|

Wilshire 5000

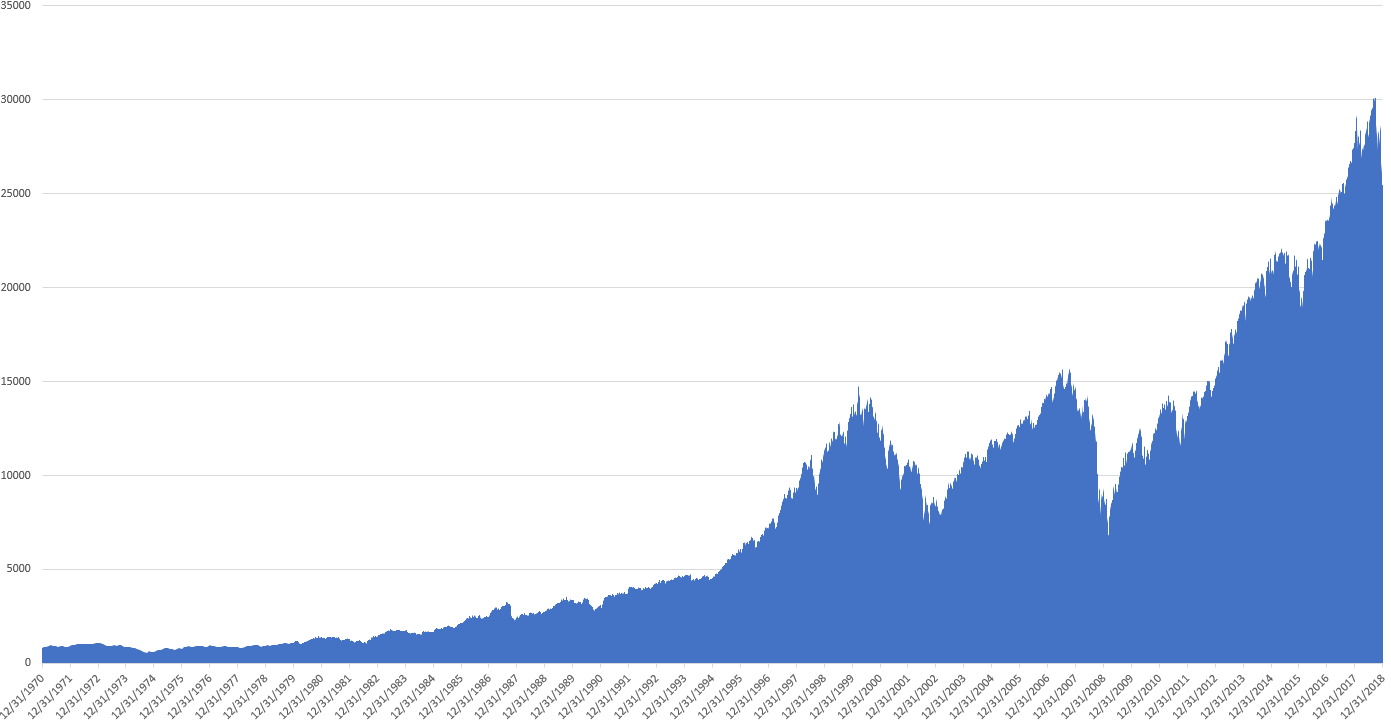

The Wilshire 5000 Total Market Index, or more simply the Wilshire 5000, is a market-capitalization-weighted index of the market value of all American-stocks actively traded in the United States. As of March 31, 2022, the index contained 3,660 components. The index is intended to measure the performance of most publicly traded companies headquartered in the United States, with readily available price data, (Bulletin Board/penny stocks and stocks of extremely small companies are excluded). Hence, the index includes a majority of the common stocks and REITs traded primarily through New York Stock Exchange, NASDAQ, or the American Stock Exchange. Limited partnerships and ADRs are not included. It can be tracked by following the ticker ^W5000. History *The Wilshire 5000 Total Market Index was established by the Wilshire Associates in 1974, naming it for the approximate number of issues it included at the time. It was renamed the "Dow Jones Wilshire 5000" in April 2004, after Dow J ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wilshire 5000 Price Index 31 Dec 1970 - 03 Jan 2019

Wilshire may refer to: People *Wilshire (surname) Places *Beaumont-Wilshire, Portland, Oregon, a neighborhood in that city *Stonybrook-Wilshire, Pennsylvania, a community in that state *Mid-Wilshire, a neighborhood in Central Los Angeles *Wilshire Boulevard, a street in Los Angeles County *Wilshire Park, Los Angeles, a district in that city Buildings and commercial centers *Bullocks Wilshire, a notable building in Los Angeles, California * The Regent Beverly Wilshire Hotel, in Beverly Hills, California * Wilshire Center, Los Angeles, California *Wilshire Theater, Beverly Hills, California *Wilshire Grand Center, skyscraper in Los Angeles, California Heavy-rail stations * Wilshire/Normandie, Los Angeles County Metro Rail station * Wilshire/Vermont, Los Angeles County Metro Rail station * Wilshire/Western, Los Angeles County Metro Rail station Miscellaneous *LAPD Wilshire Division, a division of the Los Angeles Police Department *Wilshire 4500, stock index *Wilshire 5000, stock in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bear Market

A market trend is a perceived tendency of financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time-frames. Traders attempt to identify market trends using technical analysis, a framework which characterizes market trends as predictable price tendencies within the market when price reaches support and resistance levels, varying over time. A market trend can only be determined in hindsight, since at any time prices in the future are not known. Market terminology The terms "bull market" and "bear market" describe upward and downward market trends, respectively, and can be used to describe either the market as a whole or specific sectors and securities. The terms come from London's Exchange Alley in the early 18th century, where traders who engaged in naked short selling were called "bear-skin jobbers" because they sold a bear's skin (the s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

News Corporation (1980–2013)

News Corporation (abbreviated News Corp.), also variously known as News Corporation Limited, was an American multinational mass media corporation controlled by media mogul Rupert Murdoch and headquartered at 1211 Avenue of the Americas in New York City. Prior to its split in 2013, it was the world's largest media company in terms of total assets and the world's fourth largest media group in terms of revenue, and News Corporation had become a media powerhouse since its inception, dominating the news, television, film, and print industries. News Corporation was a publicly traded company listed on NASDAQ. Formerly incorporated in Adelaide, South Australia, the company was re-incorporated under Delaware General Corporation Law after a majority of shareholders approved the move on November 12, 2004. News Corporation was headquartered at 1211 Avenue of the Americas, New York, in the newer 1960s–1970s corridor of the Rockefeller Center complex. On June 28, 2012, after concerns f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Russell 3000

The Russell 3000 Index is a capitalization-weighted stock market index that seeks to be a benchmark of the entire U.S stock market. It measures the performance of the 3,000 largest publicly held companies incorporated in America as measured by total market capitalization, and represents approximately 97% of the American public equity market. The index was launched on January 1, 1984, and is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. The ticker symbol on most systems is ^RUA. Record values Annual returns Investing The Russell 3000 Index is tracked by several exchange-traded funds, such as the iShares Russell 3000 ETF () and the Vanguard Russell 3000 ETF (). Ten largest constituents *Apple () *Microsoft () *Amazon () *Alphabet (Class A) () * Tesla () *Alphabet (Class C) () *Meta Platforms () *Nvidia () *Berkshire Hathaway () *UnitedHealth () (as of December 31, 2021) Top sectors by weight *Technology *Consumer Discretionary *Health Care *Ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wilshire 4500

The Wilshire 4500 Completion Index, more commonly the Wilshire 4500, is a capitalization-weighted index of all stocks actively traded in the United States with the exception of the stocks included in the S&P 500 index. The index is created by removing the stocks in the S&P 500 Index from the Wilshire 5000. Many managers of small-cap and mid-cap funds use the Wilshire 4500 as a performance benchmark. The Thrift Savings Plan's small-cap fund used this index, although it now tracks the Dow Jones U.S. Completion Total Stock Market Index. See also *Wilshire 5000 *Wilshire Associates * Russell Small Cap Completeness Index The Russell Small Cap Completeness Index measures the performance of the companies in the Russell 3000 Index excluding the companies in the S&P 500. , the index contains 2,561 holdings. It provides a performance standard for active money managers s ... External links * https://web.archive.org/web/20140126081314/http://web.wilshire.com/Indexes/Broad/Wilshire4500/ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Index Fund

An index fund (also index tracker) is a mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that the fund can a specified basket of underlying investments.Reasonable Investor(s), Boston University Law Review, available at: https://ssrn.com/abstract=2579510 While index providers often emphasize that they are for-profit organizations, index providers have the ability to act as "reluctant regulators" when determining which companies are suitable for an index. Those rules may include tracking prominent indexes like the S&P 500 or the Dow Jones Industrial Average or implementation rules, such as tax-management, tracking error minimization, large block trading or patient/flexible trading strategies that allow for greater tracking error but lower market impact costs. Index funds may also have rules that screen for social and sustainable criteria. An index fund's rules of construction clearly identify the type of companies suitable for the fund. The most c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Center For Research In Security Prices

The Center for Research in Security Prices (CRSP) is a provider of historical stock market data. The Center is a part of the Booth School of Business at the University of Chicago. CRSP maintains some of the largest and most comprehensive Proprietary software, proprietary historical databases in stock market research. Academic researchers and investment professionals rely on CRSP for accurate, survivor bias-free information which provides a foundation for their research and analyses. As of 2020, CRSP claims over 500 clients. The name is usually pronounced "crisp". CRSP was founded in 1960 by James H. Lorie (professor of finance and director of research) and Lawrence Fisher (assistant professor of finance) of the University of Chicago, with a grant from Merrill Lynch, Merrill Lynch, Pierce, Fenner & Smith. Its goal was to provide a source of accurate and comprehensive data that could be used to answer basic questions about the behavior of stock markets. The first effort of the Center ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OTC Markets Group

OTC Markets Group (previously known as Pink Sheets) is an American financial market providing price and liquidity information for almost 10,000 over-the-counter (OTC) securities. The group has its headquarters in New York City. OTC-traded securities are organized into three markets to inform investors of opportunities and risks: OTCQX, OTCQB and Pink. History The company was first established in 1913 as the National Quotation Bureau (NQB). For decades, the NQB reported quotations for both stocks and bonds, publishing the quotations in the paper-based Pink Sheets and Yellow Sheets respectively. The publications were named for the color of paper on which they were printed. NQB was owned by CCH from 1963 to 1993. In September 1999, the NQB introduced the real-time Electronic Quotation Service. The National Quotation Bureau changed its name to Pink Sheets LLC in 2000 and subsequently to Pink OTC Markets in 2008. The company eventually changed to its current name, OTC Markets G ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or "book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or "book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

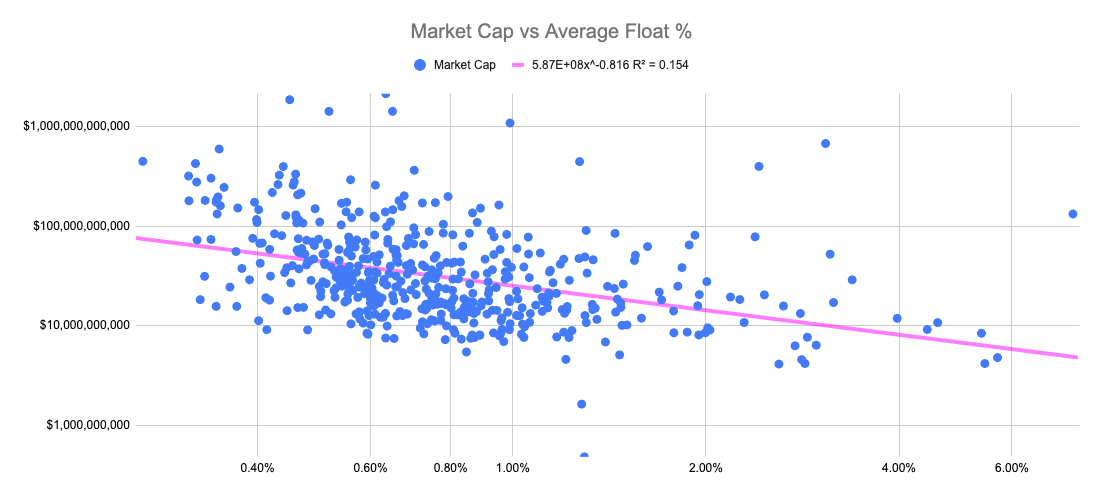

Free Float

In the context of stock markets, the public float or free float represents the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection (than entire market capitalization) of what public investors consider the company to be worth. In this context, the ''float'' may refer to all the shares outstanding that can be publicly traded. Calculating public float The float is calculated by subtracting the locked-in shares from outstanding shares. For example, a company may have 10 million outstanding shares, with 3 million of them in a locked-in position; this company's float would be 7 million (multiplied by the share price). Stocks with smaller floats tend to be more volatile than those with larger floats. In general, the la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)