|

Credible Threat

A non-credible threat is a term used in game theory and economics Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interac ... to describe a threat in a sequential game that a ''rational'' player would not actually carry out, because it would not be in his best interest to do so. A threat, and its counterparta commitment, are both defined by American economist and Nobel prize winner, T.C. Schelling, who stated that: "A announces that B's behaviour will lead to a response from A. If this response is a reward, then the announcement is a commitment; if this response is a penalty, then the announcement is a threat." While a player might make a threat, it is only deemed credible if it serves the best interest of the player.Heifetz, A., & Yalon-Fortus, J. (2012). Game Theory: Interactive Strategi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Game Theory

Game theory is the study of mathematical models of strategic interactions. It has applications in many fields of social science, and is used extensively in economics, logic, systems science and computer science. Initially, game theory addressed two-person zero-sum games, in which a participant's gains or losses are exactly balanced by the losses and gains of the other participant. In the 1950s, it was extended to the study of non zero-sum games, and was eventually applied to a wide range of Human behavior, behavioral relations. It is now an umbrella term for the science of rational Decision-making, decision making in humans, animals, and computers. Modern game theory began with the idea of mixed-strategy equilibria in two-person zero-sum games and its proof by John von Neumann. Von Neumann's original proof used the Brouwer fixed-point theorem on continuous mappings into compact convex sets, which became a standard method in game theory and mathematical economics. His paper was f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyses what is viewed as basic elements within economy, economies, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and Expenditure, investment expenditure interact; and the factors of production affecting them, such as: Labour (human activity), labour, Capital (economics), capital, Land (economics), land, and Entrepreneurship, enterprise, inflation, economic growth, and public policies that impact gloss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sequential Game

In game theory, a sequential game is defined as a game where one player selects their action before others, and subsequent players are informed of that choice before making their own decisions. This turn-based structure, governed by a time axis, distinguishes sequential games from Simultaneous game, simultaneous games, where players act without knowledge of others’ choices and outcomes are depicted in Payoff Matrix, payoff matrices (e.g., Rock paper scissors, rock-paper-scissors). Sequential games are a type of dynamic game, a broader category where decisions occur over time (e.g., Differential game, differential games), but they specifically emphasize a clear order of moves with known prior actions. Because later players know what earlier players did, the order of moves shapes strategy through information rather than timing alone. Sequential games are typically represented using Decision tree, decision trees, which map out all possible sequences of play, unlike the static matr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomas Schelling

Thomas Crombie Schelling (April 14, 1921 – December 13, 2016) was an American economist and professor of foreign policy, national security, nuclear strategy, and arms control at the School of Public Policy at the University of Maryland, College Park. He was also co-faculty at the New England Complex Systems Institute. Schelling was awarded the 2005 Nobel Memorial Prize in Economic Sciences (shared with Robert Aumann) for "having enhanced our understanding of conflict and cooperation through game theory analysis." Biography Early years Schelling was born on April 14, 1921, in Oakland, California. He graduated from San Diego High School. He received his bachelor's degree in economics from the University of California, Berkeley, in 1944 and received his PhD in economics from Harvard University in 1951. Career Schelling served with the Marshall Plan in Europe, the White House, and the Executive Office of the President from 1948 to 1953. He wrote most of his dissertation o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Solution Concept

In game theory, a solution concept is a formal rule for predicting how a game will be played. These predictions are called "solutions", and describe which strategies will be adopted by players and, therefore, the result of the game. The most commonly used solution concepts are equilibrium concepts, most famously Nash equilibrium. Many solution concepts, for many games, will result in more than one solution. This puts any one of the solutions in doubt, so a game theorist may apply a refinement to narrow down the solutions. Each successive solution concept presented in the following improves on its predecessor by eliminating implausible equilibria in richer games. Formal definition Let \Gamma be the class of all games and, for each game G \in \Gamma, let S_G be the set of strategy profiles of G. A ''solution concept'' is an element of the direct product \Pi_2^; ''i.e''., a function F: \Gamma \rightarrow \bigcup\nolimits_ 2^ such that F(G) \subseteq S_G for all G \in \Gamma. Rati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Information Set (game Theory)

In game theory, an information set is the basis for decision making in a game, which includes the actions available to players and the potential outcomes of each action. It consists of a collection of decision nodes that a player cannot distinguish between when making a move, due to incomplete information about previous actions or the current state of the game. In other words, when a player's turn comes, they may be uncertain about which exact node in the game tree they are currently at, and the information set represents all the possibilities they must consider. Information sets are a fundamental concept particularly important in games with imperfect information. In games with perfect information (such as chess or Go (game), Go), every information set contains exactly one decision node, as each player can observe all previous moves and knows the exact game state. However, in games with imperfect information—such as most Card game, card games like poker or Bridge (card game), bri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nash Equilibrium

In game theory, the Nash equilibrium is the most commonly used solution concept for non-cooperative games. A Nash equilibrium is a situation where no player could gain by changing their own strategy (holding all other players' strategies fixed). The idea of Nash equilibrium dates back to the time of Cournot, who in 1838 applied it to his model of competition in an oligopoly. If each player has chosen a strategy an action plan based on what has happened so far in the game and no one can increase one's own expected payoff by changing one's strategy while the other players keep theirs unchanged, then the current set of strategy choices constitutes a Nash equilibrium. If two players Alice and Bob choose strategies A and B, (A, B) is a Nash equilibrium if Alice has no other strategy available that does better than A at maximizing her payoff in response to Bob choosing B, and Bob has no other strategy available that does better than B at maximizing his payoff in response to Alice c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Backward Induction

Backward induction is the process of determining a sequence of optimal choices by reasoning from the endpoint of a problem or situation back to its beginning using individual events or actions. Backward induction involves examining the final point in a series of decisions and identifying the optimal process or action required to arrive at that point. This process continues backward until the best action for every possible point along the sequence is determined. Backward induction was first utilized in 1875 by Arthur Cayley, who discovered the method while attempting to solve the secretary problem. In dynamic programming, a method of mathematical optimization, backward induction is used for solving the Bellman equation. In the related fields of automated planning and scheduling and automated theorem proving, the method is called backward search or backward chaining. In chess, it is called retrograde analysis. In game theory, a variant of backward induction is used to compute subgame ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subgame Perfect Nash Equilibrium

In game theory, a subgame perfect equilibrium (SPE), or subgame perfect Nash equilibrium (SPNE), is a refinement of the Nash equilibrium concept, specifically designed for dynamic games where players make sequential decisions. A strategy profile is an SPE if it represents a Nash equilibrium in every possible subgame of the original game. Informally, this means that at any point in the game, the players' behavior from that point onward should represent a Nash equilibrium of the continuation game (i.e. of the subgame), no matter what happened before. This ensures that strategies are credible and rational throughout the entire game, eliminating non-credible threats. Every finite extensive game with complete information (all players know the complete state of the game) and perfect recall (each player remembers all their previous actions and knowledge throughout the game) has a subgame perfect equilibrium. A common method for finding SPE in finite games is backward induction, wher ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-credible Threat

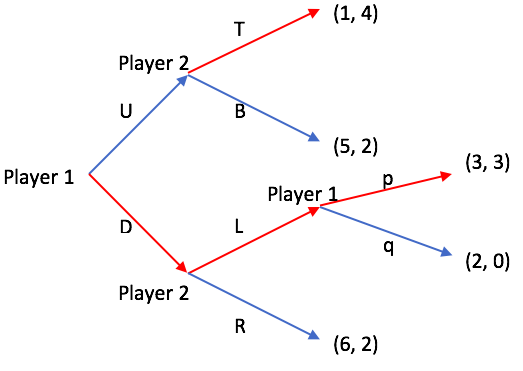

A non-credible threat is a term used in game theory and economics to describe a threat in a sequential game that a ''rational'' player would not actually carry out, because it would not be in his best interest to do so. A threat, and its counterparta commitment, are both defined by American economist and Nobel prize winner, T.C. Schelling, who stated that: "A announces that B's behaviour will lead to a response from A. If this response is a reward, then the announcement is a commitment; if this response is a penalty, then the announcement is a threat." While a player might make a threat, it is only deemed credible if it serves the best interest of the player.Heifetz, A., & Yalon-Fortus, J. (2012). Game Theory: Interactive Strategies in Economics and Management. Cambridge University Press. ProQuest Ebook Central In other words, the player would be willing to carry through with the action that is being threatened regardless of the choice of the other player. This is based on the as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dynamic Inconsistency

In economics, dynamic inconsistency or time inconsistency is a situation in which a decision-maker's preferences change over time in such a way that a preference can become inconsistent at another point in time. This can be thought of as there being many different "selves" within decision makers, with each "self" representing the decision-maker at a different point in time; the inconsistency occurs when not all preferences are aligned. The term "dynamic inconsistency" is more closely affiliated with game theory, whereas "time inconsistency" is more closely affiliated with behavioral economics. In game theory In the context of game theory, dynamic inconsistency is a situation in a dynamic game where a player's best plan for some future period will not be optimal when that future period arrives. A dynamically inconsistent game is subgame imperfect. In this context, the inconsistency is primarily about commitment and credible threats. This manifests itself through a violation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |