|

Credit History

:''This article deals with the general concept of the term credit history. For detailed information about the same topic in the United States, see Credit score in the United States.'' A credit history is a record of a borrower's responsible repayment of debts. A credit report is a record of the borrower's credit history from a number of sources, including banks, credit card companies, collection agencies, and governments.http://money.usnews.com/money/blogs/my-money/2013/04/22/credit-report-vs-credit-score-do-you-know-the-difference A borrower's credit score is the result of a mathematical algorithm applied to a credit report and other sources of information to predict future delinquency. In many countries, when a customer submits an application for credit from a bank, credit card company, or a store, their information is forwarded to a credit bureau. The credit bureau matches the name, address and other identifying information on the credit applicant with information retained b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Score

A credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual. A credit score is primarily based on a credit report, information typically sourced from credit bureaus. Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to consumers and to mitigate losses due to bad debt. Lenders use credit scores to determine who qualifies for a loan, at what interest rate, and what credit limits. Lenders also use credit scores to determine which customers are likely to bring in the most revenue. Credit scoring is not limited to banks. Other organizations, such as mobile phone companies, insurance companies, landlords, and government departments employ the same techniques. Digital finance companies such as online lenders also use alternative data sources to calculate the creditworthiness of borrowers. By country Australia In Australia, cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Scoring

A credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual. A credit score is primarily based on a credit report, information typically sourced from credit bureaus. Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to consumers and to mitigate losses due to bad debt. Lenders use credit scores to determine who qualifies for a loan, at what interest rate, and what credit limits. Lenders also use credit scores to determine which customers are likely to bring in the most revenue. Credit scoring is not limited to banks. Other organizations, such as mobile phone companies, insurance companies, landlords, and government departments employ the same techniques. Digital finance companies such as online lenders also use alternative data sources to calculate the creditworthiness of borrowers. By country Australia In Australia, cre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Score In The United States

A credit score is a number that provides a comparative estimate of an individual's creditworthiness based on an analysis of their credit report. It is an inexpensive and main alternative to other forms of consumer loan underwriting. Lenders, such as banks and credit card companies, use credit scores to evaluate the risk of lending money to consumers. Lenders contend that widespread use of credit scores has made credit more widely available and less expensive for many consumers. Under the Wall Street reform bill passed in 2010, a consumer is entitled to receive a free report of the specific credit score used if they are denied a loan, credit card or insurance due to their credit score. History Before credit scores, credit was evaluated using credit reports from credit bureaus. During the late 1950s, banks started using computerized credit scoring to redefine creditworthiness as abstract statistical risk. The Equal Credit Opportunity Act banned denying credit on gender or marit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Political And Economic Research Council

Politics (from , ) is the set of activities that are associated with making decisions in groups, or other forms of power relations among individuals, such as the distribution of resources or status. The branch of social science that studies politics and government is referred to as political science. It may be used positively in the context of a "political solution" which is compromising and nonviolent, or descriptively as "the art or science of government", but also often carries a negative connotation.. The concept has been defined in various ways, and different approaches have fundamentally differing views on whether it should be used extensively or limitedly, empirically or normatively, and on whether conflict or co-operation is more essential to it. A variety of methods are deployed in politics, which include promoting one's own political views among people, negotiation with other political subjects, making laws, and exercising internal and external force, including ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Rating

A credit rating is an evaluation of the credit risk of a prospective debtor (an individual, a business, company or a government), predicting their ability to pay back the debt, and an implicit forecast of the likelihood of the debtor defaulting. The credit rating represents an evaluation of a credit rating agency of the qualitative and quantitative information for the prospective debtor, including information provided by the prospective debtor and other non-public information obtained by the credit rating agency's analysts. Credit reporting (or credit score) – is a subset of credit rating – it is a numeric evaluation of an ''individual's'' credit worthiness, which is done by a credit bureau or consumer credit reporting agency. Sovereign credit ratings A sovereign credit rating is the credit rating of a sovereign entity, such as a national government. The sovereign credit rating indicates the risk level of the investing environment of a country and is used by investors when ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

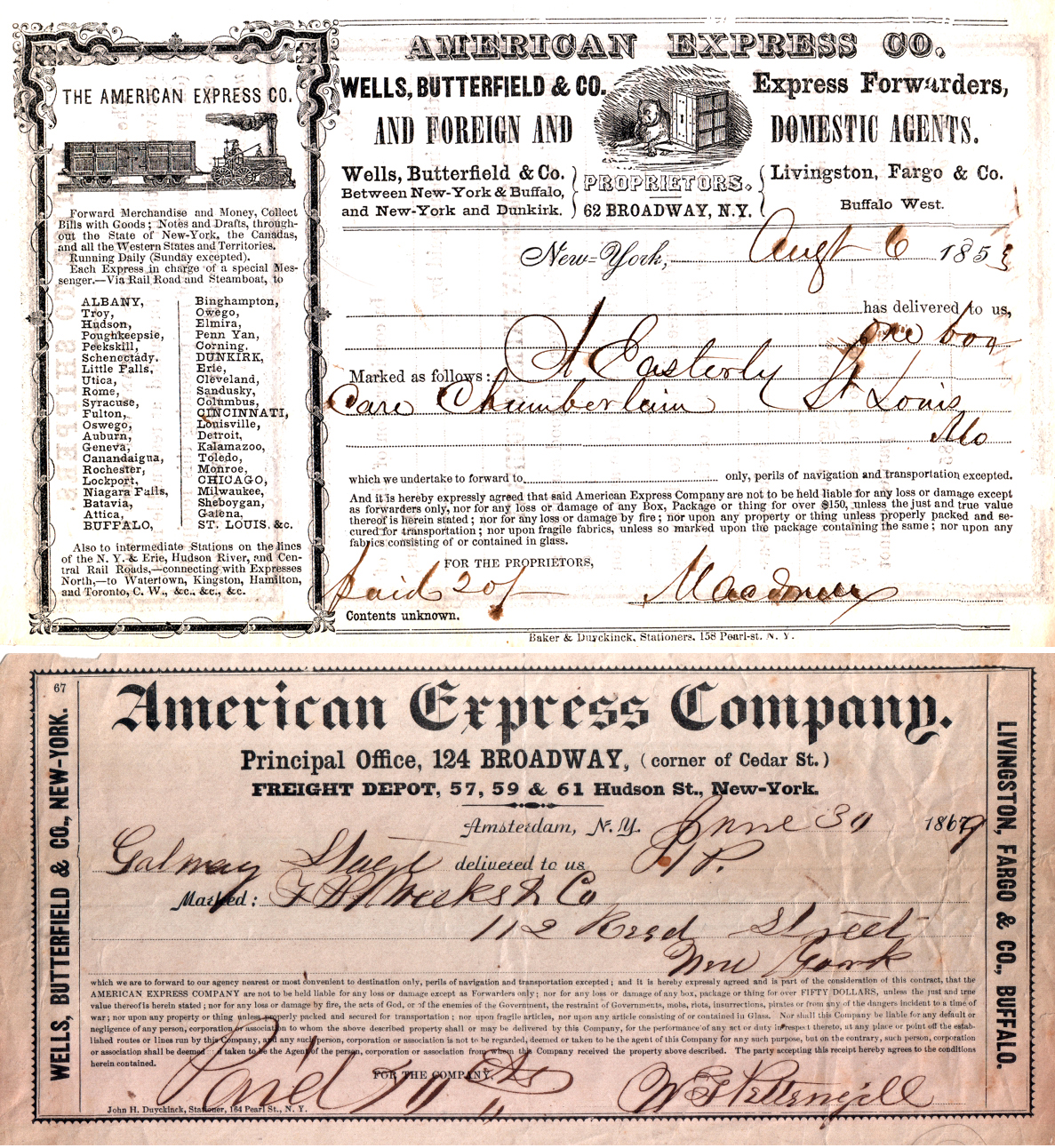

American Express

American Express Company (Amex) is an American multinational corporation, multinational corporation specialized in payment card industry, payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. The company was founded in 1850 and is one of the 30 components of the Dow Jones Industrial Average. The company's logo, adopted in 1958, is a gladiator or centurion whose image appears on the company's well-known traveler's cheques, charge cards, and credit cards. During the 1980s, Amex invested in the brokerage industry, acquiring what became, in increments, Shearson Lehman Hutton and then divesting these into what became Smith Barney Shearson (owned by Primerica) and a revived Lehman Brothers. By 2008 neither the Shearson nor the Lehman name existed. In 2016, credit cards using the American Express network accounted for 22.9% of the total dollar volume of credit card transactions in the United States. , the com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equifax Canada

Equifax Canada Inc is one of two agencies (the other being TransUnion Canada) providing credit bureau and information reports for businesses, including the financial sectors. Owned by Equifax of Atlanta, Georgia, Equifax Canada is based in Toronto, Ontario. Services offered: * Disputes * Fraud * General * Score * Fraudulent avoidance All credit reporting company are required by law to allow Quebecers to check their credit reports and scores online at no charge, Equifax Canada took additional steps to expand this access to all Canadian. See also *Identity theft Identity theft occurs when someone uses another person's personal identifying information, like their name, identifying number, or credit card number, without their permission, to commit fraud or other crimes. The term ''identity theft'' was c ... References External links Equifax Canada Financial services companies of Canada Banking in Canada {{canada-company-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of Spain

The Bank of Spain ( es, link=no, Banco de España) is the central bank of Spain. Established in Madrid in 1782 by Charles III, today the bank is a member of the European System of Central Banks and is also Spain's national competent authority for banking supervision within the Single Supervisory Mechanism. Its activity is regulated by the Bank of Spain Autonomy Act. History Originally named the ''Banco Nacional de San Carlos'', it was founded in 1782 by Charles III in Madrid, to stabilize government finances through its state bonds (''vales reales'') following the American Revolutionary War in which Spain gave military and financial support to the Thirteen Colonies. Although it aided the state, the bank was initially owned privately by stockholders. Its assets included those of "Spanish capitalists, French rentiers, and several treasuries of Indian communities in New Spain" (colonial Mexico). Its first director was French banker François Cabarrus, known in Spain as Francisco C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Spain

, image_flag = Bandera de España.svg , image_coat = Escudo de España (mazonado).svg , national_motto = ''Plus ultra'' (Latin)(English: "Further Beyond") , national_anthem = (English: "Royal March") , image_map = , map_caption = , image_map2 = , capital = Madrid , coordinates = , largest_city = Madrid , languages_type = Official language , languages = Spanish , ethnic_groups = , ethnic_groups_year = , ethnic_groups_ref = , religion = , religion_ref = , religion_year = 2020 , demonym = , government_type = Unitary parliamentary constitutional monarchy , leader_title1 = Monarch , leader_name1 = Felipe VI , leader_title2 = Prime Minister , leader_name2 = Pedro Sánchez , legislature = C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union, and oversees their commercial banking system. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Most central banks also have supervisory and regulatory powers to ensure the stability of member institutions, to prevent bank runs, and to discourage reckless or fraudulent behavior by member banks. Central banks in most developed nations are institutionally independent from political interference. Still, limited control by the executive and legislative bodies exists. Activities of central banks Functions of a central bank usually include: * Monetary policy: by setting the official interest rate and controlling the money supply; *Financial stability: acting as a government's banker and as the bankers' bank ("lender of last resort"); * Reserve management: managing a country ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Consumer Agency Of Canada

The Financial Consumer Agency of Canada (FCAC) is an agency of the Government of Canada that enforces consumer protection legislation, regulations and industry commitments by federally regulated financial entities. It also provides programs and information to help consumers understand their rights and responsibilities when dealing with financial institutions and promotes financial literacy. Mandate FCAC has a dual mandate, set out in the ''Financial Consumer Agency of Canada Act''. Broadly, these two main elements are: * ensuring and enforcing compliance by the financial sector with federal legislation and regulations, as well as voluntary codes of conduct and public commitments * promoting greater financial literacy by informing consumers about their rights and responsibilities when dealing with financial entities and payment card network operators. Under its compliance mandate, FCAC is responsible for: * ensuring that the market conduct of federally regulated financial entities ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Of Canada

The government of Canada (french: gouvernement du Canada) is the body responsible for the federal administration of Canada. A constitutional monarchy, the Crown is the corporation sole, assuming distinct roles: the executive, as the ''Crown-in-Council''; the legislature A legislature is an assembly with the authority to make law Law is a set of rules that are created and are enforceable by social or governmental institutions to regulate behavior,Robertson, ''Crimes against humanity'', 90. with its p ..., as the ''Crown-in-Parliament''; and the courts, as the ''Crown-on-the-Bench''. Three institutions—the Privy Council ( conventionally, the Cabinet); the Parliament of Canada; and the Judiciary of Canada, judiciary, respectively—exercise the powers of the Crown. The term "Government of Canada" (french: Gouvernement du Canada, links=no) more commonly refers specifically to the executive—Minister of the Crown, ministers of the Crown (the Cabinet) and th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)