|

Conditional Value At Risk

Expected shortfall (ES) is a risk measure—a concept used in the field of financial risk measurement to evaluate the market risk or credit risk of a portfolio. The "expected shortfall at q% level" is the expected return on the portfolio in the worst q\% of cases. ES is an alternative to value at risk that is more sensitive to the shape of the tail of the loss distribution. Expected shortfall is also called conditional value at risk (CVaR), average value at risk (AVaR), expected tail loss (ETL), and superquantile. ES estimates the risk of an investment in a conservative way, focusing on the less profitable outcomes. For high values of q it ignores the most profitable but unlikely possibilities, while for small values of q it focuses on the worst losses. On the other hand, unlike the discounted maximum loss, even for lower values of q the expected shortfall does not consider only the single most catastrophic outcome. A value of q often used in practice is 5%. Expected shortfall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Measure

In financial mathematics, a risk measure is used to determine the amount of an asset or set of assets (traditionally currency) to be kept in reserve. The purpose of this reserve is to make the risks taken by financial institutions, such as banks and insurance companies, acceptable to the regulator. In recent years attention has turned towards convex and coherent risk measurement. Mathematically A risk measure is defined as a mapping from a set of random variables to the real numbers. This set of random variables represents portfolio returns. The common notation for a risk measure associated with a random variable X is \rho(X). A risk measure \rho: \mathcal \to \mathbb \cup \ should have certain properties: ; Normalized : \rho(0) = 0 ; Translative : \mathrm\; a \in \mathbb \; \mathrm \; Z \in \mathcal ,\;\mathrm\; \rho(Z + a) = \rho(Z) - a ; Monotone : \mathrm\; Z_1,Z_2 \in \mathcal \;\mathrm\; Z_1 \leq Z_2 ,\; \mathrm \; \rho(Z_2) \leq \rho(Z_1) Set-valued In a situatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Distortion Function

A distortion function in mathematics and statistics, for example, g: ,1\to ,1/math>, is a non-decreasing function such that g(0) = 0 and g(1) = 1. The dual distortion function is \tilde(x) = 1 - g(1-x). Distortion functions are used to define distortion risk measures. Given a probability space (\Omega,\mathcal,\mathbb), then for any random variable X and any distortion function g we can define a new probability measure In mathematics, a probability measure is a real-valued function defined on a set of events in a probability space that satisfies measure properties such as ''countable additivity''. The difference between a probability measure and the more g ... \mathbb such that for any A \in \mathcal it follows that : \mathbb(A) = g(\mathbb(X \in A)). References Functions related to probability distributions {{probability-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pareto Distribution

The Pareto distribution, named after the Italian civil engineer, economist, and sociologist Vilfredo Pareto ( ), is a power-law probability distribution that is used in description of social, quality control, scientific, geophysical, actuarial, and many other types of observable phenomena; the principle originally applied to describing the distribution of wealth in a society, fitting the trend that a large portion of wealth is held by a small fraction of the population. The Pareto principle or "80-20 rule" stating that 80% of outcomes are due to 20% of causes was named in honour of Pareto, but the concepts are distinct, and only Pareto distributions with shape value () of log45 ≈ 1.16 precisely reflect it. Empirical observation has shown that this 80-20 distribution fits a wide range of cases, including natural phenomena and human activities. Definitions If ''X'' is a random variable with a Pareto (Type I) distribution, then the probability that ''X'' is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exponential Distribution

In probability theory and statistics, the exponential distribution is the probability distribution of the time between events in a Poisson point process, i.e., a process in which events occur continuously and independently at a constant average rate. It is a particular case of the gamma distribution. It is the continuous analogue of the geometric distribution, and it has the key property of being memoryless. In addition to being used for the analysis of Poisson point processes it is found in various other contexts. The exponential distribution is not the same as the class of exponential families of distributions. This is a large class of probability distributions that includes the exponential distribution as one of its members, but also includes many other distributions, like the normal, binomial, gamma, and Poisson distributions. Definitions Probability density function The probability density function (pdf) of an exponential distribution is : f(x;\lambda) = \begin \l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Logistic Distribution

Logistic may refer to: Mathematics * Logistic function, a sigmoid function used in many fields ** Logistic map, a recurrence relation that sometimes exhibits chaos ** Logistic regression, a statistical model using the logistic function ** Logit, the inverse of the logistic function ** Logistic distribution, the derivative of the logistic function, a continuous probability distribution, used in probability theory and statistics * Mathematical logic, subfield of mathematics exploring the applications of formal logic to mathematics Other uses * Logistics, the management of resources and their distributions ** Logistic engineering, the scientific study of logistics ** Military logistics, the study of logistics at the service of military units and operations See also *Logic (other) Logic is the study of the principles and criteria of valid inference and demonstration Logic may also refer to: *Mathematical logic, a branch of mathematics that grew out of symbolic log ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Laplace Distribution

In probability theory and statistics, the Laplace distribution is a continuous probability distribution named after Pierre-Simon Laplace. It is also sometimes called the double exponential distribution, because it can be thought of as two exponential distributions (with an additional location parameter) spliced together along the abscissa, although the term is also sometimes used to refer to the Gumbel distribution. The difference between two independent identically distributed exponential random variables is governed by a Laplace distribution, as is a Brownian motion evaluated at an exponentially distributed random time. Increments of Laplace motion or a variance gamma process evaluated over the time scale also have a Laplace distribution. Definitions Probability density function A random variable has a \textrm(\mu, b) distribution if its probability density function is :f(x\mid\mu,b) = \frac \exp \left( -\frac \right) \,\! Here, \mu is a location parameter and b > ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student's T-distribution

In probability and statistics, Student's ''t''-distribution (or simply the ''t''-distribution) is any member of a family of continuous probability distributions that arise when estimating the mean of a normally distributed population in situations where the sample size is small and the population's standard deviation is unknown. It was developed by English statistician William Sealy Gosset under the pseudonym "Student". The ''t''-distribution plays a role in a number of widely used statistical analyses, including Student's ''t''-test for assessing the statistical significance of the difference between two sample means, the construction of confidence intervals for the difference between two population means, and in linear regression analysis. Student's ''t''-distribution also arises in the Bayesian analysis of data from a normal family. If we take a sample of n observations from a normal distribution, then the ''t''-distribution with \nu=n-1 degrees of freedom can be d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Normal Distribution

In statistics, a normal distribution or Gaussian distribution is a type of continuous probability distribution for a real-valued random variable. The general form of its probability density function is : f(x) = \frac e^ The parameter \mu is the mean or expectation of the distribution (and also its median and mode), while the parameter \sigma is its standard deviation. The variance of the distribution is \sigma^2. A random variable with a Gaussian distribution is said to be normally distributed, and is called a normal deviate. Normal distributions are important in statistics and are often used in the natural and social sciences to represent real-valued random variables whose distributions are not known. Their importance is partly due to the central limit theorem. It states that, under some conditions, the average of many samples (observations) of a random variable with finite mean and variance is itself a random variable—whose distribution converges to a normal dist ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Copula (probability Theory)

In probability theory and statistics, a copula is a multivariate cumulative distribution function for which the marginal probability distribution of each variable is uniform on the interval , 1 Copulas are used to describe/model the dependence (inter-correlation) between random variables. Their name, introduced by applied mathematician Abe Sklar in 1959, comes from the Latin for "link" or "tie", similar but unrelated to grammatical copulas in linguistics. Copulas have been used widely in quantitative finance to model and minimize tail risk and portfolio-optimization applications. Sklar's theorem states that any multivariate joint distribution can be written in terms of univariate marginal distribution functions and a copula which describes the dependence structure between the variables. Copulas are popular in high-dimensional statistical applications as they allow one to easily model and estimate the distribution of random vectors by estimating marginals and cop ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Convex Function

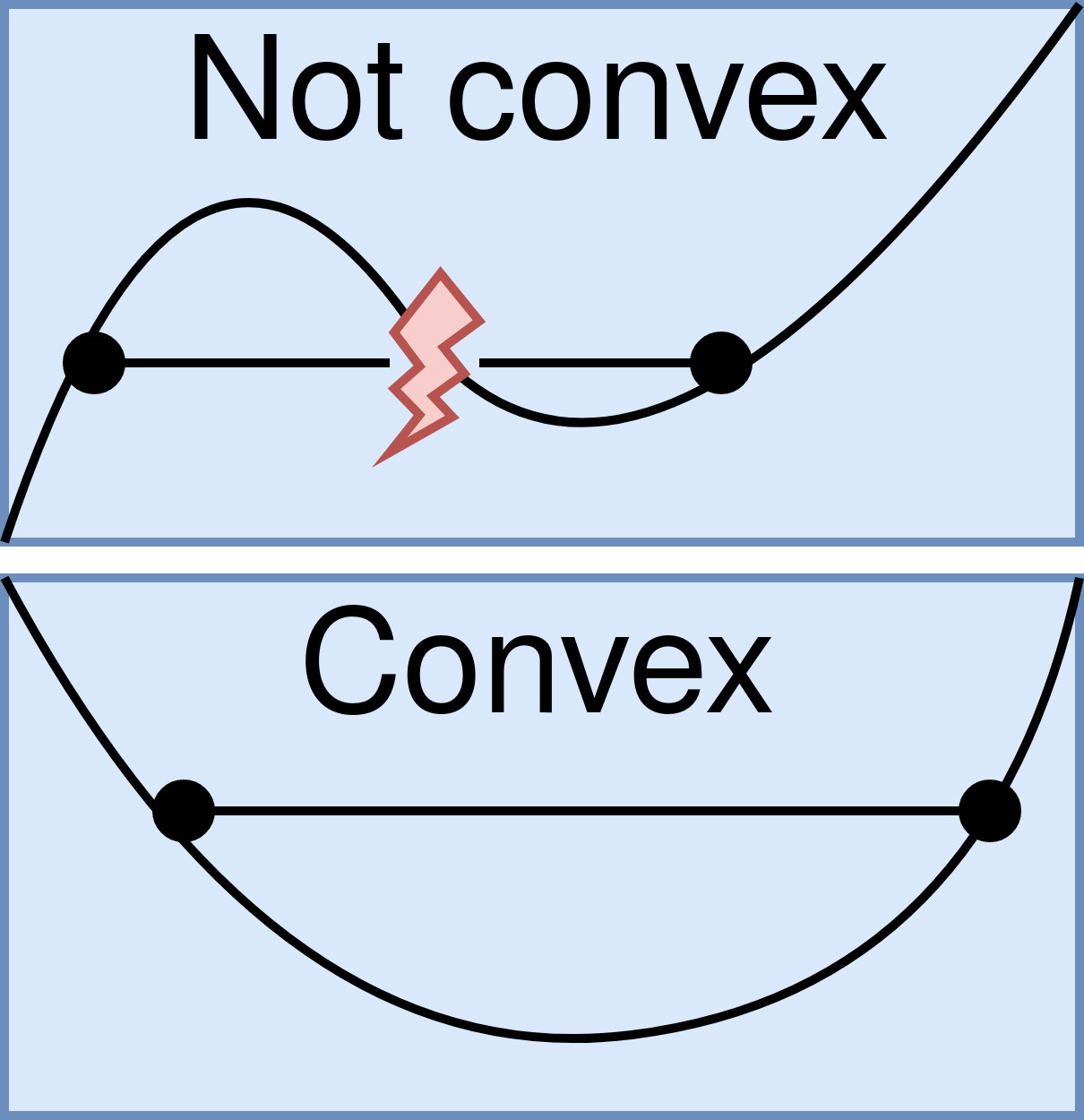

In mathematics, a real-valued function is called convex if the line segment between any two points on the graph of the function lies above the graph between the two points. Equivalently, a function is convex if its epigraph (the set of points on or above the graph of the function) is a convex set. A twice-differentiable function of a single variable is convex if and only if its second derivative is nonnegative on its entire domain. Well-known examples of convex functions of a single variable include the quadratic function x^2 and the exponential function e^x. In simple terms, a convex function refers to a function whose graph is shaped like a cup \cup, while a concave function's graph is shaped like a cap \cap. Convex functions play an important role in many areas of mathematics. They are especially important in the study of optimization problems where they are distinguished by a number of convenient properties. For instance, a strictly convex function on an open set has n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Portfolio Optimization

Portfolio optimization is the process of selecting the best portfolio (asset distribution), out of the set of all portfolios being considered, according to some objective. The objective typically maximizes factors such as expected return, and minimizes costs like financial risk. Factors being considered may range from tangible (such as assets, liabilities, earnings or other fundamentals) to intangible (such as selective divestment). Modern portfolio theory Modern portfolio theory was introduced in a 1952 doctoral thesis by Harry Markowitz; see Markowitz model. It assumes that an investor wants to maximize a portfolio's expected return contingent on any given amount of risk. For portfolios that meet this criterion, known as efficient portfolios, achieving a higher expected return requires taking on more risk, so investors are faced with a trade-off between risk and expected return. This risk-expected return relationship of efficient portfolios is graphically represented by a curve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Modern Portfolio Theory

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of diversification in investing, the idea that owning different kinds of financial assets is less risky than owning only one type. Its key insight is that an asset's risk and return should not be assessed by itself, but by how it contributes to a portfolio's overall risk and return. It uses the variance of asset prices as a proxy for risk. Economist Harry Markowitz introduced MPT in a 1952 essay, for which he was later awarded a Nobel Memorial Prize in Economic Sciences; see Markowitz model. Mathematical model Risk and expected return MPT assumes that investors are risk averse, meaning that given two portfolios that offer the same expected return, investors will prefer the less risky one. Thus, an investor will take on increased risk only if compen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |