|

Wells Fargo (1852–1998)

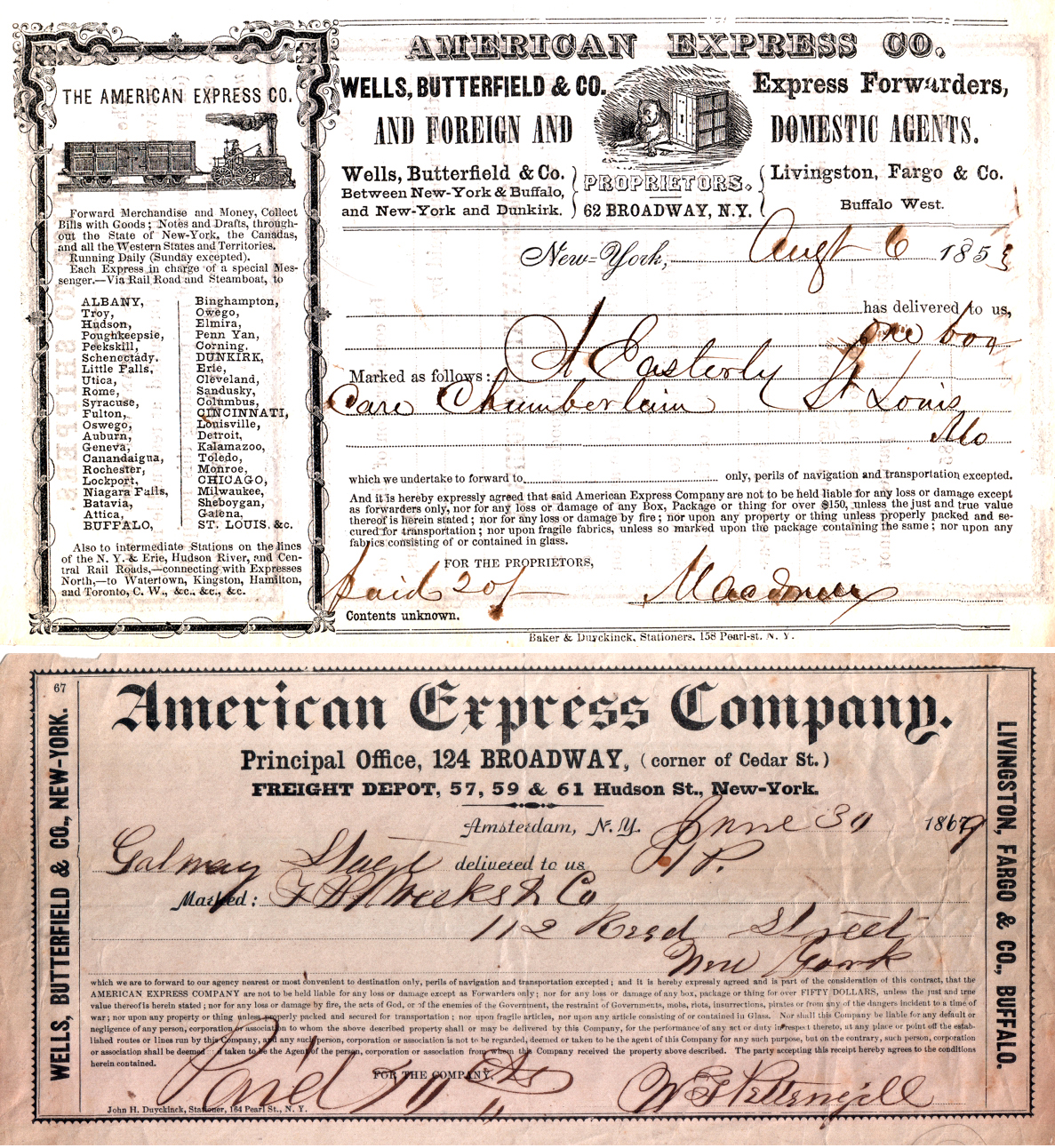

Wells Fargo was an American banking company based in San Francisco, California, that was acquired by Norwest Corporation in 1998. During the California Gold Rush in early 1848 at Sutter's Mill near Coloma, California, financiers and entrepreneurs from all over North America and the world flocked to California, drawn by the promise of huge profits. Vermont native Henry Wells and New Yorker William G. Fargo watched the California economy boom with keen interest. Before either Wells or Fargo could pursue opportunities offered in the Western United States, however, they had business to attend to in the Eastern United States. Wells, founder of Wells and Company, and Fargo, a partner in Livingston, Fargo, and Company, and mayor of Buffalo, New York, from 1862 to 1863 and again from 1864 to 1865, were major figures in the young and fiercely competitive express industry. In 1849 a new rival, John Warren Butterfield, founder of Butterfield, Wasson & Company, entered the business. B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

San Francisco

San Francisco (; Spanish language, Spanish for "Francis of Assisi, Saint Francis"), officially the City and County of San Francisco, is the commercial, financial, and cultural center of Northern California. The city proper is the List of California cities by population, fourth most populous in California and List of United States cities by population, 17th most populous in the United States, with 815,201 residents as of 2021. It covers a land area of , at the end of the San Francisco Peninsula, making it the second most densely populated large U.S. city after New York City, and the County statistics of the United States, fifth most densely populated U.S. county, behind only four of the five New York City boroughs. Among the 91 U.S. cities proper with over 250,000 residents, San Francisco was ranked first by per capita income (at $160,749) and sixth by aggregate income as of 2021. Colloquial nicknames for San Francisco include ''SF'', ''San Fran'', ''The '', ''Frisco'', and '' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multinational Corporation

A multinational company (MNC), also referred to as a multinational enterprise (MNE), a transnational enterprise (TNE), a transnational corporation (TNC), an international corporation or a stateless corporation with subtle but contrasting senses, is a corporate organization that owns and controls the production of goods or services in at least one country other than its home country. Control is considered an important aspect of an MNC, to distinguish it from international portfolio investment organizations, such as some international mutual funds that invest in corporations abroad simply to diversify financial risks. Black's Law Dictionary suggests that a company or group should be considered a multinational corporation "if it derives 25% or more of its revenue from out-of-home-country operations". Most of the largest and most influential companies of the modern age are publicly traded multinational corporations, including '' Forbes Global 2000'' companies. History Colonialism Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Market

The money market is a component of the economy that provides short-term funds. The money market deals in short-term loans, generally for a period of a year or less. As short-term securities became a commodity, the money market became a component of the financial market for assets involved in short-term borrowing, lending, buying and selling with original maturities of one year or less. Trading in money markets is done over the counter and is wholesale. There are several money market instruments in most Western countries, including treasury bills, commercial paper, banker's acceptances, deposits, certificates of deposit, bills of exchange, repurchase agreements, federal funds, and short-lived mortgage- and asset-backed securities. The instruments bear differing maturities, currencies, credit risks, and structures. A market can be described as a money market if it is composed of highly liquid, short-term assets. Money market funds typically invest in government securities, ce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Management

Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contracts or, more commonly, via collective investment schemes like mutual funds, exchange-traded funds, or REITs. The term asset management is often used to refer to the management of investment funds, while the more generic term fund management may refer to all forms of institutional investment, as well as investment management for private investors. Investment managers who specialize in ''advisory'' or ''discretionary'' management on behalf of (normally wealthy) private investors may often refer to their services as money management or portfolio management within the context of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Exchange

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Trading

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market. The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: USD 1 is worth X CAD, or CHF, or JPY, etc. The foreign exchange market works th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Currency Exchange

A bureau de change (plural bureaux de change, both ) (British English) or currency exchange (American English) is a business where people can exchange one currency for another. Nomenclature Although originally French, the term "bureau de change" is widely used throughout Europe and French-speaking Canada, where it is common to find a sign saying "exchange" or "change". Since the adoption of the euro, many exchange offices have started incorporating its logotype prominently on their signage. In the United States and English-speaking Canada the business is described as "currency exchange" and sometimes "money exchange", sometimes with various additions such as "foreign", "desk", "office", "counter", "service", etc.; for example, "foreign currency exchange office". Location A bureau de change is often located at a bank, at a travel agent, airport, main railway station or large stores—namely, anywhere there is likely to be a market for people needing to convert currency. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equities

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Cards

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards (stainless steel, gold, palladium, titanium), and a few gemstone-encrusted metal cards. A regular credit card is different from a charge card, which requires the balance to be repaid in full each month or at the end of each statement cycle. In contrast, credit cards allow the consumers to build a continuing balance of debt, subject to interest being charged. A credit card diffe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodities

In economics, a commodity is an economic good, usually a resource, that has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them. The price of a commodity good is typically determined as a function of its market as a whole: well-established physical commodities have actively traded spot and derivative markets. The wide availability of commodities typically leads to smaller profit margins and diminishes the importance of factors (such as brand name) other than price. Most commodities are raw materials, basic resources, agricultural, or mining products, such as iron ore, sugar, or grains like rice and wheat. Commodities can also be mass-produced unspecialized products such as chemicals and computer memory. Popular commodities include crude oil, corn, and gold. Other definitions of commodity include something useful or valued and an alternative term for an economic good or service avail ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |