|

Tariff

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. ''Protective tariffs'' are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing imports means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead, boosting their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and reduce th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tariff Rates In Japan (1870-1960)

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. ''Protective tariffs'' are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing imports means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead, boosting their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and reduce the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Export Quota

Non-tariff barriers to trade (NTBs; also called non-tariff measures, NTMs) are trade barriers that restrict imports or exports of goods or services through mechanisms other than the simple imposition of tariffs. The Southern African Development Community (SADC) defines a non-tariff barrier as "''any obstacle to international trade that is not an import or export duty. They may take the form of import quotas, subsidies, customs delays, technical barriers, or other systems preventing or impeding trade''". According to the World Trade Organization, non-tariff barriers to trade include import licensing, rules for valuation of goods at customs, pre-shipment inspections, rules of origin ('made in'), and trade prepared investment measures. A 2019 UNCTAD report concluded that trade costs associated with non-tariff measures were more than double those of traditional tariffs. History The transition from tariffs to non-tariff barriers One of the reasons why industrialized countries have m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-tariff Barriers To Trade

Non-tariff barriers to trade (NTBs; also called non-tariff measures, NTMs) are trade barriers that restrict imports or exports of goods or services through mechanisms other than the simple imposition of tariffs. The Southern African Development Community (SADC) defines a non-tariff barrier as "''any obstacle to international trade that is not an import or export duty. They may take the form of import quotas, subsidies, customs delays, technical barriers, or other systems preventing or impeding trade''". According to the World Trade Organization, non-tariff barriers to trade include import licensing, rules for valuation of goods at customs, pre-shipment inspections, rules of origin ('made in'), and trade prepared investment measures. A 2019 UNCTAD report concluded that trade costs associated with non-tariff measures were more than double those of traditional tariffs. History The transition from tariffs to non-tariff barriers One of the reasons why industrialized countries have m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade Liberalization

Free trade is a trade policy that does not restrict imports or exports. It can also be understood as the free market idea applied to international trade. In government, free trade is predominantly advocated by political parties that hold economically liberal positions, while economic nationalist and left-wing political parties generally support protectionism, the opposite of free trade. Most nations are today members of the World Trade Organization multilateral trade agreements. Free trade was best exemplified by the unilateral stance of Great Britain who reduced regulations and duties on imports and exports from the mid-nineteenth century to the 1920s. An alternative approach, of creating free trade areas between groups of countries by agreement, such as that of the European Economic Area and the Mercosur open markets, creates a protectionist barrier between that free trade area and the rest of the world. Most governments still impose some protectionist policies that are inten ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

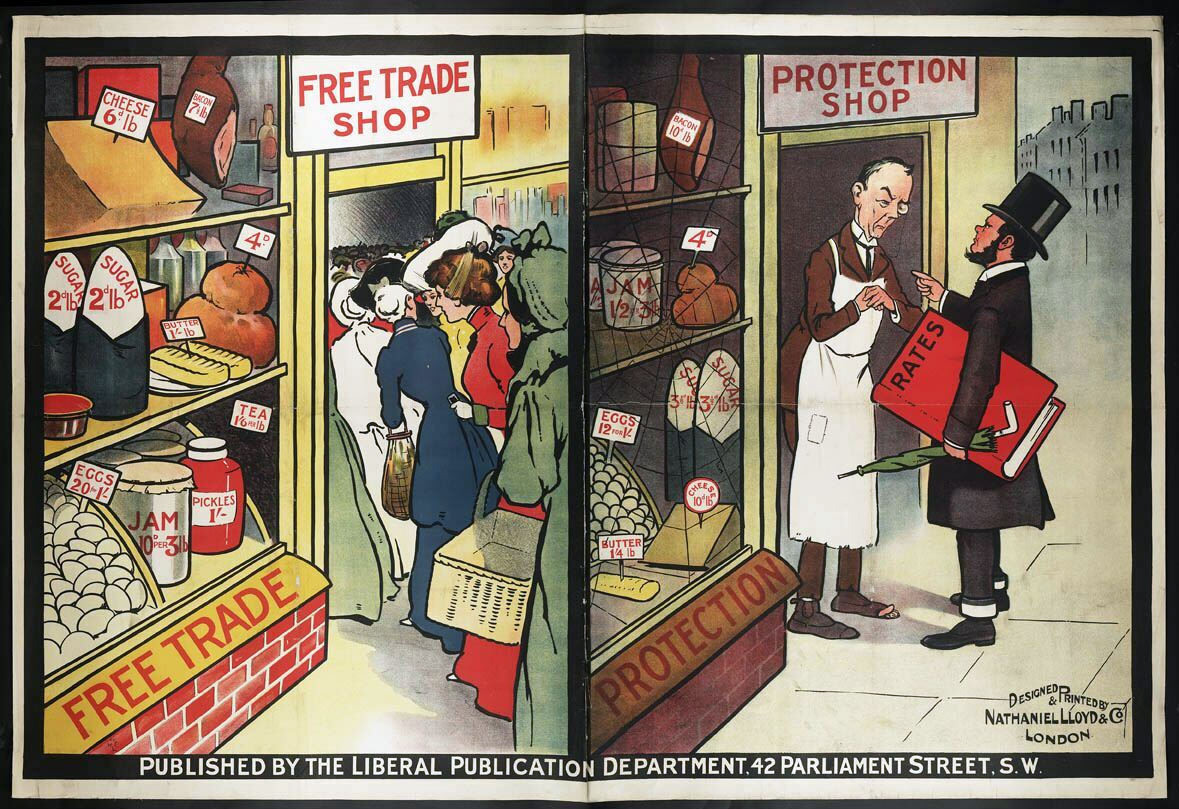

Protectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations. Proponents argue that protectionist policies shield the producers, businesses, and workers of the Import substitution industrialization, import-competing sector in the country from foreign competitors. Opponents argue that protectionist policies reduce trade and adversely affect consumers in general (by raising the cost of imported goods) as well as the producers and workers in export sectors, both in the country implementing protectionist policies and in the countries protected against. Protectionism is advocated mainly by parties that hold Economic nationalism, economic nationalist or left-wing positions, while economically right-wing political parties generally support free trade. There is a consensus among economists that protectioni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Free Trade

Free trade is a trade policy that does not restrict imports or exports. It can also be understood as the free market idea applied to international trade. In government, free trade is predominantly advocated by political parties that hold economically liberal positions, while economic nationalist and left-wing political parties generally support protectionism, the opposite of free trade. Most nations are today members of the World Trade Organization multilateral trade agreements. Free trade was best exemplified by the unilateral stance of Great Britain who reduced regulations and duties on imports and exports from the mid-nineteenth century to the 1920s. An alternative approach, of creating free trade areas between groups of countries by agreement, such as that of the European Economic Area and the Mercosur open markets, creates a protectionist barrier between that free trade area and the rest of the world. Most governments still impose some protectionist policies that are inte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Protective Tariff

Protective tariffs are tariffs that are enacted with the aim of protecting a domestic industry. They aim to make imported goods cost more than equivalent goods produced domestically, thereby causing sales of domestically produced goods to rise, supporting local industry. Tariffs are also imposed in order to raise government revenue, or to reduce an undesirable activity (sin tax). Although a tariff can simultaneously protect domestic industry and earn government revenue, the goals of protection and revenue maximization suggest different tariff rates, entailing a tradeoff between the two aims. How tariffs work A tariff is a tax added onto goods imported into a country; protective tariffs are taxes that are intended to increase the cost of an import so it is less competitive against a roughly equivalent domestic good. For example, if similar cloth for sale in America cost $4 in for a version imported from Britain (including additional shipping, etc.) and $4 for a version originat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exports

An export in international trade is a good produced in one country that is sold into another country or a service provided in one country for a national or resident of another country. The seller of such goods or the service provider is an ''exporter''; the foreign buyer is an '' importer''. Services that figure in international trade include financial, accounting and other professional services, tourism, education as well as intellectual property rights. Exportation of goods often requires the involvement of customs authorities. Firms Many manufacturing firms begin their global expansion as exporters and only later switch to another mode for serving a foreign market. Barriers There are four main types of export barriers: motivational, informational, operational/resource-based, and knowledge. Trade barriers are laws, regulations, policy, or practices that protect domestically made products from foreign competition. While restrictive business practices sometimes hav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade Barrier

Trade barriers are government-induced restrictions on international trade. According to the theory of comparative advantage, trade barriers are detrimental to the world economy and decrease overall economic efficiency. Most trade barriers work on the same principle: the imposition of some sort of cost (money, time, bureaucracy, quota) on trade that raises the price or availability of the traded products. If two or more nations repeatedly use trade barriers against each other, then a trade war results. Barriers take the form of tariffs (which impose a financial burden on imports) and non-tariff barriers to trade (which uses other overt and covert means to restrict imports and occasionally exports). In theory, free trade involves the removal of all such barriers, except perhaps those considered necessary for health or national security. In practice, however, even those countries promoting free trade heavily subsidize certain industries, such as agriculture and steel. Overview High- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Import Substitution Industrialization

Import substitution industrialization (ISI) is a trade and economic policy that advocates replacing foreign imports with domestic production.''A Comprehensive Dictionary of Economics'' p.88, ed. Nelson Brian 2009. It is based on the premise that a country should attempt to reduce its foreign dependency through the local production of industrialized products. The term primarily refers to 20th-century development economics policies, but it has been advocated since the 18th century by economists such as Friedrich ListMehmet, Ozay (1999). ''Westernizing the Third World: The Eurocentricity of Economic Development.'' London: Routledge. and Alexander Hamilton.Chang, Ha-Joon (2002). ''Kicking Away the Ladder: Development Strategy in Historical Perspective.'' London: Anthem Press. ISI policies have been enacted by developing countries with the intention of producing development and self-sufficiency by the creation of an internal market. The state leads economic development by nationalizat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Repeal Of The Corn Laws

The Corn Laws were tariffs and other trade restrictions on imported food and corn enforced in the United Kingdom between 1815 and 1846. The word ''corn'' in British English denotes all cereal grains, including wheat, oats and barley. They were designed to keep corn prices high to favour domestic producers, and represented British mercantilism. The Corn Laws blocked the import of cheap corn, initially by simply forbidding importation below a set price, and later by imposing steep import duties, making it too expensive to import it from abroad, even when food supplies were short. The House of Commons passed the corn law bill on March 10, 1815, the House of Lords on March 20 and the bill received Royal assent on March 23, 1815. The Corn Laws enhanced the profits and political power associated with land ownership. The laws raised food prices and the costs of living for the British public, and hampered the growth of other British economic sectors, such as manufacturing, by reducing t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

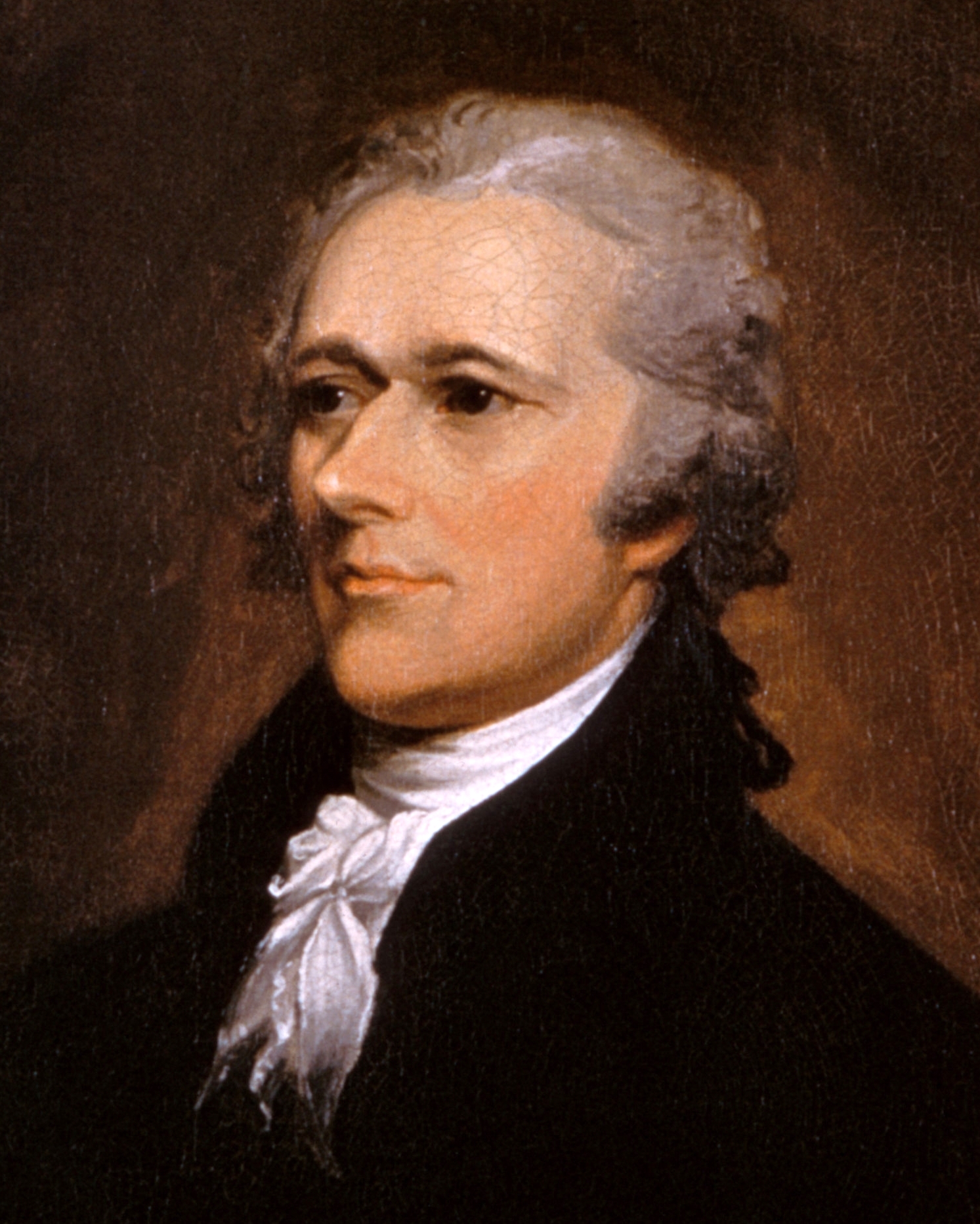

Infant Industry Argument

The infant industry argument is an economic rationale for trade protectionism. The core of the argument is that nascent industries often do not have the economies of scale that their older competitors from other countries may have, and thus need to be protected until they can attain similar economies of scale. The logic underpinning the argument is that trade protectionism is costly in the short run but leads to long-term benefits. Early articulations The argument was first fully articulated by the first United States Secretary of the Treasury Alexander Hamilton in his 1790 Report on Manufactures. Hamilton professed that developing an industrial base in a country was impossible without protectionism because import duties are necessary to shelter domestic "infant industries" until they could achieve economies of scale. The argument was systematically developed by American political economist Daniel Raymond, and was later picked up by economist Friedrich List in his 1841 work ''T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)

.gif)