|

Autonomous Consumption

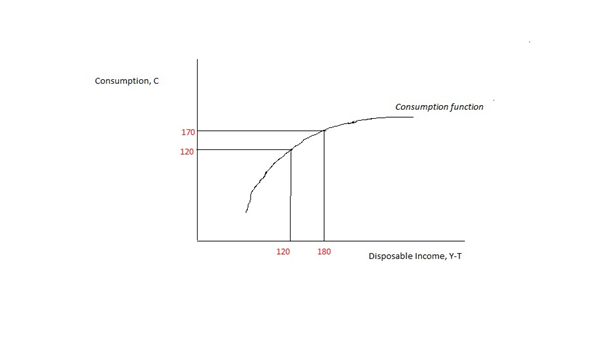

Autonomous consumption (also exogenous consumption, autonomous spending) is the consumption expenditure that occurs when income levels are zero. Such consumption is considered autonomous of income only when expenditure on these consumables does not vary with changes in income; generally, it may be required to fund necessities and debt obligations. If income levels are actually zero, this consumption counts as dissaving, because it is financed by borrowing or using up savings. Autonomous consumption contrasts with induced consumption, in that it does not systematically fluctuate with income, whereas induced consumption does. The two are related, for all households, through the consumption function: :C = c_0 + c_1 Y_d where * ''C'' = total consumption, * ''c0'' = autonomous consumption (''c0'' > 0), * ''c1'' = the marginal propensity to consume (the gradient of induced consumption) (0 < ''c1'' < 1), and * ''Yd'' = disposable income (income after government t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

LibreTexts

LibreTexts (formerly called STEMHyperlibrary and ChemWiki) is a 501(c)(3) nonprofit online educational resource project. The project provides open access to its content on its website, and the site is built on the proprietary Mindtouch platform. LibreTexts was started in 2008 by Professor Delmar Larsen at the University of California Davis and has since expanded to 400 texts in 154 courses (as of 2018), making it one of the largest and most visited online educational resources. LibreTexts currently has 13 library disciplines. Support LibreTexts' current primary support is from the 2018 Open Textbook Pilot Program award from the Department of Education Organization Act The Department of Education Organization Act is a United States federal law enacted in 1979, which created the Department of Education. The new department was split off from the Department of Health, Education, and Welfare, which the Act also r .... FIPSE Other funding comes from the University of California ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Consumables

Consumables (also known as consumable goods, non-durable goods, or soft goods) are goods that are intended to be consumed. People have, for example, always consumed food and water. Consumables are in contrast to durable goods. Disposable products are a particular, extreme case of consumables, because their end-of-life is reached after a single use. Consumables are products that consumers use ''recurrently'', i.e., items which "get used up" or discarded. For example, consumable office supplies are such products as paper, pens, file folders, Post-it notes, and toner or ink cartridges. This is in contrast to capital goods or durable goods in the office, such as computers, fax machines, and other business machines or office furniture. Sometimes a company sells a durable good at an attractively low price in the hopes that the consumer will then buy the consumables that go with it at a price providing a higher margin. Printers and ink cartridges are an example, as are cameras and f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Dissaving

Dissaving is negative saving. If spending is greater than disposable income, dissaving is taking place. This spending is financed by already accumulated savings, such as money in a savings account, or it can be borrowed. Household dissaving therefore corresponds to an absolute decrease in their financial investments. Usually dissavings start after retirement, when an individual starts deducting money from the amount that he has been saving during his life time. There are also other reasons for dissavings; like big purchases, huge events, and emergencies. On the macro level, also governments could reach a certain situation where they start dissaving from their accumulated funds. Why people save Savings is when an income contributor keeps a certain amount of the income on a side (saving account) and start having an accumulative amount of money based on their savings. People usually save money for certain reasons such as: 1- Emergencies are those unexpected emerging events that might ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Acting as a provider of loans is one of the main activities of financial institutions such as banks ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Savings

Wealth is the abundance of valuable financial assets or physical possessions which can be converted into a form that can be used for transactions. This includes the core meaning as held in the originating Old English word , which is from an Indo-European word stem. The modern concept of wealth is of significance in all areas of economics, and clearly so for growth economics and development economics, yet the meaning of wealth is context-dependent. A person possessing a substantial net worth is known as ''wealthy''. Net worth is defined as the current value of one's assets less liabilities (excluding the principal in trust accounts). At the most general level, economists may define wealth as "the total of anything of value" that captures both the subjective nature of the idea and the idea that it is not a fixed or static concept. Various definitions and concepts of wealth have been asserted by various people in different contexts.Denis "Authentic Development: Is it Sustainab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Induced Consumption

Induced consumption is the portion of Consumption (economics), consumption that varies with Disposable and discretionary income, disposable income. When a change in disposable income “induces” a change in consumption on goods and services, then that changed consumption is called “induced consumption”. In contrast, expenditures for autonomous consumption do not vary with income. For instance, expenditure on a consumable that is considered a normal good would be considered to be induced. In the simple linear consumption function, C = a + b \times Y_ induced consumption is represented by the term b \times Y_, where Y_ denotes disposable income and b is called the marginal propensity to consume. See also * Lifestyle creep * Diderot effect * Induced demand References Consumption (macroeconomics) {{Econ-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Consumption Function

In economics, the consumption function describes a relationship between consumption and disposable income. The concept is believed to have been introduced into macroeconomics by John Maynard Keynes in 1936, who used it to develop the notion of a government spending multiplier. Details Its simplest form is the ''linear consumption function'' used frequently in simple Keynesian models: :C = a + b \cdot Y_ where a is the autonomous consumption that is independent of disposable income; in other words, consumption when disposable income is zero. The term b \cdot Y_ is the induced consumption that is influenced by the economy's income level Y_. The parameter b is known as the marginal propensity to consume, i.e. the increase in consumption due to an incremental increase in disposable income, since \partial C / \partial Y_ = b. Geometrically, b is the slope of the consumption function. Keynes proposed this model to fit three stylized facts: * People typically spend a part, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Marginal Propensity To Consume

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending ( consumption) occurs with an increase in disposable income (income after taxes and transfers). The proportion of disposable income which individuals spend on consumption is known as propensity to consume. MPC is the proportion of additional income that an individual consumes. For example, if a household earns one extra dollar of disposable income, and the marginal propensity to consume is 0.65, then of that dollar, the household will spend 65 cents and save 35 cents. Obviously, the household cannot spend ''more'' than the extra dollar (without borrowing or using savings). If the extra money accessed by the individual gives more economic confidence, then the MPC of the individual may well exceed 1, as they may borrow or utilise savings. According to John Maynard Keynes, marginal propensity to consume is less than one. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Consumption (economics)

Consumption refers to the use of resources to fulfill present needs and desires. It is seen in contrast to investing, which is spending for acquisition of ''future'' income. Consumption is a major concept in economics and is also studied in many other social sciences. Different schools of economists define consumption differently. According to mainstream economics, mainstream economists, only the final purchase of newly produced Good (economics), goods and Service (economics), services by individuals for immediate use constitutes consumption, while other types of expenditure — in particular, fixed investment, intermediate consumption, and government spending — are placed in separate categories (see consumer choice). Other economists define consumption much more broadly, as the aggregate of all economic activity that does not entail the design, production and marketing of goods and services (e.g., the selection, adoption, use, disposal and recycling of goods and services). E ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Consumption Function

In economics, the consumption function describes a relationship between consumption and disposable income. The concept is believed to have been introduced into macroeconomics by John Maynard Keynes in 1936, who used it to develop the notion of a government spending multiplier. Details Its simplest form is the ''linear consumption function'' used frequently in simple Keynesian models: :C = a + b \cdot Y_ where a is the autonomous consumption that is independent of disposable income; in other words, consumption when disposable income is zero. The term b \cdot Y_ is the induced consumption that is influenced by the economy's income level Y_. The parameter b is known as the marginal propensity to consume, i.e. the increase in consumption due to an incremental increase in disposable income, since \partial C / \partial Y_ = b. Geometrically, b is the slope of the consumption function. Keynes proposed this model to fit three stylized facts: * People typically spend a part, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Dissaving

Dissaving is negative saving. If spending is greater than disposable income, dissaving is taking place. This spending is financed by already accumulated savings, such as money in a savings account, or it can be borrowed. Household dissaving therefore corresponds to an absolute decrease in their financial investments. Usually dissavings start after retirement, when an individual starts deducting money from the amount that he has been saving during his life time. There are also other reasons for dissavings; like big purchases, huge events, and emergencies. On the macro level, also governments could reach a certain situation where they start dissaving from their accumulated funds. Why people save Savings is when an income contributor keeps a certain amount of the income on a side (saving account) and start having an accumulative amount of money based on their savings. People usually save money for certain reasons such as: 1- Emergencies are those unexpected emerging events that might ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |