|

The Total Money Makeover

''The Total Money Makeover: A Proven Plan for Financial Fitness'' is a personal finance book written by Dave Ramsey that was first published in 2003. An updated edition was published in 2007 and 2013. It teaches an effective way of getting out of debt, staying out of debt, and corrects myths about money. Summary ''The Total Money Makeover'' teaches how to get out of debt, how to budget, and corrects money myths. The book teaches the seven "baby steps" to follow in order to achieve financial stability, planning ahead for upcoming financial events, like retirement, and shares stories of individuals and couples that have done so successfully using ''The Total Money Makeover''. The seven baby steps are: # Save a $1,000 beginner emergency fund. # Get out of debt using the debt-snowball method. This means to list all debts arranging them by smallest to largest amount. Make only the minimum payments on all except the smallest debt. Use any available money to pay as much as possible t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dave Ramsey

David Lawrence Ramsey III (born September 3, 1960) is an American personal finance personality, radio show host, author, and businessman. An evangelical Christian, he hosts the nationally syndicated radio program ''The Ramsey Show''. Ramsey has written several books, including ''The New York Times'' bestseller ''The Total Money Makeover'', and hosted a television show on Fox Business from 2007 to 2010. Early life Ramsey was born in Antioch, Tennessee, to real estate developers. He attended Antioch High School where he played ice hockey. At age 18, Ramsey took the real estate exam and began selling property, working through college at The University of Tennessee, Knoxville, where he earned a Bachelor of Science degree in Finance and Real Estate. By 1986, Ramsey had amassed a significant portfolio worth over $4million. However, when the Competitive Equality Banking Act of 1987 took effect, several banks changed ownership and recalled his $1.2million in loans and lines of credit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Security

Economic security or financial security is the condition of having stable income or other resources to support a standard of living now and in the foreseeable future. It includes: * probable continued solvency * predictability of the future cash flow of a person or other economic entity, such as a country * employment security or job security Financial security more often refers to individual and family money management and savings. Economic security tends to include the broader effect of a society's production levels and monetary support for non-working citizens. Components of individual economic security In the United States, children's economic security is indicated by the income level and employment security of their families or organizations. Economic security of people over 50 years old is based on Social Security benefits, pensions and savings, earnings and employment, and health insurance coverage. Arizona In 1972, the state legislature of Arizona formed a Department o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2003 Non-fiction Books

3 (three) is a number, numeral and digit. It is the natural number following 2 and preceding 4, and is the smallest odd prime number and the only prime preceding a square number. It has religious or cultural significance in many societies. Evolution of the Arabic digit The use of three lines to denote the number 3 occurred in many writing systems, including some (like Roman and Chinese numerals) that are still in use. That was also the original representation of 3 in the Brahmic (Indian) numerical notation, its earliest forms aligned vertically. However, during the Gupta Empire the sign was modified by the addition of a curve on each line. The Nāgarī script rotated the lines clockwise, so they appeared horizontally, and ended each line with a short downward stroke on the right. In cursive script, the three strokes were eventually connected to form a glyph resembling a with an additional stroke at the bottom: ३. The Indian digits spread to the Caliphate in the 9th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Insider

''Insider'', previously named ''Business Insider'' (''BI''), is an American financial and business news website founded in 2007. Since 2015, a majority stake in ''Business Insider''s parent company Insider Inc. has been owned by the German publishing house Axel Springer. It operates several international editions, including one in the United Kingdom. ''Insider'' publishes original reporting and aggregates material from other outlets. , it maintained a liberal policy on the use of anonymous sources. It has also published native advertising and granted sponsors editorial control of its content. The outlet has been nominated for several awards, but is criticized for using factually incorrect clickbait headlines to attract viewership. In 2015, Axel Springer SE acquired 88 percent of the stake in Insider Inc. for $343 million (€306 million), implying a total valuation of $442 million. In February 2021, the brand was renamed simply ''Insider''. History ''Busi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankrate

Bankrate, LLC is a consumer financial services company based in New York City. Bankrate.com, perhaps its best-known brand, is a personal finance website. As of November 8, 2017, it became a subsidiary of Red Ventures through an acquisition. History Bankrate was founded in 1976 by Robert K. Heady as a print publisher of the "Bank Rate Monitor." In 1996, the company began moving its business online. Today, Bankrate, Inc.'s online network includes Bankrate.com as well as CreditCards.com, Caring.com, Interest.com, Bankaholic.com, Mortgage-calc.com, CreditCardGuide.com, ThePointsGuy.com, Bankrate.com.cn, CreditCards.ca, NetQuote.com, CD.com, Walla.by and Quizzle. The online network received over 150 million visits in 2010. In January 2011, Bankrate completed the acquisition of Trouve Media. In December 2011, Bankrate completed the acquisition of substantially all of the assets of InsWeb Corporation for $65 million in cash. In March 2012, Bankrate acquired InsuranceAgents.com. Afte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published six days a week by Dow Jones & Company, a division of News Corp. The newspaper is published in the broadsheet format and online. The ''Journal'' has been printed continuously since its inception on July 8, 1889, by Charles Dow, Edward Jones, and Charles Bergstresser. The ''Journal'' is regarded as a newspaper of record, particularly in terms of business and financial news. The newspaper has won 38 Pulitzer Prizes, the most recent in 2019. ''The Wall Street Journal'' is one of the largest newspapers in the United States by circulation, with a circulation of about 2.834million copies (including nearly 1,829,000 digital sales) compared with ''USA Today''s 1.7million. The ''Journal'' publishes the luxury news and lifestyle magazine ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt-snowball Method

The debt snowball method is a debt-reduction strategy, whereby one who owes on more than one account pays off the accounts starting with the smallest balances first, while paying the minimum payment on larger debts. Once the smallest debt is paid off, one proceeds to the next larger debt, and so forth, proceeding to the largest ones last. This method is sometimes contrasted with the debt stacking method, also called the debt avalanche method, where one pays off accounts on the highest interest rate first. The debt-snowball method is most often applied to repaying revolving credit such as credit cards. Under the method, extra cash is dedicated to paying debts with the smallest amount owed. Methodology The basic steps in the debt snowball method are as follows: # List all debts in ascending order from smallest balance to largest. This is the method's most distinctive feature, in that the order is determined by amount owed, not the rate of interest charged. However, if two debts ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emergency Fund

An emergency fund, also known as contingency fund, is a personal budget set aside as a financial safety net for future mishaps or unexpected expenses. A critical part of financial planning, it is supposed to ensure one's personal finances are prepared for any emergency so that the risks of becoming dependent on credit, falling into debt, or running out of money in general are reduced if such a situation were to occur. Emergency funds may be used in the case of job loss, medical emergencies, automobile problems, home appliance repairs/replacements and unplanned travel expenses. Saving The recommended amount of money to be allocated into an emergency fund depends on one's personal financial or economic situation. Generally, an adequate fund tends to cover six months' worth of expenses or more. In early adulthood, it is generally accepted one should save $500. An emergency fund includes all the basic expenses like house rent, grocery expenses, electricity bills, phone bills, etc. It ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

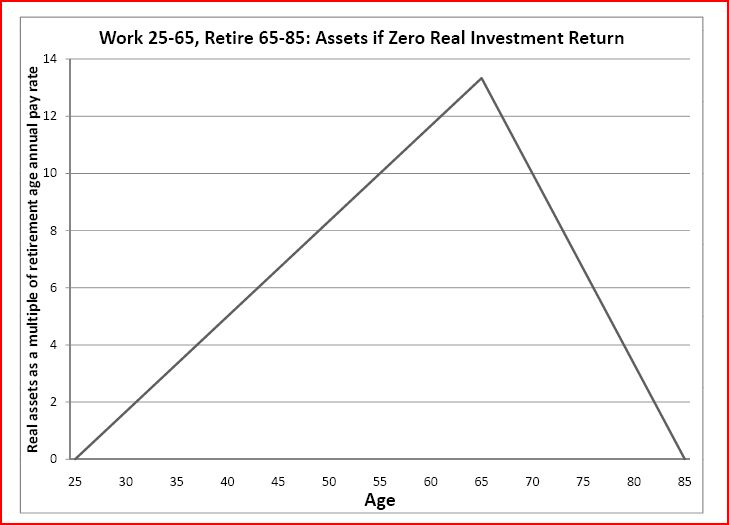

Retirement

Retirement is the withdrawal from one's position or occupation or from one's active working life. A person may also semi-retire by reducing work hours or workload. Many people choose to retire when they are elderly or incapable of doing their job due to health reasons. People may also retire when they are eligible for private or public pension benefits, although some are forced to retire when bodily conditions no longer allow the person to work any longer (by illness or accident) or as a result of legislation concerning their positions. In most countries, the idea of retirement is of recent origin, being introduced during the late-nineteenth and early-twentieth centuries. Previously, low life expectancy, lack of social security and the absence of pension arrangements meant that most workers continued to work until their death. Germany was the first country to introduce retirement benefits in 1889. Nowadays, most developed countries have systems to provide pensions on retirement ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

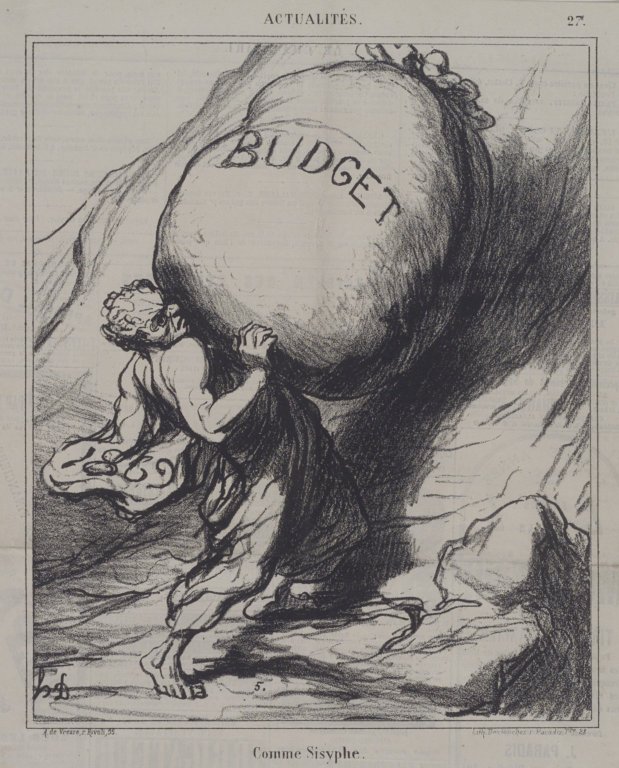

Budget

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms. A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources. Government The budget of a government is a summary or plan of the anticipated resources (often but not always from taxes) and expenditures of that government. There are three types of government budget: the operating or current budget, the capital or investment budget, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Finance

Personal finance is the financial management which an individual or a family unit performs to budget, save, and spend monetary resources over time, taking into account various financial risks and future life events. When planning personal finances, the individual would consider the suitability to his or her needs of a range of banking products ( checking, savings accounts, credit cards and consumer loans) or investment in private equity, ( companies' shares, bonds, mutual funds) and insurance (life insurance, health insurance, disability insurance) products or participation and monitoring of and- or employer-sponsored retirement plans, social security benefits, and income tax management. History Before a specialty in personal finance was developed, various disciplines which are closely related to it, such as family economics, and consumer economics were taught in various colleges as part of home economics for over 100 years. The earliest known research in personal financ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity. The term can also be used metaphorically to cover moral obligations and other interactions not based on a monetary value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person. Etymology The English term "debt" was first used in the late 13th century. The term "debt" comes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |