $65 of that $100 is consumed, the MPC is 65%. Restated, the marginal propensity to save is 35%. For the purposes of calculating the amount of income subject to garnishments, United States' federal law defin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or " repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Criminal Charges

A criminal charge is a formal accusation made by a governmental authority (usually a public prosecutor or the police) asserting that somebody has committed a crime. A charging document, which contains one or more criminal charges or counts, can take several forms, including: * complaint * information * indictment * citation * traffic ticket The charging document is what generally starts a criminal case in court. But the procedure by which somebody is charged with a crime and what happens when somebody has been charged varies from country to country and even, within a country, from state to state. Before a person is found guilty of a crime, a criminal charge must be proven beyond a reasonable doubt. Punishment There can be multiple punishments due to certain criminal charges. Minor criminal charges such as misdemeanors, tickets, and infractions have less harsh punishments. The judge usually sentences the person accused of committing the charges right after the hearing. The p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Default (finance)

In finance, default is failure to meet the legal obligations (or conditions) of a loan, for example when a home buyer fails to make a mortgage payment, or when a corporation or government fails to pay a bond which has reached maturity. A national or sovereign default is the failure or refusal of a government to repay its national debt. The biggest private default in history is Lehman Brothers, with over $600 billion when it filed for bankruptcy in 2008. The biggest sovereign default is Greece, with $138 billion in March 2012. Distinction from insolvency, illiquidity and bankruptcy The term "default" should be distinguished from the terms "insolvency", illiquidity and " bankruptcy": * Default: Debtors have been passed behind the payment deadline on a debt whose payment was due. * Illiquidity: Debtors have insufficient cash (or other "liquefiable" assets) to pay debts. * Insolvency: A legal term meaning debtors are unable to pay their debts. * Bankruptcy: A legal finding tha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scots Law

Scots law () is the legal system of Scotland. It is a hybrid or mixed legal system containing civil law and common law elements, that traces its roots to a number of different historical sources. Together with English law and Northern Ireland law, it is one of the three legal systems of the United Kingdom.Stair, General Legal Concepts (Reissue), para. 4 (Online) Retrieved 2011-11-29 Early Scots law before the 12th century consisted of the different legal traditions of the various cultural groups who inhabited the country at the time, the Gaels in most of the country, with the Britons and Anglo-Saxons in some districts south of the Forth and with the Norse in the islands and north of the River Oykel. The introduction of feudalism from the 12th century and the expansion of the Kingdom of Scotland established the modern roots of Scots law, which was gradually influenced by other, especially Anglo-Norman and continental legal traditions. Although there was some indirect Roman la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |