|

Wilko V. Swan

''Wilko v. Swan'', 346 U.S. 427 (1953), is a United States Supreme Court decision on the arbitration of securities fraud claims. It had originally been brought by an investor who claimed his broker at Hayden Stone had sold stock to him without disclosing that he and the firm were the primary sellers. By a 7–2 margin the Court held that the provisions of the Securities Act of 1933 barring any waiver of rights under that statute took precedence over the Federal Arbitration Act's (FAA) requirement that arbitration clauses in contracts be given full effect by federal courts. It reversed a decision to the contrary by a divided panel of the Second Circuit Court of Appeals. Justice Stanley Forman Reed wrote the majority opinion that relied on the explicit wording in the Securities Act and expressed doubt as to whether arbitration could truly protect the rights of investors. Robert H. Jackson wrote a short concurrence distancing himself slightly from that latter opinion. Felix Frank ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States District Court For The Southern District Of New York

The United States District Court for the Southern District of New York (in case citations, S.D.N.Y.) is a United States district court, federal trial court whose geographic jurisdiction encompasses eight counties of New York (state), New York State. Two of these are in New York City: Manhattan, New York (Manhattan) and The Bronx, Bronx; six are in Downstate: Westchester County, New York, Westchester, Putnam County, New York, Putnam, Rockland County, New York, Rockland, Orange County, New York, Orange, Dutchess County, New York, Dutchess, and Sullivan County, New York, Sullivan. Appeals from the Southern District of New York are taken to the United States Court of Appeals for the Second Circuit (except for patent claims and claims against the U.S. government under the Tucker Act, which are appealed to the United States Court of Appeals for the Federal Circuit, Federal Circuit). Because it covers Manhattan, the Southern District of New York has long been one of the most active an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities Exchange Act Of 1934

The Securities Exchange Act of 1934 (also called the Exchange Act, '34 Act, or 1934 Act) (, codified at et seq.) is a law governing the secondary trading of securities (stocks, bonds, and debentures) in the United States of America. A landmark of wide-ranging legislation, the Act of '34 and related statutes form the basis of regulation of the financial markets and their participants in the United States. The 1934 Act also established the Securities and Exchange Commission (SEC), the agency primarily responsible for enforcement of United States federal securities law. Companies raise billions of dollars by issuing securities in what is known as the primary market. Contrasted with the Securities Act of 1933, which regulates these original issues, the Securities Exchange Act of 1934 regulates the secondary trading of those securities between persons often unrelated to the issuer, frequently through brokers or dealers. Trillions of dollars are made and lost each year through t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Waiver

A waiver is the voluntary relinquishment or surrender of some known right or privilege. Regulatory agencies of state departments or the federal government may issue waivers to exempt companies from certain regulations. For example, a United States law restricted the size of banks, but when banks exceeded these sizes, they obtained waivers. In another example, the United States federal government may issue waivers to individual states so that they may provide Medicaid in different ways than the law typically requires. While a waiver is often in writing, sometimes a person's words can also be used as a counteract to a waiver. An example of a written waiver is a disclaimer, which becomes a waiver when accepted. When the right to hold a person liable through a lawsuit is waived, the waiver may be called an exculpatory clause, liability waiver, legal release, or hold harmless clause. In some cases, parties may sign a "non-waiver" contract which specifies that no rights are waived, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stay Of Proceedings

Stay may refer to: Places * Stay, Kentucky, an unincorporated community in the US Law * Stay of execution, a ruling to temporarily suspend the enforcement of a court judgment * Stay of proceedings, a ruling halting further legal process in a trial Structures and mechanics * Stay, in a cable-stayed bridge * Stay, bone (corsetry), one of the rigid parts of a corset ** Stays, or corset, a garment worn to mold and shape the torso; See History of corsets * Stays (nautical), heavy ropes, wires, or rods that connect the masts of a sailing vessel to the hull * Boiler stay, an internal structural element of a boiler * Chain stay and seat stay, parts of a bicycle frame * Collar stay, a small rigid piece used to maintain the point of a shirt collar * Guy-wire, or stay, a metal cable used to support a tall structure, such as a radio mast * Stay cable, used to hold up a weight Arts, entertainment, and media Films * ''Stay'' (2005 film), a 2005 psychological thriller directed by Marc Fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Primary Market

:''"Primary market" may also refer to a market in art valuation.'' The primary market is the part of the capital market that deals with the issuance and sale of securities to purchasers directly by the issuer, with the issuer being paid the proceeds. A primary market means the market for new issues of securities, as distinguished from the secondary market, where previously issued securities are bought and sold. "A market is primary if the proceeds of sales go to the issuer of the securities sold." Buyers buy securities that were not previously traded. Concept In a primary market, companies, governments, or public sector institutions can raise funds through bond issues, and corporations can raise capital through the sale of new stock through an initial public offering (IPO). This is often done through an investment bank or underwriter or finance syndicate of securities dealers. The process of selling new shares to buyers is called underwriting. Dealers earn a commission that i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bagholder

In financial slang, a bagholder is a shareholder left holding shares of worthless stocks. The bagholder typically bought in near the peak, when people were hyping the asset and the price was high, and held it all the way through steep declines, losing a lot of money in the process. It can also refer to the holder of other assets and financial instruments that become worthless, such as the junior bonds of a defaulted company or the coins of a failed cryptocurrency. The word is derived by combining shareholder with the expression "left holding the bag." Examples The shareholders could be caught up in a corporate bankruptcy and accounting scandal, as was the case with Enron and Worldcom, or the victims of a pump and dump scheme, in which investors fall victim to e-mail spam, rigged stock tip forums, or other tricks used by stock touts to drive up the shares of worthless penny stocks. If a worthless property is bought with the idea to sell it for a higher price, the gullible person ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Board Of Directors

A board of directors (commonly referred simply as the board) is an executive committee that jointly supervises the activities of an organization, which can be either a for-profit or a nonprofit organization such as a business, nonprofit organization, or a government agency. The powers, duties, and responsibilities of a board of directors are determined by government regulations (including the jurisdiction's corporate law) and the organization's own constitution and by-laws. These authorities may specify the number of members of the board, how they are to be chosen, and how often they are to meet. In an organization with voting members, the board is accountable to, and may be subordinate to, the organization's full membership, which usually elect the members of the board. In a stock corporation, non-executive directors are elected by the shareholders, and the board has ultimate responsibility for the management of the corporation. In nations with codetermination (such as Germ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BorgWarner

BorgWarner Inc. is an American automotive supplier headquartered in Auburn Hills, Michigan. The company maintains production facilities and technical systems at 93 sites (as of June 6, 2022) in 22 countries worldwide and has around 49,000 employees. BorgWarner is one of the 25 largest automotive suppliers in the world. Frédéric Lissalde has been CEO of BorgWarner Inc. since August 1, 2018. The company was formed in 1928 as Borg-Warner Corporation. It was formed as a fusion of companies including Borg & Beck, Marvel-Schebler, Warner Gear and Mechanics Universal Joint. In 1987, Borg-Warner Corporation ceased to exist as a result of a series of complex financial transactions, although a new company of the same name (still Borg-Warner Corporation) continued the business. At the same time, Borg-Warner Automotive Inc. was created as a subsidiary of the new company; the mother company, the new Borg-Warner Corporation, was later known as Borg-Warner Security Corporation. In 1993, Bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mergers And Acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is a legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. A deal may be euphemistically called a ''merger of equals'' if both CEOs agree that joining together is in the best interest of both of their companies. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. In most countries, mergers and acquisitions must co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

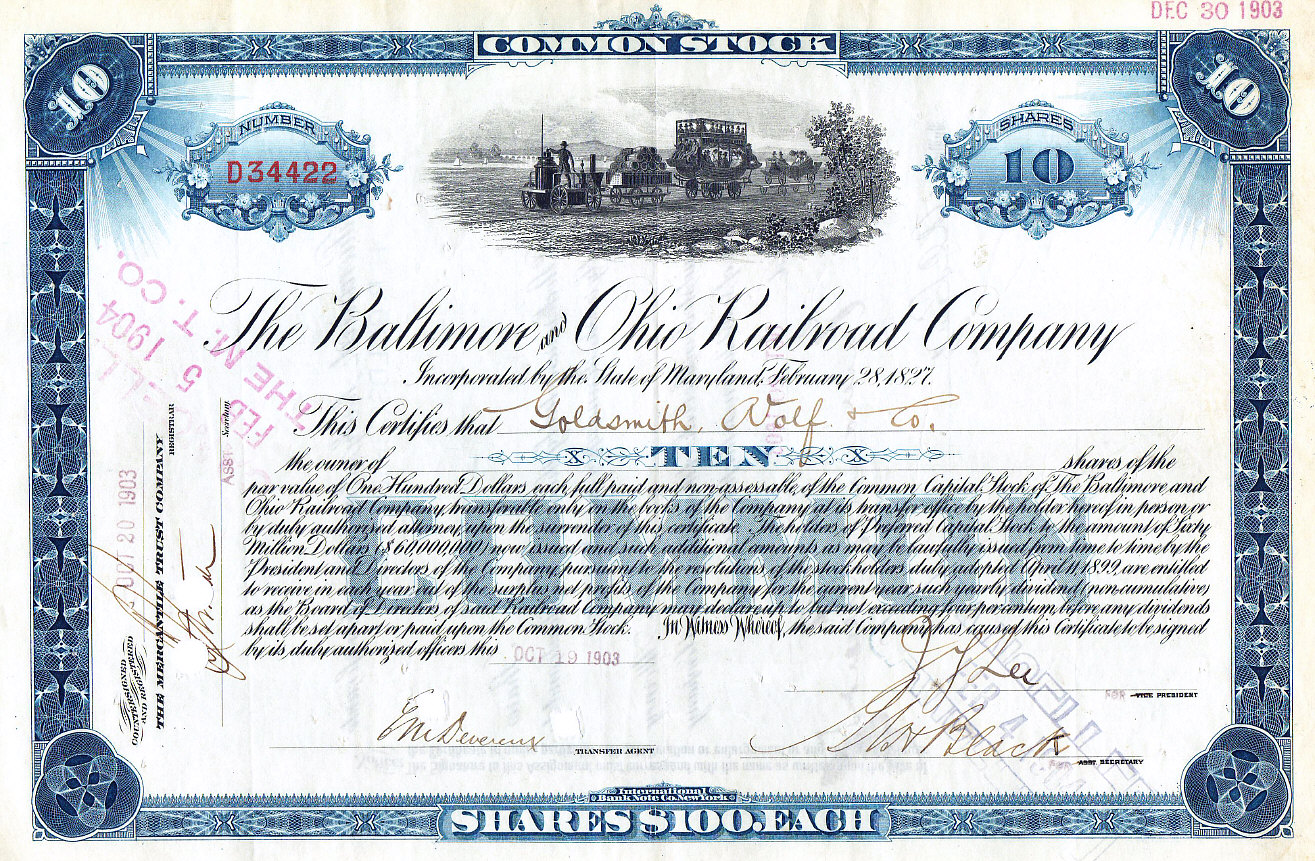

Common Stock

Common stock is a form of corporate equity ownership, a type of security. The terms voting share and ordinary share are also used frequently outside of the United States. They are known as equity shares or ordinary shares in the UK and other Commonwealth realms. This type of share gives the stockholder the right to share in the profits of the company, and to vote on matters of corporate policy and the composition of the members of the board of directors. The owners of common stock do not own any particular assets of the company, which belong to all the shareholders in common. A corporation may issue both ordinary and preference shares, in which case the preference shareholders have priority to receive dividends. In the event of liquidation, ordinary shareholders receive any remaining funds after bondholders, creditors (including employees), and preference shareholders are paid. When the liquidation happens through bankruptcy, the ordinary shareholders typically receive nothing. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pump And Dump

Pump and dump (P&D) is a form of securities fraud that involves artificially inflating the price of an owned stock through false and misleading positive statements, in order to sell the cheaply purchased stock at a higher price. Once the operators of the scheme "dump" (sell) their overvalued shares, the price falls and investors lose their money. This is most common with small-cap cryptocurrencies and very small corporations/companies, i.e. " microcaps". While fraudsters in the past relied on cold calls, the Internet now offers a cheaper and easier way of reaching large numbers of potential investors through spam email, investment research websites, social media, and misinformation. Scenarios Pump-and-dump schemes may take place on the Internet using an email spam campaign, through media channels via a fake press release, or through telemarketing from " boiler room" brokerage houses (such as that dramatized in the 2000 film '' Boiler Room''). Often the stock promoter will cla ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |