|

Logbook Loan

A logbook loan is a form of secured lending in the United Kingdom and is the most common modern example of a security bill of sale. Borrowers transfer ownership of their car, van or motorcycle to the logbook lender as security for a loan. While making repayments borrowers keep possession of their vehicle and continue to use it. When the logbook loan is repaid, the borrower regains ownership of their vehicle. Borrowers hand the logbook lender the V5C registration document - or "logbook" - but this is purely symbolic and has no legal effect. If the borrower defaults, the logbook lender can seize the vehicle and look to the proceeds of sale for satisfaction of the loan. Unlike a car title loan in the United States, the logbook lender can, under English law, seize the vehicle without a court order. In England, Wales and Northern Ireland, logbook loans are regulated by the Bills of Sale Act 1878 and Bills of Sale Act (1878) Amendment Act 1882. FCA compliant logbook lenders utilise your ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The United Kingdom includes the island of Great Britain, the north-eastern part of the island of Ireland, and many smaller islands within the British Isles. Northern Ireland shares a land border with the Republic of Ireland; otherwise, the United Kingdom is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. The total area of the United Kingdom is , with an estimated 2020 population of more than 67 million people. The United Kingdom has evolved from a series of annexations, unions and separations of constituent countries over several hundred years. The Treaty of Union between the Kingdom of England (which included Wales, annexed in 1542) and the Kingdom of Scotland in 170 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bill Of Sale

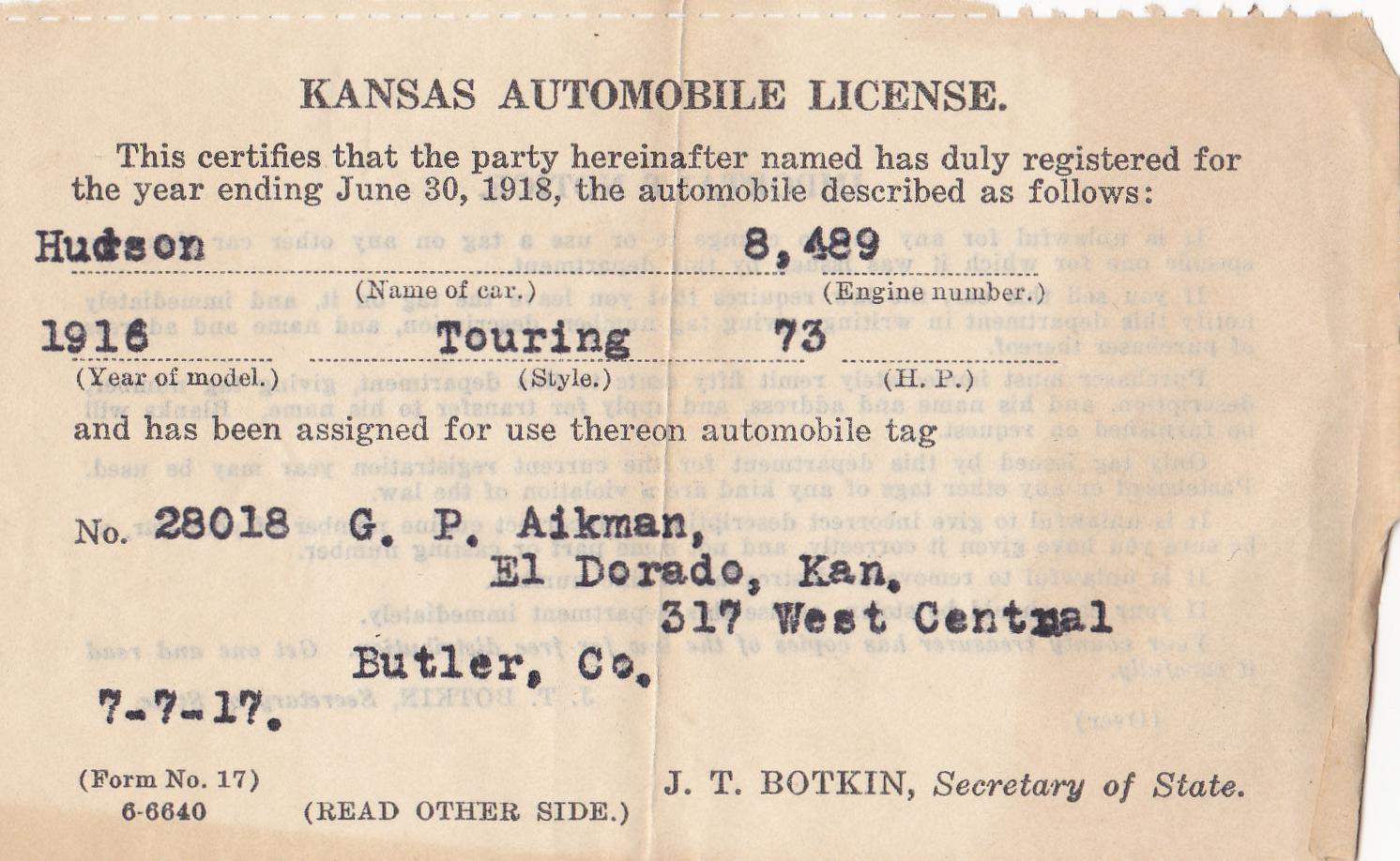

A bill of sale is a document that transfers ownership of goods from one person to another. It is used in situations where the former owner transfers possession of the goods to a new owner. Bills of sale may be used in a wide variety of transactions: people can sell their goods, exchange them, give them as gifts or mortgage them to get a loan. They can only be used: * to transfer ownership of goods that people already own; * to transfer ownership of moveable tangible goods; and * by individuals and unincorporated businesses. Bills of sale exist at common law quite independently of any legislation. In England and Wales, they are regulated by two Victorian pieces of legislation: the Bills of Sale Act 1878 and the Bills of Sale Act (1878) Amendment Act 1882. This area of the law was subject to review by the Law Commission, which published a proposal for change in 2017. Bills of sale in the US Historical origin The term "bill of sale" originally referred to any writing by which an ab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Vehicle Registration Certificate

A vehicle registration certificate is an official document providing proof of registration of a vehicle. It is used primarily by governments as a means of ensuring that all road vehicles are on the national vehicle register, but is also used as a form of law enforcement and to facilitate change of ownership when buying and selling a vehicle. European Union and European Economic Area In the European Economic Area ( EU, Iceland, Liechtenstein and Norway), vehicle registration certificates are governed by the European directive 1999/37/EC. The information contained in these registration certificates includes: * Vehicle registration number * Personal data of the individual to whom the vehicle is registered * Vehicle identification number (VIN) * Engine specifications * Exhaust emissions United Kingdom In the UK the document (V5C) was previously referred to as the "log book", and this name is still common usage. The document is issued by the DVLA and tracks the registered keeper of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Title Loan

A title loan (also known as a car title loan) is a type of secured loan where borrowers can use their vehicle title as collateral. Borrowers who get title loans must allow a lender to place a lien on their car title, and temporarily surrender the hard copy of their vehicle title, in exchange for a loan amount. When the loan is repaid, the lien is removed and the car title is returned to its owner. If the borrower defaults on their payments then the lender is liable to repossess the vehicle and sell it to repay the borrowers’ outstanding debt. These loans are typically short-term, and tend to carry higher interest rates than other sources of credit. Lenders typically do not check the credit history of borrowers for these loans and only consider the value and condition of the vehicle that is being used to secure it. Despite the secured nature of the loan, lenders argue that the comparatively high rates of interest that they charge are necessary. As evidence for this, they point to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Conduct Authority

The Financial Conduct Authority (FCA) is a financial regulation, financial regulatory body in the United Kingdom, but operates independently of the UK Government, and is financed by charging fees to members of the financial services industry. The FCA regulates financial firms providing services to consumers and maintains the integrity of the financial markets in the United Kingdom. It focuses on the regulation of conduct by both retail and wholesale financial services firms.Archived here. Like its predecessor the Financial Services Authority, FSA, the FCA is structured as a company limited by guarantee. The FCA works alongside the Prudential Regulation Authority (United Kingdom), Prudential Regulation Authority and the Financial Policy Committee to set regulatory requirements f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Law Commission (England And Wales)

In England and Wales the Law Commission ( cy, Comisiwn y Gyfraith) is an independent law commission set up by Parliament by the Law Commissions Act 1965 to keep the law of England and Wales under review and to recommend reforms. The organisation is headed by a Chairman (currently Sir Nicholas Green, a judge of the Court of Appeal) and four Law Commissioners. It proposes changes to the law that will make the law simpler, more accessible, fairer, modern and more cost-effective. It consults widely on its proposals and in the light of the responses to public consultation, it presents recommendations to the UK Parliament that, if legislated upon, would implement its law reform recommendations. The commission is part of the Commonwealth Association of Law Reform Agencies. Activities The Law Commissions Act 1965 requires the Law Commission to submit "programmes for the examination of different branches of the law" to the Lord Chancellor for his approval before undertaking new work. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Title Loan

A title loan (also known as a car title loan) is a type of secured loan where borrowers can use their vehicle title as collateral. Borrowers who get title loans must allow a lender to place a lien on their car title, and temporarily surrender the hard copy of their vehicle title, in exchange for a loan amount. When the loan is repaid, the lien is removed and the car title is returned to its owner. If the borrower defaults on their payments then the lender is liable to repossess the vehicle and sell it to repay the borrowers’ outstanding debt. These loans are typically short-term, and tend to carry higher interest rates than other sources of credit. Lenders typically do not check the credit history of borrowers for these loans and only consider the value and condition of the vehicle that is being used to secure it. Despite the secured nature of the loan, lenders argue that the comparatively high rates of interest that they charge are necessary. As evidence for this, they point to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payday Loan

A payday loan (also called a payday advance, salary loan, payroll loan, small dollar loan, short term, or cash advance loan) is a short-term unsecured loan, often characterized by high interest rates. The term "payday" in payday loan refers to when a borrower writes a postdated check to the lender for the payday salary, but receives part of that payday sum in immediate cash from the lender. However, in common parlance, the concept also applies regardless of whether repayment of loans is linked to a borrower's payday. The loans are also sometimes referred to as "cash advances", though that term can also refer to cash provided against a prearranged line of credit such as a credit card. Legislation regarding payday loans varies widely between different countries, and in federal systems, between different states or provinces. To prevent usury (unreasonable and excessive rates of interest), some jurisdictions limit the annual percentage rate (APR) that any lender, including payday l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Advance

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards (stainless steel, gold, palladium, titanium), and a few gemstone-encrusted metal cards. A regular credit card is different from a charge card, which requires the balance to be repaid in full each month or at the end of each statement cycle. In contrast, credit cards allow the consumers to build a continuing balance of debt, subject to interest being charged. A credit card diff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |