|

TurboTax Basic 2003 Box Disc And Store Receipt

TurboTax is a software package for preparation of American income tax returns, produced by Intuit. TurboTax is a market leader in its product segment, competing with H&R Block Tax Software and TaxAct. TurboTax was developed by Michael A. Chipman of Chipsoft in 1984 and was sold to Intuit in 1993. The company has been subject of controversy over its political influence and deceptive business practices. Intuit, the maker of TurboTax, has lobbied extensively against the Internal Revenue Service (IRS) creating its own online system of tax filing like those that exist in most other wealthy countries. Intuit is under investigation by multiple state attorneys general, as well as New York's Department of Financial Services. As part of an agreement with the IRS Free File program, TurboTax allowed individuals making less than $39,000 a year to use a free version of TurboTax; a 2019 ProPublica investigation revealed that TurboTax deliberately made this version hard to find, even through ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (United States)

Tax returns in the United States are reports filed with the Internal Revenue Service (IRS) or with the state or local tax collection agency ( California Franchise Tax Board, for example) containing information used to calculate income tax or other taxes. Tax returns are generally prepared using forms prescribed by the IRS or other applicable taxing authority. Federal returns Under the Internal Revenue Code returns can be classified as either ''tax returns'' or ''information returns'', although the term "tax return" is sometimes used to describe both kinds of returns in a broad sense. Tax returns, in the more narrow sense, are reports of tax liabilities and payments, often including financial information used to compute the tax. A very common federal tax form is IRS Form 1040. A tax return provides information so that the taxation authority can check on the taxpayer's calculations, or can determine the amount of tax owed if the taxpayer is not required to calculate that amount ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CalFile

CalFile is the current tax preparation program/service of the California Franchise Tax Board (FTB). ReadyReturn is the former tax preparation program initiated by the FTB as a pilot in 2005, tax returns for the 2004 tax year, based on their 2003 tax data, went out to 51,850 taxpayers receiving a "pre-populated" form based on financial information reported to the FTB by employers and banks. Recipients were single, no-dependents, standard-deduction, only-wage-income, one-employer, with a maximum adjusted gross income of $139,917. The purpose of ReadyReturn was to make it easier for taxpayers to file their returns, and to make the filing process more accurate and faster. CalFile and ReadyReturn at one point coexisted for different taxpayer categories.Ventry, Dennis J. Jr''Intuit’s Nine Lies Kill State E-Filing Programs and Keep ‘Free’ File Alive''/ref> In 2015, ReadyReturn's best features were included in CalFile, and ReadyReturn was no longer a separate program. Read ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Digital Rights Management

Digital rights management (DRM) is the management of legal access to digital content. Various tools or technological protection measures (TPM) such as access control technologies can restrict the use of proprietary hardware and copyrighted works. DRM technologies govern the use, modification, and distribution of copyrighted works (such as software and multimedia content), as well as systems that enforce these policies within devices. Laws in many countries criminalize the circumvention of DRM, communication about such circumvention, and the creation and distribution of tools used for such circumvention. Such laws are part of the United States' Digital Millennium Copyright Act (DMCA), and the European Union's Information Society Directive (the French DADVSI is an example of a member state of the European Union implementing the directive). DRM techniques include licensing agreements and encryption. The industry has expanded the usage of DRM to various hardware products, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Insider

''Insider'', previously named ''Business Insider'' (''BI''), is an American financial and business news website founded in 2007. Since 2015, a majority stake in ''Business Insider''s parent company Insider Inc. has been owned by the German publishing house Axel Springer. It operates several international editions, including one in the United Kingdom. ''Insider'' publishes original reporting and aggregates material from other outlets. , it maintained a liberal policy on the use of anonymous sources. It has also published native advertising and granted sponsors editorial control of its content. The outlet has been nominated for several awards, but is criticized for using factually incorrect clickbait headlines to attract viewership. In 2015, Axel Springer SE acquired 88 percent of the stake in Insider Inc. for $343 million (€306 million), implying a total valuation of $442 million. In February 2021, the brand was renamed simply ''Insider''. History ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Return (Canada)

A tax return is the completion of documentation that calculates an entity or individual's income earned and the amount of taxes to be paid to the government or government organizations or, potentially, back to the taxpayer. Taxation is one of the biggest sources of income for the government. There are two types of taxes— direct and indirect—which are both parts of the tax revenue. Tax revenue is the income gained by government from taxes that are levied on income, profit, goods and services, land revenue, ownership, and transfer of property, and other taxes. Total tax revenue calculated as a percentage of GDP shows the share of the country’s output collected by the government through taxes. Tax revenue is used by governments to grant sums of money to communities, the military, education, hospitals, and infrastructure. In the United States the Internal Revenue Service (IRS) administers federal tax laws. It is a government entity that fulfils three main functions. Fi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world." Formed in 1944, started on 27 December 1945, at the Bretton Woods Conference primarily by the ideas of Harry Dexter White and John Maynard Keynes, it came into formal existence in 1945 with 29 member countries and the goal of reconstructing the international monetary system. It now plays a central role in the management of balance of payments difficulties and international financial crises. Countries contribute funds to a pool through a quota system from which countries experiencing balance of payments problems can borrow money. , the fund had XDR 477 billi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

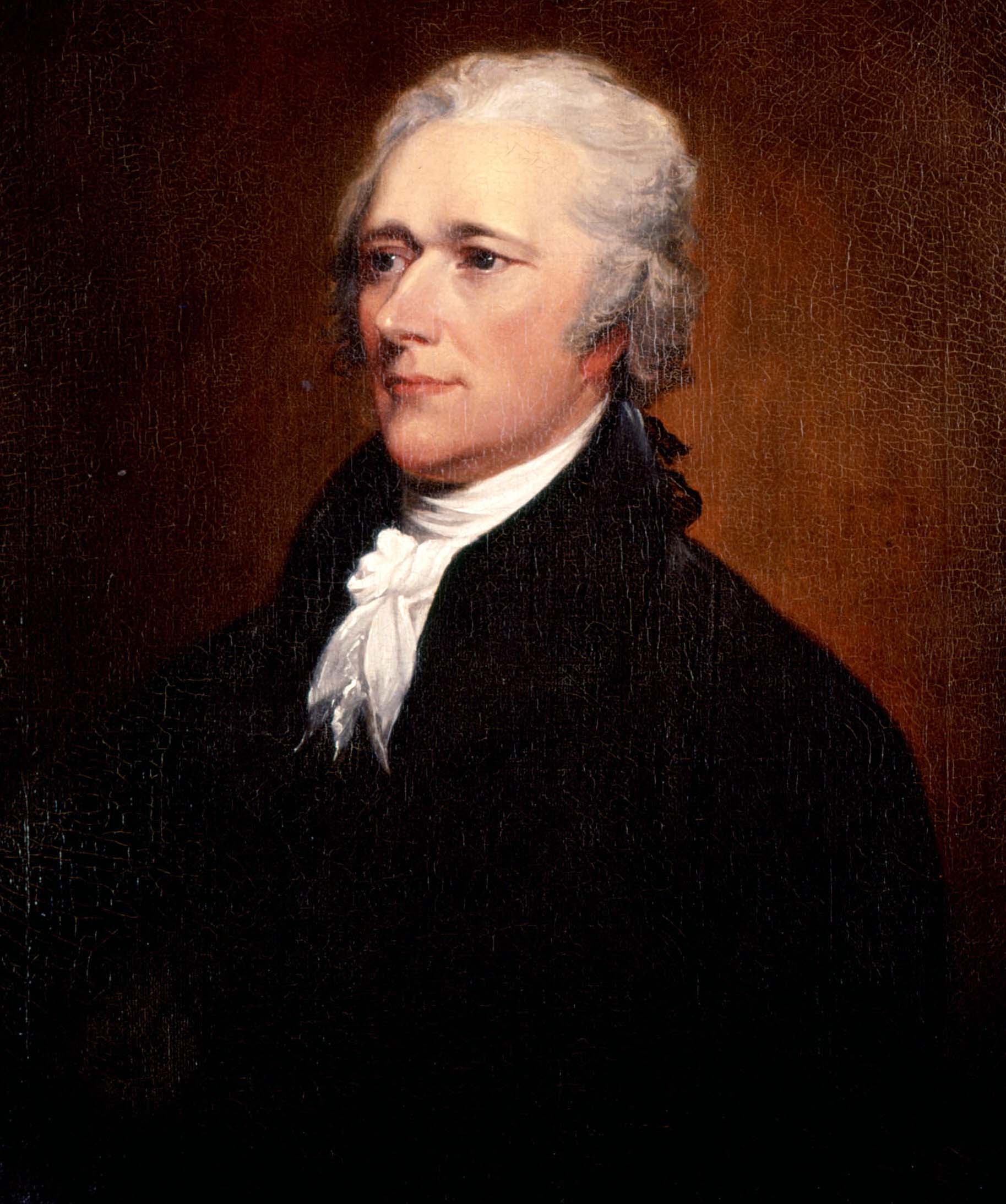

Secretary Of Treasury

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal advisor to the president of the United States on all matters pertaining to economic and fiscal policy. The secretary is a statutory member of the Cabinet of the United States, and is fifth in the presidential line of succession. Under the Appointments Clause of the United States Constitution, the officeholder is nominated by the president of the United States, and, following a confirmation hearing before the Senate Committee on Finance, is confirmed by the United States Senate. The secretary of state, the secretary of the treasury, the secretary of defense, and the attorney general are generally regarded as the four most important Cabinet officials, due to the size and importance of their respective departments. The current secretar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 U.S. state, states, a Washington, D.C., federal district, five major unincorporated territories, nine United States Minor Outlying Islands, Minor Outlying Islands, and 326 Indian reservations. The United States is also in Compact of Free Association, free association with three Oceania, Pacific Island Sovereign state, sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Palau, Republic of Palau. It is the world's List of countries and dependencies by area, third-largest country by both land and total area. It shares land borders Canada–United States border, with Canada to its north and Mexico–United States border, with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the List of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Timothy F

Timothy is a masculine name. It comes from the Greek name ( Timόtheos) meaning "honouring God", "in God's honour", or "honoured by God". Timothy (and its variations) is a common name in several countries. People Given name * Timothy (given name), including a list of people with the name * Tim (given name) * Timmy * Timo * Timotheus * Timothée Surname * Christopher Timothy (born 1940), Welsh actor. * Miriam Timothy (1879–1950), British harpist. * Nick Timothy (born 1980), British political adviser. Mononym * Saint Timothy, a companion and co-worker of Paul the Apostle * Timothy I (Nestorian patriarch) Education * Timothy Christian School (Illinois), a school system in Elmhurst, Illinois * Timothy Christian School (New Jersey), a school in Piscataway, New Jersey Arts and entertainment * "Timothy" (song), a 1970 song by The Buoys * ''Timothy Goes to School'', a Canadian-Chinese children's animated series * ''Timothy'' (TV film), a 2014 Australian television com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Filing

Tax preparation is the process of preparing tax returns, often income tax returns, often for a person other than the taxpayer, and generally for compensation. Tax preparation may be done by the taxpayer with or without the help of tax preparation software and online services. Tax preparation may also be done by a licensed professional such as an attorney, certified public accountant or enrolled agent, or by an unlicensed tax preparation business. Because United States income tax laws are considered to be complicated, many taxpayers seek outside assistance with taxes (53.5% of individual tax returns in 2016 were filed by paid preparers). Some states have licensing requirements for anyone who prepares tax returns for a fee and some for fee-based preparation of state tax returns only. Commercial tax preparation software, such as TurboTax, is widely used by individuals preparing their own tax returns. The Free File Alliance provides free tax preparation software for individuals with les ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Adjusted Gross Income

In the United States income tax system, adjusted gross income (AGI) is an individual's total gross income minus specific deductions. It is used to calculate taxable income, which is AGI minus allowances for personal exemptions and itemized deductions. For most individual tax purposes, AGI is more relevant than gross income. Gross income is sales price of goods or property, minus cost of the property sold, plus other income. It includes wages, interest, dividends, business income, rental income, and all other types of income. Adjusted gross income is gross income less deductions from a business or rental activity and 21 other specific items. Several deductions (''e.g.'' medical expenses and miscellaneous itemized deductions) are limited based on a percentage of AGI. Certain phase outs, including those of lower tax rates and itemized deductions, are based on levels of AGI. Many states base state income tax on AGI with certain deductions. Adjusted gross income is calculated ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |