|

Welsh Rates Of Income Tax

Welsh Rates of Income Tax (WRIT) ( cy, Cyfradd Treth Incwm Cymru (CTIC)) is part of the UK income tax system and from 6 April 2019 a proportion of income tax paid btaxpayers living in Walesis transferred straight to the Welsh Government to fund Welsh public services. It is administered by HM Revenue and Customs (HMRC), but it is not a devolved tax comparable to Scottish income tax. History The Wales Act 2014, which received Royal Assent on 17 December 2014, gave the National Assembly for Wales the power to set a Welsh basic, higher and additional rate of income tax to be charged on people living in Wales. From 6 April 2019 the UK government reduced the three rates of UK income tax (basic, higher and additional) paid by people in Wales 10p. The Welsh Government decided the WRIT on the Welsh three rates, which added to the reduced UK rates. The Welsh Parliament can set Welsh rates anything from zero to any number in the pound. These Welsh rates are then added to each of the UK i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United Kingdom

Taxation in the United Kingdom may involve payments to at least three different levels of government: central government (HM Revenue & Customs), devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion. History A uniform Land tax, originally was introduced in England during the late 17th century, formed the main source of government revenue throughout the 18th century and the early 19th century.Stephen Dowell, ''History of Taxation and Taxes in England'' (Routledge ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HM Revenue And Customs

HM Revenue and Customs (His Majesty's Revenue and Customs, or HMRC) is a non-ministerial government department, non-ministerial Departments of the United Kingdom Government, department of the His Majesty's Government, UK Government responsible for the tax collection, collection of Taxation in the United Kingdom, taxes, the payment of some forms of Welfare state in the United Kingdom, state support, the administration of other regulatory Regime#Politics, regimes including the national minimum wage and the issuance of national insurance numbers. HMRC was formed by the merger of the Inland Revenue and HM Customs and Excise, which took effect on 18 April 2005. The department's logo is the St Edward's Crown enclosed within a circle. Prior to the Elizabeth II, Queen's death on 8 September 2022, the department was known as ''Her'' Majesty's Revenue and Customs and has since been amended to reflect the change of monarch. Departmental responsibilities The department is responsible for the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scottish Income Tax

Income tax in Scotland is a tax of personal income gained through employment. This is a tax controlled by the Scottish Parliament, and collected by the UK government agency HM Revenue & Customs. Since 2017, the Scottish Parliament has had the ability to set income tax rates and bands, apart from the personal allowance. Over the next couple of years, some modest differences developed between income tax rates in Scotland and those elsewhere in the UK. History When the devolved Scottish Parliament was set up in 1999, the Scottish Parliament had the power to Scottish variable rate, vary the rate of income tax by 3% (in either direction) from the rates applied in the rest of the UK. This power was specifically authorised by the second question of the 1997 Scottish devolution referendum, 1997 devolution referendum. In any event, no Scottish Government ever chose to use the variable rate, and left tax rates the same as they were in the rest of the UK. Following the passage of the Sc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wales Act 2014

The Wales Act 2014legislation.gov.uk Wales Act 2014 is an Act of the . The bill was introduced to the on 20 March 2014 by , |

Royal Assent

Royal assent is the method by which a monarch formally approves an act of the legislature, either directly or through an official acting on the monarch's behalf. In some jurisdictions, royal assent is equivalent to promulgation, while in others that is a separate step. Under a modern constitutional monarchy, royal assent is considered little more than a formality. Even in nations such as the United Kingdom, Norway, the Netherlands, Liechtenstein and Monaco which still, in theory, permit their monarch to withhold assent to laws, the monarch almost never does so, except in a dire political emergency or on advice of government. While the power to veto by withholding royal assent was once exercised often by European monarchs, such an occurrence has been very rare since the eighteenth century. Royal assent is typically associated with elaborate ceremony. In the United Kingdom the Sovereign may appear personally in the House of Lords or may appoint Lords Commissioners, who announce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welsh Government

The Welsh Government ( cy, Llywodraeth Cymru) is the Welsh devolution, devolved government of Wales. The government consists of ministers and Minister (government), deputy ministers, and also of a Counsel General for Wales, counsel general. Ministers only attend the Cabinet Meetings of the Welsh Government. It is led by the First Minister of Wales, first minister, usually the leader of the largest party in the Senedd (Welsh Parliament; ), who selects ministers and deputy ministers with the approval of the Senedd. The government is responsible for Table (parliamentary procedure), tabling policy in List of devolved matters in Wales, devolved areas (such as health, education, economic development, transport and local government) for consideration by the Senedd and implementing policy that has been approved by it. The current Welsh Government is a Second Drakeford government, Labour minority administration, following the 2021 Senedd election. Mark Drakeford has been the first minister ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pound Sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and the word "pound" is also used to refer to the British currency generally, often qualified in international contexts as the British pound or the pound sterling. Sterling is the world's oldest currency that is still in use and that has been in continuous use since its inception. It is currently the fourth most-traded currency in the foreign exchange market, after the United States dollar, the euro, and the Japanese yen. Together with those three currencies and Renminbi, it forms the basket of currencies which calculate the value of IMF special drawing rights. As of mid-2021, sterling is also the fourth most-held reserve currency in global reserves. The Bank of England is the central bank for sterling, issuing its own banknotes, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HM Treasury

His Majesty's Treasury (HM Treasury), occasionally referred to as the Exchequer, or more informally the Treasury, is a department of His Majesty's Government responsible for developing and executing the government's public finance policy and economic policy. The Treasury maintains the Online System for Central Accounting and Reporting (OSCAR), the replacement for the Combined Online Information System (COINS), which itemises departmental spending under thousands of category headings, and from which the Whole of Government Accounts (WGA) annual financial statements are produced. History The origins of the Treasury of England have been traced by some to an individual known as Henry the Treasurer, a servant to King William the Conqueror. This claim is based on an entry in the Domesday Book showing the individual Henry "the treasurer" as a landowner in Winchester, where the royal treasure was stored. The Treasury of the United Kingdom thus traces its origins to the Treasury of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Of The United Kingdom

ga, Rialtas a Shoilse gd, Riaghaltas a Mhòrachd , image = HM Government logo.svg , image_size = 220px , image2 = Royal Coat of Arms of the United Kingdom (HM Government).svg , image_size2 = 180px , caption = Royal coat of arms of the United Kingdom, Royal Arms , date_established = , state = United Kingdom , address = 10 Downing Street, London , leader_title = Prime Minister of the United Kingdom, Prime Minister (Rishi Sunak) , appointed = Monarchy of the United Kingdom, Monarch of the United Kingdom (Charles III) , budget = 882 billion , main_organ = Cabinet of the United Kingdom , ministries = 23 Departments of the Government of the United Kingdom#Ministerial departments, ministerial departments, 20 Departments of the Government of the United Kingdom#Non-ministerial departments, non-ministerial departments , responsible = Parliament of the United Kingdom , url = The Government of the United Kingdom (commonly referred to as British Governmen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Block Grant

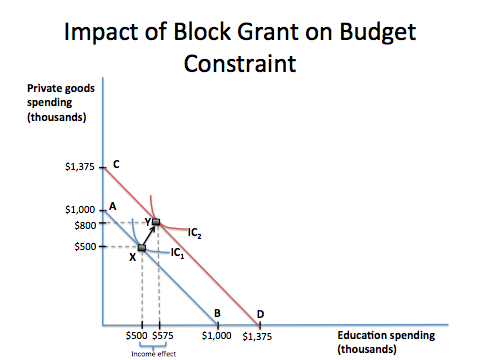

A block grant is a grant-in-aid of a specified amount from a larger government to a smaller regional government body. Block grants have less oversight from the larger government and provide flexibility to each subsidiary government body in terms of designing and implementing programs. Block grants, categorical grants, and general revenue sharing are three types of federal government grants-in-aid programs.A block grant differs from a categorical grant, in that the latter has stricter and more specific provisions on the how it is to be spent. Graphical representation The figure demonstrates the impact of an education block grant on a town's budget constraint. According to microeconomic theory, the grant shifts the town's budget constraint outwards, enabling the town to spend more on both education and other goods, due to the income effect. While this increases the town's utility, it does not maximize the town's spending on education. Therefore, if the goal of a grant progr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

England

England is a country that is part of the United Kingdom. It shares land borders with Wales to its west and Scotland to its north. The Irish Sea lies northwest and the Celtic Sea to the southwest. It is separated from continental Europe by the North Sea to the east and the English Channel to the south. The country covers five-eighths of the island of Great Britain, which lies in the North Atlantic, and includes over 100 smaller islands, such as the Isles of Scilly and the Isle of Wight. The area now called England was first inhabited by modern humans during the Upper Paleolithic period, but takes its name from the Angles, a Germanic tribe deriving its name from the Anglia peninsula, who settled during the 5th and 6th centuries. England became a unified state in the 10th century and has had a significant cultural and legal impact on the wider world since the Age of Discovery, which began during the 15th century. The English language, the Anglican Church, and Engli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welsh Revenue Authority

The Welsh Revenue Authority ( cy, Awdurdod Cyllid Cymru) is a non-ministerial department of the Welsh Government responsible for the administration and collection of devolved taxes in Wales. The Welsh Revenue Authority is accountable to the Senedd. History For over 800 years most taxes in Wales had been collected by the UK Government. The Welsh Revenue Authority was formed in 2017 as the first non-ministerial government department of the Welsh Government, in anticipation of it becoming responsible for collecting taxes devolved to the Senedd under the terms of the Wales Act 2014 and 2017. The 2017 Act also gave the Senedd powers to vary the basic rate of income tax by 10p, but this will be administered by HMRC. The Tax Collection and Management (Wales) Act 2016, which establishes the legal basis for the operation of the Welsh Revenue Authority, was passed by the Welsh Parliament in April 2016. The Welsh Revenue Authority was officially established to collect Wales' newly devo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.png)