|

Cafeteria Plan

A cafeteria plan or cafeteria system is a type of employee benefit plan offered in the United States pursuant to Section 125 of the Internal Revenue Code. Its name comes from the earliest such plans that allowed employees to choose between different types of benefits, similar to the ability of a customer to choose among available items in a cafeteria. Qualified cafeteria plans are excluded from gross income. To qualify, a cafeteria plan must allow employees to choose from two or more benefits consisting of cash or qualified benefit plans. The Internal Revenue Code explicitly excludes deferred compensation plans from qualifying as a cafeteria plan subject to a gross income exemption. Section 125 also provides two exceptions. If the cafeteria plan discriminates in favor of highly compensated employees, the highly compensated employees will be required to report their cafeteria plan benefits as income. The second exception is that if "the statutory nontaxable benefits provided t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employee Benefit

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Employees work in return for wages, which can be paid on the basis of an hourly rate, by piecework or an annual salary, depending on the type of work an employee does, the prevailing conditions of the sector and the bargaining power between the parties. Employees in some sectors may receive gratuities, bonus payments or stock options. In some types of employment, employees may receive benefits in addition to payment. Benefits may include health insurance, housing, disability insurance. Employment is typically governed by employment laws, organisation or legal contracts. Employees and employers An employee contributes labour and expertise to an endeavo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not separately organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, eff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cafeteria

A cafeteria, sometimes called a canteen outside the U.S., is a type of food service location in which there is little or no waiting staff table service, whether a restaurant or within an institution such as a large office building or school; a school dining location is also referred to as a dining hall or lunchroom (in American English). Cafeterias are different from coffeehouses, although the English term came from the Spanish ''cafetería'', same meaning. Instead of table service, there are food-serving counters/stalls or booths, either in a line or allowing arbitrary walking paths. Customers take the food that they desire as they walk along, placing it on a tray. In addition, there are often stations where customers order food, particularly items such as hamburgers or tacos which must be served hot and can be immediately prepared with little waiting. Alternatively, the patron is given a number and the item is brought to their table. For some food items and drinks, such a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deferred Compensation

Deferred compensation is an arrangement in which a portion of an employee's income is paid out at a later date after which the income was earned. Examples of deferred compensation include pensions, retirement plans, and employee stock options. The primary benefit of most deferred compensation is the deferral of tax to the date(s) at which the employee receives the income. United States In the US, Internal Revenue Code section 409A regulates the treatment for federal income tax purposes of "non-qualified deferred compensation", the timing of deferral elections, and of distributions. While technically "deferred compensation" is any arrangement where an employee receives wages after they have earned them, the more common use of the phrase refers to "non-qualified" deferred compensation and a specific part of the tax code that provides a special benefit to corporate executives and other highly compensated corporate employees. Non-qualifying Deferred compensation is a written agreement ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flexible Spending Account

In the United States, a flexible spending account (FSA), also known as a flexible spending arrangement, is one of a number of tax-advantaged financial accounts, resulting in payroll tax savings. One significant disadvantage to using an FSA is that funds not used by the end of the plan year are forfeited to the employer, known as the "use it or lose it" rule. Under the terms of the Affordable Care Act however a plan may permit an employee to carry over up to $550 into the following year without losing the funds but this does not apply to all plans and some plans may have lower limits. The most common type of flexible spending account, the medical expense FSA (also medical FSA or health FSA), is similar to a health savings account (HSA) or a health reimbursement account (HRA). However, while HSAs and HRAs are almost exclusively used as components of a consumer-driven health care plan, medical FSAs are commonly offered with more traditional health plans as well. In addition, funds ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Insurance Contributions Act Tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court rule ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Unemployment Tax Act

The Federal Unemployment Tax Act (or FUTA, ) is a United States federal law that imposes a federal employer tax used to help fund state workforce agencies. Employers report this tax by filing an annual Form 940 with the Internal Revenue Service. In some cases, the employer is required to pay the tax in installments during the tax year. FUTA covers a federal share of the costs of administering the unemployment insurance (UI) and job service programs in every state. In addition, FUTA pays one-half of the cost of extended unemployment benefits (during periods of high unemployment) and provides for a fund from which states may borrow, if necessary, to pay benefits. Legal basis The legality of FUTA has been affirmed in the 1937 Supreme Court case ''Steward Machine Co. v. Davis''. Amount of tax Until June 30, 2011, the Federal Unemployment Tax Act imposed a tax of 6.2%, which was composed of a permanent rate of 6.0% and a temporary rate of 0.2%, which was passed by Congress in 1976. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Acne Vulgaris

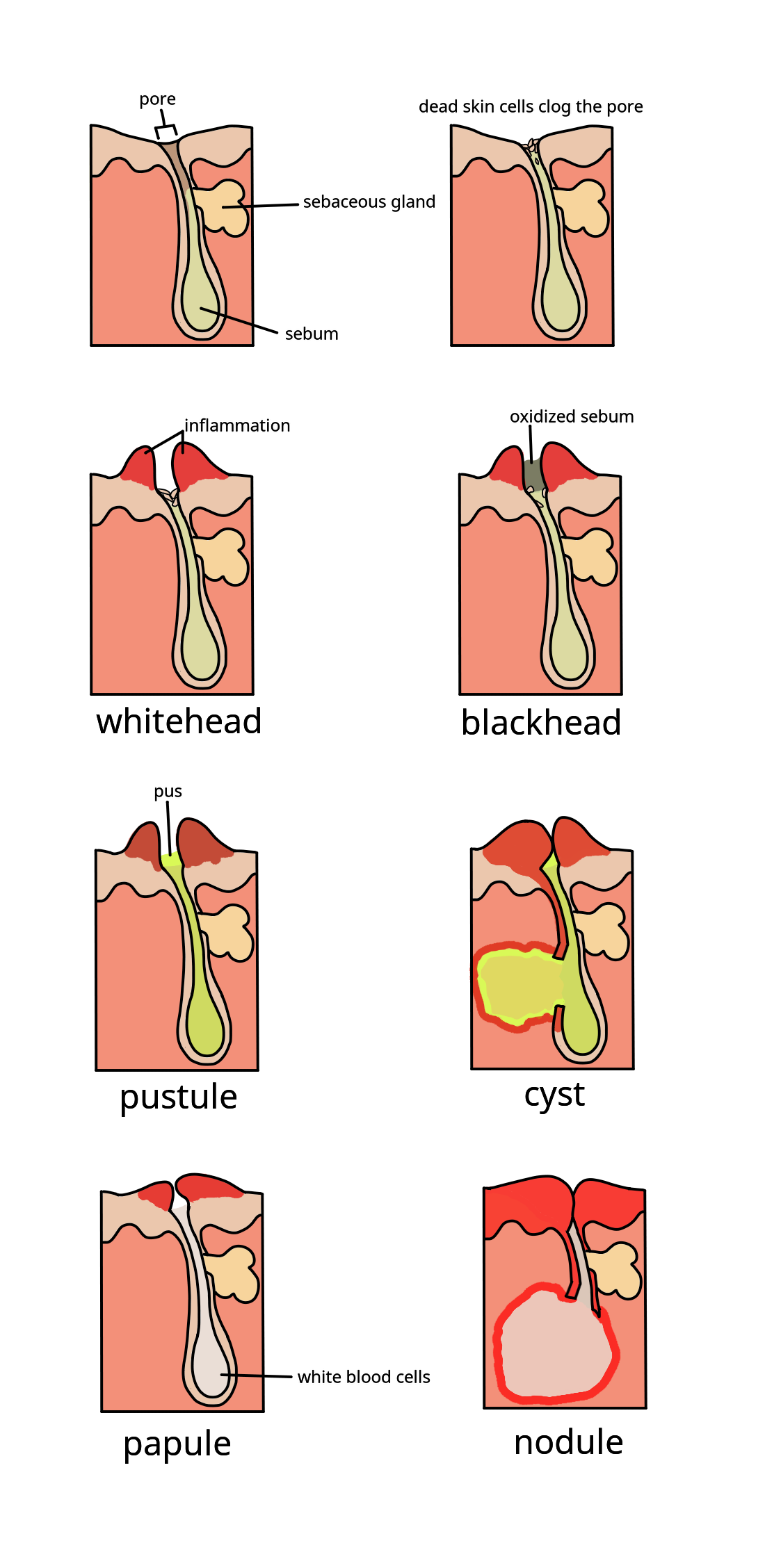

Acne, also known as ''acne vulgaris'', is a long-term skin condition that occurs when dead skin cells and oil from the skin clog hair follicles. Typical features of the condition include blackheads or whiteheads, pimples, oily skin, and possible scarring. It primarily affects skin with a relatively high number of oil glands, including the face, upper part of the chest, and back. The resulting appearance can lead to anxiety, reduced self-esteem, and, in extreme cases, depression or thoughts of suicide. Susceptibility to acne is primarily genetic in 80% of cases. The roles of diet and cigarette smoking in the condition are unclear, and neither cleanliness nor exposure to sunlight appear to play a part. In both sexes, hormones called androgens appear to be part of the underlying mechanism, by causing increased production of sebum. Another common factor is the excessive growth of the bacterium ''Cutibacterium acnes'', which is present on the skin. Treatments for acne are ava ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lactose Intolerance

Lactose intolerance is a common condition caused by a decreased ability to digest lactose, a sugar found in dairy products. Those affected vary in the amount of lactose they can tolerate before symptoms develop. Symptoms may include abdominal pain, bloating, diarrhea, flatulence, and nausea. These symptoms typically start thirty minutes to two hours after eating or drinking milk-based food. Their severity typically depends on the amount a person eats or drinks. Lactose intolerance does not cause damage to the gastrointestinal tract. Lactose intolerance is due to the lack of the enzyme lactase in the small intestines to break lactose down into glucose and galactose. There are four types: primary, secondary, developmental, and congenital. Primary lactose intolerance occurs as the amount of lactase declines as people age. Secondary lactose intolerance is due to injury to the small intestine. Such injury could be the result of infection, celiac disease, inflammatory bowel disease, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United States

The United States, United States of America has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey. Taxes fall much more heavily on labor income than on capital income. Divergent taxes and subsidies for different forms of income and spending can also constitute a form of indirect taxation of some activities over others. For example, individual spending on higher education can ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payroll Taxes In The United States

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital such as higher education. National payroll tax systems Australia The Australian federal government (ATO) requires withholding tax on employment income (payroll taxes of the first type), under a system known as pay-as-you-go (PAYG). The individual states impose payroll taxes of the second type. Bermuda In Bermuda, payroll tax accounts for over a third of the annual national bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |