|

Unfair Tax Competition

Tax competition, a form of regulatory competition, exists when governments use reductions in fiscal burdens to encourage the inflow of productive resources or to discourage the exodus of those resources. Often, this means a governmental strategy of attracting foreign direct investment, foreign indirect investment (financial investment), and high value human resources by minimizing the overall taxation level and/or special tax preferences, creating a comparative advantage. Scholars generally consider economic development incentives to be inefficient, economically costly, and distortionary. History From the mid 1900s governments had more freedom in setting their taxes, as the barriers to free movement of Capital (economics), capital and people were high. The gradual process of globalization is lowering these barriers and results in rising capital flows and greater manpower mobility. Impact According to a 2020 study, tax competition "primarily reduces taxes for mobile firms and is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regulatory Competition

Regulatory competition, also called competitive governance or policy competition, is a phenomenon in law, economics and politics concerning the desire of lawmakers to compete with one another in the kinds of law offered in order to attract businesses or other actors to operate in their jurisdiction. Regulatory competition depends upon the ability of actors such as companies, workers or other kinds of people to move between two or more separate legal systems. Once this is possible, then the temptation arises for the people running those different legal systems to compete to offer better terms than their "competitors" to attract investment. Historically, regulatory competition has operated within countries having federal systems of regulation - particularly the United States, but since the mid-20th century and the intensification of economic globalisation, regulatory competition became an important issue internationally. One opinion is that regulatory competition in fact creates a "rac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Policy

Public policy is an institutionalized proposal or a decided set of elements like laws, regulations, guidelines, and actions to solve or address relevant and real-world problems, guided by a conception and often implemented by programs. Public policy can be considered to be the sum of government direct and indirect activities and has been conceptualized in a variety of ways. They are created and/or enacted on behalf of the public typically by a government. Sometimes they are made by nonprofit organisations or are made in co-production with communities or citizens, which can include potential experts, scientists, engineers and stakeholders or scientific data, or sometimes use some of their results. They are typically made by policy-makers affiliated with (in democratic polities) currently elected politicians. Therefore, the "policy process is a complex political process in which there are many actors: elected politicians, political party leaders, pressure groups, civil servants, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Residence

The criteria for residence for tax purposes vary considerably from jurisdiction to jurisdiction, and "residence" can be different for other, non-tax purposes. For individuals, physical presence in a jurisdiction is the main test. Some jurisdictions also determine residency of an individual by reference to a variety of other factors, such as the ownership of a home or availability of accommodation, family, and financial interests. For companies, some jurisdictions determine the residence of a corporation based on its place of incorporation. Other jurisdictions determine the residence of a corporation by reference to its place of management. Some jurisdictions use both a place-of-incorporation test and a place-of-management test. Domicile is, in common law jurisdictions, a different legal concept to residence, though the place of residence and the place of domicile would typically be the same. The criteria for residence in double taxation treaties may be different from those of do ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emigration

Emigration is the act of leaving a resident country or place of residence with the intent to settle elsewhere (to permanently leave a country). Conversely, immigration describes the movement of people into one country from another (to permanently move to a country). A migrant ''emigrates'' from their old country, and ''immigrates'' to their new country. Thus, both emigration and immigration describe migration, but from different countries' perspectives. Demographers examine push and pull factors for people to be pushed out of one place and attracted to another. There can be a desire to escape negative circumstances such as shortages of land or jobs, or unfair treatment. People can be pulled to the opportunities available elsewhere. Fleeing from oppressive conditions, being a refugee and seeking asylum to get refugee status in a foreign country, may lead to permanent emigration. Forced displacement refers to groups that are forced to abandon their native country, such as by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Renunciation Of Citizenship

Renunciation (or renouncing) is the act of rejecting something, especially if it is something that the renunciant has previously enjoyed or endorsed. In religion, renunciation often indicates an abandonment of pursuit of material comforts, in the interests of achieving spiritual enlightenment. It is highly practiced in Jainism and Hinduism. In Hinduism, the renounced order of life is '' sannyāsa''; in Buddhism, the Pali word for "renunciation" is ''nekkhamma'', conveying more specifically "giving up the world and leading a holy life" or "freedom from lust, craving and desires". See Sangha, Bhikkhu, Bhikkhuni, Śramaṇa. In Christianity, some denominations have a tradition of renunciation of the Devil. Renunciation of citizenship is the formal process by which a person voluntarily relinquishes the status of citizen of a specific country. A person can also renounce property, as when a person submits a disclaimer of interest in property that has been left to them in a will. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Base

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal person, legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner (Tax noncompliance, non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat tax, flat percentag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid digital subscribers. It also is a producer of popular podcasts such as '' The Daily''. Founded in 1851 by Henry Jarvis Raymond and George Jones, it was initially published by Raymond, Jones & Company. The ''Times'' has won 132 Pulitzer Prizes, the most of any newspaper, and has long been regarded as a national " newspaper of record". For print it is ranked 18th in the world by circulation and 3rd in the U.S. The paper is owned by the New York Times Company, which is publicly traded. It has been governed by the Sulzberger family since 1896, through a dual-class share structure after its shares became publicly traded. A. G. Sulzberger, the paper's publisher and the company's chairman, is the fifth generation of the family to head the pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

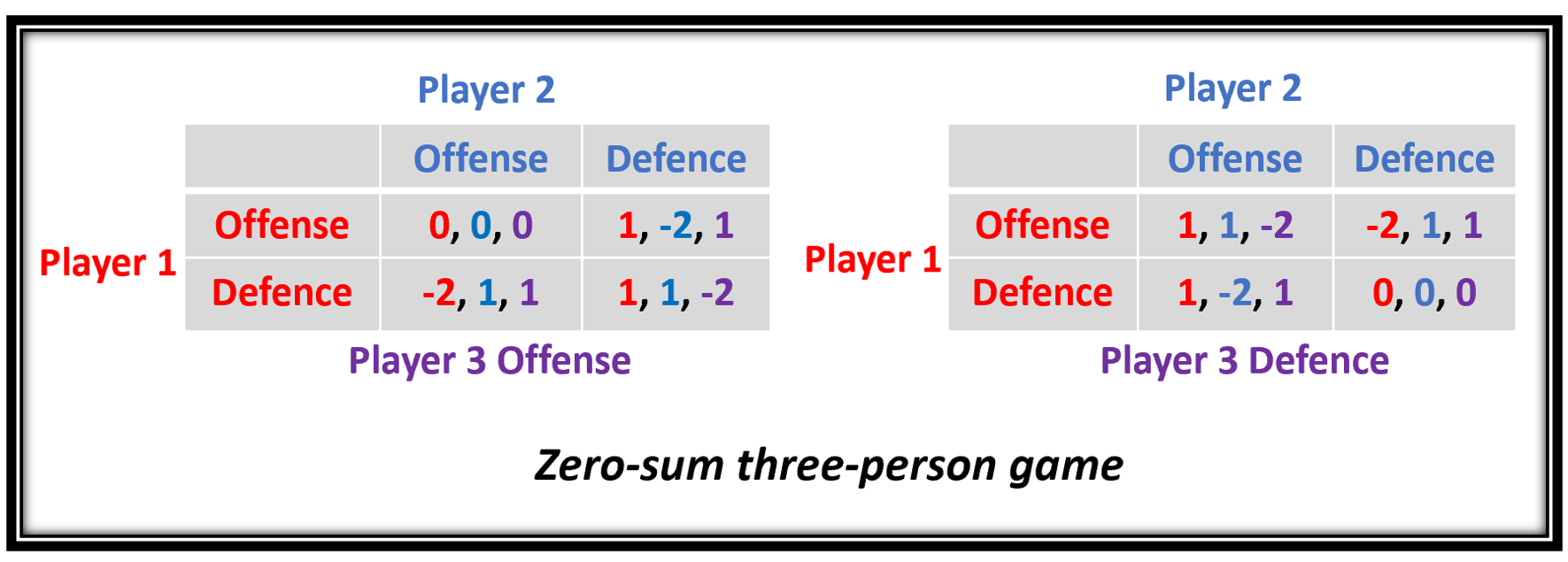

Zero-sum Game

Zero-sum game is a mathematical representation in game theory and economic theory of a situation which involves two sides, where the result is an advantage for one side and an equivalent loss for the other. In other words, player one's gain is equivalent to player two's loss, therefore the net improvement in benefit of the game is zero. If the total gains of the participants are added up, and the total losses are subtracted, they will sum to zero. Thus, cutting a cake, where taking a more significant piece reduces the amount of cake available for others as much as it increases the amount available for that taker, is a zero-sum game if all participants value each unit of cake equally. Other examples of zero-sum games in daily life include games like poker, chess, and bridge where one person gains and another person loses, which results in a zero-net benefit for every player. In the markets and financial instruments, futures contracts and options are zero-sum games as well. In c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Responsibility

Social responsibility is an ethical framework in which an individual is obligated to work and cooperate with other individuals and organizations for the benefit of the community that will inherit the world that individual leaves behind. Social responsibility is a duty every individual has to maintain; a balance between the economy and the ecosystem one lives within. A trade-off might perhaps exist between economic development, in the material sense, and the welfare of the society and environment. Social responsibility pertains not only to business organizations but also to everyone whose actions impact the environment. It aims to ensure secure healthcare for people living in rural areas and eliminate barriers like distance, financial condition, etc. Another example is keeping the outdoors free of trash and litter by using the ethical framework combining the resources of land managers, municipalities, nonprofits, educational institutions, businesses, manufacturers, and individual ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare State

A welfare state is a form of government in which the state (or a well-established network of social institutions) protects and promotes the economic and social well-being of its citizens, based upon the principles of equal opportunity, equitable distribution of wealth, and public responsibility for citizens unable to avail themselves of the minimal provisions for a good life. There is substantial variability in the form and trajectory of the welfare state across countries and regions. All welfare states entail some degree of private-public partnerships wherein the administration and delivery of at least some welfare programmes occurs through private entities. Welfare state services are also provided at varying territorial levels of government. Early features of the welfare state, such as public pensions and social insurance, developed from the 1880s onwards in industrializing Western countries. World War I, the Great Depression, and World War II have been characterized as impo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Revenue

Tax revenue is the income that is collected by governments through taxation. Taxation is the primary source of government revenue. Revenue may be extracted from sources such as individuals, public enterprises, trade, royalties on natural resources and/or foreign aid. An inefficient collection of taxes is greater in countries characterized by poverty, a large agricultural sector and large amounts of foreign aid. Just as there are different types of tax, the form in which tax revenue is collected also differs; furthermore, the agency that collects the tax may not be part of central government, but may be a third party licensed to collect tax which they themselves will use. For example, in the UK, the Driver and Vehicle Licensing Agency (DVLA) collects vehicle excise duty, which is then passed onto HM Treasury. Tax revenues on purchases come in two forms: "tax" itself is a percentage of the price added to the purchase (such as sales tax in U.S. states, or VAT in the UK), while ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Havens

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but mos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)

'_oil_on_panel%2C_1620-1640._USC_Fisher_Museum_of_Art.jpg)