|

US Budget Deficit

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt: * "Debt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Debt To Federal Revenue Ratio

Federal or foederal (archaic) may refer to: Politics General *Federal monarchy, a federation of monarchies *Federation, or ''Federal state'' (federal system), a type of government characterized by both a central (federal) government and states or regional governments that are partially self-governing; a union of states *Federal republic, a federation which is a republic *Federalism, a political philosophy *Federalist, a political belief or member of a political grouping * Federalization, implementation of federalism Particular governments *Federal government of the United States **United States federal law **United States federal courts *Government of Argentina * Government of Australia *Government of Pakistan *Federal government of Brazil *Government of Canada *Government of India *Federal government of Mexico * Federal government of Nigeria * Government of Russia *Government of South Africa * Government of Philippines Other *''The Federalist Papers'', critical early arguments i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation

A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity (a legal entity recognized by private and public law "born out of statute"; a legal person in legal context) and recognized as such in law for certain purposes. Early incorporated entities were established by charter (i.e. by an '' ad hoc'' act granted by a monarch or passed by a parliament or legislature). Most jurisdictions now allow the creation of new corporations through List of company registers, registration. Corporations come in many different types but are usually divided by the law of the jurisdiction where they are chartered based on two aspects: by whether they can issue share capital, stock, or by whether they are formed to make a profit (accounting), profit. Depending on the number of owners, a corporation can be classified as ''aggregate'' (the subject of this article) or ''corporation sole, sole'' (a legal entity consisting of a sing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Debt Ceiling

The United States debt ceiling or debt limit is a legislative limit on the amount of national debt that can be incurred by the U.S. Treasury, thus limiting how much money the federal government may pay on the debt they already borrowed. The debt ceiling is an aggregate figure that applies to the gross debt, which includes debt in the hands of the public and in intra-government accounts. About 0.5% of debt is not covered by the ceiling. As of July 2019, it appeared that the government would default on its obligations within a couple months. The budget problem was caused in part by lower tax revenue (due to new tax legislation that took effect in the 2018 tax year under which many companies had their taxes drastically reduced) and in part by the government having already reached its borrowing limit ($22 trillion as of March 2019). Relationship to federal budget The process of setting the debt ceiling is separate and distinct from the United States budget process, and rais ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Policy Of The United States

Fiscal policy is any changes the government makes to the national budget to influence a nation's economy. "An essential purpose of this Financial Report is to help American citizens understand the current fiscal policy and the importance and magnitude of policy reforms essential to make it sustainable. A sustainable fiscal policy is explained as the debt held by the public to Gross Domestic Product which is either stable or declining over the long term" (Bureau of the fiscal service). The approach to economic policy in the United States was rather laissez-faire until the Great Depression. The government tried to stay away from economic matters as much as possible and hoped that a balanced budget would be maintained. Prior to the Great Depression, the economy did have economic downturns and some were quite severe. However, the economy tended to self-correct so the laissez faire approach to the economy tended to work. President Franklin D. Roosevelt first instituted fiscal policie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Care Prices In The United States

Health care prices in the United States of America describes market and non-market factors that determine pricing, along with possible causes as to why prices are higher than other countries. Compared to other OECD countries, U.S. healthcare costs are one-third higher or more relative to the size of the economy (GDP). According to the CDC, during 2015 health expenditures per-person were nearly $10,000 on average, with total expenditures of $3.2 trillion or 17.8% GDP. Proximate reasons for the differences with other countries include: higher prices for the same services (i.e., higher price per unit) and greater use of healthcare (i.e., more units consumed). Higher administrative costs, higher per-capita income, and less government intervention to drive down prices are deeper causes. While the annual inflation rate in healthcare costs has declined in recent decades; it still remains above the rate of economic growth, resulting in a steady increase in healthcare expenditures relativ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demographics Of The United States

The United States had an official estimated resident population of 333,287,557 on July 1, 2022, according to the U.S. Census Bureau. This figure includes the 50 states and the District of Columbia but excludes the population of five unincorporated U.S. territories ( Puerto Rico, Guam, the U.S. Virgin Islands, American Samoa, and the Northern Mariana Islands) as well as several minor island possessions. The United States is the third most populous country in the world. The Census Bureau showed a population increase of 0.4% for the twelve-month period ending in July 2022, below the world average annual rate of 0.9%. The total fertility rate in the United States estimated for 2021 is 1.664 children per woman, which is below the replacement fertility rate of approximately 2.1 and the cremation rate is 57.5%. The U.S. population almost quadrupled during the 20th centuryat a growth rate of about 1.3% a yearfrom about 76 million in 1900 to 281 million in 2000. It i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Growth

Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy in a financial year. Statisticians conventionally measure such growth as the percent rate of increase in the real gross domestic product Gross domestic product (GDP) is a money, monetary Measurement in economics, measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjec ..., or real GDP. Growth is usually calculated in real terms – i.e., real vs. nominal in economics, inflation-adjusted terms – to eliminate the distorting effect of inflation on the prices of goods produced. Measures of national income and output, Measurement of economic growth uses National accounts, national income accounting. Since economic growth is measured as the annual percent change of gross domestic product (GDP), it has all the advantag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt-to-GDP Ratio

In economics, the debt-to-GDP ratio is the ratio between a country's government debt (measured in units of currency) and its gross domestic product (GDP) (measured in units of currency per year). While it is a "ratio", it is technically measured in units of year, and can be interpreted as the number of years a country needs to pay off its entire debt, if all its GDP is devoted towards it. A low debt-to-GDP ratio indicates that an economy produces goods and services sufficient to pay back debts without incurring further debt. Geopolitical and economic considerations – including interest rates, war, recessions, and other variables – influence the borrowing practices of a nation and the choice to incur further debt. It should not be confused with a deficit-to-GDP ratio, which, for countries running budget deficits, measures a country's annual net fiscal loss in a given year ( total expenditures minus total revenue, or the net change in debt per annum) as a percentage share of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster (e.g. a pandemic). In the United States, a recession is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." The European Union has adopted a similar definition. In the United Kingdom, a recession is defined as negative economic growth for two consecutive quarters. Governments usually respond to recessions by adopting expansionary macroeconomic policies, such as increasing money supply and decreasing int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Domestic Product

Gross domestic product (GDP) is a money, monetary Measurement in economics, measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is often revised before being considered a reliable indicator. List of countries by GDP (nominal) per capita, GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation, inflation rates of the countries; therefore, using a basis of List of countries by GDP (PPP) per capita, GDP per capita at purchasing power parity (PPP) may be more useful when comparing standard of living, living standards between nations, while nominal GDP is more useful comparing national economies on the international market. Total GDP can also be broken down into the contribution of each industry or sector of the economy. The ratio of GDP to the total population of the region is the GDP per capita, p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

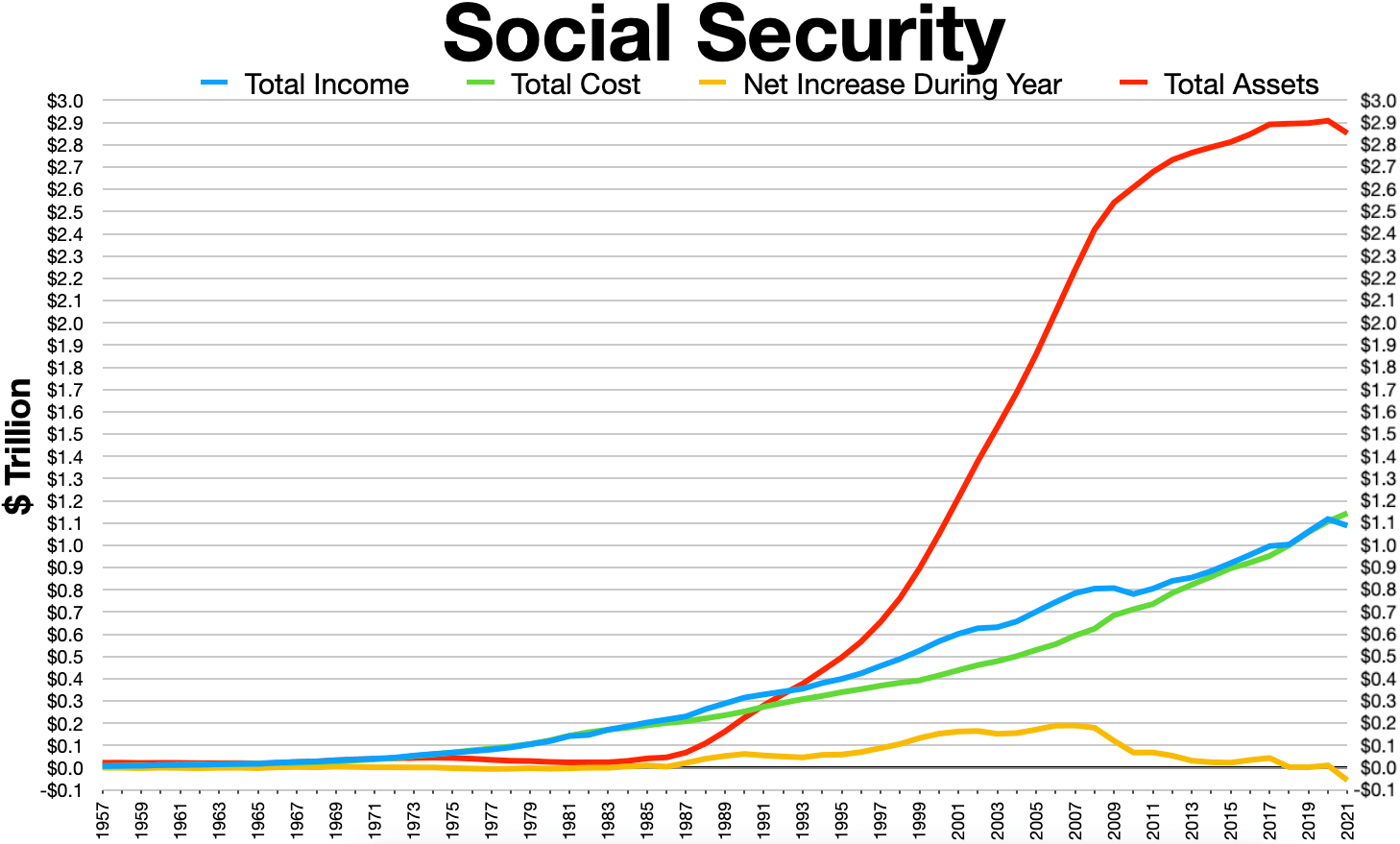

Social Security Trust Fund

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund (collectively, the Social Security Trust Fund or Trust Funds) are trust funds that provide for payment of Social Security (Old-Age, Survivors, and Disability Insurance; OASDI) benefits administered by the United States Social Security Administration. The Social Security Administration collects payroll taxes and uses the money collected to pay Old-Age, Survivors, and Disability Insurance benefits by way of trust funds. When the program runs a surplus, the excess funds increase the value of the Trust Fund. As of 2021, the Trust Fund contained (or alternatively, was owed) $2.908 trillion The Trust Fund is required by law to be invested in non-marketable securities issued and guaranteed by the "full faith and credit" of the federal government. These securities earn a market rate of interest. Excess funds are used by the government for non-Social Security purposes, creating the obligatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |