|

Induced Consumption

Induced consumption is the portion of Consumption (economics), consumption that varies with Disposable and discretionary income, disposable income. When a change in disposable income “induces” a change in consumption on goods and services, then that changed consumption is called “induced consumption”. In contrast, expenditures for autonomous consumption do not vary with income. For instance, expenditure on a consumable that is considered a normal good would be considered to be induced. In the simple linear consumption function, C = a + b \times Y_ induced consumption is represented by the term b \times Y_, where Y_ denotes disposable income and b is called the marginal propensity to consume. See also * Lifestyle creep * Diderot effect * Induced demand References Consumption (macroeconomics) {{Econ-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption (economics)

Consumption refers to the use of resources to fulfill present needs and desires. It is seen in contrast to investing, which is spending for acquisition of ''future'' income. Consumption is a major concept in economics and is also studied in many other social sciences. Different schools of economists define consumption differently. According to mainstream economics, mainstream economists, only the final purchase of newly produced Good (economics), goods and Service (economics), services by individuals for immediate use constitutes consumption, while other types of expenditure — in particular, fixed investment, intermediate consumption, and government spending — are placed in separate categories (see consumer choice). Other economists define consumption much more broadly, as the aggregate of all economic activity that does not entail the design, production and marketing of goods and services (e.g., the selection, adoption, use, disposal and recycling of goods and services). E ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

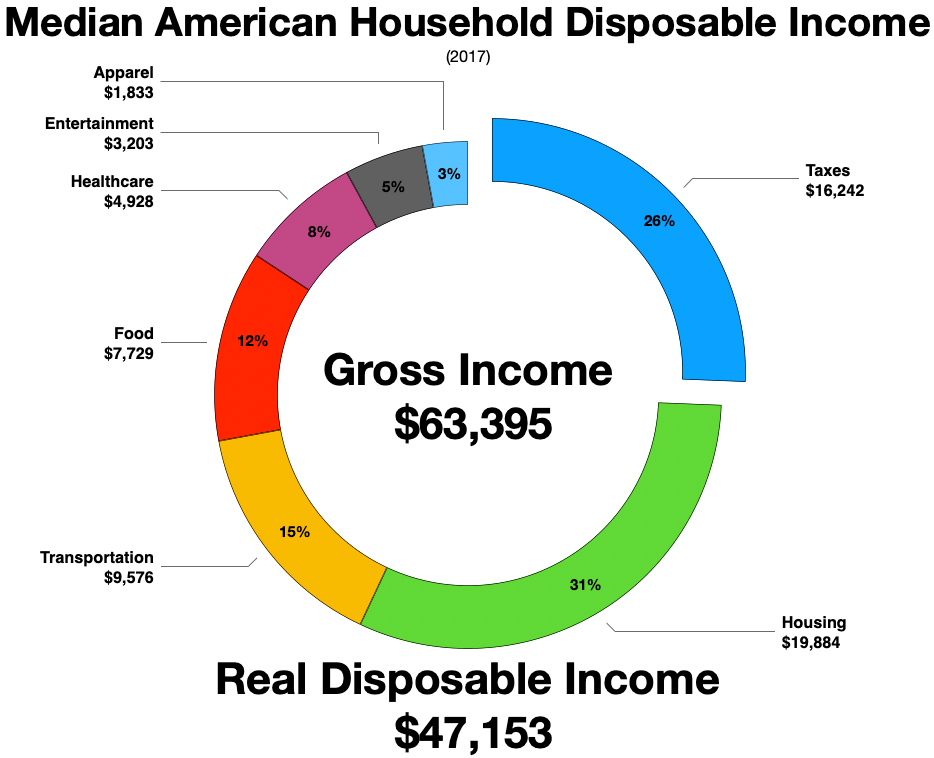

Disposable And Discretionary Income

Disposable income is total personal income minus current taxes on income. In national accounting, personal income minus personal current taxes equals disposable personal income or household disposable income. Subtracting personal outlays (which includes the major category of personal r privateconsumption expenditure) yields personal (or, private) savings, hence the income left after paying away all the taxes is referred to as disposable income. Restated, consumption expenditure plus savings equals disposable income after accounting for transfers such as payments to children in school or elderly parents' living and care arrangements. The marginal propensity to consume (MPC) is the fraction of a change in disposable income that is consumed. For example, if disposable income rises by $100, and $65 of that $100 is consumed, the MPC is 65%. Restated, the marginal propensity to save is 35%. For the purposes of calculating the amount of income subject to garnishments, United St ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Autonomous Consumption

Autonomous consumption (also exogenous consumption, autonomous spending) is the consumption expenditure that occurs when income levels are zero. Such consumption is considered autonomous of income only when expenditure on these consumables does not vary with changes in income; generally, it may be required to fund necessities and debt obligations. If income levels are actually zero, this consumption counts as dissaving, because it is financed by borrowing or using up savings. Autonomous consumption contrasts with induced consumption, in that it does not systematically fluctuate with income, whereas induced consumption does. The two are related, for all households, through the consumption function: :C = c_0 + c_1 Y_d where * ''C'' = total consumption, * ''c0'' = autonomous consumption (''c0'' > 0), * ''c1'' = the marginal propensity to consume (the gradient of induced consumption) (0 < ''c1'' < 1), and * ''Yd'' = disposable income (income after government t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Normal Good

In economics, a normal good is a type of a Good (economics), good which experiences an increase in demand due to an increase in income, unlike inferior goods, for which the opposite is observed. When there is an increase in a person's income, for example due to a wage rise, a good for which the demand rises due to the wage increase, is referred as a normal good. Conversely, the demand for normal goods declines when the income decreases, for example due to a wage decrease or layoffs. Analysis There is a positive correlation between the income and demand for normal goods, that is, the changes income and demand for normal goods moves in the same direction. That is to say, that normal goods have an elastic relationship for the demand of a good with the income of the person consuming the good. In economics, the concept of elasticity, and specifically income elasticity of demand is key to explain the concept of normal goods. Income elasticity of demand measures the magnitude of the c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

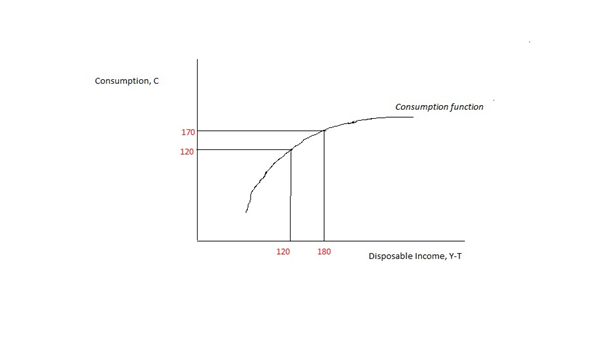

Consumption Function

In economics, the consumption function describes a relationship between consumption and disposable income. The concept is believed to have been introduced into macroeconomics by John Maynard Keynes in 1936, who used it to develop the notion of a government spending multiplier. Details Its simplest form is the ''linear consumption function'' used frequently in simple Keynesian models: :C = a + b \cdot Y_ where a is the autonomous consumption that is independent of disposable income; in other words, consumption when disposable income is zero. The term b \cdot Y_ is the induced consumption that is influenced by the economy's income level Y_. The parameter b is known as the marginal propensity to consume, i.e. the increase in consumption due to an incremental increase in disposable income, since \partial C / \partial Y_ = b. Geometrically, b is the slope of the consumption function. Keynes proposed this model to fit three stylized facts: * People typically spend a part, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Propensity To Consume

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending ( consumption) occurs with an increase in disposable income (income after taxes and transfers). The proportion of disposable income which individuals spend on consumption is known as propensity to consume. MPC is the proportion of additional income that an individual consumes. For example, if a household earns one extra dollar of disposable income, and the marginal propensity to consume is 0.65, then of that dollar, the household will spend 65 cents and save 35 cents. Obviously, the household cannot spend ''more'' than the extra dollar (without borrowing or using savings). If the extra money accessed by the individual gives more economic confidence, then the MPC of the individual may well exceed 1, as they may borrow or utilise savings. According to John Maynard Keynes, marginal propensity to consume is less than one. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lifestyle Creep

Lifestyle creep, also known as lifestyle inflation, is a phenomenon that occurs when, as more resources are spent on standard of living, former luxuries become perceived necessities. Description An individual's discretionary income could increase as a result of increased income or decreased cost, such as paying off a mortgage. As discretionary income increases, individuals are able to spend money on things that were previously unaffordable. Lifestyle creep occurs when spending increases at the same rate as income. It can be reflected in purchases, such as expensive vehicles or a second home. Spending money on things with ongoing maintenance costs, such as club memberships, also are demonstrated in lifestyle creep. Lifestyle creep tends to be insidious, so it can be difficult to realize it is occurring. This is why some experts have called it a “silent inflation”. Although it is difficult to perceive, it can be contagious as people compare their own lifestyle with others. S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diderot Effect

The Diderot effect is a phenomenon that occurs when acquiring a new possession leads to a spiral of consumption that results in the acquisition of even more possessions. In other words, buying something new can cause a chain reaction leading to one buying more and more things. Each new item makes one feel like one needs other things to go with it or to keep up with it. This can lead to overspending and accumulating more possessions than one needs or uses. The term was coined by anthropologist and scholar of consumption patterns Grant McCracken in 1986, and is named after the French philosopher Denis Diderot (1713–1784), who first described the effect in an essay titled "Regrets for my Old Dressing Gown, or, A warning to those who have more taste than fortune". The term has been used in discussions of sustainable consumption and green consumerism, in regard to the process whereby a purchase or gift creates Contentment, dissatisfaction with existing possessions and environment, pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |