|

Mark-to-model

Mark-to-Model refers to the practice of pricing a position or portfolio at prices determined by financial models, in contrast to allowing the market to determine the price. Often the use of models is necessary where a market for the financial product is not available, such as with complex financial instruments. One shortcoming of Mark-to-Model is that it gives an artificial illusion of liquidity, and the actual price of the product depends on the accuracy of the financial models used to estimate the price. On the other hand it is argued that Asset managers and Custodians have a real problem valuing illiquid assets in their portfolios even though many of these assets are perfectly sound and the asset manager has no intention of selling them. Assets should be valued at mark to market prices as required by the Basel rules. However mark to market prices should not be used in isolation, but rather compared to model prices to test their validity. Models should be improved to take into a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Model Risk

In finance, model risk is the risk of loss resulting from using insufficiently accurate models to make decisions, originally and frequently in the context of valuing financial securities. Here, Rebonato (2002) defines model risk as "the risk of occurrence of a significant difference between the mark-to-model value of a complex and/or illiquid instrument, and the price at which the same instrument is revealed to have traded in the market". However, model risk is increasingly relevant in contexts other than financial securities valuation, including assigning consumer credit scores, real-time prediction of fraudulent credit card transactions, and computing the probability of an air flight passenger being a terrorist. In fact, Burke regards failure to use a model (instead over-relying on expert judgment) as a type of model risk.http://www.siiglobal.org/SII/WEB5/sii_files/Membership/PIFs/Risk/Model%20Risk%2024%2011%2009%20Final.pdf Types Derman describes various types of model ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Model

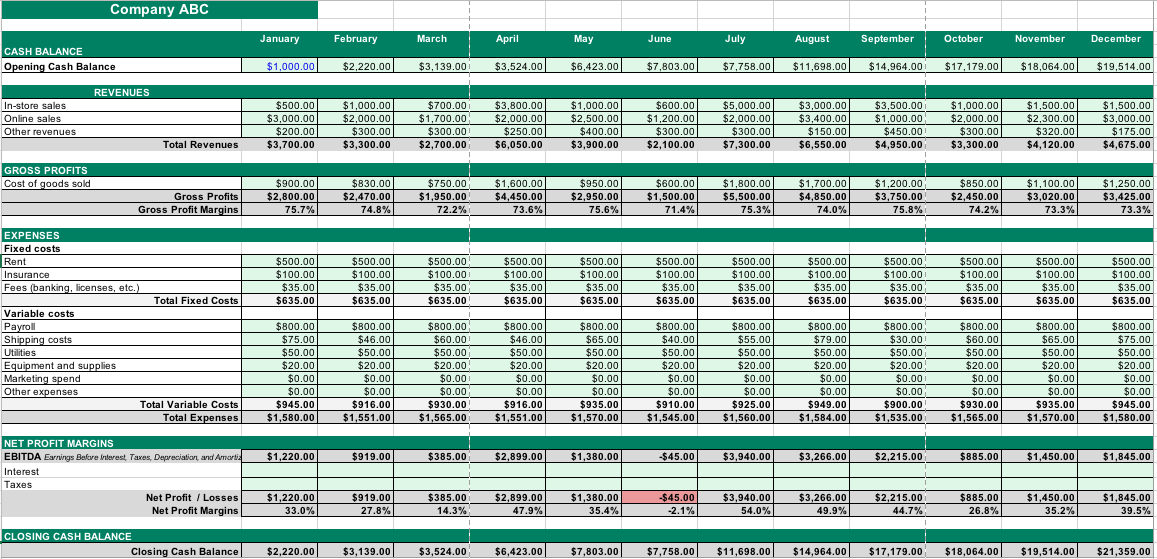

Financial modeling is the task of building an abstract representation (a model) of a real world financial situation. This is a mathematical model designed to represent (a simplified version of) the performance of a financial asset or portfolio of a business, project, or any other investment. Typically, then, financial modeling is understood to mean an exercise in either asset pricing or corporate finance, of a quantitative nature. It is about translating a set of hypotheses about the behavior of markets or agents into numerical predictions. At the same time, "financial modeling" is a general term that means different things to different users; the reference usually relates either to accounting and corporate finance applications or to quantitative finance applications. Accounting In corporate finance and the accounting profession, ''financial modeling'' typically entails financial statement forecasting; usually the preparation of detailed company-specific models used for deci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contracts

In finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The item transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price'' or ''delivery price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a Derivative (finance), derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the Long (finance), long position holder and the selling party is said to be the Short (finance), short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Valuation (finance)

In finance, valuation is the process of determining the value of a (potential) investment, asset, or security. Generally, there are three approaches taken, namely discounted cashflow valuation, relative valuation, and contingent claim valuation. Valuations can be done for assets (for example, investments in marketable securities such as companies' shares and related rights, business enterprises, or intangible assets such as patents, data and trademarks) or for liabilities (e.g., bonds issued by a company). Valuation is a subjective exercise, and in fact, the process of valuation itself can also affect the value of the asset in question. Valuations may be needed for various reasons such as investment analysis, capital budgeting, merger and acquisition transactions, financial reporting, taxable events to determine the proper tax liability. In a business valuation context, various techniques are used to determine the (hypothetical) price that a third party would pay for a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivatives (finance)

The derivative of a function is the rate of change of the function's output relative to its input value. Derivative may also refer to: In mathematics and economics * Brzozowski derivative in the theory of formal languages *Covariant derivative, a way of specifying a derivative along tangent vectors of a manifold with a connection. * Exterior derivative, an extension of the concept of the differential of a function to differential forms of higher degree. *Formal derivative, an operation on elements of a polynomial ring which mimics the form of the derivative from calculus * Fréchet derivative, a derivative defined on normed spaces. * Gateaux derivative, a generalization of the concept of directional derivative in differential calculus. * Lie derivative, the change of a tensor field (including scalar functions, vector fields and one-forms), along the flow defined by another vector field. * Radon–Nikodym derivative in measure theory * Derivative (set theory), a concept app ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Level 1, Level 2, Level 3 Assets

Level or levels may refer to: Engineering *Level (optical instrument), a device used to measure true horizontal or relative heights *Spirit level or bubble level, an instrument designed to indicate whether a surface is horizontal or vertical *Canal pound or level *Regrading or levelling, the process of raising and/or lowering the levels of land *Storey or level, a vertical unit of a building or a mine *Level (coordinate), vertical position *Horizontal plane parallel Gaming *Level (video games), a stage of the game *Level (role-playing games), a measurement of character development Music *Level (music), similar to but more general and basic than a chord * "Level" (The Raconteurs song) * ''Levels'' (album), an album by AKA * "Levels" (Avicii song) * "Levels" (Bilal song) * "Levels" (Nick Jonas song) * "Levels" (Meek Mill song) * "Levels" (NorthSideBenji song), featuring Houdini * "Levels" (Sidhu Moose Wala song) Places * Level Mountain, a volcano in northern British Columbia, Can ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mark To Market

Mark-to-market (MTM or M2M) or fair value accounting is accounting for the "fair value" of an asset or liability based on the current market price, or the price for similar assets and liabilities, or based on another objectively assessed "fair" value. Fair value accounting has been a part of Generally Accepted Accounting Principles (GAAP) in the United States since the early 1990s. Failure to use it is viewed as the cause of the Orange County Bankruptcy, even though its use is considered to be one of the reasons for the Enron scandal and the eventual bankruptcy of the company, as well as the closure of the accounting firm Arthur Andersen. Mark-to-market accounting can change values on the balance sheet as market conditions change. In contrast, historical cost accounting, based on the past transactions, is simpler, more stable, and easier to perform, but does not represent current market value. It summarizes past transactions instead. Mark-to-market accounting can become volat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rational Pricing

Rational pricing is the assumption in financial economics that asset prices – and hence asset pricing models – will reflect the arbitrage-free price of the asset as any deviation from this price will be "arbitraged away". This assumption is useful in pricing fixed income securities, particularly bonds, and is fundamental to the pricing of derivative instruments. Arbitrage mechanics Arbitrage is the practice of taking advantage of a state of imbalance between two (or possibly more) markets. Where this mismatch can be exploited (i.e. after transaction costs, storage costs, transport costs, dividends etc.) the arbitrageur can "lock in" a risk-free profit by purchasing and selling simultaneously in both markets. In general, arbitrage ensures that "the law of one price" will hold; arbitrage also equalises the prices of assets with identical cash flows, and sets the price of assets with known future cash flows. The law of one price The same asset must trade at the same ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative (finance)

In finance, a derivative is a contract between a buyer and a seller. The derivative can take various forms, depending on the transaction, but every derivative has the following four elements: # an item (the "underlier") that can or must be bought or sold, # a future act which must occur (such as a sale or purchase of the underlier), # a price at which the future transaction must take place, and # a future date by which the act (such as a purchase or sale) must take place. A derivative's value depends on the performance of the underlier, which can be a commodity (for example, corn or oil), a financial instrument (e.g. a stock or a bond), price index, a price index, a currency, or an interest rate. Derivatives can be used to insure against price movements (Hedge (finance)#Etymology, hedging), increase exposure to price movements for speculation, or get access to otherwise hard-to-trade assets or markets. Most derivatives are price guarantees. But some are based on an event or p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Warren Buffett

Warren Edward Buffett ( ; born August 30, 1930) is an American investor and philanthropist who currently serves as the chairman and CEO of the conglomerate holding company Berkshire Hathaway. As a result of his investment success, Buffett is one of the best-known investors in the world. According to ''Forbes'', as of May 2025, Buffett's estimated net worth stood at US$160.2 billion, making him the fifth-richest individual in the world. Buffett was born in Omaha, Nebraska. The son of U.S. congressman and businessman Howard Buffett, he developed an interest in business and investing during his youth. He entered the Wharton School of the University of Pennsylvania in 1947 before graduating from the University of Nebraska at 20. He went on to graduate from Columbia Business School, where he molded his investment philosophy around the concept of value investing pioneered by Benjamin Graham. He attended New York Institute of Finance to focus on his economics background and soon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mark-to-market

Mark-to-market (MTM or M2M) or fair value accounting is accounting for the "fair value" of an asset or liability based on the current market price, or the price for similar assets and liabilities, or based on another objectively assessed "fair" value. Fair value accounting has been a part of Generally Accepted Accounting Principles (GAAP) in the United States since the early 1990s. Failure to use it is viewed as the cause of the Orange County Bankruptcy, even though its use is considered to be one of the reasons for the Enron scandal and the eventual bankruptcy of the company, as well as the closure of the accounting firm Arthur Andersen. Mark-to-market accounting can change values on the balance sheet as market conditions change. In contrast, historical cost accounting, based on the past transactions, is simpler, more stable, and easier to perform, but does not represent current market value. It summarizes past transactions instead. Mark-to-market accounting can become volati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Enron

Enron Corporation was an American Energy development, energy, Commodity, commodities, and services company based in Houston, Texas. It was led by Kenneth Lay and developed in 1985 via a merger between Houston Natural Gas and InterNorth, both relatively small regional companies at the time of the merger. Before its bankruptcy on December 2, 2001, Enron employed approximately 20,600 staff and was a major electricity, natural gas, communications, and pulp and paper industry, pulp and paper company, with claimed revenues of nearly $101 billion during 2000. ''Fortune (magazine), Fortune'' named Enron "America's Most Innovative Company" for six consecutive years. At the end of 2001, it was revealed that Enron's reported financial condition was sustained by an institutionalized, systematic, and creatively planned accounting scandals, accounting fraud, known since as the Enron scandal. Enron became synonymous with willful, institutional fraud and systemic Corporate crime, corruptio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |