|

Wirecard AG

Wirecard AG is an insolvent German payment processor and financial services provider whose former CEO, COO, two board members, and other executives have been arrested or otherwise implicated in criminal proceedings. In June 2020, the company announced that €1.9 billion in cash was missing. It owed €3.2 billion in debt. The company is being dismantled after it sold the assets of its main business unit to Santander Bank for €100 million in November 2020. Other assets, including its North American, UK and Brazilian units had been previously sold at nondisclosed prices. The company offered electronic payment transaction services and risk management, and issued and processed physical and virtual cards. As of 2017, the company was listed on the Frankfurt Stock Exchange, and was a part of the DAX stock index from September 2018 to August 2020. The company is at the center of an international financial scandal. Allegations of accounting malpractices had trailed the company ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aktiengesellschaft

(; abbreviated AG, ) is a German word for a corporation limited by Share (finance), share ownership (i.e. one which is owned by its shareholders) whose shares may be traded on a stock market. The term is used in Germany, Austria, Switzerland (where it is equivalent to a ''S.A. (corporation), société anonyme'' or a ''società per azioni''), and South Tyrol for companies incorporated there. It is also used in Luxembourg (as lb, Aktiëgesellschaft, label=none, ), although the equivalent French language term ''S.A. (corporation), société anonyme'' is more common. In the United Kingdom, the equivalent term is public limited company, "PLC" and in the United States while the terms Incorporation (business), "incorporated" or "corporation" are typically used, technically the more precise equivalent term is "joint-stock company" (though note for the British term only a minority of public limited companies have their shares listed on stock exchanges). Meaning of the word The German w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Santander Bank

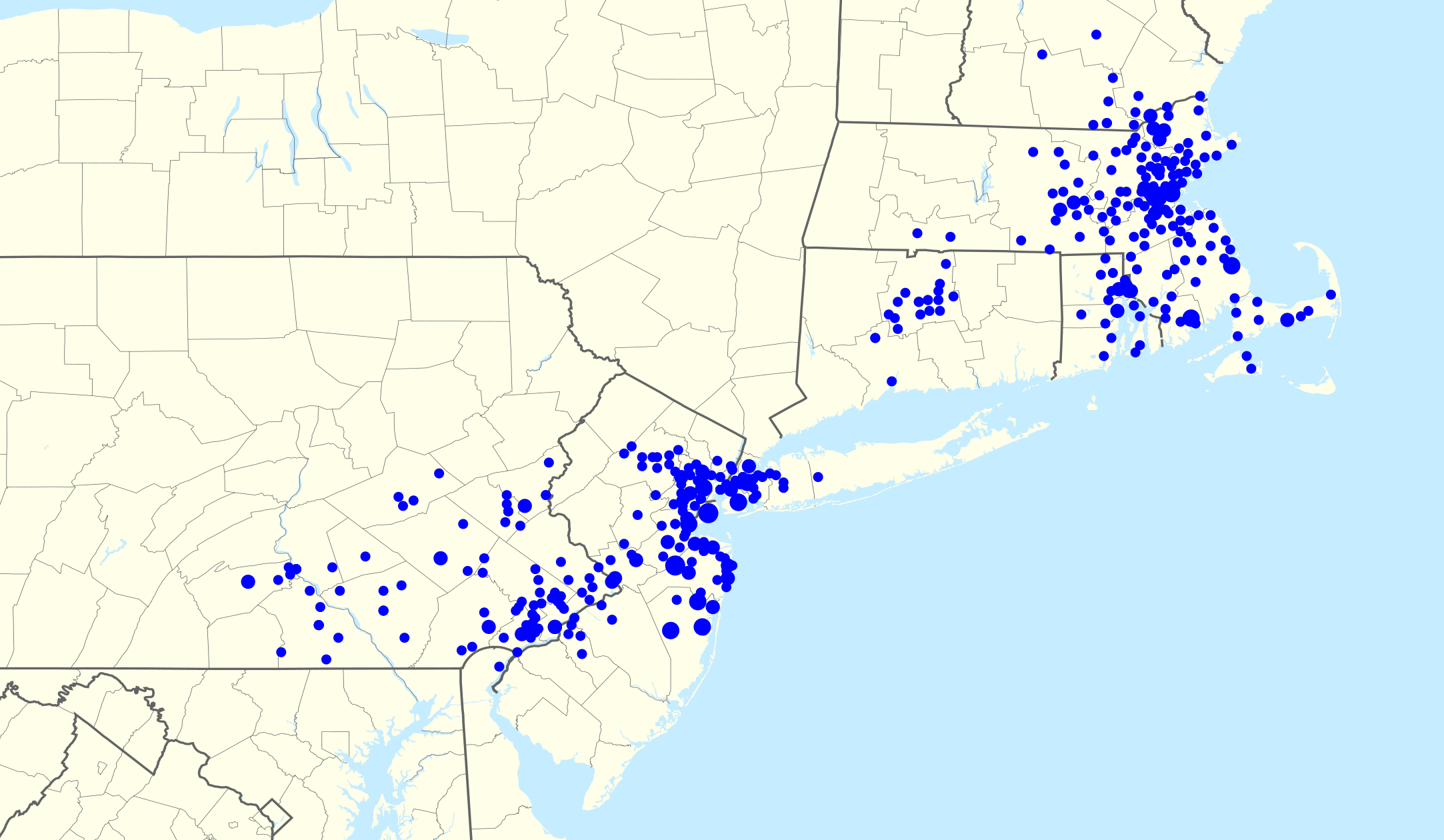

Santander Bank, N. A. (), formerly Sovereign Bank, is a wholly owned subsidiary of the Spanish Santander Group. It is based in Boston and its principal market is the northeastern United States. It has $57.5 billion in deposits, operates about 650 retail banking offices and over 2,000 ATMs, and employs approximately 9,800 people. It offers an array of financial services and products including retail banking, mortgages, corporate banking, cash management, credit card, capital markets, trust and wealth management, and insurance. Sovereign Bank was rebranded as Santander Bank on October 17, 2013; the stadium, arena, and performing arts center for which it has naming rights were also rebranded. History Santander Bank, N.A., was founded on October 8, 1902 as "Sovereign Bank", a savings and loan in Wyomissing, Pennsylvania. The company's earliest customers were largely textile workers. Sovereign expanded rapidly during the savings and loan crisis of the 1980s and 1990s, acqu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Services

A payment service provider (PSP) is a third-party company that assists businesses to accept electronic payments, such as credit cards and debit cards payments. PSPs act as intermediaries between those who make payments, i.e. consumers, and those who accept them, i.e. retailers. Some of the most renowned PSPs are: * Adyen * PayPal * Stripe Operation PSPs establish technical connections with acquiring banks and card networks, enabling merchants to accept different payment methods without the need to partner with a particular bank. They fully manage payment processing and external network relationships, making the merchant less dependent on banking institutions. PSP can also offer risk management services for card and bank based payments, transaction payment matching, reporting, fund remittance and fraud protection. Some PSPs provide services to process other next generation methods (payment systems) including cash payments, wallets, prepaid cards or vouchers, and even pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dot-com Bubble

The dot-com bubble (dot-com boom, tech bubble, or the Internet bubble) was a stock market bubble in the late 1990s, a period of massive growth in the use and adoption of the Internet. Between 1995 and its peak in March 2000, the Nasdaq Composite stock market index rose 400%, only to fall 78% from its peak by October 2002, giving up all its gains during the bubble. During the dot-com crash, many online shopping companies, such as Pets.com, Webvan, and Boo.com, as well as several communication companies, such as Worldcom, NorthPoint Communications, and Global Crossing, failed and shut down. Some companies that survived, such as Amazon, lost large portions of their market capitalization, with Cisco Systems alone losing 80% of its stock value. Background Historically, the dot-com boom can be seen as similar to a number of other technology-inspired booms of the past including railroads in the 1840s, automobiles in the early 20th century, radio in the 1920s, television in the 19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jan Marsalek

Jan Marsalek (also Maršálek, born 15 March 1980 in Vienna) is an Austrian alleged white-collar criminal and former manager, known for his position as board member and chief operating officer of the German payment processing firm Wirecard. He has been a fugitive since June 2020 because of his role in the Wirecard scandal. Biography Marsalek went to school in Austria, but did not obtain a degree. At the age of 19, he founded an e-commerce software company. He started working for Wirecard in 2000 and was initially hired for his knowledge on WAP systems. On 1 February 2010, he became the firm's chief operating officer and also joined the company board. His last known residence before he became a fugitive was in Munich. Accusations Marsalek is considered one of the main culprits in the Wirecard accounting scandal. The Financial Times reported that Marsalek is a person of interest for a number of European governments due to his alleged links to Russian intelligence. Investigati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Markus Braun

Markus Braun (born 1969) is an Austrian tech investor and digital entrepreneur. From January 2002 until his resignation and arrest in June 2020, he was the CEO and CTO at the now insolvent payment processor, Wirecard AG. Braun stepped down from Wirecard amidst fraud allegations, but has denied any wrongdoing. Court cases are pending as of 2023. Education Braun graduated from the Technical University of Vienna with a degree in commercial computer science and business studies , and then went on to earn a PhD in social and economic sciences from the University of Vienna in 2000. Career Braun started his career as a consultant at Contrast Management Consulting GmbH, a position he held until November 1998. Between 1998 and 2001, he worked with KPMG Consulting AG in Munich. Wirecard In 2002, Braun joined the management board of Wirecard AG and became CEO and CTO of the company. Wirecard was one of the world's largest digital platforms in the area of financial commerce and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insolvency

In accounting, insolvency is the state of being unable to pay the debts, by a person or company ( debtor), at maturity; those in a state of insolvency are said to be ''insolvent''. There are two forms: cash-flow insolvency and balance-sheet insolvency. Cash-flow insolvency is when a person or company has enough assets to pay what is owed, but does not have the appropriate form of payment. For example, a person may own a large house and a valuable car, but not have enough liquid assets to pay a debt when it falls due. Cash-flow insolvency can usually be resolved by negotiation. For example, the bill collector may wait until the car is sold and the debtor agrees to pay a penalty. Balance-sheet insolvency is when a person or company does not have enough assets to pay all of their debts. The person or company might enter bankruptcy, but not necessarily. Once a loss is accepted by all parties, negotiation is often able to resolve the situation without bankruptcy. A company t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Whistleblower

A whistleblower (also written as whistle-blower or whistle blower) is a person, often an employee, who reveals information about activity within a private or public organization that is deemed illegal, immoral, illicit, unsafe or fraudulent. Whistleblowers can use a variety of internal or external channels to communicate information or allegations. Over 83% of whistleblowers report internally to a supervisor, human resources, compliance, or a neutral third party within the company, hoping that the company will address and correct the issues. A whistleblower can also bring allegations to light by communicating with external entities, such as the media, government, or law enforcement. Whistleblowing can occur in either the private sector or the public sector. Retaliation is a real risk for whistleblowers, who often pay a heavy price for blowing the whistle. The most common form of retaliation is abrupt termination of employment. However, several other actions may also be conside ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wirecard Scandal

The Wirecard scandal (German: ''Wirecard-Skandal'') was a series of corrupt business practices and fraudulent financial reporting that led to the insolvency of Wirecard, a payment processor and financial services provider, headquartered in Munich, Germany. The company was part of the DAX index. They offered customers electronic payment transaction and risk management services, as well as the issuance and processing of physical cards. The subsidiary, Wirecard Bank AG, held a banking license and had contracts with multiple international financial services companies. Allegations of accounting malpractices have trailed the company since the early days of its incorporation, reaching a peak in 2019 after the ''Financial Times'' published a series of investigations along with whistleblower complaints and internal documents. On 25 June 2020, Wirecard filed for insolvency after revealing that €1.9 billion was "missing", and the termination and arrest of its CEO Markus Braun. Quest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Frankfurt Stock Exchange

The Frankfurt Stock Exchange (german: link=no, Börse Frankfurt, former German name – FWB) is the world's 12th largest stock exchange by market capitalization. It has operations from 8:00 am to 10:00 pm ( German time). Organisation Located in Frankfurt, Germany, the Frankfurt Stock Exchange is owned and operated by Deutsche Börse AG and Börse Frankfurt Zertifikate AG. It is located in the district of Innenstadt and within the central business district known as Bankenviertel. With 90 percent of its turnover generated in Germany, namely at the two trading venues Xetra and Börse Frankfurt, the Frankfurt Stock Exchange is the largest of the seven regional securities exchanges in Germany. The trading indices are DAX, DAXplus, CDAX, DivDAX, LDAX, MDAX, SDAX, TecDAX, VDAX and EuroStoxx 50. Trading venues Xetra and Börse Frankfurt Through its Deutsche Börse Cash Market business section, Deutsche Börse AG now operates two trading venues at the Frankfurt Stock Exchan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Virtual Card

The term digital card can refer to a physical item, such as a memory card on a camera, or, increasingly since 2017, to the digital content hosted as a virtual card or cloud card, as a digital virtual representation of a physical card. They share a common purpose: Identity Management, Credit card, or Debit card. A non-physical digital card, unlike a #Magnetic stripe card, Magnetic stripe card can can emulate (imitate) any kind of card. Other common uses include Loyalty program, loyalty card and Health insurance, health insurance card; physical driver's license and Social Security number, Social Security card are still mandated by some government agencies. A smartphone or smartwatch can store content from the card issuer; discount offers and news updates can be transmitted wirelessly, via Internet These virtual cards are used in very high volumes OMNY, by the mass transit sector, replacing paper based tickets and MetroCard, earlier MagStrip cards. History Magnetic recording on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Acquiring Bank

An acquiring bank (also known simply as an acquirer) is a bank or financial institution that processes credit or debit card payments on behalf of a merchant. The acquirer allows merchants to accept credit card payments from the card-issuing banks within a card association, such as Visa, MasterCard, Discover, China UnionPay, American Express. The acquiring bank enters into a contract with a merchant and offers it a merchant account. This arrangement provides the merchant with a line of credit. Under the agreement, the acquiring bank exchanges funds with issuing banks on behalf of the merchant and pays the merchant for its daily payment-card activity's net balance — that is, gross sales minus reversals, interchange fees, and acquirer fees. Acquirer fees are an additional markup added to association interchange fees by the acquiring bank, and those fees vary at the acquirer's discretion. Risks The acquiring bank accepts the risk that the merchant will remain solvent. The main so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)