|

Value Investing

Value investing is an investment paradigm that involves buying securities that appear underpriced by some form of fundamental analysis. The various forms of value investing derive from the investment philosophy first taught by Benjamin Graham and David Dodd at Columbia Business School in 1928, and subsequently developed in their 1934 text '' Security Analysis''. The early value opportunities identified by Graham and Dodd included stock in public companies trading at discounts to book value or tangible book value, those with high dividend yields, and those having low price-to-earning multiples, or low price-to-book ratios. High-profile proponents of value investing, including Berkshire Hathaway chairman Warren Buffett, have argued that the essence of value investing is buying stocks at less than their intrinsic value. The discount of the market price to the intrinsic value is what Benjamin Graham called the " margin of safety". For the last 25 years, under the influence o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intrinsic Value (finance)

In finance, the intrinsic value of an asset usually refers to a value calculated on simplified assumptions. For example, the intrinsic value of an option is based on the current market value of the underlying instrument, but ignores the possibility of future fluctuations and the time value of money. Options An option is said to have intrinsic value if the option is in-the-money. When out-of-the-money, its intrinsic value is ''zero''. For an option, the intrinsic value is the same as the "immediate value" or the "current value" of the contract, which is the profit that could be gained by exercising the option immediately. The intrinsic value for an in-the-money option is calculated as the absolute value of the difference between the current price (''S'') of the underlying and the strike price (''K'') of the option. :IV_= 0 :IV_=\left \vert S-K \right \vert = \left \vert K-S \right \vert For example, if the strike price for a call option is USD 1.00 and the price of the un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Benjamin Graham (1894-1976) Portrait On 23 March 1950

Benjamin Graham (; né Grossbaum; May 9, 1894 – September 21, 1976) was a British-born American economist, professor and investor. He is widely known as the "father of value investing", and wrote two of the founding texts in neoclassical investing: ''Security Analysis'' (1934) with David Dodd, and ''The Intelligent Investor'' (1949). His investment philosophy stressed investor psychology, minimal debt, buy-and-hold investing, fundamental analysis, concentrated diversification, buying within the margin of safety, activist investing, and contrarian mindsets. After graduating from Columbia University at age 20, he started his career on Wall Street, eventually founding the Graham–Newman Partnership. After employing his former student Warren Buffett, he took up teaching positions at his '' alma mater,'' and later at UCLA Anderson School of Management at the University of California, Los Angeles. His work in managerial economics and investing has led to a modern wave of value ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagion began around September and led to the Wall Street stock market crash of October 24 (Black Thursday). It was the longest, deepest, and most widespread depression of the 20th century. Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by the mid-1930s. However, in many countries, the negative effects of the Great Depression lasted until the beginning of World War II. Devastating effects were seen in both rich and poor countries with falling personal income, prices, tax revenues, and profits. International trade fell by more than 50%, unemployment in the U.S. rose to 23% ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividends

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business (called retained earnings). The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash (usually a deposit into a bank account) or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets. The dividend received by a shareholder is income of the shareholder and may be subject to income tax (see dividend tax). The tax treatment of this income varies considerably between jurisdictions. The corporation does not receive a tax de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Momentum Investing

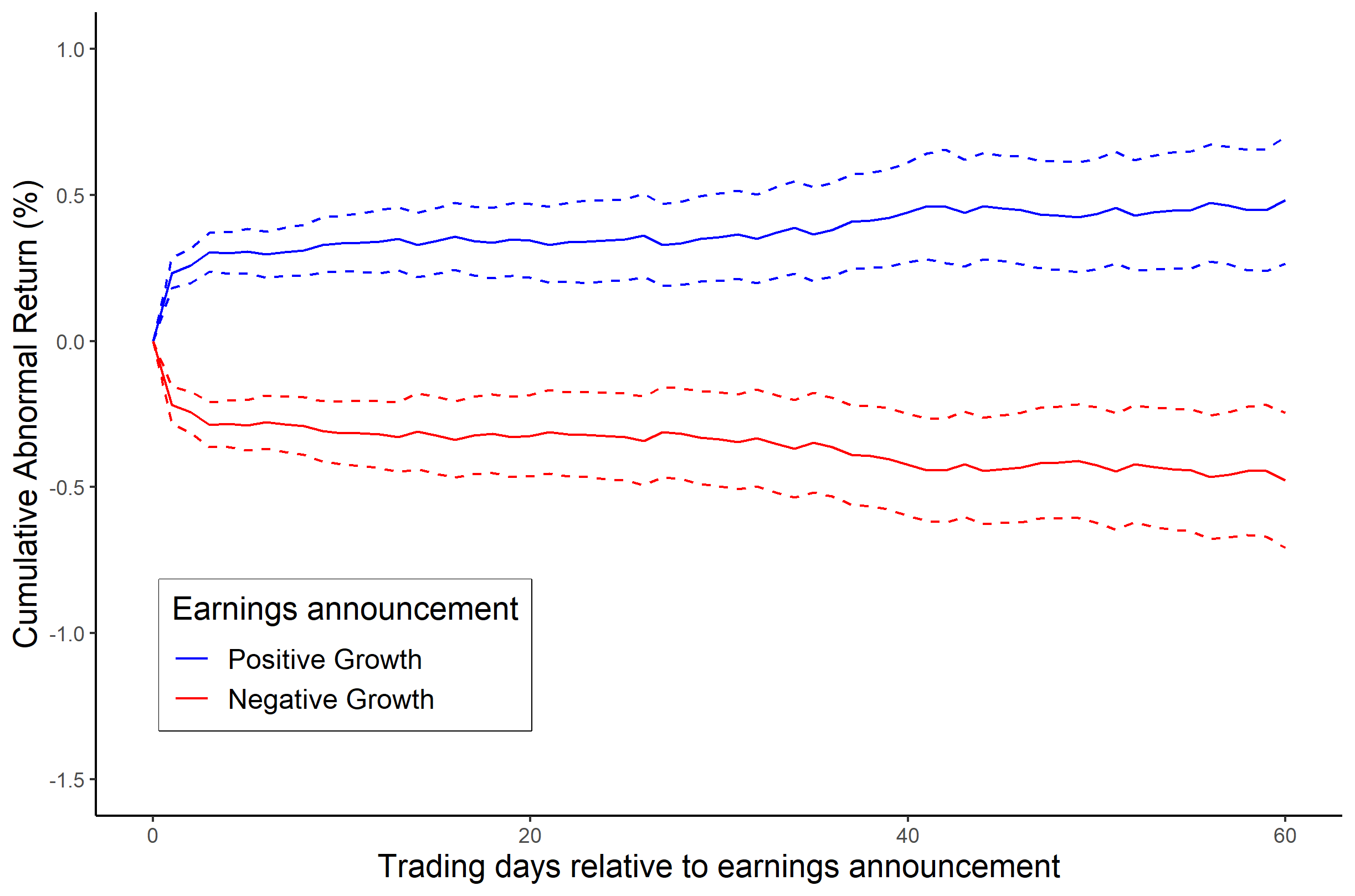

Momentum investing is a system of buying stocks or other securities that have had high returns over the past three to twelve months, and selling those that have had poor returns over the same period. While momentum investing is well-established as a phenomenon no consensus exists about the explanation for this strategy, and economists have trouble reconciling momentum with the efficient market hypothesis and random walk hypothesis. Two main hypotheses have been submitted to explain the momentum effect in terms of an efficient market. In the first, it is assumed that momentum investors bear significant risk for assuming this strategy, and, therefore, the high returns are a compensation for the risk. Momentum strategies often involve disproportionately trading in stocks with high bid-ask spreads and so it is important to take transactions costs into account when evaluating momentum profitability. The second theory assumes that momentum investors are exploiting behavioral shortcomings ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fidelity Investments

Fidelity Investments, commonly referred to as Fidelity, earlier as Fidelity Management & Research or FMR, is an American multinational financial services corporation based in Boston, Massachusetts. The company was established in 1946 and is one of the largest asset managers in the world with $4.5 trillion in assets under management, now as of December 2021 their assets under administration amounts to $11.8 trillion. Fidelity Investments operates a brokerage firm, manages a large family of mutual funds, provides fund distribution and investment advice, retirement services, index funds, wealth management, securities execution and clearance, asset custody, and life insurance. History The "Fidelity Fund" became Fidelity Investments under Edward C. Johnson II; incorporated in Massachusetts, May 1, 1930. During the Great Depression, the "Fidelity Fund" was the only fund approved by John C. Hull in his term in office as Securities Director for Massachusetts because of widespread ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Timing

Market timing is the strategy of making buying or selling decisions of financial assets (often stocks) by attempting to predict future market price movements. The prediction may be based on an outlook of market or economic conditions resulting from technical or fundamental analysis. This is an investment strategy based on the outlook for an aggregate market rather than for a particular financial asset. The efficient-market hypothesis is an assumption that asset prices reflect all available information, meaning that it is theoretically impossible to systematically "beat the market." Approaches Market timing can cause poor performance. After fees, the average "trend follower" does not show skills or abilities compared to benchmarks. "Trend Tracker" reported returns are distorted by survivor bias, selection bias, and fill bias. At the Federal Reserve Bank of St. Louis, YiLi Chien, Senior Economist wrote about return-chasing behavior. The average equity mutual fund investor tends ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream macroeconomics. Keynes's intellect was evident early in life; in 1902, he gained admittance to the competitive mathematics program at King's College at the University of Cambridge. During the Great Depression of the 1930s, Keynes spearheaded a revolution in economic thinking, challenging the ideas of neoclassical economics that held that free markets would, in the short to medium term, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

King's College, Cambridge

King's College is a constituent college of the University of Cambridge. Formally The King's College of Our Lady and Saint Nicholas in Cambridge, the college lies beside the River Cam and faces out onto King's Parade in the centre of the city. King's was founded in 1441 by King Henry VI soon after he had founded its sister institution at Eton College. Initially, King's accepted only students from Eton College. However, the king's plans for King's College were disrupted by the Wars of the Roses and the resultant scarcity of funds, and then his eventual deposition. Little progress was made on the project until 1508, when King Henry VII began to take an interest in the college, probably as a political move to legitimise his new position. The building of the college's chapel, begun in 1446, was finished in 1544 during the reign of Henry VIII. King's College Chapel is regarded as one of the finest examples of late English Gothic architecture. It has the world's largest fan vau ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Efficient-market Hypothesis

The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information. Because the EMH is formulated in terms of risk adjustment, it only makes testable predictions when coupled with a particular model of risk. As a result, research in financial economics since at least the 1990s has focused on market anomalies, that is, deviations from specific models of risk. The idea that financial market returns are difficult to predict goes back to Bachelier, Mandelbrot, and Samuelson, but is closely associated with Eugene Fama, in part due to his influential 1970 review of the theoretical and empirical research. The EMH provides the basic logic for modern risk-based theories of asset prices, and frameworks such as consumption-based asset pricing and in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Seth Klarman

Seth Andrew Klarman (born May 21, 1957) is an American billionaire investor, hedge fund manager, and author. He is a proponent of value investing. He is the chief executive and portfolio manager of the Baupost Group, a Boston-based private investment partnership he founded in 1982. He closely follows the investment philosophy of Benjamin Graham and is known for buying unpopular assets while they are undervalued, seeking a margin of safety and profiting from any rise in price. Since his fund's $27 million-dollar inception in 1982, he has realized a 20% compounded return on investment. He manages $27 billion in assets. In 2008, he was inducted into ''Institutional Investor'' Alpha's Hedge Fund Manager Hall of Fame. ''Forbes'' listed his personal fortune at US$1.50 billion and said he was the 15th highest earning hedge fund manager in the world in 2017. He has drawn numerous comparisons to fellow value investor Warren Buffett, and akin to Buffett's notation as the "Oracle of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)