|

Welfare Reform Act 2012

The Welfare Reform Act 2012 is an Act of Parliament in the United Kingdom which makes changes to the rules concerning a number of benefits offered within the British social security system. It was enacted by the Parliament of the United Kingdom on 8 March 2012. Among the provisions of the Act are changes to housing benefit which came into force on 1 April 2013. These changes include an "under-occupancy penalty" which reduces the amount of benefit paid to claimants in social housing if they are deemed to have too much living space in the property they are renting.(This already applied to tenants in private rental accommodation). Although the Act does not introduce any new direct taxes, this ''penalty'' has been characterised by the Labour Party and some in the media as the "Bedroom Tax", attempting to link it with the public debate about the "Poll Tax" in the 1990s. Advocating the Act, the Chancellor of the Exchequer (George Osborne) stated that the changes would reduce welfare ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare Reform Act

Welfare Reform Act is a stock short title used for legislation in the United Kingdom relating to social security benefits. The Bill for an Act with this short title may have been known as a Welfare Reform Bill during its passage through Parliament. List United Kingdom *The Welfare Reform and Pensions Act 1999 *The Welfare Reform Act 2007 *The Welfare Reform Act 2009 *The Welfare Reform Act 2012 Northern Ireland *The Welfare Reform Act (Northern Ireland) 2007 *The Welfare Reform Act (Northern Ireland) 2010 United States The Personal Responsibility and Work Opportunity Act is sometimes referred to as the Welfare Reform Act of 1996 The Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA) is a United States federal law passed by the 104th United States Congress and signed into law by President Bill Clinton. The bill implemented major changes to ... See also : List of short titles {{UK legislation Lists of legislation by short title Law of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Universal Credit

Universal Credit is a United Kingdom social security payment. It is means-tested and is replacing and combining six benefits for working-age households with a low income: income-related Employment and Support Allowance, income-based Jobseeker's Allowance, and Income Support; Child Tax Credit and Working Tax Credit; and Housing Benefit. An award of UC is made up of different elements, which become payable to the claimant if relevant criteria apply: a standard allowance for singles or couples, child elements and disabled child elements for children in the household, housing cost element, childcare costs element, as well as elements for being a carer or having an illness or disability and therefore having limited capability to work. The new policy was announced in 2010 at the Conservative Party annual conference by the Work and Pensions Secretary, Iain Duncan Smith, who said it would make the social security system fairer to claimants and taxpayers. At the same venue the Welfare R ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Working Tax Credit

Working Tax Credit (WTC) is a state benefit in the United Kingdom made to people who work and have a low income. It was introduced in April 2003 and is a means-tested benefit. Despite their name, tax credits are not to be confused with tax credits linked to a person's tax bill, because they are used to top-up wages. Unlike most other benefits, it is paid by HM Revenue and Customs (HMRC). WTC can be claimed by working individuals, childless couples and working families with dependent children. In addition, people may also be entitled to Child Tax Credit (CTC) if they are responsible for any children. WTC and CTC are assessed jointly and families remain eligible for CTC even if where no adult is working or they have too much income to receive WTC. In 2010 the coalition government announced that the Working Tax Credit would, by 2017, be integrated into and replaced by the new Universal Credit. However implementation of this has been repeatedly delayed and will not be finished unt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

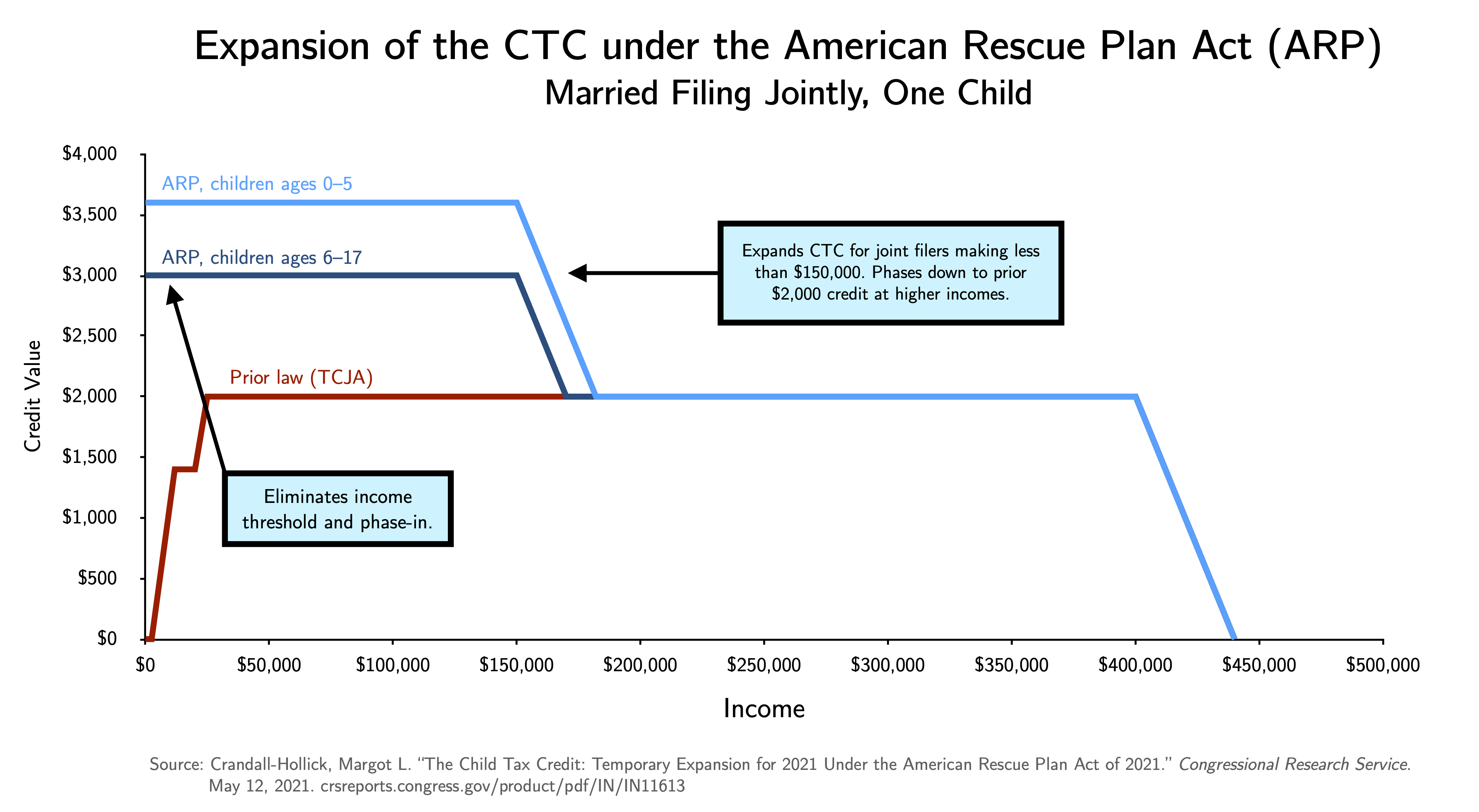

Child Tax Credit

A child tax credit (CTC) is a tax credit for parents with dependent children given by various countries. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayer's income level. For example, in the United States, only families making less than $400,000 per year may claim the full CTC. Similarly, in the United Kingdom, the tax credit is only available for families making less than £42,000 per year. Germany Germany has a programme called the which, despite technically being a tax exemption and not a tax credit, functions similarly. The child allowance is an allowance in German tax law, in which a certain amount of money is tax-free in the taxation of parents. In the income tax fee paid, child benefit and tax savings through the child tax credit are compared against each other, and the parents pay whichever results in the lesser amount of tax. United Kingdom In the United Kingdom, a family with children and an income below about ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Council Tax Benefit

Council Tax is a local taxation system used in England, Scotland and Wales. It is a tax on domestic property, which was introduced in 1993 by the Local Government Finance Act 1992, replacing the short-lived Community Charge, which in turn replaced the domestic rates. Each property is assigned one of eight bands in England and Scotland (A to H), or nine bands in Wales (A to I), based on property value, and the tax is set as a fixed amount for each band. The more valuable the property, the higher the tax, except for properties valued above £320,000 (in 1991 prices). Some property is exempt from the tax, and some people are exempt from the tax, while some get a discount. In 2011, the average annual levy on a property in England was £1,196 (). In 2014–15, the tax raised enough money to cover 24.3% of council expenditure. Council Tax is difficult to avoid or evade and therefore has one of the highest collection rates of any tax, with in-year collection rates of 97.0% in 2014– ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security Contributions And Benefits Act 1992

Social organisms, including human(s), live collectively in interacting populations. This interaction is considered social whether they are aware of it or not, and whether the exchange is voluntary or not. Etymology The word "social" derives from the Latin word ''socii'' ("allies"). It is particularly derived from the Italian ''Socii'' states, historical allies of the Roman Republic (although they rebelled against Rome in the Social War of 91–87 BC). Social theorists In the view of Karl MarxMorrison, Ken. ''Marx, Durkheim, Weber. Formations of modern social thought'', human beings are intrinsically, necessarily and by definition social beings who, beyond being "gregarious creatures", cannot survive and meet their needs other than through social co-operation and association. Their social characteristics are therefore to a large extent an objectively given fact, stamped on them from birth and affirmed by socialization processes; and, according to Marx, in producing and reproducin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Support

Income Support is an income-related benefit in the United Kingdom for some people who are on a low income, but have a reason for not actively seeking work. Claimants of Income Support may be entitled to certain other benefits, for example, Housing Benefit, Council Tax Reduction, Child Benefit, Carer's Allowance, Child Tax Credit and help with health costs. A person with capital over £16,000 cannot get Income Support, and savings over £6,000 affect how much Income Support can be received. Claimants must be between 16 and Pension Credit age, work fewer than 16 hours a week, and have a reason why they are not actively seeking work (caring for a child under 5 years old or someone who receives a specified disability benefit). Lone parents Claimants can receive income support if they are a lone parent and responsible for a child under five who is a member of their household. A claimant is considered responsible for a child in any week if receiving child benefit for the child. Howeve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare Reform Act 2007

The Welfare Reform Act 2007 (c.5) is an Act of the Parliament of the United Kingdom which alters the British social security system. A number of sections come into force two months after royal assent and the first commencement order made under the Act specified that section 31 came into force on 1 November 2007. The green paper The green paper is available as a .pdf document from the links at the end of the article. The Government's objectives for the Act, as stated in the green paper were to: *Reach 80% employment amongst all people of working age (it was just shy of 75% when the paper was released). *To reduce the numbers claiming incapacity benefit by 1 million (from 2.7 million at the time). This was later stated to be achieved "within a decade" Hutton, Parliamentary debate on Green Paper. *To help 300,000 lone parents back into work. *To increase the number of older workers, aged fifty or over, in work by 1 million. Provisions, aims and criticisms of the Act The Act is w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jobseekers Act 1995

The Jobseekers Act 1995c 18 is an Act of Parliament of the United Kingdom, which empowers the government to provide unemployment income insurance, or " Jobseeker's Allowance" while people are looking for work. In its current form, jobseeker's allowance is available without any means testing (i.e. inquiry into people's income or assets) for people who have paid into the National Insurance fund in at least the last two years. People can claim this for up to 182 days. After this, one's income and assets are means tested. If people do not have enough in National Insurance Contributions (e.g. because they have just left school or university), the other kind of Jobseeker's allowance, income-based, is being phased out and replaced by universal credit, started by the Welfare Reform Act 2012. This requires means-testing. Contents Part I, sections 1 to 25 concern the Jobseeker’s Allowance. Part II, sections 26 to 29 concern Back to Work Schemes. Part III, sections 30 to 41 are Miscell ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employment And Support Allowance

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person in legal context) and r ..., a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Employees work in return for wages, which can be paid on the basis of an hourly rate, by piecework or an annual salary, depending on the type of work an employee does, the prevailing conditions of the sector and the bargaining power between the parties. Employees in some sectors may receive gratuity, gratuities, bonus payments or employee stock option, stock options. In some types of employment, employees may re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Fund (UK)

The Social Fund in the UK was a form of welfare benefit provision payable for exceptional or intermittent needs, in addition to regular payments such as Jobseeker's Allowance or Income Support. The United Kingdom coalition government has abolished the discretionary social fund with effect from April 2013, by means of legislation contained in the Welfare Reform Act 2012. Community care grants and crisis loans will be abolished from April 2013 and instead funding is being made available to local authorities in England and to the devolved administrations to provide such assistance in their areas as they see fit. Introduction There were two categories of Social Fund: # a ‘discretionary’ social fund intended to respond flexibly to meet exceptional and intermittent needs; and # a ‘regulated’ fund intended to cover maternity, funeral, winter fuel and heating expenses. The social fund schemes were implemented in 1987 to 1988, as part of an overall review of benefits (the ''Fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |