|

Terminated Merchant File

A terminated merchant file (TMF) is a tool used by credit card processing companies to screen potential merchants before giving them a merchant account. In the case of Mastercard and American Express it is known as the MATCH list. The terminated merchant files are shared among processors and act as blacklisting, blacklists, where merchants with high-risk accounts or excessive chargebacks are put on the list and prevented from opening an account with a different credit card provider, credit card processor. Other reasons for being put on a terminated merchant file include: * Merchant collusion * Fraud * Money laundering References Payment systems Merchant services Credit {{finance-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Card

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards (stainless steel, gold, palladium, titanium), and a few gemstone-encrusted metal cards. A regular credit card is different from a charge card, which requires the balance to be repaid in full each month or at the end of each statement cycle. In contrast, credit cards allow the consumers to build a continuing balance of debt, subject to interest being charged. A credit car ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merchant

A merchant is a person who trades in commodities produced by other people, especially one who trades with foreign countries. Historically, a merchant is anyone who is involved in business or trade. Merchants have operated for as long as industry, commerce, and trade have existed. In 16th-century Europe, two different terms for merchants emerged: referred to local traders (such as bakers and grocers) and ( nl, koopman) referred to merchants who operated on a global stage, importing and exporting goods over vast distances and offering added-value services such as credit and finance. The status of the merchant has varied during different periods of history and among different societies. In modern times, the term ''merchant'' has occasionally been used to refer to a businessperson or someone undertaking activities (commercial or industrial) for the purpose of generating profit, cash flow, sales, and revenue using a combination of human, financial, intellectual and physical capit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merchant Account

A merchant account is a type of bank account that allows businesses to accept payments in multiple ways, typically debit or credit cards. A merchant account is established under an agreement between an acceptor and a merchant acquiring bank for the settlement of payment card transactions. In some cases a payment processor, independent sales organization (ISO), or member service provider (MSP) is also a party to the merchant agreement. Whether a merchant enters into a merchant agreement directly with an acquiring bank or through an aggregator, the agreement contractually binds the merchant to obey the operating regulations established by the card associations. A high-risk merchant account is a business account or merchant account that allows the business to accept online payments though they are considered to be of high-risk nature by the banks and credit card processors. The industries that possess this account are adult industry, travel, Forex trading business, multilevel market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

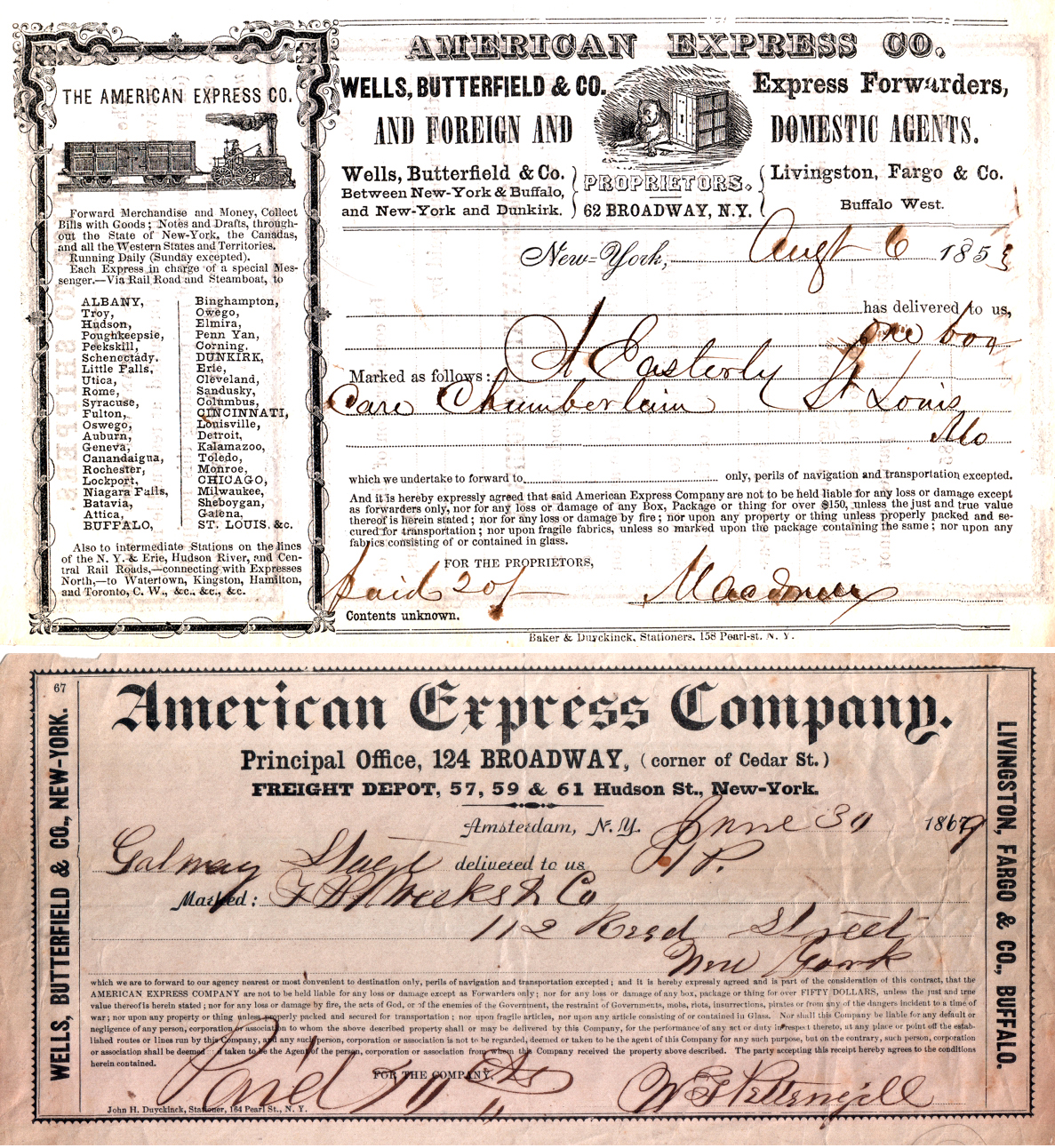

American Express

American Express Company (Amex) is an American multinational corporation specialized in payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. The company was founded in 1850 and is one of the 30 components of the Dow Jones Industrial Average. The company's logo, adopted in 1958, is a gladiator or centurion whose image appears on the company's well-known traveler's cheques, charge cards, and credit cards. During the 1980s, Amex invested in the brokerage industry, acquiring what became, in increments, Shearson Lehman Hutton and then divesting these into what became Smith Barney Shearson (owned by Primerica) and a revived Lehman Brothers. By 2008 neither the Shearson nor the Lehman name existed. In 2016, credit cards using the American Express network accounted for 22.9% of the total dollar volume of credit card transactions in the United States. , the company had 121.7million cards in force, includ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Blacklisting

Blacklisting is the action of a group or authority compiling a blacklist (or black list) of people, countries or other entities to be avoided or distrusted as being deemed unacceptable to those making the list. If someone is on a blacklist, they are seen by a government or other organization as being one of a number of people who cannot be trusted or who is considered to have done something wrong. As a verb, blacklist can mean to put an individual or entity on such a list. Origins of the term The English dramatist Philip Massinger used the phrase "black list" in his 1639 tragedy ''The Unnatural Combat''. After the restoration of the English monarchy brought Charles II of England to the throne in 1660, a list of regicides named those to be punished for the execution of his father. The state papers of Charles II say "If any innocent soul be found in this black list, let him not be offended at me, but consider whether some mistaken principle or interest may not have misled ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chargeback

A chargeback is a return of money to a payer of a transaction, especially a credit card transaction. Most commonly the payer is a consumer. The chargeback reverses a money transfer from the consumer's bank account, line of credit, or credit card. The chargeback is ordered by the bank that issued the consumer's payment card. In the distribution industry, a chargeback occurs when the supplier sells a product at a higher price to the distributor than the price they have set with the end user. The distributor submits a chargeback to the supplier so they can recover the money lost in the transaction. United States overview The chargeback mechanism exists primarily for consumer protection. Holders of credit cards issued in the United States are afforded reversal rights by Regulation Z of the Truth in Lending Act. United States debit card holders are guaranteed reversal rights by Regulation E of the Electronic Fund Transfer Act. Similar rights extend globally, pursuant to the rule ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Card Provider

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards (stainless steel, gold, palladium, titanium), and a few gemstone-encrusted metal cards. A regular credit card is different from a charge card, which requires the balance to be repaid in full each month or at the end of each statement cycle. In contrast, credit cards allow the consumers to build a continuing balance of debt, subject to interest being charged. A credit card dif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Collusion

Collusion is a deceitful agreement or secret cooperation between two or more parties to limit open competition by deceiving, misleading or defrauding others of their legal right. Collusion is not always considered illegal. It can be used to attain objectives forbidden by law; for example, by defrauding or gaining an unfair market advantage. It is an agreement among firms or individuals to divide a market, set prices, limit production or limit opportunities. It can involve "unions, wage fixing, kickbacks, or misrepresenting the independence of the relationship between the colluding parties". In legal terms, all acts effected by collusion are considered void. Definition In the study of economics and market competition, collusion takes place within an industry when rival companies cooperate for their mutual benefit. Conspiracy usually involves an agreement between two or more sellers to take action to suppress competition between sellers in the market. Because competition among ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fraud

In law, fraud is intentional deception to secure unfair or unlawful gain, or to deprive a victim of a legal right. Fraud can violate civil law (e.g., a fraud victim may sue the fraud perpetrator to avoid the fraud or recover monetary compensation) or criminal law (e.g., a fraud perpetrator may be prosecuted and imprisoned by governmental authorities), or it may cause no loss of money, property, or legal right but still be an element of another civil or criminal wrong. The purpose of fraud may be monetary gain or other benefits, for example by obtaining a passport, travel document, or driver's license, or mortgage fraud, where the perpetrator may attempt to qualify for a mortgage by way of false statements. Internal fraud, also known as "insider fraud", is fraud committed or attempted by someone within an organisation such as an employee. A hoax is a distinct concept that involves deliberate deception without the intention of gain or of materially damaging or depriving a vi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Laundering

Money laundering is the process of concealing the origin of money, obtained from illicit activities such as drug trafficking, corruption, embezzlement or gambling, by converting it into a legitimate source. It is a crime in many jurisdictions with varying definitions. It is usually a key operation of organized crime. In US law, money laundering is the practice of engaging in financial transactions to conceal the identity, source, or destination of illegally gained money. In UK law the common law definition is wider. The act is defined as "taking any action with property of any form which is either wholly or in part the proceeds of a crime that will disguise the fact that that property is the proceeds of a crime or obscure the beneficial ownership of said property". In the past, the term "money laundering" was applied only to financial transactions related to organized crime. Today its definition is often expanded by government and international regulators such as the US Offic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Systems

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, instruments, people, rules, procedures, standards, and technologies that make its exchange possible.Biago Bossone and Massimo Cirasino, "The Oversight of the Payment Systems: A Framework for the Development and Governance of Payment Systems in Emerging Economies"The World Bank, July 2001, p.7 A common type of payment system, called an operational network, links bank accounts and provides for monetary exchange using bank deposits. Some payment systems also include credit mechanisms, which are essentially a different aspect of payment. Payment systems are used in lieu of tendering cash in domestic and international transactions. This consists of a major service provided by banks and other financial institutions. Traditional payment systems include negotiable instruments such as drafts (e.g., cheques) and documentary credits such as letters of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |