|

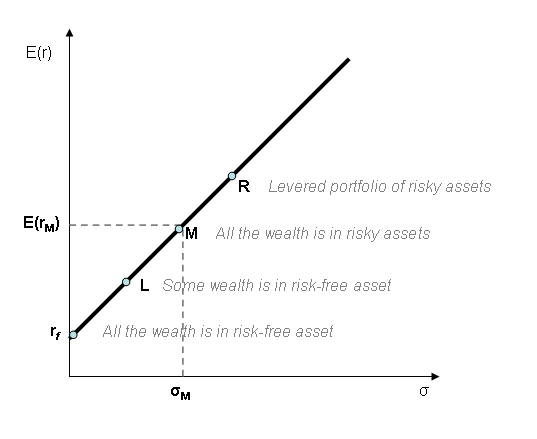

Capital Market Line

Capital market line (CML) is the tangent line drawn from the point of the risk-free asset to the feasible region for risky assets. The tangency point M represents the market portfolio, so named since all rational investors (minimum variance criterion) should hold their risky assets in the same proportions as their weights in the market portfolio. Formula :\mathrm : \sigma_p \mapsto R_f +\sigma_p \cdot\frac The CML results from the combination of the market portfolio and the risk-free asset (the point L). All points along the CML have superior risk-return profiles to any portfolio on the efficient frontier, with the exception of the Market Portfolio, the point on the efficient frontier to which the CML is the tangent. From a CML perspective, the portfolio M is composed entirely of the risky asset, the market, and has no holding of the risk free asset, i.e., money is neither invested in, nor borrowed from the money market account. Points to the left of and above the CML are infeasibl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Feasible Region

In mathematical optimization, a feasible region, feasible set, search space, or solution space is the set of all possible points (sets of values of the choice variables) of an optimization problem that satisfy the problem's constraints, potentially including inequalities, equalities, and integer constraints. This is the initial set of candidate solutions to the problem, before the set of candidates has been narrowed down. For example, consider the problem of minimizing the function x^2+y^4 with respect to the variables x and y, subject to 1 \le x \le 10 and 5 \le y \le 12. \, Here the feasible set is the set of pairs (''x'', ''y'') in which the value of ''x'' is at least 1 and at most 10 and the value of ''y'' is at least 5 and at most 12. The feasible set of the problem is separate from the objective function, which states the criterion to be optimized and which in the above example is x^2+y^4. In many problems, the feasible set reflects a constraint that one or more ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Portfolio

Market portfolio is a portfolio consisting of a weighted sum of every asset in the market, with weights in the proportions that they exist in the market, with the necessary assumption that these assets are infinitely divisible. Richard Roll's critique states that this is only a theoretical concept, as to create a market portfolio for investment purposes in practice would necessarily include every single possible available asset, including real estate, precious metals, stamp collections, jewelry, and anything with any worth, as the theoretical market being referred to would be the world market. There is some question of whether what is used for the market portfolio really matters. Some authors say that it does not make a big difference; you can use any representative index and get similar results. Roll gave an example where different indexes produce much different results, and that by choosing the index you can get any ranking you want. Brown and Brown (1987) examine this, using dif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rational Investor

The term ''Homo economicus'', or economic man, is the portrayal of humans as agents who are consistently rational and narrowly self-interested, and who pursue their subjectively defined ends optimally. It is a word play on ''Homo sapiens'', used in some economic theories and in pedagogy. In game theory, ''Homo economicus'' is often modelled through the assumption of perfect rationality. It assumes that agents always act in a way that maximize utility as a consumer and profit as a producer, and are capable of arbitrarily complex deductions towards that end. They will always be capable of thinking through all possible outcomes and choosing that course of action which will result in the best possible result. The rationality implied in ''Homo economicus'' does not restrict what sort of preferences are admissible. Only naive applications of the ''Homo economicus'' model assume that agents know what is best for their long-term physical and mental health. For example, an agent's u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NASDAQ

The Nasdaq Stock Market () (National Association of Securities Dealers Automated Quotations Stock Market) is an American stock exchange based in New York City. It is the most active stock trading venue in the US by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. History 1971–2000 "Nasdaq" was initially an acronym for the National Association of Securities Dealers Automated Quotations. It was founded in 1971 by the National Association of Securities Dealers (NASD), now known as the Financial Industry Regulatory Authority (FINRA). On February 8, 1971, the Nasdaq stock market began operations as the world's first electronic stock market. At first, it was merely a "quotation system" and did not provide a way to perform electronic trade ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

