|

United States Treasury Note

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. government debt has been managed by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt. There are four types of marketable Treasury securities: Treasury bills, Treasury notes, Treasury bonds, and Treasury Inflation Protected Securities (TIPS). The government sells these securities in auctions conducted by the Federal Reserve Bank of New York, after which they can be traded in secondary markets. Non-marketable securities include savings bonds, issued to the public and transferable only as gifts; the State and Local Government Series (SLGS), purchaseable only with the proceeds of state and municipal bond sales; and the Government Account Series, purchased by units of the federal government. Treasury securities are bac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FFR Treasuries

FFR may refer to: Medicine * Fellowship of the Faculty of Radiology of the Royal College of Surgeons in Ireland * Fractional flow reserve, a technique used in coronary catheterization * Frequency following response Military * Falster Foot Regiment, a Royal Danish Army infantry regiment * Frontier Force Regiment, of the Pakistani Army * Fitted For Radio, British Army designators for vehicles equipped to carry radio equipment Music * Fast Food Rockers, a British pop group * Fit for Rivals, an American band * ''For Future Reference'', a 1981 album by the British synthpop band Dramatis * Friendly Fire Recordings, an American record label Sports * French Rugby Federation (French: ') * French Rugby League Federation (French: ') * Russian Fencing Federation * FC Fazisi Racha, a Georgian association football club Transportation * Factory Five Racing, an American automobile kit company * Franconian Forest Railway, in Bavaria, Germany * Fischer Air, a defunct Czech airline Other ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subscription (finance)

Subscription refers to the process of investors signing up and committing to invest in a financial instrument, before the actual closing of the purchase. The term comes from the Latin word ''subscribere''. Historical Praenumeration An early form of subscription was praenumeration, a common business practice in the 18th-century book trade in Germany. The publisher offered to sell a book that was planned but had not yet been printed, usually at a discount, so as to cover their costs in advance. The business practice was particularly common with magazines, helping to determine in advance how many subscribers there would be. Praenumeration is similar to the recent crowdfunding financing model. New issues Subscription agreement Subscription to new issues can be covered by a subscription agreement, legally committing the investor to invest in the financial instrument, and committing the company to certain obligations and warranties. In some jurisdictions, it is possible for the issuer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

COVID-19 Pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identified in an outbreak in the Chinese city of Wuhan in December 2019. Attempts to contain it there failed, allowing the virus to spread to other areas of Asia and later worldwide. The World Health Organization (WHO) declared the outbreak a public health emergency of international concern on 30 January 2020, and a pandemic on 11 March 2020. As of , the pandemic had caused more than cases and confirmed deaths, making it one of the deadliest in history. COVID-19 symptoms range from undetectable to deadly, but most commonly include fever, dry cough, and fatigue. Severe illness is more likely in elderly patients and those with certain underlying medical conditions. COVID-19 transmits when people breathe in air contaminated by droplets and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CUSIP

A CUSIP is a nine-digit numeric (e.g. 037833100 for Apple) or nine-character alphanumeric (e.g. 38259P508 for Google) code that identifies a North American financial security for the purposes of facilitating clearing and settlement of trades. The CUSIP was adopted as an American National Standard under Accredited Standards X9.6. The acronym, pronounced as "kyoo-sip," derives from Committee on Uniform Security Identification Procedures. The CUSIP system is owned by the American Bankers Association and is operated by FactSet Research Systems Inc. The operating body, CUSIP Global Services (CGS), also serves as the national numbering agency (NNA) for North America, and the CUSIP serves as the National Securities Identification Number (NSIN) for products issued from both the United States and Canada. In its role as the NNA, CUSIP Global Services (CGS) also assigns all US-based ISINs. History The acronym ''CUSIP'' derives from the ''Committee on Uniform Security Identification ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Primary Dealers

A primary dealer is a firm that buys government securities directly from a government, with the intention of reselling them to others, thus acting as a market maker of government securities. The government may regulate the behaviour and number of its primary dealers and impose conditions of entry. Some governments sell their securities only to primary dealers; some sell them to others as well. Governments that use primary dealers include Australia, Belgium, Brazil, Canada, China, France, Hong Kong, India, Italy, Japan, Singapore, Spain, the United Kingdom, Pakistan and the United States. Primary dealers in the United States In the United States, a primary dealer is a bank or securities broker-dealer that is permitted to trade directly with the Federal Reserve System ("the Fed").Federal Reserve Bank of New York: ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Single-price Auction

Single-price auctions are a pricing method in securities auctions that give all purchasers of an issue the same purchase price. They can be perceived as modified Dutch auctions. This method has been used since 1992 when it debuted as an experiment of the U.S. Treasury for all auctions of 2-year and 5-year notes. There is only one main difference between the multiple-price system and the single-price system. In the multiple-price format, the ranking of the desired yield and the amount stated by the competitive bidders is from the lowest to the highest yield and the amounts awarded are at the individual yields submitted by the participants. In the single-price format, all bids accepted by the Treasury are awarded at the same interest rate which is the highest yield of accepted competitive bids. History The format of selling U.S. Treasuries by auctions was adopted in 1929 and it has evolved since then. In the beginning of the 1970s, in addition of the multiple-price auctions, were int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yield To Maturity

The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. It is the (theoretical) internal rate of return (IRR, overall interest rate): the discount rate at which the present value of all future cash flows from the bond (coupons and principal) is equal to the current price of the bond. The YTM is often given in terms of Annual Percentage Rate (A.P.R.), but more often market convention is followed. In a number of major markets (such as gilts) the convention is to quote annualized yields with semi-annual compounding (see compound interest); thus, for example, an annual effective yield of 10.25% would be quoted as 10.00%, because 1.05 × 1.05 = 1.1025 and 2 × 5 = 10. Main assumptions The YTM calculat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discounting

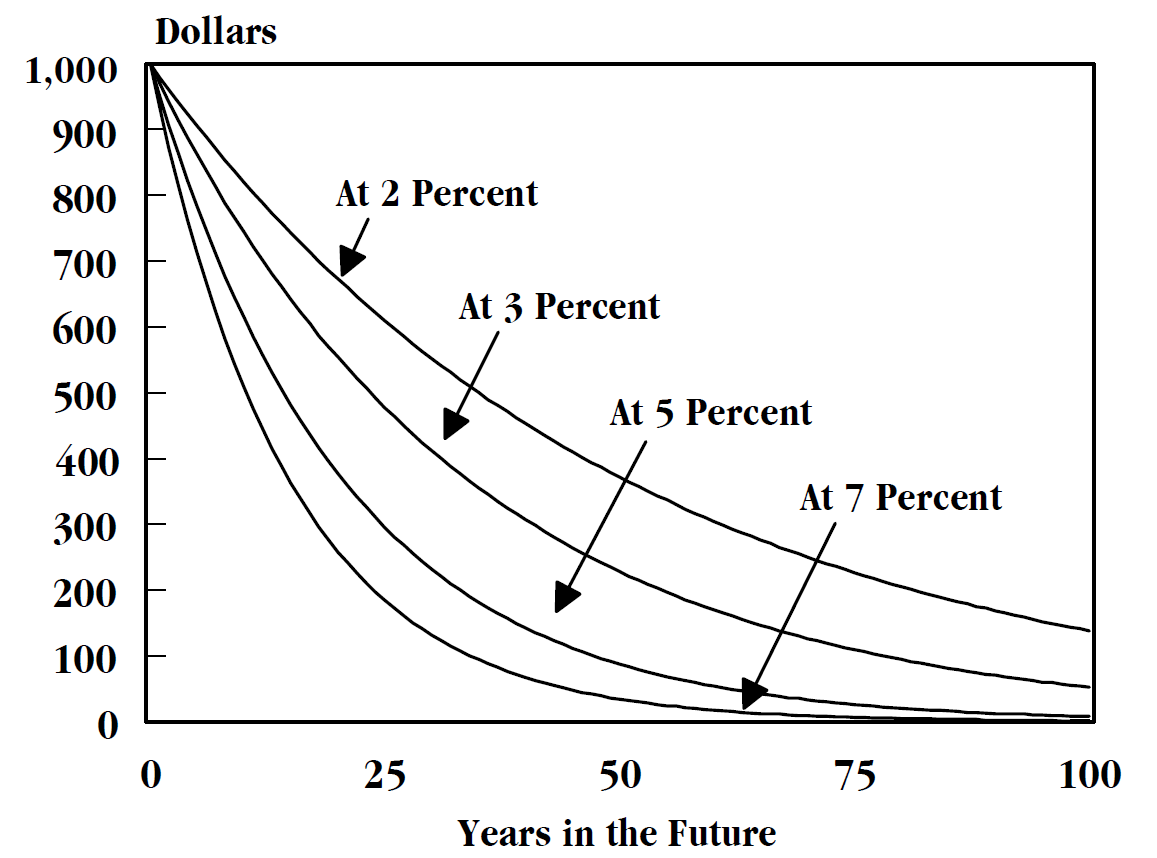

Discounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee.See "Time Value", "Discount", "Discount Yield", "Compound Interest", "Efficient Market", "Market Value" and "Opportunity Cost" in Downes, J. and Goodman, J. E. ''Dictionary of Finance and Investment Terms'', Baron's Financial Guides, 2003. Essentially, the party that owes money in the present purchases the right to delay the payment until some future date.See "Discount", "Compound Interest", "Efficient Markets Hypothesis", "Efficient Resource Allocation", "Pareto-Optimality", "Price", "Price Mechanism" and "Efficient Market" in Black, John, ''Oxford Dictionary of Economics'', Oxford University Press, 2002. This transaction is based on the fact that most people prefer current interest to delayed interest because of mortality effects, impatience effects, and salience effects. The discount, or charge, is the difference ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maturity (finance)

In finance, maturity or maturity date is the date on which the final payment is due on a loan or other financial instrument, such as a Bond (finance), bond or term deposit, at which point the Bond (finance)#Principal, principal (and all remaining interest) is due to be paid. Most instruments have a ''fixed maturity date'' which is a specific date on which the instrument matures. Such instruments include fixed interest and variable rate loans or debt instruments, however called, and other forms of security such as redeemable preference shares, provided their terms of issue specify a maturity date. It is similar in meaning to "redemption date". Some instruments have ''no fixed maturity date'' which continue indefinitely (unless repayment is agreed between the borrower and the lenders at some point) and may be known as "perpetual stocks". Some instruments have a range of possible maturity dates, and such stocks can usually be repaid at any time within that range, as chosen by the bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zero-coupon Bond

A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US savings bonds, long-term zero-coupon bonds, and any type of coupon bond that has been stripped of its coupons. Zero coupon and deep discount bonds are terms that are used interchangeably. In contrast, an investor who has a regular bond receives income from coupon payments, which are made semi-annually or annually. The investor also receives the principal or face value of the investment when the bond matures. Some zero coupon bonds are inflation indexed, and the amount of money that will be paid to the bond holder is calculated to have a set amount of purchasing power, rather than a se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker, and still one of the bankers for the Government of the United Kingdom, it is the world's eighth-oldest bank. It was privately owned by stockholders from its foundation in 1694 until it was nationalised in 1946 by the Attlee ministry. The Bank became an independent public organisation in 1998, wholly owned by the Treasury Solicitor on behalf of the government, with a mandate to support the economic policies of the government of the day, but independence in maintaining price stability. The Bank is one of eight banks authorised to issue banknotes in the United Kingdom, has a monopoly on the issue of banknotes in England and Wales, and regulates the issue of banknotes by commercial banks in Scotland and Northern Ireland. The Bank's Monetary Policy Committee has devolved responsibility for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1969 $100K Treasury Bill (front)

This year is notable for Apollo 11's first landing on the moon. Events January * January 4 – The Government of Spain hands over Ifni to Morocco. * January 5 **Ariana Afghan Airlines Flight 701 crashes into a house on its approach to London's Gatwick Airport, killing 50 of the 62 people on board and two of the home's occupants. * January 14 – An explosion aboard the aircraft carrier USS ''Enterprise'' near Hawaii kills 27 and injures 314. * January 19 – End of the siege of the University of Tokyo, marking the beginning of the end for the 1968–69 Japanese university protests. * January 20 – Richard Nixon is sworn in as the 37th President of the United States. * January 22 – An assassination attempt is carried out on Soviet leader Leonid Brezhnev by deserter Viktor Ilyin. One person is killed, several are injured. Brezhnev escaped unharmed. * January 27 ** Fourteen men, 9 of them Jews, are executed in Baghdad for spying for Israel. ** Revere ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)