|

Weighted Average Maturity

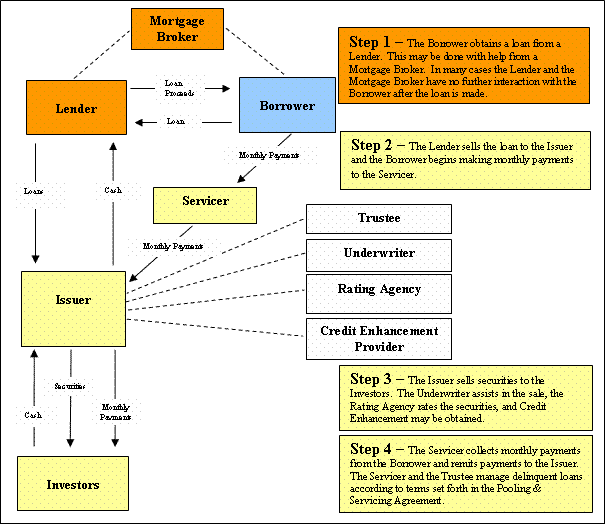

A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy. Bonds securitizing mortgages are usually treated as a separate class, termed residential; another class is commercial, depending on whether the underlying asset is mortgages owned by borrowers or assets for commercial purposes ranging from office space to multi-dwelling buildings. The structure of the MBS may be known as "pass-through", where the interest and principal payments from the borrower or homebuyer pass through it to the MBS holder, or it may be more complex, made up of a pool of other MBSs. Other types of MBS include collateralized mortgage obligations (CMOs, often structured as real estate mortgage investment conduits) and collater ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset-backed Security

An asset-backed security (ABS) is a security whose income payments, and hence value, are derived from and collateralized (or "backed") by a specified pool of underlying assets. The pool of assets is typically a group of small and illiquid assets which are unable to be sold individually. Pooling the assets into financial instruments allows them to be sold to general investors, a process called securitization, and allows the risk of investing in the underlying assets to be diversified because each security will represent a fraction of the total value of the diverse pool of underlying assets. The pools of underlying assets can include common payments from credit cards, auto loans, and mortgage loans, to esoteric cash flows from aircraft leases, royalty payments, or movie revenues. Often a separate institution, called a special purpose vehicle, is created to handle the securitization of asset backed securities. The special purpose vehicle, which creates and sells the securities, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fannie Mae

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New Deal, the corporation's purpose is to expand the secondary mortgage market by securitizing mortgage loans in the form of mortgage-backed securities (MBS), allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations (or "thrifts"). Its brother organization is the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac. In 2022, Fannie Mae was ranked number 33 on the ''Fortune'' 500 rankings of the largest United States corporations by total revenue. __TOC__ History Background and early decades Historically, most housing loans in the early 1900s in the United States were s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ginnie Mae

The Government National Mortgage Association (GNMA), or Ginnie Mae, is a government-owned corporation of the United States Federal Government within the Department of Housing and Urban Development (HUD). It was founded in 1968 and works to expand affordable housing by guaranteeing housing loans (mortgages) thereby lowering financing costs such as interest rates for those loans. It does that through guaranteeing to investors the on-time payment of mortgage-backed securities (MBS) even if homeowners default on the underlying mortgages and the homes are foreclosed upon. Ginnie Mae guarantees only securities backed by single-family and multifamily loans insured by government agencies, including the Federal Housing Authority, Department of Veterans Affairs, the Department of Housing and Urban Development’s Office of Public and Indian Housing, and the Department of Agriculture’s Rural Development. Ginnie Mae neither originates nor purchases mortgage loans nor buys, sells or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prepayment Of Loan

Prepayment is the early repayment of a loan by a borrower, in part or in full, often as a result of optional refinancing to take advantage of lower interest rates.Lemke, Lins and Picard, ''Mortgage-Backed Securities'', Chapter 4 (Thomson West, 2013 ed.). In the case of a mortgage-backed security (MBS), prepayment is perceived as a financial risk—sometimes known as "call risk"—because mortgage loans are often paid off early in order to incur lower interest payments through cheaper refinancing. The new financing may be cheaper because the borrower's credit has improved or because market interest rates have fallen; but in either of these cases, the payments that ''would have been made'' to the MBS investor would be above current market rates. Redeeming such loans early through prepayment reduces the investor's upside from credit and interest rate variability in an MBS, and in essence forces the MBS investor to reinvest the proceeds at lower interest rates. If instead the borrower's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Enhancement

Credit enhancement is the improvement of the credit profile of a structured financial transaction or the methods used to improve the credit profiles of such products or transactions. It is a key part of the securitization transaction in structured finance, and is important for credit rating agencies when rating a securitization. Types There are two primary types of credit enhancement: internal and external. Internal credit enhancement Subordination or credit tranching Establishing a senior/subordinated structure is one of the most popular techniques to create internal credit enhancement. Cash flows generated by assets are allocated with different priorities to classes of varying seniorities. The senior/subordinated structure thus consists of several tranches, from the most senior to the most subordinated (or junior). The subordinated tranches function as protective layers of the more senior tranches. The tranche with the highest seniority has the first right on cash flow. S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or "book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commercial Mortgage-backed Security

Commercial mortgage-backed securities (CMBS) are a type of mortgage-backed security backed by commercial and multifamily mortgages rather than residential real estate. CMBS tend to be more complex and volatile than residential mortgage-backed securities due to the unique nature of the underlying property assets. CMBS issues are usually structured as multiple tranches, similar to collateralized mortgage obligations (CMO), rather than typical residential "passthroughs." The typical structure for the securitization of commercial real estate loans is a real estate mortgage investment conduit (REMIC), a creation of the tax law that allows the trust to be a pass-through entity which is not subject to tax at the trust level. Many American CMBS transactions carry less prepayment risk than other MBS types, thanks to the structure of commercial mortgages. Commercial mortgages often contain lockout provisions (typically a period of 1-5 years where there can be no prepayment of the lo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Residential Mortgage-backed Security

Bonds securitizing mortgages are usually treated as a separate class, termed residential mortgage-backed security (RMBS). In that sense, making reference to the general package of financial agreements that typically represents cash yields that are paid to investors and that are supported by cash payments received from homeowners who pay interest and principal according to terms agreed to with their lenders; it is a funding instrument created by the "originator" or "sponsor" of the mortgage loan; without cross-collateralizing individual loans and mortgages (because it would be impossible to receive permission from individual homeowners), it is a funding instrument that pools the cash flow received from individuals and pays these cash receipts out with waterfall priorities that enable investors to become comfortable with the certainty of receipt of cash at any point in time. There are multiple important differences between mortgage loans originated and serviced by banks and kept on th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Special Purpose Vehicle

A special-purpose entity (SPE; or, in Europe and India, special-purpose vehicle/SPV; or, in some cases in each EU jurisdiction, FVC, financial vehicle corporation) is a legal entity (usually a limited company of some type or, sometimes, a limited partnership) created to fulfill narrow, specific or temporary objectives. SPEs are typically used by companies to isolate the firm from financial risk. A formal definition is "The Special Purpose Entity is a fenced organization having limited predefined purposes and a legal personality". Normally a company will transfer assets to the SPE for management or use the SPE to finance a large project thereby achieving a narrow set of goals without putting the entire firm at risk. SPEs are also commonly used in complex financings to separate different layers of equity infusion. Commonly created and registered in tax havens, SPEs allow tax avoidance strategies unavailable in the home district. Round-tripping is one such strategy. In addition, th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Assignment (law)

An assignment is a legal term used in the context of the law of contract and of property. In both instances, assignment is the process e whereby a person, the ''assignor'', transfers rights or benefits to another, the ''assignee''.For the assignment of claim seTrans-Lex.org/ref> An assignment may not transfer a duty, burden or detriment without the express agreement of the assignee. The right or benefit being assigned may be a gift (such as a waiver) or it may be paid for with a contractual consideration such as money. The rights may be vested or contingent,. and may include an equitable interest. Mortgages and loans are relatively straightforward and amenable to assignment. An assignor may assign rights, such as a mortgage note issued by a third party borrower, and this would require the latter to make repayments to the assignee. A related concept of assignment is novation wherein, by agreement with all parties, one contracting party is replaced by a new party. While novatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Note

In the United States, a mortgage note (also known as a ''real estate lien note'', ''borrower's note'') is a promissory note secured by a specified mortgage loan. Mortgage notes are a written promise to repay a specified sum of money plus interest at a specified rate and length of time to fulfill the promise. While the mortgage deed or contract itself hypothecates or imposes a lien on the title to real property as security for a loan, the mortgage note states the amount of debt and the rate of interest, and obligates the borrower, who signs the note, personally for repayment. In foreclosure proceedings in certain jurisdictions, borrowers may require the foreclosing party to produce the note as evidence that they are the true owners of the debt. In Australia Technical product definitions can vary between countries. In Australia, as example, a mortgage note is a secured (senior debt) debt security (also known as secured credit bond) which can be issued in relation to an entire speci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jurisdiction

Jurisdiction (from Latin 'law' + 'declaration') is the legal term for the legal authority granted to a legal entity to enact justice. In federations like the United States, areas of jurisdiction apply to local, state, and federal levels. Jurisdiction draws its substance from international law, conflict of laws, constitutional law, and the powers of the executive and legislative branches of government to allocate resources to best serve the needs of society. International dimension Generally, international laws and treaties provide agreements which nations agree to be bound to. Such agreements are not always established or maintained. The exercise of extraterritorial jurisdiction by three principles outlined in the UN charter. These are equality of states, territorial sovereignty and non-intervention. This raises the question of when can many states prescribe or enforce jurisdiction. The ''Lotus'' case establishes two key rules to the prescription and enforcement of jurisdi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)