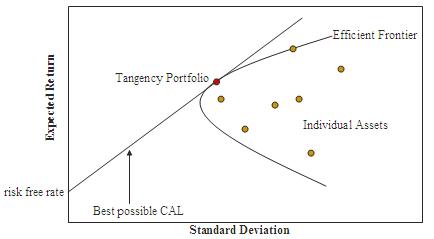

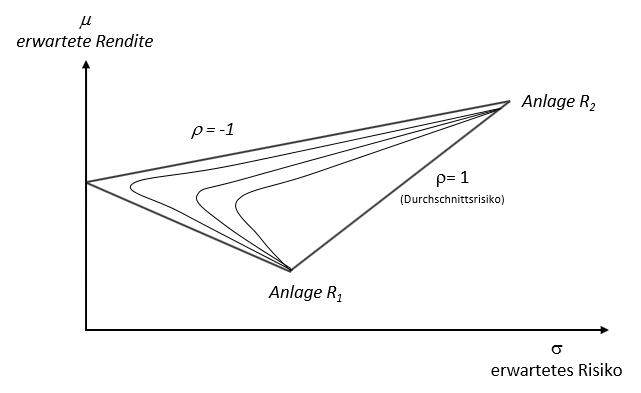

Efficient Frontier

In modern portfolio theory, the efficient frontier (or portfolio frontier) is an investment portfolio which occupies the "efficient" parts of the risk–return spectrum. Formally, it is the set of portfolios which satisfy the condition that no other portfolio exists with a higher expected return but with the same standard deviation of return (i.e., the risk). The efficient frontier was first formulated by Harry Markowitz in 1952; see Markowitz model. Overview A combination of assets, i.e. a portfolio, is referred to as "efficient" if it has the best possible expected level of return for its level of risk (which is represented by the standard deviation of the portfolio's return). Here, every possible combination of risky assets can be plotted in risk–expected return space, and the collection of all such possible portfolios defines a region in this space. In the absence of the opportunity to hold a risk-free asset, this region is the opportunity set (the feasible set). The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sharpe Ratio

In finance, the Sharpe ratio (also known as the Sharpe index, the Sharpe measure, and the reward-to-variability ratio) measures the performance of an investment such as a security or portfolio compared to a risk-free asset, after adjusting for its risk. It is defined as the difference between the returns of the investment and the risk-free return, divided by the standard deviation of the investment returns. It represents the additional amount of return that an investor receives per unit of increase in risk. It was named after William F. Sharpe, who developed it in 1966. Definition Since its revision by the original author, William Sharpe, in 1994, the '' ex-ante'' Sharpe ratio is defined as: : S_a = \frac = \frac, where R_a is the asset return, R_b is the risk-free return (such as a U.S. Treasury security). E_a-R_b/math> is the expected value of the excess of the asset return over the benchmark return, and is the standard deviation of the asset excess return. The ''ex-post' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

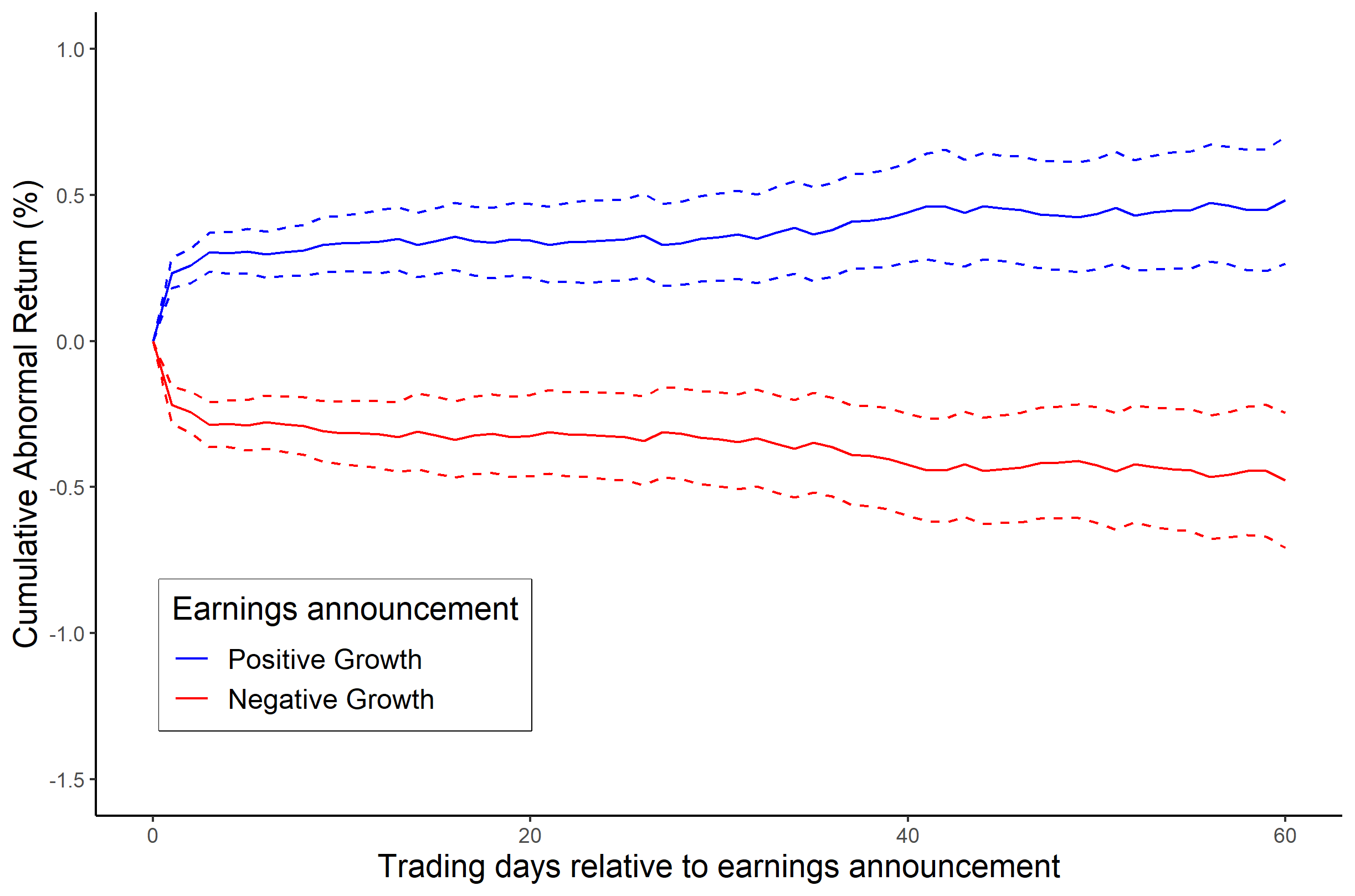

Stock Picking

In financial markets, stock valuation is the method of calculating theoretical values of companies and their stocks. The main use of these methods is to predict future market prices, or more generally, potential market prices, and thus to profit from price movement – stocks that are judged '' undervalued'' (with respect to their theoretical value) are bought, while stocks that are judged ''overvalued'' are sold, in the expectation that undervalued stocks will overall rise in value, while overvalued stocks will generally decrease in value. In the view of fundamental analysis, stock valuation based on fundamentals aims to give an estimate of the intrinsic value of a stock, based on predictions of the future cash flows and profitability of the business. Fundamental analysis may be replaced or augmented by market criteria – what the market will pay for the stock, disregarding intrinsic value. These can be combined as "predictions of future cash flows/profits (fundamental)", togeth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Efficient Market Hypothesis

The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information. Because the EMH is formulated in terms of risk adjustment, it only makes testable predictions when coupled with a particular model of risk. As a result, research in financial economics since at least the 1990s has focused on market anomalies, that is, deviations from specific models of risk. The idea that financial market returns are difficult to predict goes back to Bachelier, Mandelbrot, and Samuelson, but is closely associated with Eugene Fama, in part due to his influential 1970 review of the theoretical and empirical research. The EMH provides the basic logic for modern risk-based theories of asset prices, and frameworks such as consumption-based asset pricing and in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alpha (investment)

Alpha is a measure of the active return on an investment, the performance of that investment compared with a suitable market index. An alpha of 1% means the investment's return on investment over a selected period of time was 1% better than the market during that same period; a negative alpha means the investment underperformed the market. Alpha, along with beta, is one of two key coefficients in the capital asset pricing model used in modern portfolio theory and is closely related to other important quantities such as standard deviation, R-squared and the Sharpe ratio. In modern financial markets, where index funds are widely available for purchase, alpha is commonly used to judge the performance of mutual funds and similar investments. As these funds include various fees normally expressed in percent terms, the fund has to maintain an alpha greater than its fees in order to provide positive gains compared with an index fund. Historically, the vast majority of traditional funds ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Allocation Line

Capital allocation line (CAL) is a graph created by investors to measure the risk of risky and risk-free assets. The graph displays the return to be made by taking on a certain level of risk. Its slope is known as the "reward-to-variability ratio". Formula The capital allocation line is a straight line that has the following equation: :\mathrm : E(r_) = r_F + \sigma_C \frac In this formula ''P'' is the risky portfolio, ''F'' is riskless portfolio, and ''C'' is a combination of portfolios ''P'' and ''F''. The slope of the capital allocation line is equal to the incremental return of the portfolio to the incremental increase of risk. Hence, the slope of the capital allocation line is called the reward-to-variability ratio because the expected return increases continually with the increase of risk as measured by the standard deviation. Derivation If investors can purchase a risk free asset with some return ''rF'', then all correctly priced risky assets or portfolios will have ex ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Efficient Frontier

In modern portfolio theory, the efficient frontier (or portfolio frontier) is an investment portfolio which occupies the "efficient" parts of the risk–return spectrum. Formally, it is the set of portfolios which satisfy the condition that no other portfolio exists with a higher expected return but with the same standard deviation of return (i.e., the risk). The efficient frontier was first formulated by Harry Markowitz in 1952; see Markowitz model. Overview A combination of assets, i.e. a portfolio, is referred to as "efficient" if it has the best possible expected level of return for its level of risk (which is represented by the standard deviation of the portfolio's return). Here, every possible combination of risky assets can be plotted in risk–expected return space, and the collection of all such possible portfolios defines a region in this space. In the absence of the opportunity to hold a risk-free asset, this region is the opportunity set (the feasible set). The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |