|

Expected Value Of Including Uncertainty

In decision theory and quantitative policy analysis, the expected value of including uncertainty (EVIU) is the expected difference in the value of a decision based on a probabilistic analysis versus a decision based on an analysis that ignores uncertainty. Background Decisions must be made every day in the ubiquitous presence of uncertainty. For most day-to-day decisions, various heuristics are used to act reasonably in the presence of uncertainty, often with little thought about its presence. However, for larger high-stakes decisions or decisions in highly public situations, decision makers may often benefit from a more systematic treatment of their decision problem, such as through quantitative analysis or decision analysis. When building a quantitative decision model, a model builder identifies various relevant factors, and encodes these as ''input variables''. From these inputs, other quantities, called ''result variables'', can be computed; these provide information for t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Decision Theory

Decision theory (or the theory of choice; not to be confused with choice theory) is a branch of applied probability theory concerned with the theory of making decisions based on assigning probabilities to various factors and assigning numerical consequences to the outcome. There are three branches of decision theory: # Normative decision theory: Concerned with the identification of optimal decisions, where optimality is often determined by considering an ideal decision-maker who is able to calculate with perfect accuracy and is in some sense fully rational. # Prescriptive decision theory: Concerned with describing observed behaviors through the use of conceptual models, under the assumption that those making the decisions are behaving under some consistent rules. # Descriptive decision theory: Analyzes how individuals actually make the decisions that they do. Decision theory is closely related to the field of game theory and is an interdisciplinary topic, studied by econom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Triangular Distribution

In probability theory and statistics, the triangular distribution is a continuous probability distribution with lower limit ''a'', upper limit ''b'' and mode ''c'', where ''a'' < ''b'' and ''a'' ≤ ''c'' ≤ ''b''. Special cases Mode at a bound The distribution simplifies when ''c'' = ''a'' or ''c'' = ''b''. For example, if ''a'' = 0, ''b'' = 1 and ''c'' = 1, then the and CDF become: : : |

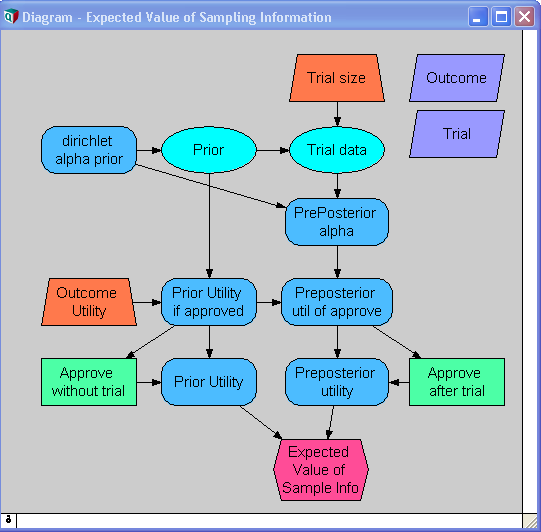

Expected Value Of Sample Information

In decision theory, the expected value of sample information (EVSI) is the expected increase in utility that a decision-maker could obtain from gaining access to a sample (statistics), sample of additional observations before making a decision. The additional information obtained from the sample (statistics), sample may allow them to make a more informed, and thus better, decision, thus resulting in an increase in expected utility. EVSI attempts to estimate what this improvement would be before seeing actual sample data; hence, EVSI is a form of what is known as ''preposterior analysis''. The use of EVSI in decision theory was popularized by Robert Schlaifer and Howard Raiffa in the 1960s. Formulation Let : \begin d\in D & \mbox D \\ x\in X & \mbox X \\ z \in Z & \mbox n \mbox \langle z_1,z_2,..,z_n \rangle \\ U(d,x) & \mbox d \mbox x \\ p(x) & \mbox x \\ p(z, x) & \mbox z \end It is common (but not essential) in EVSI scenarios for Z_i=X, p(z, x)=\prod p(z_i, x) and \int z p( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EVPI

In decision theory, the expected value of perfect information (EVPI) is the price that one would be willing to pay in order to gain access to perfect information. A common discipline that uses the EVPI concept is health economics. In that context and when looking at a decision of whether to adopt a new treatment technology, there is always some degree of uncertainty surrounding the decision, because there is always a chance that the decision turns out to be wrong. The expected value of perfect information analysis tries to measure the expected cost of that uncertainty, which “can be interpreted as the expected value of perfect information (EVPI), since perfect information can eliminate the possibility of making the wrong decision” at least from a theoretical perspective. Equation The problem is modeled with a payoff matrix ''Rij'' in which the row index ''i'' describes a choice that must be made by the player, while the column index ''j'' describes a random variable that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Certainty Equivalence

Stochastic control or stochastic optimal control is a sub field of control theory that deals with the existence of uncertainty either in observations or in the noise that drives the evolution of the system. The system designer assumes, in a Bayesian probability-driven fashion, that random noise with known probability distribution affects the evolution and observation of the state variables. Stochastic control aims to design the time path of the controlled variables that performs the desired control task with minimum cost, somehow defined, despite the presence of this noise. The context may be either discrete time or continuous time. Certainty equivalence An extremely well-studied formulation in stochastic control is that of linear quadratic Gaussian control. Here the model is linear, the objective function is the expected value of a quadratic form, and the disturbances are purely additive. A basic result for discrete-time centralized systems with only additive uncertainty is th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EVIU Comparison

In decision theory and quantitative policy analysis, the expected value of including uncertainty (EVIU) is the expected difference in the value of a decision based on a probabilistic analysis versus a decision based on an analysis that ignores uncertainty. Background Decisions must be made every day in the ubiquitous presence of uncertainty. For most day-to-day decisions, various heuristics are used to act reasonably in the presence of uncertainty, often with little thought about its presence. However, for larger high-stakes decisions or decisions in highly public situations, decision makers may often benefit from a more systematic treatment of their decision problem, such as through quantitative analysis or decision analysis. When building a quantitative decision model, a model builder identifies various relevant factors, and encodes these as ''input variables''. From these inputs, other quantities, called ''result variables'', can be computed; these provide information fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loss Function

In mathematical optimization and decision theory, a loss function or cost function (sometimes also called an error function) is a function that maps an event or values of one or more variables onto a real number intuitively representing some "cost" associated with the event. An optimization problem seeks to minimize a loss function. An objective function is either a loss function or its opposite (in specific domains, variously called a reward function, a profit function, a utility function, a fitness function, etc.), in which case it is to be maximized. The loss function could include terms from several levels of the hierarchy. In statistics, typically a loss function is used for parameter estimation, and the event in question is some function of the difference between estimated and true values for an instance of data. The concept, as old as Laplace, was reintroduced in statistics by Abraham Wald in the middle of the 20th century. In the context of economics, for example, this i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Utility Function

As a topic of economics, utility is used to model worth or value. Its usage has evolved significantly over time. The term was introduced initially as a measure of pleasure or happiness as part of the theory of utilitarianism by moral philosophers such as Jeremy Bentham and John Stuart Mill. The term has been adapted and reapplied within neoclassical economics, which dominates modern economic theory, as a utility function that represents a single consumer's preference ordering over a choice set but is not comparable across consumers. This concept of utility is personal and based on choice rather than on pleasure received, and so is specified more rigorously than the original concept but makes it less useful (and controversial) for ethical decisions. Utility function Consider a set of alternatives among which a person can make a preference ordering. The utility obtained from these alternatives is an unknown function of the utilities obtained from each alternative, not the sum of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EVIU Time To Drive To Airport

In decision theory and quantitative policy analysis, the expected value of including uncertainty (EVIU) is the expected difference in the value of a decision based on a probabilistic analysis versus a decision based on an analysis that ignores uncertainty. Background Decisions must be made every day in the ubiquitous presence of uncertainty. For most day-to-day decisions, various heuristics are used to act reasonably in the presence of uncertainty, often with little thought about its presence. However, for larger high-stakes decisions or decisions in highly public situations, decision makers may often benefit from a more systematic treatment of their decision problem, such as through quantitative analysis or decision analysis. When building a quantitative decision model, a model builder identifies various relevant factors, and encodes these as ''input variables''. From these inputs, other quantities, called ''result variables'', can be computed; these provide information fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Geometric Standard Deviation

In probability theory and statistics, the geometric standard deviation (GSD) describes how spread out are a set of numbers whose preferred average is the geometric mean. For such data, it may be preferred to the more usual standard deviation. Note that unlike the usual ''arithmetic'' standard deviation, the ''geometric'' standard deviation is a multiplicative factor, and thus is dimensionless, rather than having the same dimension as the input values. Thus, the geometric standard deviation may be more appropriately called geometric SD factor.Kirkwood, T.B.L. (1993)"Geometric standard deviation - reply to Bohidar" Drug Dev. Ind. Pharmacy 19(3): 395-6. When using geometric SD factor in conjunction with geometric mean, it should be described as "the range from (the geometric mean divided by the geometric SD factor) to (the geometric mean multiplied by the geometric SD factor), and one cannot add/subtract "geometric SD factor" to/from geometric mean. Definition If the geometric mean ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |