|

Volatility Tax

The volatility tax is a mathematical finance term, formalized by hedge fund manager Mark Spitznagel, describing the effect of large investment losses (or volatility) on compound returns.Not all risk mitigation is created equal ''Pensions & Investments'', November 20, 2017 It has also been called volatility drag, volatility decay or variance drain. This is not literally a tax in the sense of a levy imposed by a government, but the mathematical difference between geometric averages compared to arithmetic averages. This difference resembles a tax due to the mathematics which impose a lower compound return when returns vary over time, compared to a simple sum of returns. This diminishment of returns is in increasing proportion to volatility, such ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Concave Function

In mathematics, a concave function is the negative of a convex function. A concave function is also synonymously called concave downwards, concave down, convex upwards, convex cap, or upper convex. Definition A real-valued function f on an interval (or, more generally, a convex set in vector space) is said to be ''concave'' if, for any x and y in the interval and for any \alpha \in ,1/math>, :f((1-\alpha )x+\alpha y)\geq (1-\alpha ) f(x)+\alpha f(y) A function is called ''strictly concave'' if :f((1-\alpha )x + \alpha y) > (1-\alpha) f(x) + \alpha f(y)\, for any \alpha \in (0,1) and x \neq y. For a function f: \mathbb \to \mathbb, this second definition merely states that for every z strictly between x and y, the point (z, f(z)) on the graph of f is above the straight line joining the points (x, f(x)) and (y, f(y)). A function f is quasiconcave if the upper contour sets of the function S(a)=\ are convex sets. Properties Functions of a single variable # A differentia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest

In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is distinct from a fee which the borrower may pay the lender or some third party. It is also distinct from dividend which is paid by a company to its shareholders (owners) from its profit or reserve, but not at a particular rate decided beforehand, rather on a pro rata basis as a share in the reward gained by risk taking entrepreneurs when the revenue earned exceeds the total costs. For example, a customer would usually pay interest to borrow from a bank, so they pay the bank an amount which is more than the amount they borrowed; or a customer may earn interest on their savings, and so they may withdraw more than they originally deposited. In the case of savings, the customer is the lender, and the bank plays the role of the borrower. Interes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rate Of Return

In finance, return is a profit on an investment. It comprises any change in value of the investment, and/or cash flows (or securities, or other investments) which the investor receives from that investment, such as interest payments, coupons, cash dividends, stock dividends or the payoff from a derivative or structured product. It may be measured either in absolute terms (e.g., dollars) or as a percentage of the amount invested. The latter is also called the holding period return. A loss instead of a profit is described as a '' negative return'', assuming the amount invested is greater than zero. To compare returns over time periods of different lengths on an equal basis, it is useful to convert each return into a return over a period of time of a standard length. The result of the conversion is called the rate of return. Typically, the period of time is a year, in which case the rate of return is also called the annualized return, and the conversion process, described ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Geometric Brownian Motion

A geometric Brownian motion (GBM) (also known as exponential Brownian motion) is a continuous-time stochastic process in which the logarithm of the randomly varying quantity follows a Brownian motion (also called a Wiener process) with drift. It is an important example of stochastic processes satisfying a stochastic differential equation (SDE); in particular, it is used in mathematical finance to model stock prices in the Black–Scholes model. Technical definition: the SDE A stochastic process ''S''''t'' is said to follow a GBM if it satisfies the following stochastic differential equation (SDE): : dS_t = \mu S_t\,dt + \sigma S_t\,dW_t where W_t is a Wiener process or Brownian motion, and \mu ('the percentage drift') and \sigma ('the percentage volatility') are constants. The former is used to model deterministic trends, while the latter term is often used to model a set of unpredictable events occurring during this motion. Solving the SDE For an arbitrary ini ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exponential Growth

Exponential growth is a process that increases quantity over time. It occurs when the instantaneous rate of change (that is, the derivative) of a quantity with respect to time is proportional to the quantity itself. Described as a function, a quantity undergoing exponential growth is an exponential function of time, that is, the variable representing time is the exponent (in contrast to other types of growth, such as quadratic growth). If the constant of proportionality is negative, then the quantity decreases over time, and is said to be undergoing exponential decay instead. In the case of a discrete domain of definition with equal intervals, it is also called geometric growth or geometric decay since the function values form a geometric progression. The formula for exponential growth of a variable at the growth rate , as time goes on in discrete intervals (that is, at integer times 0, 1, 2, 3, ...), is x_t = x_0(1+r)^t where is the value of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ecological Fallacy

An ecological fallacy (also ecological ''inference'' fallacy or population fallacy) is a formal fallacy in the interpretation of statistical data that occurs when inferences about the nature of individuals are deduced from inferences about the group to which those individuals belong. "Ecological fallacy" is a term that is sometimes used to describe the fallacy of division, which is not a statistical fallacy. The four common statistical ecological fallacies are: confusion between ecological correlations and individual correlations, confusion between group average and total average, Simpson's paradox, and confusion between higher average and higher likelihood. Examples Mean and median An example of ecological fallacy is the assumption that a population mean has a simple interpretation when considering likelihoods for an individual. For instance, if the mean score of a group is larger than zero, this does not imply that a random individual of that group is more likely to have a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Annual Growth %

Annual growth rate (AGR) is the change in the value of a measurement over the period of a year. Economics Annual growth rate is a useful tool to identify trends in investments. According to a survey of nearly 200 senior marketing managers conducted by The Marketing Accountability Standards Board, 69% of subjects responded that they consider average annual growth rate to be a useful measurement.Farris, Paul W.; Neil T. Bendle; Phillip E. Pfeifer; David J. Reibstein (2010). ''Marketing Metrics: The Definitive Guide to Measuring Marketing Performance.'' Upper Saddle River, New Jersey: Pearson Education, Inc. . The Marketing Accountability Standards Board (MASB) endorses the definitions, purposes, and constructs of classes of measures that appear in ''Marketing Metrics'' as part of its ongoinCommon Language in Marketing Project The formula used to calculate annual growth rate uses the previous year as a base. Over longer periods of time, compound annual growth rate (CAGR) is general ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Random House

Random House is an American book publisher and the largest general-interest paperback publisher in the world. The company has several independently managed subsidiaries around the world. It is part of Penguin Random House, which is owned by German media conglomerate Bertelsmann. History Random House was founded in 1927 by Bennett Cerf and Donald Klopfer, two years after they acquired the Modern Library imprint from publisher Horace Liveright, which reprints classic works of literature. Cerf is quoted as saying, "We just said we were going to publish a few books on the side at random," which suggested the name Random House. In 1934 they published the first authorized edition of James Joyce's novel '' Ulysses'' in the Anglophone world. ''Ulysses'' transformed Random House into a formidable publisher over the next two decades. In 1936, it absorbed the firm of Smith and Haas—Robert Haas became the third partner until retiring and selling his share back to Cerf and Klopfer in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Skin In The Game (book)

''Skin in the Game: Hidden Asymmetries in Daily Life'' (acronymed: SITG) is a 2018 nonfiction book by Nassim Nicholas Taleb, a former options trader with a background in the mathematics of probability and statistics. Taleb's thesis is that skin in the game—i.e., having a measurable risk when taking a major decision—is necessary for fairness, commercial efficiency, and risk management, as well as being necessary to understand the world. The book is part of Taleb's multi-volume philosophical essay on uncertainty, titled the ''Incerto'', which also includes '' Fooled by Randomness'' (2001), '' The Black Swan'' (2007–2010), '' The Bed of Procrustes'' (2010–2016), and '' Antifragile'' (2012). The book is dedicated to "two men of courage": Ron Paul, "a Roman among Greeks"; and Ralph Nader, "Greco-Phoenician saint". Asymmetry and missing incentives If an actor pockets some rewards from a policy they enact or support without accepting any of the risks, economists consider it t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

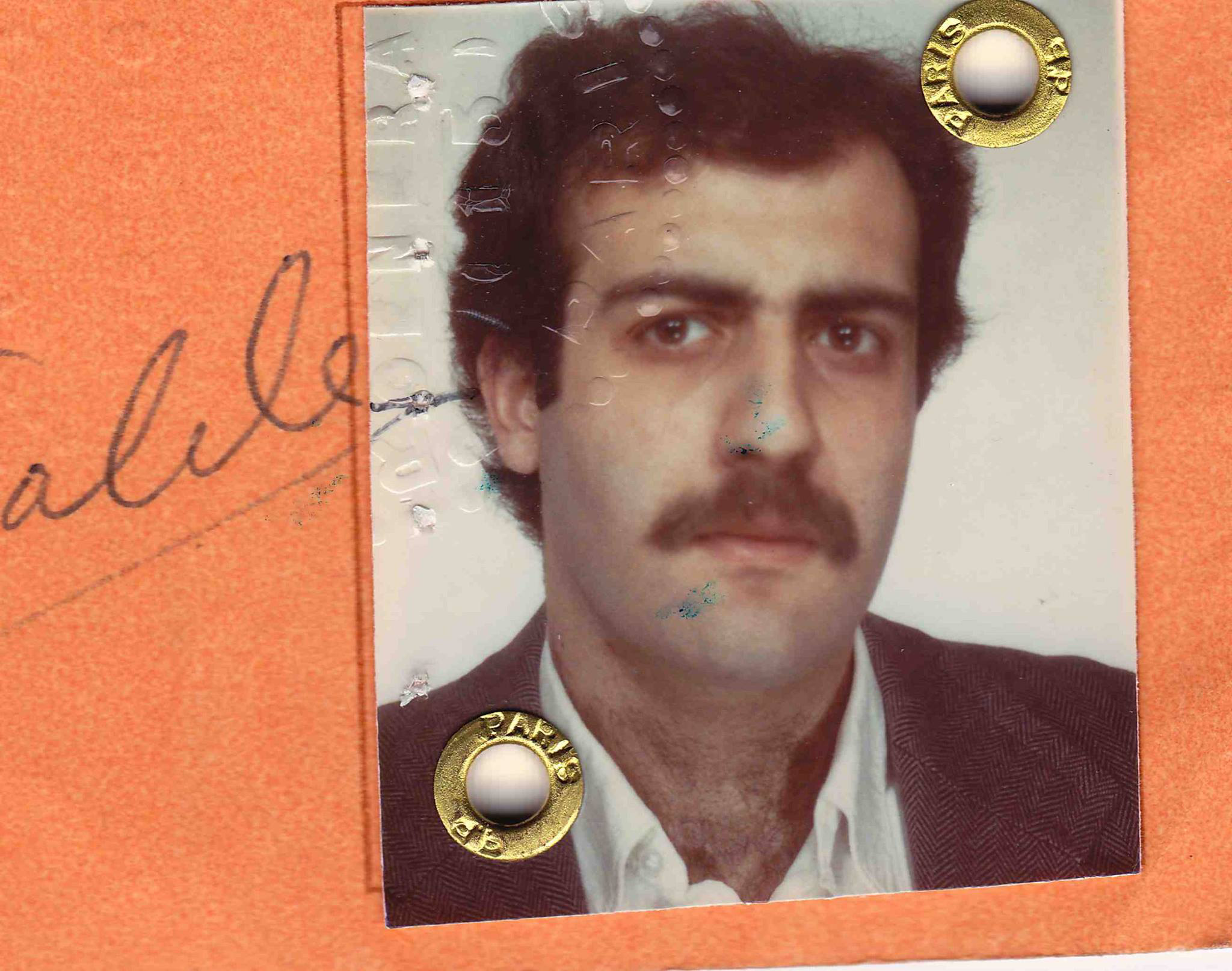

Nassim Nicholas Taleb

Nassim Nicholas Taleb (; alternatively ''Nessim ''or'' Nissim''; born 12 September 1960) is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist whose work concerns problems of randomness, probability, and uncertainty. ''The Sunday Times'' called his 2007 book '' The Black Swan'' one of the 12 most influential books since World War II. Taleb is the author of the ''Incerto'', a five-volume philosophical essay on uncertainty published between 2001 and 2018 (of which the best-known books are ''The Black Swan'' and ''Antifragile''). He has been a professor at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has been co-editor-in-chief of the academic journal ''Risk and Decision Analysis'' since September 2014. He has also been a practitioner of mathematical finance, a hedge fund manager, and a derivatives trader, and is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |