Payroll taxes in the United States on:

[Wikipedia]

[Google]

[Amazon]

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital such as higher education.

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital such as higher education.

In the United States, payroll taxes are also called employment taxes by the Internal Revenue Service.

In the United States, payroll taxes are assessed by the federal government, some of the 50 states (Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have state income tax; New Hampshire only taxes income from interest and dividends although these will be phased out by 2027),

In the United States, payroll taxes are also called employment taxes by the Internal Revenue Service.

In the United States, payroll taxes are assessed by the federal government, some of the 50 states (Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have state income tax; New Hampshire only taxes income from interest and dividends although these will be phased out by 2027),

26 USC 6672

Payroll tax in ChinaIRS publication 15

- detailed information on federal payroll tax in the U.S.

Trust Fund Recovery Penalty

irs.gov Wages and salaries Withholding taxes Taxation-related lists Payroll

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital such as higher education.

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital such as higher education.

National payroll tax systems

Australia

The Australian federal government (ATO ATO may refer to:

Technology

*Abort to Orbit, an intact abort procedure for Space Shuttle launches

*Arsenic trioxide a potent chemotherapeutic agent for acute promyelocytic leukemia

* ATO fuse

* Automatic train operation

* Assisted take off

Milit ...

) requires withholding tax on employment income (payroll taxes of the first type), under a system known as pay-as-you-go

Pay as you go or PAYG may refer to:

Finance

* Pay-as-you-go tax, or pay-as-you-earn tax

* Pay-as-you-go pension plan

* PAYGO, the practice in the US of financing expenditures with current funds rather than borrowing

* PAUG, a structured financia ...

(PAYG).

The individual states impose payroll taxes of the second type.

Bermuda

InBermuda

)

, anthem = "God Save the King"

, song_type = National song

, song = " Hail to Bermuda"

, image_map =

, map_caption =

, image_map2 =

, mapsize2 =

, map_caption2 =

, subdivision_type = Sovereign state

, subdivision_name =

, e ...

, payroll tax accounts for over a third of the annual national budget, making it the primary source of government revenue. The tax is paid by employers based on the total remuneration (salary and benefits) paid to all employees, at a standard rate of 14% (though, under certain circumstances, can be as low as 4.75%). Employers are allowed to deduct a small percentage of an employee's pay (around 4%). Another tax, social insurance

Social insurance is a form of Social protection, social welfare that provides insurance against economic risks. The insurance may be provided publicly or through the subsidizing of private insurance. In contrast to other forms of Welfare, soci ...

, is withheld by the employer.

Brazil

InBrazil

Brazil ( pt, Brasil; ), officially the Federative Republic of Brazil (Portuguese: ), is the largest country in both South America and Latin America. At and with over 217 million people, Brazil is the world's fifth-largest country by area ...

employers are required to withhold 11% of the employee's wages for Social Security and a certain percentage as Income Tax (according to the applicable tax bracket

Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer). Essentially, tax brackets are the cutoff values for taxable income—income past a certain point ...

). The employer is required to contribute an additional 20% of the total payroll value to the Social Security system. Depending on the company's main activity, the employer must also contribute to federally funded insurance and educational programs.

There is also a required deposit of 8% of the employee's wages (not withheld from him) into a bank account that can be withdrawn only when the employee is fired, or under certain other extraordinary circumstances, such as serious illness (called a "Security Fund for Duration of Employment"). All these contributions amount to a total tax burden of almost 40% of the payroll for the employer and 15% of the employee's wages.

Canada

TheNorthwest Territories

The Northwest Territories (abbreviated ''NT'' or ''NWT''; french: Territoires du Nord-Ouest, formerly ''North-Western Territory'' and ''North-West Territories'' and namely shortened as ''Northwest Territory'') is a federal territory of Canada. ...

in Canada applies a payroll tax of 2% to all employees. It is an example of the second type of payroll tax, but unlike in other jurisdictions, it is paid directly by employees rather than employers. Unlike the first type of payroll tax as it is applied in Canada, though, there is no basic personal exemption below which employees are not required to pay the tax.

Ontario

Ontario ( ; ) is one of the thirteen provinces and territories of Canada.Ontario is located in the geographic eastern half of Canada, but it has historically and politically been considered to be part of Central Canada. Located in Central Ca ...

applies a health premium tax to all payrolls on a sliding scale up to $900 per year.

China

InChina

China, officially the People's Republic of China (PRC), is a country in East Asia. It is the world's most populous country, with a population exceeding 1.4 billion, slightly ahead of India. China spans the equivalent of five time zones and ...

, the payroll tax is a specific tax that is paid to provinces and territories by employers, not by employees. The tax is deducted from the worker's pay. The Chinese Government itself requires only one tax to be withheld from paychecks: the PAYG (or pay-as-you-go) tax, which includes medicare levies and insurances.

Tax calculations and contributions differ from city to city in China, and each city's data will be updated yearly.

Taxable Income = Gross Salary – Social Benefits – ¥3,500 IIT = Taxable Income x Tax Rate – Quick Deduction Net Salary = Gross Salary – Social Benefits – IIT

Croatia

InCroatia

, image_flag = Flag of Croatia.svg

, image_coat = Coat of arms of Croatia.svg

, anthem = "Lijepa naša domovino"("Our Beautiful Homeland")

, image_map =

, map_caption =

, capit ...

, the payroll tax is composed of several items:

* national income tax on personal income ( hr, porez na dohodak), which is applied incrementally with rates of 0% (personal exemption = 3800 HRK), 24% (3800-30000 HRK) and 36% (30000 HRK - )

* optional local surcharge on personal income ( hr, prirez), which is applied by some cities and municipalities on the amount of national tax, currently up to 18% (in Zagreb

Zagreb ( , , , ) is the capital (political), capital and List of cities and towns in Croatia#List of cities and towns, largest city of Croatia. It is in the Northern Croatia, northwest of the country, along the Sava river, at the southern slop ...

)

* pension insurance ( hr, mirovinsko osiguranje), universal 20%, for some people divided into two different funds, one of which is government-managed (15%) and the other is a personal pension fund (5%)

* health insurance ( hr, zdravstveno osiguranje), universal 16.5%

* health insurance exemption exists for the population below 30 years of age as part of government policy to encourage youth employment.

Czech Republic

The income tax in the Czech Republic is progressive. The primary tax rate is 15% of gross income, but for an annual salary that is 48 times bigger than the average monthly salary (38.911 CZK in 2022, around 1.600 EUR), the rate is 23%. That applies only to the difference. The minimum wage to pay income tax is 27.840CZK in 2021 (approx. 1140EUR). For people with trade certificates, the rate applies only to 40% of their revenue. The remaining 60% can be deducted as a standard expense. Freelancers also have to file an Income tax return every year. Taxpayers can apply a few tax deductions, such as a deduction for a child (starting at approx. 600EUR annually in 2021), for being a student (approx. 160EUR in 2021), for a dependent spouse (approx. 1000EUR in 2021) and more. Health and social insurance are mandatory and a part of a payroll tax. The health insurance rate is 13,5%. For employees with a salary higher than the minimum wage (16.200CZK in 2022, approximately 660EUR), 9% pay the employers, and only 4,5% pay the employees. Trade license workers pay it themselves. Categories that do not have to pay health and social insurance are, for example, students or people registered at the unemployment department. The social insurance rate is 31,5% for employees (6,5% paid by the employee and 25% by the employer) and 29,2% for freelancers. The income tax makes up to half of the national income. The health and social insurance make another 30-40%.France

In France, statutory payroll tax only covers employee and employer contributions to the social security system. Income tax deductions from the payroll are voluntary and may be requested by the employee, otherwise, employees are billed 2 mandatory income tax prepayments during the year directly by the tax authority (set at 1/3 of the prior year's final tax bill). Employee payroll tax is made up of assigned taxes for the three branches of the social security system and includes both basic and supplementary coverage. Different percentages apply depending on thresholds that are multiples of the social security earnings ceiling (in 2012 = 36,372 euro per year). Contributions for salaries between the minimum wage and 1.6 times the minimum wage are eligible to relief (known as Fillon relief) of up to 28 percentage points of employer contributions, effectively halving employer non-wage costs.Germany

German employers are obliged to withhold wage tax on a monthly basis. The wage tax withheld will be qualified as prepayment of the income tax of the employee in case the taxpayer files an annual income tax return. The actual tax rate depends on the personal income of the employee and the tax class the employee (and his/her partner) has chosen. The choice of tax class is only important for withholding tax, and therefore for immediately disposable income. The choice of tax class has no effect on tax refunds. In addition to income tax withheld, employees and employers in Germany must pay contributions to finance social security benefits. The social security system consists of four insurances, for which the contribution will be (nearly) equally shared between employer and employee (old age insurance, unemployment insurance, health insurance and nursing care insurance). Contributions are payable only on wages up to the social security threshold: In addition there are some insurance which are covered by the employee only (accident insurance, insolvency insurance, contribution to the maternity allocation, contribution for sick pay allocation for small companies). The following table shows employee and employer contributions by category for the year 2015.Greece

An employer is obligated to deduct tax at source from an employee and to make additional contributions to social security as in many other EU member states. The employer's contribution amounts to 28.06% of the salary. The employee's contribution is 16%.Hong Kong

InHong Kong

Hong Kong ( (US) or (UK); , ), officially the Hong Kong Special Administrative Region of the People's Republic of China ( abbr. Hong Kong SAR or HKSAR), is a city and special administrative region of China on the eastern Pearl River Delt ...

, salaries tax is capped at 15%. Depending on income, employers fall into different tax brackets.

Sweden

In 2018, the Swedish social security contribution paid by the employer is 31.42 percent, calculated on top of the employee's salary. The percentage is lower for old employees. The other type of Swedish payroll tax is the income tax withheld (PAYE

A pay-as-you-earn tax (PAYE), or pay-as-you-go (PAYG) in Australia, is a withholding of taxes on income payments to employees. Amounts withheld are treated as advance payments of income tax due. They are refundable to the extent they exceed tax as ...

), which consists of municipal, county, and, for higher income brackets, state tax. In most municipalities, the income tax comes to approximately 32 percent, with the two higher income brackets also paying a state tax of 20 or 25 percent respectively. The combination of the two types is a total marginal tax

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, and effective. These rates can also be p ...

effect of 52 to 60 percent.

According to a 2019 study in the ''American Economic Review'', a large employee payroll tax cut for young workers did not lead to increases in wages for young workers, but it did lead to an increase in employment, capital, sales, and profits of firms with many young workers.

United Kingdom

In theUnited Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the continental mainland. It comprises England, Scotland, Wales and North ...

, pay as you earn

A pay-as-you-earn tax (PAYE), or pay-as-you-go (PAYG) in Australia, is a withholding of taxes on income payments to employees. Amounts withheld are treated as advance payments of income tax due. They are refundable to the extent they exceed tax as ...

(PAYE) income tax and Employees' National Insurance

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their famil ...

contributions are examples of the first kind of payroll tax, while Employers' National Insurance contributions are an example of the second kind of payroll tax. There are currently (February 2022) five PAYE income tax bands in Scotland and four elsewhere; see for details. Both income tax and National Insurance contributions are paid only on income above a lower threshold. In Scotland this threshold is progressively eliminated for the highest earners, beginning at £100,000 per year.

United States

In the United States, payroll taxes are also called employment taxes by the Internal Revenue Service.

In the United States, payroll taxes are assessed by the federal government, some of the 50 states (Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have state income tax; New Hampshire only taxes income from interest and dividends although these will be phased out by 2027),

In the United States, payroll taxes are also called employment taxes by the Internal Revenue Service.

In the United States, payroll taxes are assessed by the federal government, some of the 50 states (Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have state income tax; New Hampshire only taxes income from interest and dividends although these will be phased out by 2027), Washington, D.C.

)

, image_skyline =

, image_caption = Clockwise from top left: the Washington Monument and Lincoln Memorial on the National Mall, United States Capitol, Logan Circle, Jefferson Memorial, White House, Adams Morgan, ...

, and numerous cities. These taxes are imposed on employers and employees and on various compensation bases and are collected and paid to the taxing jurisdiction by the employers. Most jurisdictions imposing payroll taxes require reporting quarterly and annually in most cases, and electronic reporting is generally required for all but small employers. The Federal Insurance Contributions Act tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for reti ...

is a federal payroll tax imposed on both employees and employers to fund Social Security

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specificall ...

and Medicare—federal programs that provide benefits for retirees, the disabled, and children of deceased workers.

Income tax withholding

Federal, state, and localwithholding tax

Tax withholding, also known as tax retention, Pay-as-You-Go, Pay-as-You-Earn, Tax deduction at source or a ''Prélèvement à la source'', is income tax paid to the government by the payer of the income rather than by the recipient of the income ...

es are required in those jurisdictions imposing an income tax. Employers having contact with the jurisdiction must withhold the tax from wages paid to their employees in those jurisdictions. Computation of the amount of tax to withhold is performed by the employer based on representations by the employee regarding their tax status on IRS Form W-4

Form W-4 (otherwise known as the "Employee's Withholding Allowance Certificate") is an Internal Revenue Service (IRS) tax form completed by an employee in the United States to indicate his or her tax situation ( exemptions, status, etc.) to the em ...

.

Amounts of income tax so withheld must be paid to the taxing jurisdiction, and are available as refundable tax credits

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "disc ...

to the employees. Income taxes withheld from payroll are not final taxes, merely prepayments. Employees must still file income tax returns and self assess tax, claiming amounts withheld as payments.

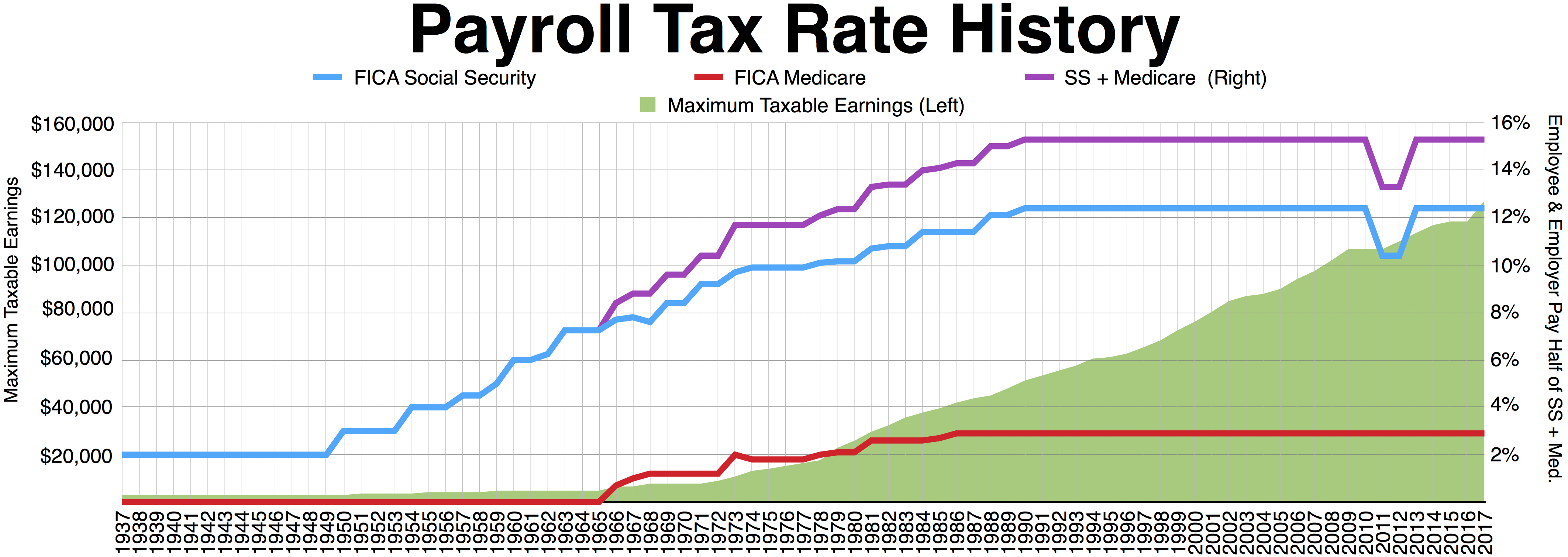

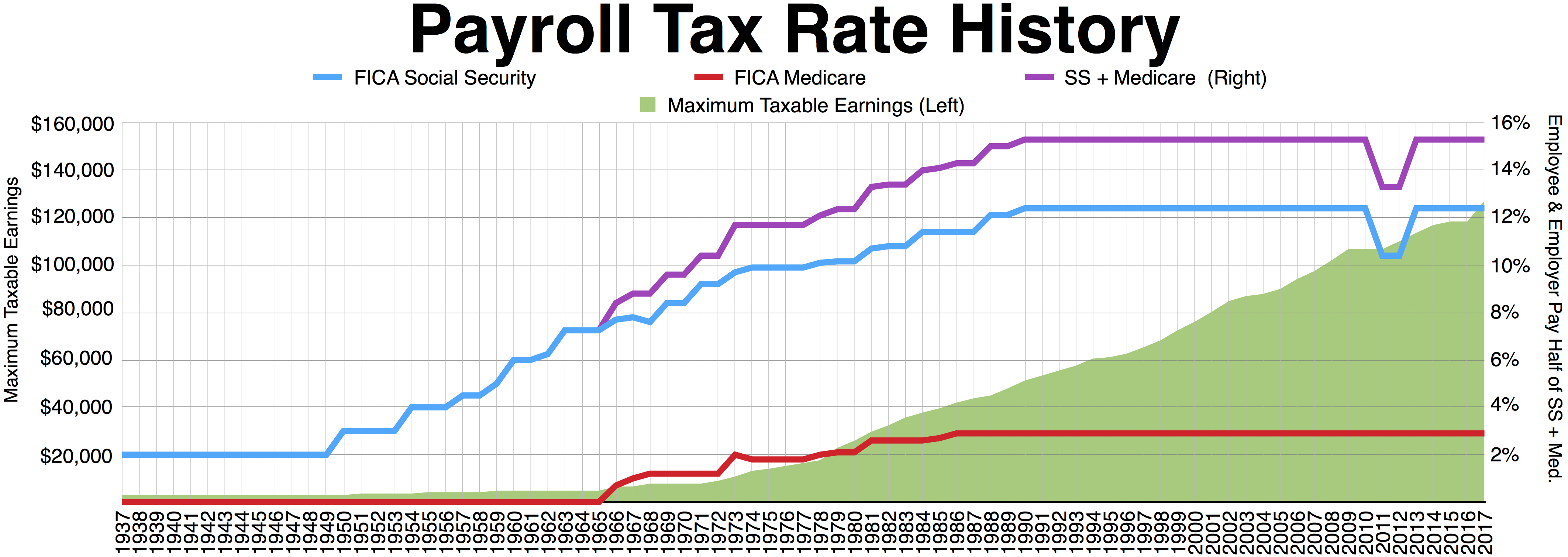

Social Security and Medicare taxes

Federal social insurance taxes are imposed on employers and employees, ordinarily consisting of a tax of 12.4% of wages up to an annual wage maximum ($118,500 in wages, for a maximum contribution of $14,694 in 2016) for Social Security and a tax of 2.9% (half imposed on employer and half withheld from the employee's pay) of all wages for Medicare. The Social Security tax is divided into 6.2% that is visible to employees (the "employee contribution") and 6.2% that is visible only to employers (the "employer's contribution"). For the years 2011 and 2012, the employee's contribution had been temporarily reduced to 4.2%, while the employer's portion remained at 6.2%, but Congress allowed the rate to return to 6.2% for the individual in 2013. To the extent an employee's portion of the 6.2% tax exceeded the maximum by reason of multiple employers, the employee is entitled to a refundabletax credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "disc ...

upon filing an income tax return for the year.

Unemployment taxes

Employers are subject to unemployment taxes by the federal and all state governments. The tax is a percentage of taxable wages with a cap. The tax rate and cap vary by jurisdiction and by employer's industry and experience rating. For 2009, the typical maximum tax per employee was under $1,000. Some states also impose unemployment, disability insurance, or similar taxes on employees.Reporting and payment

Employers must report payroll taxes to the appropriate taxing jurisdiction in the manner each jurisdiction provides. Quarterly reporting of aggregate income tax withholding andSocial Security tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for reti ...

es is required in most jurisdictions. Employers must file reports of aggregate unemployment tax quarterly and annually with each applicable state, and annually at the Federal level.

Each employer is required to provide each employee an annual report on IRS Form W-2

Form W-2 (officially, the "Wage and Tax Statement") is an Internal Revenue Service (IRS) tax form used in the United States to report wages paid to employees and the taxes withheld from them. Employers must complete a Form W-2 for each employee ...

of wages paid and Federal, state and local taxes withheld. A copy must be sent to the IRS, and some state governments also require a copy. These are due by January 31 and February 28 (March 31 if filed electronically), respectively, following the calendar year in which wages are paid. The Form W-2 constitutes proof of payment of tax for the employee.

Employers are required to pay payroll taxes to the taxing jurisdiction under varying rules, in many cases within one banking day. Payment of Federal and many state payroll taxes is required to be made by electronic funds transfer

Electronic funds transfer (EFT) is the electronic transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, via computer-based systems, without the direct intervention of b ...

if certain dollar thresholds are met, or by deposit with a bank for the benefit of the taxing jurisdiction.

Penalties

Failure to timely and properly pay federal payroll taxes results in an automatic penalty of 2% to 10%. This is called theTrust Fund Recovery Penalty

{{UStaxation

In the United States, the term trust fund recovery penalty refers to a tax penalty assessed against the directors or officers of a business entity which failed to pay a required tax on behalf of its employees. The name derives from ...

. Similar state and local penalties apply. Failure to properly file monthly or quarterly returns may result in additional penalties. Failure to file Forms W-2 results in an automatic penalty of up to $50 per form not timely filed. State and local penalties vary by jurisdiction.

A particularly severe penalty applies where federal income tax withholding and Social Security taxes are not paid to the IRS. The penalty of up to 100% of the amount not paid can be assessed against the employer entity as well as any person (such as a corporate officer) having control or custody of the funds from which payment should have been made.See also

*List of countries by tax rates

A comparison of tax rates by countries is difficult and somewhat subjective, as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. The list focuses on ...

References

{{Reflist, colwidth=30emExternal links

Payroll tax in China

- detailed information on federal payroll tax in the U.S.

Trust Fund Recovery Penalty

irs.gov Wages and salaries Withholding taxes Taxation-related lists Payroll