|

Home Mortgage Interest Deduction

A home mortgage interest deduction allows taxpayers who own their homes to reduce their taxable income by the amount of interest paid on the loan which is secured by their principal residence (or, sometimes, a second home). The mortgage deduction makes home purchases more attractive, but contributes to higher house prices. Most developed countries do not allow a deduction for interest on personal loans, but the Netherlands, Switzerland, the United States, Belgium, Denmark, and Ireland allow some form of the deduction. Status in countries Canada Canadian federal income tax does not allow a deduction from taxable income for interest on loans secured by the taxpayer's personal residence, but landlords who own rental residential or commercial property may deduct mortgage interest as a reasonable business expense; the difference between the two being that the deduction is only allowed when the property is not for the taxpayer's personal use, but is rented as a business. However, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

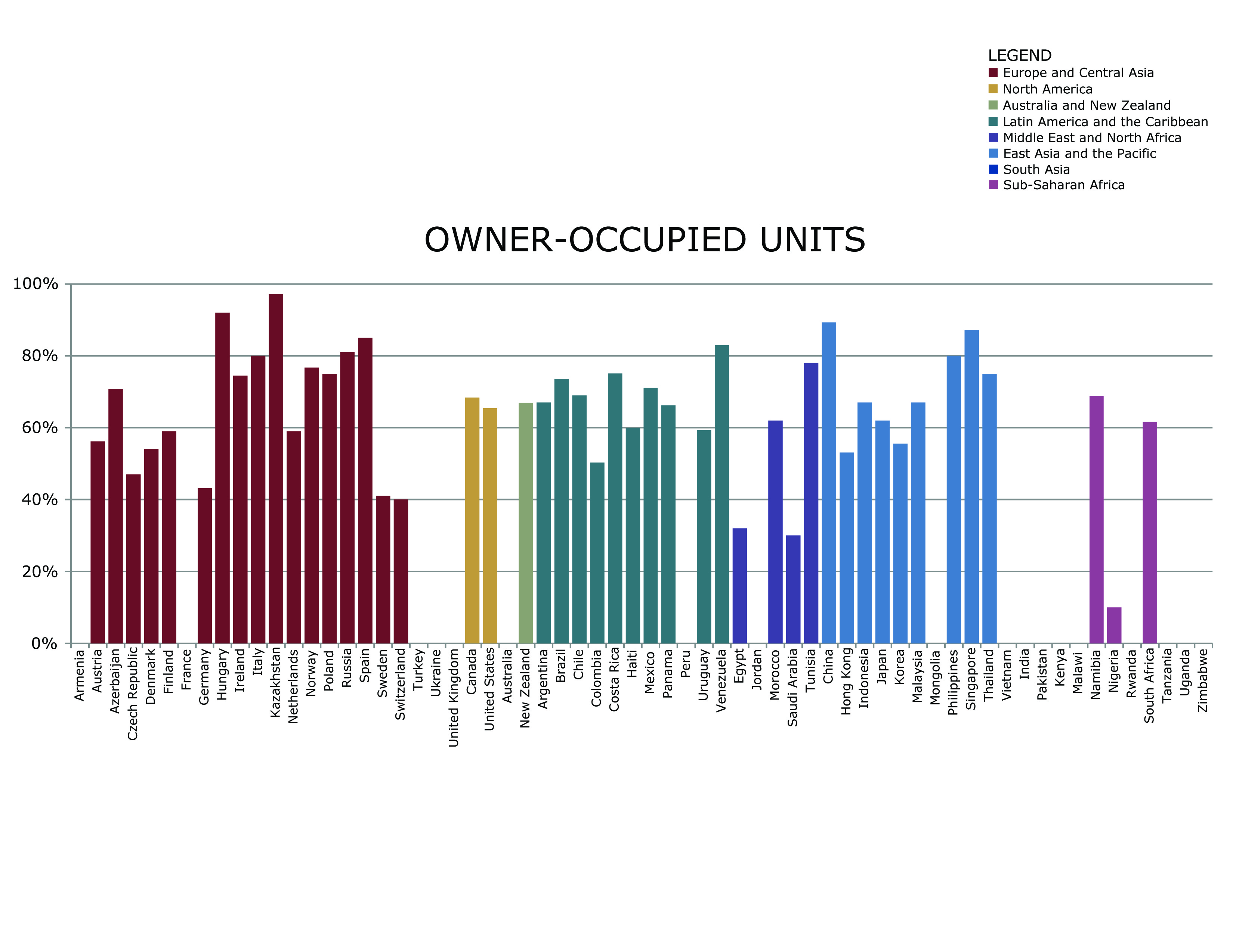

Owner-occupier

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investment. Acquisition Some homes are constructed by the owners with the intent to occupy. Many are inherited. A large number are purchased, as new homes from a real estate developer or as an existing home from a previous landlord or owner-occupier. A house is usually the most expensive single purchase an individual or family makes, and often costs several times the annual household income. Given the high cost, most individuals do not have enough savings on hand to pay the entire amount outright. In developed countries, mortgage loans are available from financial institutions in return for interest. If the home owner f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student Financial Aid (Sweden)

Student financial aid in Sweden consists of grants and loans administered by the Swedish National Board of Student Aid, a Swedish government agency. Students living with their parents often only take the student grant, while other students tend to take both the student grant and the student loan. The loans and grants are normally approved for a maximum of twelve semesters, or 240 weeks. In 2016, weekly student aid for a full-time student was as follows: In 2018 the interest rates for tuition fees were low at 0.13, with the average debt equivalent to $21,000, even though students borrow only for living expenses, as Swedish universities charge no tuition fees. No income tax is paid on student grants and student loans. Students must meet basic requirements to receive financial aid. * Must meet the age requirements. May receive student aid until the year that they turn 56, but the right to take out a loan will be limited from the year that they turn 47. For upper secondary edu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid digital subscribers. It also is a producer of popular podcasts such as '' The Daily''. Founded in 1851 by Henry Jarvis Raymond and George Jones, it was initially published by Raymond, Jones & Company. The ''Times'' has won 132 Pulitzer Prizes, the most of any newspaper, and has long been regarded as a national " newspaper of record". For print it is ranked 18th in the world by circulation and 3rd in the U.S. The paper is owned by the New York Times Company, which is publicly traded. It has been governed by the Sulzberger family since 1896, through a dual-class share structure after its shares became publicly traded. A. G. Sulzberger, the paper's publisher and the company's chairman, is the fifth generation of the family to head the pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Edward Glaeser

Edward Ludwig Glaeser (born May 1, 1967) is an American economist and Fred and Eleanor Glimp Professor of Economics at Harvard University. He is also Director for the Cities Research Programme at the International Growth Centre. He was educated at The Collegiate School in New York City before obtaining his A.B. in economics from Princeton University and his Ph.D. in economics from the University of Chicago. Glaeser joined the faculty of Harvard in 1992, where he is currently (as of January 2018) the Fred and Eleanor Glimp Professor at the Department of Economics. He previously served as the Director of the Taubman Center for State and Local Government and the Director of the Rappaport Institute for Greater Boston (both at Harvard Kennedy School). He is a senior fellow at the Manhattan Institute, and a contributing editor of ''City Journal''. He was also an editor of the ''Quarterly Journal of Economics''. Glaeser and John A. List were mentioned as reasons why the AEA committee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidy

A subsidy or government incentive is a form of financial aid or support extended to an economic sector (business, or individual) generally with the aim of promoting economic and social policy. Although commonly extended from the government, the term subsidy can relate to any type of support – for example from NGOs or as implicit subsidies. Subsidies come in various forms including: direct (cash grants, interest-free loans) and indirect (tax breaks, insurance, low-interest loans, accelerated depreciation, rent rebates). Furthermore, they can be broad or narrow, legal or illegal, ethical or unethical. The most common forms of subsidies are those to the producer or the consumer. Producer/production subsidies ensure producers are better off by either supplying market price support, direct support, or payments to factors of production. Consumer/consumption subsidies commonly reduce the price of goods and services to the consumer. For example, in the US at one time it was cheaper to buy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Foundation

The Tax Foundation is an American think tank based in Washington, D.C. It was founded in 1937 by a group of businessmen in order to "monitor the tax and spending policies of government agencies". The Tax Foundation collects data and publishes research studies on U.S. tax policies at both the federal and state levels. Its stated mission is to "improve lives through tax policy research and education that leads to greater economic growth and opportunity". The Tax Foundation is organized as a 501(c)(3) tax-exempt non-profit educational and research organization, with three primary areas of research: the Center for Federal Tax Policy, the Center for State Tax Policy, and the Center for Legal Reform. The group is known for its annual reports such as ''Facts & Figures: How Does Your State Compare'', which was first produced in 1941, and its " Tax Freedom Day" brochures, which it has produced since the early 1970s. History The Tax Foundation was organized on December 5, 1937, i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Association Of Realtors

The National Association of Realtors (NAR) is an American trade association for those who work in the real estate industry. It has over 1.4 million members, making it one of the biggest trade associations in the USA including NAR's institutes, societies, and councils, involved in all aspects of the residential and commercial real estate industries. The organisation holds a U.S. trademark over the term "realtor", limiting the use of the term to its members. NAR also functions as a self-regulatory organization for real estate brokerage. The organization is headquartered in Chicago. Overview The National Association of Realtors was founded on May 12, 1908 as the ''National Association of Real Estate Exchanges'' in Chicago, Illinois. In 1916, the National Association of Real Estate Exchanges changed its name to The National Association of Real Estate Boards. The current name was adopted in 1972. NAR's members are residential and commercial real estate brokers, real estate salesp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Incentive

In general, incentives are anything that persuade a person to alter their behaviour. It is emphasised that incentives matter by the basic law of economists and the laws of behaviour, which state that higher incentives amount to greater levels of effort and therefore, higher levels of performance. Divisions Incentives can be broken down into two categories; intrinsic incentives and extrinsic incentives. The motivation of people's behaviour comes from within. In activities, they are often motivated by the task itself or the internal reward rather than the external reward. There are many internal rewards, for example, participating in activities can satisfy people's sense of achievement and bring them positive emotions. An intrinsic incentive is when a person is motivated to act in a certain way for their own personal satisfaction. This means that when a person is intrinsically incentivised, they perform a certain task to please themselves and are not seeking any external reward, nor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

El Paso, Texas

El Paso (; "the pass") is a city in and the county seat, seat of El Paso County, Texas, El Paso County in the western corner of the U.S. state of Texas. The 2020 population of the city from the United States Census Bureau, U.S. Census Bureau was 678,815, making it the List of United States cities by population, 23rd-largest city in the U.S., the List of cities in Texas by population, sixth-largest city in Texas, and the second-largest city in the Southwestern United States behind Phoenix, Arizona. The city is also List of U.S. cities with large Hispanic populations, the second-largest majority-Hispanic city in the U.S., with 81% of its population being Hispanic. Its metropolitan statistical area covers all of El Paso and Hudspeth County, Texas, Hudspeth counties in Texas, and had a population of 868,859 in 2020. El Paso has consistently been ranked as one of the safest large cities in America. El Paso stands on the Rio Grande across the Mexico–United States border from Ciuda ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

San Francisco, California

San Francisco (; Spanish for " Saint Francis"), officially the City and County of San Francisco, is the commercial, financial, and cultural center of Northern California. The city proper is the fourth most populous in California and 17th most populous in the United States, with 815,201 residents as of 2021. It covers a land area of , at the end of the San Francisco Peninsula, making it the second most densely populated large U.S. city after New York City, and the fifth most densely populated U.S. county, behind only four of the five New York City boroughs. Among the 91 U.S. cities proper with over 250,000 residents, San Francisco was ranked first by per capita income (at $160,749) and sixth by aggregate income as of 2021. Colloquial nicknames for San Francisco include ''SF'', ''San Fran'', ''The '', ''Frisco'', and ''Baghdad by the Bay''. San Francisco and the surrounding San Francisco Bay Area are a global center of economic activity and the arts and sciences, spurred ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard Deduction

Under United States tax law, the standard deduction is a dollar amount that non- itemizers may subtract from their income before income tax (but not other kinds of tax, such as payroll tax) is applied. Taxpayers may choose either itemized deductions or the standard deduction, but usually choose whichever results in the lesser amount of tax payable. The standard deduction is available to US citizens and aliens who are resident for tax purposes and who are individuals, married persons, and heads of household. The standard deduction is based on filing status and typically increases each year. It is not available to nonresident aliens residing in the United States (with few exceptions, for example, students from India on F1 visa status can use the standard deduction). Additional amounts are available for persons who are blind and/or are at least 65 years of age. The standard deduction is distinct from the personal exemption, which was eliminated by The Tax Cuts and Jobs Act of 2017 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)