|

Venture Capital

Venture capital (commonly abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth (in terms of number of employees, annual revenue, scale of operations, etc). Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the companies they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model and they are usually from high technology industries, such as information technology (IT), clean technology or biotechnology. Typical venture capital investments occur after an initial "seed funding" round. The first ro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

In the field of finance, the term private equity (PE) refers to investment funds, usually limited partnerships (LP), which buy and restructure financially weak companies that produce goods and provide services. A private-equity fund is both a type of ownership of assets ( financial equity) and is a class of assets (debt securities and equity securities), which function as modes of financial management for operating private companies that are not publicly traded in a stock exchange. Private-equity capital is invested into a target company either by an investment management company (private equity firm), or by a venture capital fund, or by an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Each category of investor provides working capital to the target company to finance the expansion of the company with the development of new products and services, the restructuring ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity Secondary Market

In finance, the private-equity secondary market (also often called private-equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private-equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private-equity funds as well as hedge funds can be more complex and labor-intensive. Sellers of private-equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private-equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including "pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets". For the vast majority of private-equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

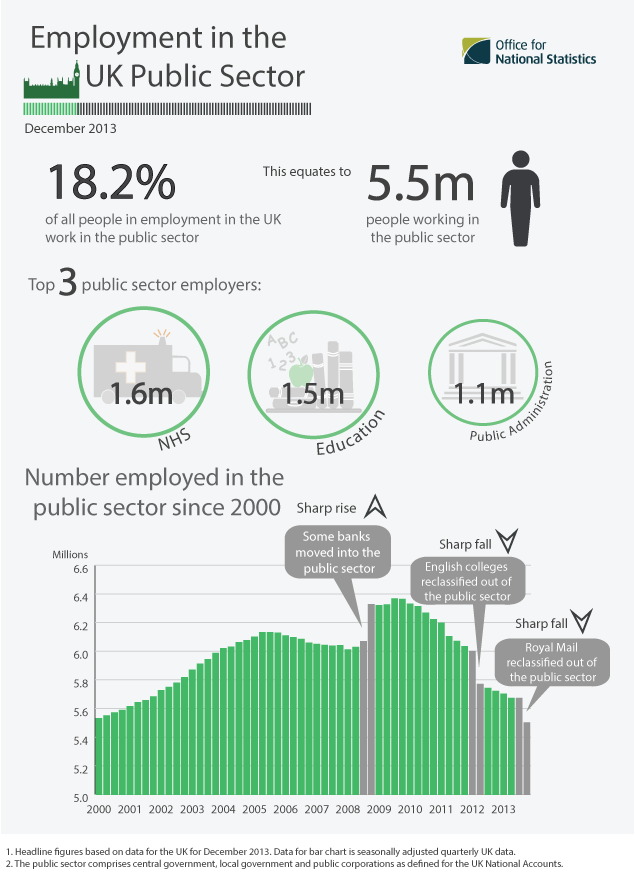

Public Sector

The public sector, also called the state sector, is the part of the economy composed of both public services and public enterprises. Public sectors include the public goods and governmental services such as the military, law enforcement, infrastructure, public transit, public education, along with health care and those working for the government itself, such as elected officials. The public sector might provide services that a non-payer cannot be excluded from (such as street lighting), services which benefit all of society rather than just the individual who uses the service. Public enterprises, or state-owned enterprises, are self-financing commercial enterprises that are under public ownership which provide various private goods and services for sale and usually operate on a commercial basis. Organizations that are not part of the public sector are either part of the private sector or voluntary sector. The private sector is composed of the economic sectors that are intende ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Sector

The private sector is the part of the economy, sometimes referred to as the citizen sector, which is owned by private groups, usually as a means of establishment for profit or non profit, rather than being owned by the government. Employment The private sector employs most of the workforce in some countries. In private sector, activities are guided by the motive to earn money. A 2013 study by the International Finance Corporation (part of the World Bank Group) identified that 90 percent of jobs in developing countries are in the private sector. Diversification In free enterprise countries, such as the United States, the private sector is wider, and the state places fewer constraints on firms. In countries with more government authority, such as China, the public sector makes up most of the economy. Regulation States legally regulate the private sector. Businesses operating within a country must comply with the laws in that country. In some cases, usually involving multinatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unicorn (finance)

In business, a unicorn is a privately held startup company valued at over US$1 billion. The term was first published in 2013, coined by venture capitalist Aileen Lee, choosing the mythical animal to represent the statistical rarity of such successful ventures. CB Insights identified 1,170 unicorns worldwide . Unicorns with over $10 billion in valuation have been designated as "decacorn" companies. For private companies valued over $100 billion, the terms "centicorn", "hectocorn", and "super-unicorn" have been used. The term "kilocorn" has been used for companies valued at $1 trillion, of which Apple was the first. History Aileen Lee originated the term "unicorn" in a 2013 ''TechCrunch'' article, "Welcome To The Unicorn Club: Learning from Billion-Dollar Startups". At the time, 39 companies were identified as unicorns. In a different study done by ''Harvard Business Review'', it was determined that startups founded between 2012 and 2015 were growing in valuation twice as f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brex

Brex Inc is an American financial service and technology company based in San Francisco, California. Brex offers business credit cards and Cash Management Accounts to technology companies. Brex cards are business charge cards, which require at least $50,000 in a bank account if professionally invested, if not with $100,000 to open, and cardholders who default won't damage their personal credit or assets. Emigrant Bank issues the Brex cards. History Brex was founded by Brazilians Henrique Dubugras and Pedro Franceschi on January 3, 2017. They had previously founded online payments company, Pagar.me, before selling it to Stone. Brex did not start as a fintech startup but rather as a VR startup, however the founders pivoted the company three weeks into Y Combinator's 12-week accelerator program. In February 2021, the company announced a submission application with the Federal Deposit Insurance Corporation (FDIC) and the Utah Department of Financial Institutions (UDFI) to es ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Airtable

Airtable is a cloud collaboration service headquartered in San Francisco. It was founded in 2012 by Howie Liu, Andrew Ofstad, and Emmett Nicholas. Airtable is a spreadsheet-database hybrid, with the features of a database but applied to a spreadsheet. The fields in an Airtable table are similar to cells in a spreadsheet, but have types such as 'checkbox', 'phone number', and 'drop-down list', and can reference file attachments like images. Users can create a database, set up column types, add records, link tables to one another, collaborate, sort records and publish views to external websites. History 2015 * February 2015: Raised $3 million from Caffeinated Capital, Freestyle Capital, Data Collective, CrunchFund. * April 2015: Airtable launches its API and embedded databases. * May 2015: Raised $7.6 million funding from Charles River Ventures and Ashton Kutcher. * July 2015: Introduced Airtable Forms to collect and organize data. * August 2015: Airtable made "Add to Slac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Risk

Financial risk is any of various types of risk associated with financing, including financial transactions that include company loans in risk of default. Often it is understood to include only downside risk, meaning the potential for financial loss and uncertainty about its extent. A science has evolved around managing market and financial risk under the general title of modern portfolio theory initiated by Dr. Harry Markowitz in 1952 with his article, "Portfolio Selection". In modern portfolio theory, the variance (or standard deviation) of a portfolio is used as the definition of risk. Types According to Bender and Panz (2021), financial risks can be sorted into five different categories. In their study, they apply an algorithm-based framework and identify 193 single financial risk types, which are sorted into the five categories market risk, liquidity risk, credit risk, business risk and investment risk. Market risk The four standard market risk factors are equity ri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity. The term can also be used metaphorically to cover moral obligations and other interactions not based on a monetary value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person. Etymology The English term "debt" was first used in the late 13th century. The term "debt" comes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Market

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), JSE Limited (JSE), Bombay Stock Exchange (BSE) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (merger, spinoff) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bilateral basis, although some bonds trade o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |