|

The Forstall System

The Forstall System was a banking system developed by Edmund Jean Forstall in 1842 and used until the end of the Civil War.Holden, Arthur C. “The Phenomena of Long-Term Credit”. ''Land Economics'' 42 (1966): 363-370. After the Panic of 1837, banks underwent two main reformations. New York adapted a free banking system while Louisiana set up a banking system with specie reserve requirements.Klebaner, Benjamin J. ''American Commercial Banking: A History''. Washington: Beard Books, 1990. Print. The Forstall System propelled Louisiana to economic maturity with its sound and credible banking system. It has been called one of the building blocks of the modern financial system still in place today. Background Prior to the Panic of 1837, the banking system across the nation was expanding and greatly contributed to economic growth and development. During and after the Panic, banks stopped issuing specie requirements. A five-year depression followed with record-high unemployment.Hammond ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Edmund Jean Forstall

Edmund Jean Forstall (c. 1794-1874) was an American banker, merchant, and planter, from New Orleans, Louisiana, from a prominent Louisiana Creole family through his mother, and Irish heritage on his father's side. He is known for developing The Forstall System in 1842. Career By 1818, through family connections, Forstall was a director of The Louisiana State Bank. He began his mercantile career with Gordon, Grant & Co. in the early 1820s, which then became Gordon, Forstall & Co. in 1826, where he managed the New Orleans Branch. In 1938, Forstall became the president of Citizens Bank of Louisiana. In 1842, he developed The Forstall System which was a banking system used until the end of the Civil War.Holden, Arthur C. “The Phenomena of Long-Term Credit”. ''Land Economics'' 42 (1966): 363-370. Philanthropy Forstall was an Administrator of the University of Louisiana under President William Newton Mercer, with Secretary Albert G. Blanchard, Chief Justice of the Louisiana ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Requirement

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the central bank on the basis of a specified proportion of deposit liabilities of the bank. This rate is commonly referred to as the reserve ratio. Though the definitions vary, the commercial bank's reserves normally consist of cash held by the bank and stored physically in the bank vault (vault cash), plus the amount of the bank's balance in that bank's account with the central bank. A bank is at liberty to hold in reserve sums above this minimum requirement, commonly referred to as ''excess reserves''. The reserve ratio is sometimes used by a country’s monetary authority as a tool in monetary policy, to influence the country's money supply by limiting or expanding the amount of lending by the banks. Monetary authorities increase the reserve r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capture Of New Orleans

The capture of New Orleans (April 25 – May 1, 1862) during the American Civil War was a turning point in the war, which precipitated the capture of the Mississippi River. Having fought past Forts Jackson and St. Philip, the Union was unopposed in its capture of the city itself. Many residents resented the controversial and confrontational administration of the city by its U.S. Army military governor, who caused lasting resentment. This capture of the largest Confederate city was a major turning point and an event of international importance. It also caught many Confederate generals by surprise who planned for a attack from the north instead of from the gulf of Mexico. Background The history of New Orleans contrasts significantly with the histories of other cities that were included in the Confederate States of America. Because it was founded by the French and controlled by Spain for a time, New Orleans had a population who were mostly Catholic, and who had created a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Formation

Capital formation is a concept used in macroeconomics, national accounts and financial economics. Occasionally it is also used in corporate accounts. It can be defined in three ways: *It is a specific statistical concept, also known as net investment, used in national accounts statistics, econometrics and macroeconomics. In that sense, it refers to a measure of the ''net additions'' to the (physical) capital stock of a country (or an economic sector) in an accounting interval, or, a measure of the amount by which the total physical capital stock ''increased'' during an accounting period. To arrive at this measure, standard valuation principles are used. *It is used also in economic theory, as a modern general term for capital accumulation, referring to the total "stock of capital" that has been formed, or to the growth of this total capital stock. *In a much broader or vaguer sense, the term "capital formation" has in more recent times been used in financial economics to refer to s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Investments

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical effe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commercial Paper

Commercial paper, in the global financial market, is an unsecured promissory note with a fixed maturity of rarely more than 270 days. In layperson terms, it is like an " IOU" but can be bought and sold because its buyers and sellers have some degree of confidence that it can be successfully redeemed later for cash, based on their assessment of the creditworthiness of the issuing company. Commercial paper is a money-market security issued by large corporations to obtain funds to meet short-term debt obligations (for example, payroll) and is backed only by an issuing bank or company promise to pay the face amount on the maturity date specified on the note. Since it is not backed by collateral, only firms with excellent credit ratings from a recognized credit rating agency will be able to sell their commercial paper at a reasonable price. Commercial paper is usually sold at a discount from face value and generally carries lower interest repayment rates than bonds due to the sh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Requirement

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the central bank on the basis of a specified proportion of deposit liabilities of the bank. This rate is commonly referred to as the reserve ratio. Though the definitions vary, the commercial bank's reserves normally consist of cash held by the bank and stored physically in the bank vault (vault cash), plus the amount of the bank's balance in that bank's account with the central bank. A bank is at liberty to hold in reserve sums above this minimum requirement, commonly referred to as ''excess reserves''. The reserve ratio is sometimes used by a country’s monetary authority as a tool in monetary policy, to influence the country's money supply by limiting or expanding the amount of lending by the banks. Monetary authorities increase the reserve r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Civil War

The American Civil War (April 12, 1861 – May 26, 1865; also known by other names) was a civil war in the United States. It was fought between the Union ("the North") and the Confederacy ("the South"), the latter formed by states that had seceded. The central cause of the war was the dispute over whether slavery would be permitted to expand into the western territories, leading to more slave states, or be prevented from doing so, which was widely believed would place slavery on a course of ultimate extinction. Decades of political controversy over slavery were brought to a head by the victory in the 1860 U.S. presidential election of Abraham Lincoln, who opposed slavery's expansion into the west. An initial seven southern slave states responded to Lincoln's victory by seceding from the United States and, in 1861, forming the Confederacy. The Confederacy seized U.S. forts and other federal assets within their borders. Led by Confederate President Jefferson Davis, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

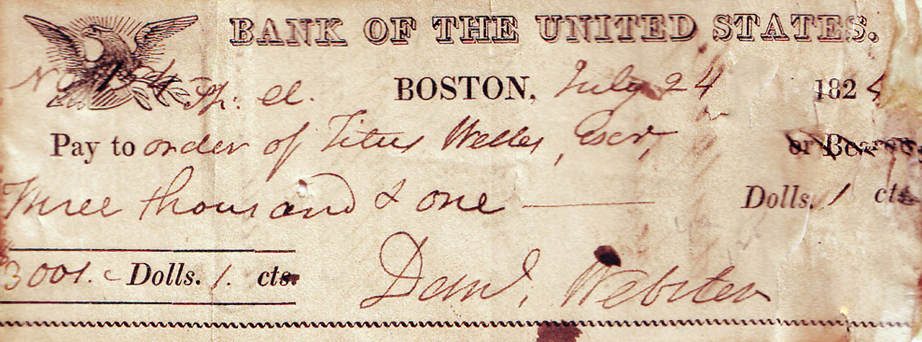

Second Bank Of The United States

The Second Bank of the United States was the second federally authorized Hamiltonian national bank in the United States. Located in Philadelphia, Pennsylvania, the bank was chartered from February 1816 to January 1836.. The Bank's formal name, according to section 9 of its charter as passed by Congress, was "The President Directors and Company of the Bank of the United States". While other banks in the US were chartered by and only allowed to have branches in a single state, it was authorized to have branches in multiple states and lend money to the US government. A private corporation with public duties, the Bank handled all fiscal transactions for the U.S. Government, and was accountable to Congress and the U.S. Treasury. Twenty percent of its capital was owned by the federal government, the Bank's single largest stockholder.. Four thousand private investors held 80 percent of the Bank's capital, including three thousand Europeans. The bulk of the stocks were held by a few hundr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panic

Panic is a sudden sensation of fear, which is so strong as to dominate or prevent reason and logical thinking, replacing it with overwhelming feelings of anxiety and frantic agitation consistent with an animalistic fight-or-flight reaction. Panic may occur singularly in individuals or manifest suddenly in large groups as mass panic (closely related to herd behavior). Etymology The word "panic" derives from antiquity and is a tribute to the ancient god Pan. One of the many gods in the mythology of ancient Greece, Pan was the god of shepherds and of woods and pastures. The Greeks believed that he often wandered peacefully through the woods, playing a pipe, but when accidentally awakened from his noontime nap he could give a great shout that would cause flocks to stampede. From this aspect of Pan's nature Greek authors derived the word ''panikos'', “sudden fear,” the ultimate source of the English word: "panic". The Greek term indicates the feeling of total fear that i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_(14785143685).jpg)