|

Tom Cryer

Tommy Keith Cryer, also known as Tom Cryer (September 11, 1949 in Lake Charles, Louisiana - June 4, 2012), was an attorney in Shreveport, Louisiana who was charged with and later acquitted of willful failure to file U.S. Federal income tax returns in a timely fashion. In a case in United States Tax Court, Cryer contested a determination by the U.S. Internal Revenue Service that he owed $1.7 million in taxes and penalties. Before the case could come to trial, Cryer died June 4, 2012. He was 62. According to a resume published by Cryer on his website, Cryer graduated with honors from Louisiana State University (LSU) Law School in 1973, and was inducted into the LSU Law School Hall of Fame in 1987. Cryer was a member of the Order of the Coif, a law school honor society. He served as a Special Advisor and Draftsman at the Louisiana Constitutional Convention in 1973 and he argued cases before the Louisiana Supreme Court. He opened a solo law practice in 1975 and gained experience in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lake Charles, Louisiana

Lake Charles (French: ''Lac Charles'') is the fifth-largest incorporated city in the U.S. state of Louisiana, and the parish seat of Calcasieu Parish, located on Lake Charles, Prien Lake, and the Calcasieu River. Founded in 1861 in Calcasieu Parish, it is a major industrial, cultural, and educational center in the southwest region of the state. As of the 2020 U.S. census, Lake Charles's population was 84,872. The city and metropolitan area of Lake Charles is considered a regionally significant center of petrochemical refining, gambling, tourism, and education, being home to McNeese State University and Sowela Technical Community College. Because of the lakes and waterways throughout the city, metropolitan Lake Charles is often called ''the Lake Area''. History On March 7, 1861, Lake Charles was incorporated as the town of Charleston, Louisiana. Lake Charles was founded by merchant and tradesman Marco Eliche (or Marco de Élitxe) as an outpost. He was a Sephardic Jew ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

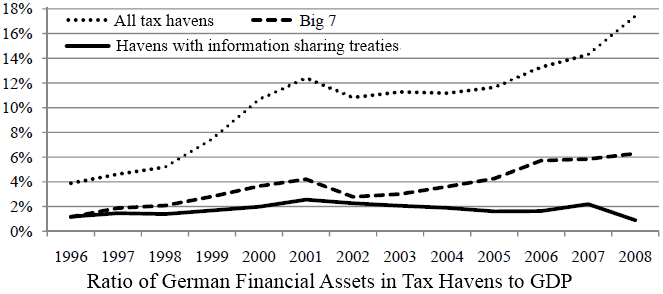

Tax Evasion

Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to reduce the taxpayer's tax liability, and it includes dishonest tax reporting, declaring less income, profits or gains than the amounts actually earned, overstating deductions, using bribes against authorities in countries with high corruption rates and hiding money in secret locations. Tax evasion is an activity commonly associated with the informal economy. One measure of the extent of tax evasion (the "tax gap") is the amount of unreported income, which is the difference between the amount of income that should be reported to the tax authorities and the actual amount reported. In contrast, tax avoidance is the legal use of tax laws to reduce one's tax burden. Both tax evasion and tax avoidance can be viewed as forms of tax noncompliance, as they desc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Louisiana Lawyers

Louisiana , group=pronunciation (French: ''La Louisiane'') is a state in the Deep South and South Central regions of the United States. It is the 20th-smallest by area and the 25th most populous of the 50 U.S. states. Louisiana is bordered by the state of Texas to the west, Arkansas to the north, Mississippi to the east, and the Gulf of Mexico to the south. A large part of its eastern boundary is demarcated by the Mississippi River. Louisiana is the only U.S. state with political subdivisions termed parishes, which are equivalent to counties, making it one of only two U.S. states not subdivided into counties (the other being Alaska and its boroughs). The state's capital is Baton Rouge, and its largest city is New Orleans, with a population of roughly 383,000 people. Some Louisiana urban environments have a multicultural, multilingual heritage, being so strongly influenced by a mixture of 18th century Louisiana French, Dominican Creole, Spanish, French Canadian, Acadia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1949 Births

Events January * January 1 – A United Nations-sponsored ceasefire brings an end to the Indo-Pakistani War of 1947. The war results in a stalemate and the division of Kashmir, which still continues as of 2022. * January 2 – Luis Muñoz Marín becomes the first democratically elected Governor of Puerto Rico. * January 11 – The first "networked" television broadcasts take place, as KDKA-TV in Pittsburgh, Pennsylvania goes on the air, connecting east coast and mid-west programming in the United States. * January 16 – Şemsettin Günaltay forms the new government of Turkey. It is the 18th government, last One-party state, single party government of the Republican People's Party. * January 17 – The first Volkswagen Beetle, VW Type 1 to arrive in the United States, a 1948 model, is brought to New York City, New York by Dutch businessman Ben Pon Sr., Ben Pon. Unable to interest dealers or importers in the Volkswagen, Pon sells the sample car to pay his ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2012 Deaths

This is a list of deaths of notable people, organised by year. New deaths articles are added to their respective month (e.g., Deaths in ) and then linked here. 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 See also * Lists of deaths by day The following pages, corresponding to the Gregorian calendar, list the historical events, births, deaths, and holidays and observances of the specified day of the year: Footnotes See also * Leap year * List of calendars * List of non-standard ... * Deaths by year {{DEFAULTSORT:deaths by year ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United States

The United States, United States of America has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey. Taxes fall much more heavily on labor income than on capital income. Divergent taxes and subsidies for different forms of income and spending can also constitute a form of indirect taxation of some activities over others. For example, individual spending on higher education can ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Register

The ''Federal Register'' (FR or sometimes Fed. Reg.) is the official journal of the federal government of the United States that contains government agency rules, proposed rules, and public notices. It is published every weekday, except on federal holidays. The final rules promulgated by a federal agency and published in the ''Federal Register'' are ultimately reorganized by topic or subject matter and codified in the '' Code of Federal Regulations'' (CFR), which is updated annually. The ''Federal Register'' is compiled by the Office of the Federal Register (within the National Archives and Records Administration) and is printed by the Government Publishing Office. There are no copyright restrictions on the ''Federal Register''; as a work of the U.S. government, it is in the public domain. Contents The ''Federal Register'' provides a means for the government to announce to the public changes to government requirements, policies, and guidance. * Proposed new rules and regulat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Administrative Procedure Act (United States)

The Administrative Procedure Act (APA), , is the United States federal statute that governs the way in which administrative agencies of the federal government of the United States may propose and establish regulations and it grants U.S. federal courts oversight over all agency actions. According to Hickman & Pierce, it is one of the most important pieces of United States administrative law, and serves as a sort of "constitution" for U.S. administrative law. The APA applies to both the federal executive departments and the independent agencies. U.S. Senator Pat McCarran called the APA "a bill of rights for the hundreds of thousands of Americans whose affairs are controlled or regulated" by federal government agencies. The text of the APA can be found under Title 5 of the United States Code, beginning at Section 500. There is a similar Model State Administrative Procedure Act (Model State APA), which was drafted by the National Conference of Commissioners on Uniform State Law ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commissioner V

A commissioner (commonly abbreviated as Comm'r) is, in principle, a member of a Regulatory agency, commission or an individual who has been given a Wiktionary: commission, commission (official charge or authority to do something). In practice, the title of commissioner has evolved to include a variety of senior officials, often sitting on a specific commission. In particular, the commissioner frequently refers to senior police or government officials. A high commissioner is equivalent to an ambassador, originally between the United Kingdom and the Dominions and now between all Commonwealth states, whether Commonwealth realms, republics in the Commonwealth of Nations, republics or countries having a monarch other than that of the realms. The title is sometimes given to senior officials in the private sector; for instance, many North American sports leagues. There is some confusion between commissioners and commissary, commissaries because other European languages use the same word ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Protester (United States)

A tax protester is someone who refuses to pay a tax claiming that the tax laws are unconstitutional or otherwise invalid. Tax protesters are different from tax resisters, who refuse to pay taxes as a protest against a government or its policies, or a moral opposition to taxation in general, not out of a belief that the tax law itself is invalid. The United States has a large and organized culture of people who espouse such theories. Tax protesters also exist in other countries. Legal commentator Daniel B. Evans has defined tax protesters as people who "refuse to pay taxes or file tax returns out of a mistaken belief that the federal income tax is unconstitutional, invalid, voluntary, or otherwise does not apply to them under one of a number of bizarre arguments" (divided into several classes: constitutional, conspiracy, administrative, statutory, and arguments based on 16th Amendment and the "861" section of the tax code; see the Tax protester arguments article for an overview ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax In The United States

Income taxes in the United States are imposed by the federal government, and most states. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed (with some exceptions in the case of Federal income taxation), but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels. In the United States, the term "payroll tax" usually refers to FICA taxes that are paid to fund Social Security and Medicare, while "income tax" re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lawyer

A lawyer is a person who practices law. The role of a lawyer varies greatly across different legal jurisdictions. A lawyer can be classified as an advocate, attorney, barrister, canon lawyer, civil law notary, counsel, counselor, solicitor, legal executive, or public servant — with each role having different functions and privileges. Working as a lawyer generally involves the practical application of abstract legal theories and knowledge to solve specific problems. Some lawyers also work primarily in advancing the interests of the law and legal profession. Terminology Different legal jurisdictions have different requirements in the determination of who is recognized as being a lawyer. As a result, the meaning of the term "lawyer" may vary from place to place. Some jurisdictions have two types of lawyers, barrister and solicitors, while others fuse the two. A barrister (also known as an advocate or counselor in some jurisdictions) is a lawyer who typically specia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |