|

Prime Rate

A prime rate or prime lending rate is an interest rate used by banks, usually the interest rate at which banks lend to customers with good credit. Some variable interest rates may be expressed as a percentage above or below prime rate. Use in different banking systems United States and Canada Historically, in North American banking, the prime rate was the actual interest rate, although this is no longer the case. The prime rate varies little among banks and adjustments are generally made by banks at the same time, although this does not happen frequently. the prime rate is 6.25% in the United States and 5.45% in Canada. In the United States, the prime rate runs approximately 300 basis points (or 3 percentage points) above the federal funds rate, which is the interest rate that banks charge each other for overnight loans made to fulfill reserve funding requirements. The Federal funds rate plus a much smaller increment is frequently used for lending to the most creditworthy bor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Malaysia

Malaysia ( ; ) is a country in Southeast Asia. The federation, federal constitutional monarchy consists of States and federal territories of Malaysia, thirteen states and three federal territories, separated by the South China Sea into two regions: Peninsular Malaysia and Borneo's East Malaysia. Peninsular Malaysia shares a land and maritime Malaysia–Thailand border, border with Thailand and Maritime boundary, maritime borders with Singapore, Vietnam, and Indonesia. East Malaysia shares land and maritime borders with Brunei and Indonesia, and a maritime border with the Philippines and Vietnam. Kuala Lumpur is the national capital, the country's largest city, and the seat of the Parliament of Malaysia, legislative branch of the Government of Malaysia, federal government. The nearby Planned community#Planned capitals, planned capital of Putrajaya is the administrative capital, which represents the seat of both the Government of Malaysia#Executive, executive branch (the Cabine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Economics

Financial economics, also known as finance, is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on ''both sides'' of a trade".William F. Sharpe"Financial Economics", in Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus: Merton H. Miller, (1999). The History of Finance: An Eyewitness Account, ''Journal of Portfolio Management''. Summer 1999. asset pricing, commonly known as "Investments", and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance. The subject is concerned with "the allocation and deployment of economic resources, both spatially and across time, in an uncertain environment".See Fama and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. U.S. Congress, Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and bank regulation, regulating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FRED (Federal Reserve Economic Data)

Federal Reserve Economic Data (FRED) is a database maintained by the Research division of the Federal Reserve Bank of St. Louis that has more than 816,000 economic time series from various sources. They cover banking, business/fiscal, consumer price indexes, employment and population, exchange rates, gross domestic product, interest rates, monetary aggregates, producer price indexes, reserves and monetary base, U.S. trade and international transactions, and U.S. financial data. The time series are compiled by the Federal Reserve and many are collected from government agencies such as the U.S. Census and the Bureau of Labor Statistics. Services ALFRED (Archival Federal Reserve Economic Data) lets users retrieve vintage versions of economic data that were available on specific dates in history. The ALFRED website states that “In general, economic data for past observation periods are revised as more accurate estimates become available. As a result, previous vintages of data ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Home Equity Line Of Credit

A home equity line of credit, or HELOC ( /ˈhiːˌlɒk/ ''HEE-lok''), is a revolving type of secured loan in which the lender agrees to lend a maximum amount within an agreed period (called a term), where the collateral is the borrower's property (akin to a second mortgage). Because a home often is a consumer's most valuable asset, many homeowners use their HELOC for major purchases or projects, such as home improvements, education, property investment or medical bills, and choose not to use them for day-to-day expenses. A reason for the popularity of HELOCs is their flexibility, both in terms of borrowing and repaying. Furthermore, their popularity may also stem from having a better image than a "second mortgage", a term which can more directly imply an undesirable level of debt. However, within the lending industry itself, HELOCs are categorized as a second mortgage. HELOCs are usually offered at attractive interest rates. This is because they are secured against a borrower’s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Card

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards (stainless steel, gold, palladium, titanium), and a few gemstone-encrusted metal cards. A regular credit card is different from a charge card, which requires the balance to be repaid in full each month or at the end of each statement cycle. In contrast, credit cards allow the consumers to build a continuing balance of debt, subject to interest being charged. A credit car ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student Loans

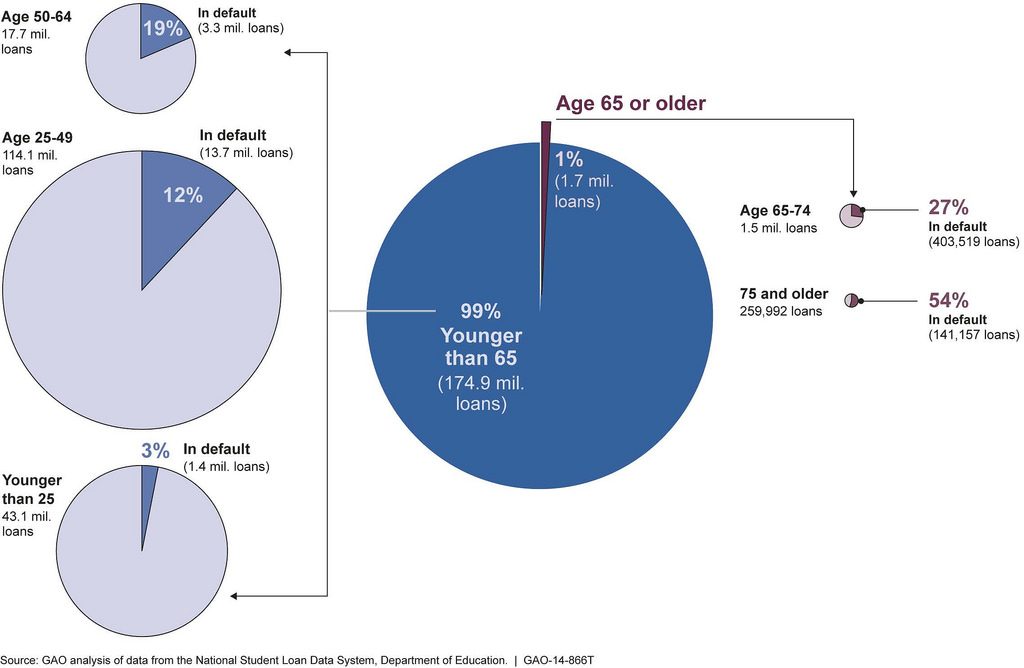

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries. Australia Tertiary student places in Australia are usually funded through the HECS-HELP scheme. This funding is in the form of loans that are not normal debts. They are repaid over time via a supplementary tax, using a sliding scale based on taxable income. As a consequence, loan repayments are only made when the former student has income to support the repayments. Discounts are available for early repayment. The scheme is available to cit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Variable Rate

A floating interest rate, also known as a variable or adjustable rate, refers to any type of debt instrument, such as a loan, bond, mortgage, or credit, that does not have a fixed rate of interest over the life of the instrument. Floating interest rates typically change based on a reference rate (a benchmark of any financial factor, such as the Consumer Price Index). One of the most common reference rates to use as the basis for applying floating interest rates is the London Inter-bank Offered Rate, or LIBOR (the rates at which large banks lend to each other). The rate for such debt will usually be referred to as a spread or margin over the base rate: for example, a five-year loan may be priced at the six-month LIBOR + 2.50%. At the end of each six-month period, the rate for the following period will be based on the LIBOR at that point (the reset date), plus the spread. The basis will be agreed between the borrower and lender, but 1, 3, 6 or 12 month money market rates are common ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Adjustable-rate Mortgage

A variable-rate mortgage, adjustable-rate mortgage (ARM), or tracker mortgage is a mortgage loan with the interest rate on the note periodically adjusted based on an index which reflects the cost to the lender of borrowing on the credit markets.Wiedemer, John P, ''Real Estate Finance, 8th Edition'', pp 99–105 The loan may be offered at the lender's standard variable rate/base rate. There may be a direct and legally defined link to the underlying index, but where the lender offers no specific link to the underlying market or index, the rate can be changed at the lender's discretion. The term "variable-rate mortgage" is most common outside the United States, whilst in the United States, "adjustable-rate mortgage" is most common, and implies a mortgage regulated by the Federal government, with caps on charges. In many countries, adjustable rate mortgages are the norm, and in such places, may simply be referred to as mortgages. Among the most common indices are the rates on 1-year co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maybank

Malayan Banking Berhad (doing business as Maybank) is a Malaysian universal bank, with key operating "home markets" of Malaysia, Singapore, and Indonesia. According to the 2020 Brand Finance report, Maybank is Malaysia's most valuable bank brand, the fourth top brand in amongst the Asean countries, and ranked 70th in the world’s most valuable bank brands. Background Maybank is Malaysia's largest bank by market capitalisation and total assets and one of the largest banks in Southeast Asia, with total assets exceeding US$203 billion and having a net profit of US$1.98 billion for 2019. Maybank is also ranked 106th in The Banker's 2020 Top 1000 World Banks (as at July 2020) and is ranked 349th in the Forbes Global 2000 Leading Companies (as at May 2020). Maybank is the largest public listed company on Bursa Malaysia, the Malaysian stock exchange, with a market capitalisation of US$23.7 billion as of 31 December 2019. Maybank's Islamic banking arm, Maybank Islamic, is the la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |