|

Warrant (finance)

In finance, a warrant is a security that entitles the holder to buy or sell stock, typically the stock of the issuing company, at a fixed price called the exercise price. Warrants and options are similar in that the two contractual financial instruments allow the holder special rights to buy securities. Both are discretionary and have expiration dates. They differ mainly in that warrants are only issued by specific authorized institutions (typically the corporation on which the warrant is based) and in certain technical aspects of their trading and exercise. Warrants are frequently attached to bonds or preferred stock as a sweetener, allowing the issuer to pay lower interest rates or dividends. They can be used to enhance the yield of the bond and make them more attractive to potential buyers. Warrants can also be used in private equity deals. Frequently, these warrants are detachable and can be sold independently of the bond or stock. In the case of warrants issued with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitabili ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Dilution

Stock dilution, also known as equity dilution, is the decrease in existing shareholders' ownership percentage of a company as a result of the company issuing new equity. New equity increases the total shares outstanding which has a dilutive effect on the ownership percentage of existing shareholders. This increase in the number of shares outstanding can result from a primary market offering (including an initial public offering), employees exercising stock options, or by issuance or conversion of convertible bonds, preferred shares or warrants into stock. This dilution can shift fundamental positions of the stock such as ownership percentage, voting control, earnings per share, and the value of individual shares. Control dilution Control dilution describes the reduction in ownership percentage or loss of a controlling share of an investment's stock. Many venture capital contracts contain an anti-dilution provision in favor of the original investors, to protect their equity ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Finance

Corporate finance is the area of finance that deals with the sources of funding, the capital structure of corporations, the actions that managers take to increase the value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to maximize or increase shareholder value. Correspondingly, corporate finance comprises two main sub-disciplines. Capital budgeting is concerned with the setting of criteria about which value-adding projects should receive investment funding, and whether to finance that investment with equity or debt capital. Working capital management is the management of the company's monetary funds that deal with the short-term operating balance of current assets and current liabilities; the focus here is on managing cash, inventories, and short-term borrowing and lending (such as the terms on credit extended to customers). The terms corporate finance and corporate financier ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Discovery

In economics and finance, the price discovery process (also called price discovery mechanism) is the process of determining the price of an asset in the marketplace through the interactions of buyers and sellers. Overview Price discovery is different from valuation. Price discovery process involves buyers and sellers arriving at a transaction price for a specific item at a given time. It involves the following: http://agecon.okstate.edu/pricing/ Pricing and Price discovery Issues * Buyers and seller (number, size, location, and valuation perceptions) * Market mechanism (bidding and settlement processes, liquidity) * Available information (amount, timeliness, significance and reliability) including futures and other related markets * Risk management choices. "Market" is a broad term that covers buyers, sellers and even sentiment. A single market will have one or more execution venues, which describes where trades are executed. This could be in the street for a street market, o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Exchange

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as "continuous auction" markets with buyers and sellers consummating transactions via open outcry at a central location such as the floor of the exchange or by using an electronic trading platform. To be able to trade a security on a certain stock exchange, the security must be listed there. Usually, there is a central location for record keeping, but trade is increasingly less linked to a physical place as modern markets use electronic com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Covered Warrant

In finance a covered warrant (sometimes called naked warrant) is a type of warrant that has been issued without an accompanying bond or equity. Like a normal warrant, it allows the holder to buy or sell a specific amount of equities, currency, or other financial instruments from the issuer at a specified price at a predetermined date. Unlike normal warrants, they are usually issued by financial institutions instead of share-issuing companies and are listed as fully tradable securities on a number of stock exchanges. They can also have a variety of underlying instruments, not just equities, and may allow the holder to buy or sell the underlying asset. These attributes make it possible to use covered warrants as a tool to speculate on financial markets. Structure and features A covered warrant gives the holder the right, but not the obligation, to buy (" call" warrant) or to sell (" put" warrant) an underlying asset at a specified price (the "strike" or "exercise" price) by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Share (finance)

In financial markets, a share is a unit of equity ownership in the capital stock of a corporation, and can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of an enterprise. The owner of shares in a company is a shareholder (or stockholder) of the corporation. A share is an indivisible unit of capital, expressing the ownership relationship between the company and the shareholder. The denominated value of a share is its face value, and the total of the face value of issued shares represent the capital of a company, which may not reflect the market value of those shares. The income received from the ownership of shares is a dividend. There are different types of shares such as equity shares, preference shares, deferred shares, redeemable shares, bonus shares, right shares, and employee stock option plan shares. Valuation Shares are valued according to the various principles in different market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Or Share Option

Cash or Share Option is a specialized form of warrant where the settlement is either cash or physical delivery of shares depending if the option expires in the money or out of the money. Normally, the holder of the certificate receives the exercise price in cash when option is in the money In finance, moneyness is the relative position of the current price (or future price) of an underlying asset (e.g., a stock) with respect to the strike price of a derivative, most commonly a call option or a put option. Moneyness is firstly a th ..., that is price of the underlying at expiry is equal or above the exercise price, and physical delivery of the underlying when the option is out of the money, that is the price of the underlying at expiry is below the exercise price. Then the holder is the one giving the option. {{Derivatives market Options (finance) Equity securities ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Covered Warrant

In finance a covered warrant (sometimes called naked warrant) is a type of warrant that has been issued without an accompanying bond or equity. Like a normal warrant, it allows the holder to buy or sell a specific amount of equities, currency, or other financial instruments from the issuer at a specified price at a predetermined date. Unlike normal warrants, they are usually issued by financial institutions instead of share-issuing companies and are listed as fully tradable securities on a number of stock exchanges. They can also have a variety of underlying instruments, not just equities, and may allow the holder to buy or sell the underlying asset. These attributes make it possible to use covered warrants as a tool to speculate on financial markets. Structure and features A covered warrant gives the holder the right, but not the obligation, to buy (" call" warrant) or to sell (" put" warrant) an underlying asset at a specified price (the "strike" or "exercise" price) by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Greeks (finance)

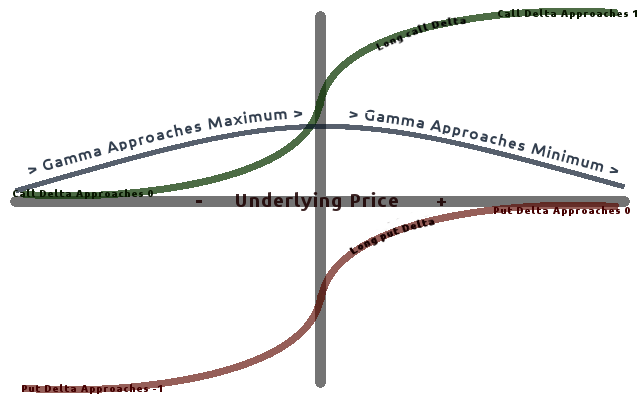

In mathematical finance, the Greeks are the quantities representing the sensitivity of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model are relatively easy to calculate, a desirable property of financial models, and are very useful for derivatives traders, especi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)